SAP CFO Defends $8 Billion Qualtrics Buy, Saying Price Was Right

November 16 2018 - 9:21AM

Dow Jones News

By Patrick Costello

BARCELONA--SAP SE's (SAP.XE) Chief Financial Officer Luka Mucic

on Friday dismissed concerns that it paid too much for Qualtrics, a

U.S.-based startup that the German software company acquired just

days before a planned initial public offering.

Mr. Mucic defended the $8 billion pricetag of the market

analytics business as appropriate, saying the price is in line with

similar acquisitions in the tech sector given Qualtrics's revenue

multiples.

Qualtrics's canceled IPO was heavily oversubscribed and had been

expected to generate proceeds of $6 billion, the CFO said.

"If you look at what we paid, it's not that much of an uplift,"

Mr. Mucic said at Morgan Stanley's telecoms and technology

conference in Barcelona, Spain.

Mr. Mucic called the acquisition a "transformational strategic

opportunity" that justified SAP's about-face on eschewing

large-scale mergers and acquisitions, a position it has held for

years.

SAP still expects to expand margins and post "double-digit"

operating profit growth next year, even with the inclusion of

Qualtrics, Mr. Mucic said.

The company will give more explicit guidance after the

transaction with Qualtrics closes--likely early next year--and with

its fourth-quarter earnings, he said.

Write to Patrick Costello at patrick.costello@dowjones.com

(END) Dow Jones Newswires

November 16, 2018 09:06 ET (14:06 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

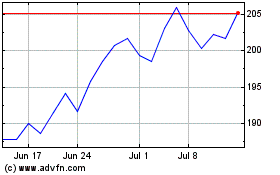

SAP (NYSE:SAP)

Historical Stock Chart

From Aug 2024 to Sep 2024

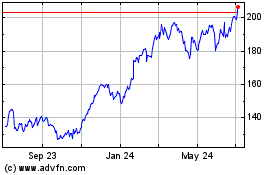

SAP (NYSE:SAP)

Historical Stock Chart

From Sep 2023 to Sep 2024