PG&E Stock Rises as Regulator Mulls Utility's Future -- 2nd Update

November 16 2018 - 11:53AM

Dow Jones News

By Katherine Blunt, Russell Gold and Kimberly Chin

Shares of PG&E Corp. opened sharply higher Friday on

investor hopes that California officials would move to rescue the

utility from potential wildfire-related liabilities that threaten

to plunge it into bankruptcy.

California's energy regulator late Thursday pledged a review of

the company, including exploring a breakup of the state's largest

utility, expanding an existing probe into its safety practices.

But he also indicated an openness to let the company pass on

some wildfire-related lawsuit costs to its customers, a signal that

sparked a rally in the company's shares after days of declines.

Michael Picker, president of the California Public Utilities

Commission, said Thursday in an interview with The Wall Street

Journal that "in general, we try to make sure that all utilities

have the economic strength and wherewithal to procure the goods and

services that Californians need."

He said that he preferred that PG&E not enter into

bankruptcy because it could raise its cost of borrowing, which

could end up raising energy costs for its customers. "It is

generally not good policy for utilities to go into bankruptcy," he

said.

Shares in PG&E surged more than 40 percent to open at

$25.20, erasing Thursday's steep losses. The share price had fallen

for six consecutive days on concerns that the utility, already

facing billions of dollars in potential liability costs from 2017

wildfires, could face even higher costs related to the Camp Fire in

Northern California that has killed more than 60 people.

California lawmakers earlier this year passed legislation

allowing utilities to securitize wildfire-related liabilities such

as lawsuit costs by issuing bonds that would be paid off by their

customers. But while the measure provided a path to do this for

last year's fires, and fires starting next year, by seeking

approval from the Public Utilities Commission, it is unclear

whether it could be applied to this year's fires.

Mr. Picker said Thursday that attorneys with the commission have

told him it could be applied to 2018 fires, but that the question

could be resolved later, since it would likely take many months in

any case for findings of fault and damages in the fires to become

clear.

If it cannot, California lawmakers might have to act to revise

the legislation. Thus far, they have said little about whether they

would address the issue, and it looks likely to linger into next

year.

PG&E spokeswoman Lynsey Paulo said in a statement on

Thursday evening that "we agree with CPUC President Picker's

statement that an essential component of providing safe electrical

service is long-term financial stability. Access to affordable

capital is critical to carrying out safety measures and meeting

California's bold clean-energy goals."

The utility disclosed late last week that a problem occurred on

one of its high-voltage power lines in Northern California 15

minutes before the start of the Camp Fire was reported in the area

Nov. 8. No definitive connection between the line outage and the

fire has been made, and California fire investigators will likely

take months to make a final determination.

PG&E has stressed that the cause of the fire has not been

determined.

Both Moody's Investors Service and S&P Global ratings on

Thursday downgraded their ratings on PG&E Corp.'s debt, as well

as that of its subsidiary, Pacific Gas & Electric Co.

Write to Russell Gold at russell.gold@wsj.com, Katherine Blunt

at katherine.blunt@wsj.com and Kimberly Chin at

kimberly.chin@wsj.com

(END) Dow Jones Newswires

November 16, 2018 11:38 ET (16:38 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

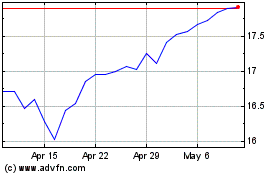

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

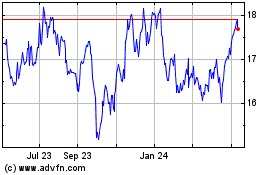

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024