By Saabira Chaudhuri and Jennifer Maloney

Americans are increasingly laying off the booze, prompting the

world's biggest brewers and liquor companies to push beyond their

traditional fare and roll out teas, energy drinks and nonalcoholic

spirits.

New data show that U.S. alcohol volumes dropped 0.8% last year,

slightly steeper than the 0.7% decline in 2017. Beer was worst hit,

with volumes down 1.5% in 2018, compared with a 1.1% decline in

2017, while growth in wine and spirits slowed, according to data

compiled for The Wall Street Journal by industry tracker IWSR.

The fall in alcohol volumes reflects "a growing trend toward

mindful drinking or complete abstinence, particularly among the

millennial cohort," says IWSR's U.S. head Brandy Rand. Wine grew by

0.4%, down from 1% the year before, while spirits climbed 1.9%,

compared with 2.2% in 2017.

In response to the slowdown, alcohol makers are trying to

diversify. Molson Coors Brewing Co. has turned to kombucha,

Budweiser brewer Anheuser-Busch InBev SA sells a spiked coconut

water, and Smirnoff maker Diageo PLC wants teetotalers to start

mixing cocktails with a pricey, alcohol-free gin alternative.

IWSR forecasts low- and no-alcohol products in the U.S. -- still

a small slice of the market -- to grow 32.1% between 2018 and 2022,

triple the category's growth over the past five years. IWSR's sales

figures are based on products shipped.

Molson Coors, grappling with weak sales of Coors Light, wants to

build out a broad portfolio of "brewed beverages," Chief Executive

Mark Hunter said in an interview. That means beer, tea and perhaps

even coffee, he said. The company has invested in Boulder,

Co.-based Bhakti Chai Tea Co. and bought a California-based maker

of kombucha -- a fizzy, fermented tea.

"We're certainly not sitting on our hands," Mr. Hunter said.

Industry executives say drinkers are increasingly concerned

about health and that younger generations socialize differently

from their parents, drinking less.

"Twenty years ago we didn't have coffee shops open late, and

pubs and bars open for coffee," said Ben Branson, chief executive

of nonalcoholic distilled spirit maker Seedlip Ltd., which is part

owned by Diageo. "People are favoring experiences over 'lets go

drink on a night out.'"

While booze makers are partly responding by pushing pricier

tipples -- helping sales by value grow despite lower volumes --

they're also scrambling to offer a wider selection of drinks.

Brewers, in particular, are under pressure as consumers abandon

mainstream beer.

AB InBev last year created a new global position, head of

nonalcoholic beverages, to lead its efforts to diversify.

Nonalcoholic drinks -- including energy drinks and nonalcoholic

beers -- already make up more than 10% of the Bud brewer's volumes.

In 2017 it acquired Hiball Inc., a maker of organic energy drinks.

AB InBev recently began selling Budweiser Prohibition brew -- a

nonalcoholic version of its flagship beer -- in Columbus and

Detroit. Nonalcoholic beer volumes in the U.S. are expected to

climb 9.3% over the next five years, according to research firm

Euromonitor.

The beer company also has stepped up its efforts to woo

consumers defecting to wine and cocktails. Its craft-style

breweries in Oregon, California and New York have served as

incubators for new, boozy versions of coconut water, matcha tea and

agua fresca, a Mexican fruit-juice drink.

The brewer plans to later this month launch a seltzer brand, Bon

& Viv, which it will advertise alongside its beers at the Super

Bowl.

"People are looking for something that tastes good but also

allows them to live well," Chelsea Phillips, head of marketing for

AB InBev's Beyond Beer division in the U.S., said in an

interview.

Volumes of ready-to-drink alcoholic beverages jumped 6.1% last

year, according to IWSR, driven by hard seltzers, which executives

say appeal to consumers because of their low calories and

sugar.

Distillers also are embracing the popularity of lower-alcohol

drinks.

Late last year, Diageo launched a lower-alcohol, botanical

version of Ketel One, which it said has 25% fewer calories than the

regular vodka. Alcohol content is 30% compared with 40% in regular

Ketel One.

Diageo Chief Executive Ivan Menezes said last year that adults

opting for lower alcohol options was "an important trend over the

next many years" and that the company was "putting a lot of focus

behind it."

Diageo has been working to help expand Seedlip, in which it took

a minority stake in 2016. The London-based brand, which can be

drunk with tonic or used in cocktails, markets itself as solving

the dilemma of "what to drink when you're not drinking."

Seedlip is available in 6,000 locations, including 500 in the

U.S., where it recently opened its first office. The upscale brand

sells three variants, which cost about $30 a bottle upward.

This spring, Seedlip plans to launch a new nonalcoholic brand

called Æcorn Aperitifs, designed to be drunk before dinner. The

liquid will be made from English grapes, herbs, roots and bitter

botanicals, and is aimed at consumers who want a nonalcoholic

option to drink with food.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and

Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

January 17, 2019 11:51 ET (16:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

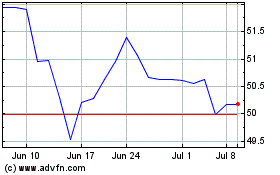

Molson Coors Beverage (NYSE:TAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

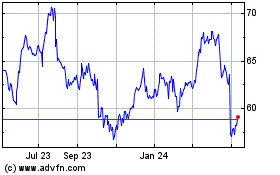

Molson Coors Beverage (NYSE:TAP)

Historical Stock Chart

From Apr 2023 to Apr 2024