LVMH Close to Deal for Hotel Operator Belmond

December 13 2018 - 7:30PM

Dow Jones News

By Craig Karmin

French luxury-goods company LVMH Moet Hennessy Louis Vuitton SE

is close to a deal to acquire Belmond Ltd., a London-based owner

and operator of high-end hotels around the world, according to

people familiar with the matter.

LVMH is near an agreement to pay $25 a share in cash for

Belmond, a transaction that would value the company's equity at

around $2.6 billion, these people said. That bid would represent a

more than $7 premium to where Belmond shares -- which trade on the

New York Stock Exchange -- closed on Thursday.

Belmond's enterprise value, including debt, would be about $3.2

billion, said people familiar with the offer.

The Paris-based luxury goods company, which owns fashion brands

like Fendi and Louis Vuitton and champagne maker Dom Perignon,

would be a surprise winner in a highly competitive sales process.

For weeks, Middle Eastern and Asian government funds, big hotel

brands and private equity firms have dominated the bidding, say

people familiar with the process.

But LVMH now looks poised to prevail, and announcement could

come as early as Friday, these people said. The French company's

shares closed at EUR255.85 euros, up EUR1.50, or 0.59%, on Thursday

in Paris.

Write to Craig Karmin at craig.karmin@wsj.com

(END) Dow Jones Newswires

December 13, 2018 19:15 ET (00:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

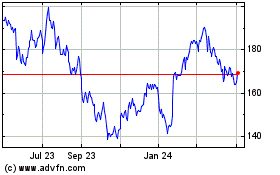

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Aug 2024 to Sep 2024

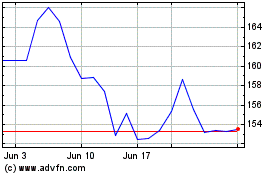

LVMH Moet Hennessy Louis... (PK) (USOTC:LVMUY)

Historical Stock Chart

From Sep 2023 to Sep 2024