Tyson Trims Sales Forecast on Lower Meat Prices -- Update

November 13 2018 - 12:23PM

Dow Jones News

By Jacob Bunge and Micah Maidenberg

Tyson Foods Inc. expects meat prices to face continued pressure

over the next year, as the U.S. protein industry grapples with

rising supplies and trade disputes, executives said.

Lower meat prices led the Arkansas-based company to reduce its

2019 sales forecast by $1 billion to $41 billion. The company

expects a continued boom in beef profits to offset challenges

facing its poultry and pork divisions, keeping its profit steady in

fiscal 2019.

Tyson, the largest U.S. meat supplier by sales, this year has

dealt with rising freight costs, swinging agricultural commodity

markets and trade disputes that have pushed domestic meat

stockpiles higher.

While Tyson has been able to raise prices on some of its own

products and its beef and pork export volumes have been strong,

pressure on prices will continue, said Noel White, Tyson's chief

executive.

"We expect another good year, but not without challenges," Mr.

White said Tuesday on a conference call.

U.S. production of poultry and red meat are set to rise this

year by a combined 2.4%, according to U.S. Agriculture Department

estimates. New and expanded processing plants are projected to

drive pork and chicken production to record levels this year, while

beef supplies have also grown. That has ramped up competition

between products such as ground beef and chicken breasts in grocery

store meat cases and on restaurant menus.

For the year ahead, Tyson projected that its adjusted profit

would be $5.75 to $6.10 a share, comparable to 2018's level. That

projection, Tyson Chief Financial Officer Stewart Glendinning said,

depended on no major shifts in the cost of grain required to feed

poultry and livestock, and no further deterioration in chicken

prices.

Tyson shares fell 6.7% to $57.40 in morning trading Tuesday.

Tyson said Tuesday it booked $9.99 billion in sales during its

fiscal fourth quarter, less than the $10.3 billion analysts polled

by FactSet were expecting.

Overall, the company said average prices for its products fell

4.1% during the quarter.

For the period ended Sept. 29, Tyson reported a profit of $537

million, or $1.47 a share, compared with $394 million, or a $1.07 a

share, a year earlier. On an adjusted basis, Tyson earned $1.58 a

share, compared with expectations of $1.33 a share.

Write to Jacob Bunge at jacob.bunge@wsj.com and Micah Maidenberg

at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

November 13, 2018 12:08 ET (17:08 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

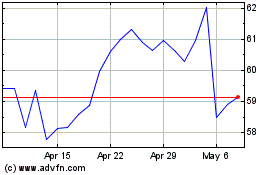

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Aug 2024 to Sep 2024

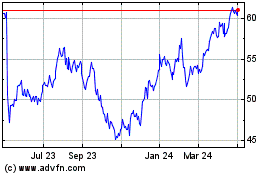

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Sep 2023 to Sep 2024