- $(64) million Predecessor quarterly

GAAP loss (for one month ended July 31, 2018), $(0.65) per diluted

share

- $1,011 million Successor quarterly GAAP

income (for two months ended September 30, 2018), $10.99 per

diluted share

- $54 million combined adjusted income

for Predecessor and Successor, $0.58 per diluted share

- 6.5 basis points (bps) combined

adjusted servicing profitability

- $65 million combined Servicing pretax

income, adjusted pretax income of $81 million

- $32 million combined Originations

pretax income, adjusted pretax income of $33 million

- $4 million combined Xome pretax income,

adjusted pretax income of $11 million

- Signed agreement for strategic

acquisition of originator with $25 billion servicing and $10+

billion annual originations

Mr. Cooper Group Inc. (NASDAQ: COOP) (the “Company”), which

principally operates under the Mr. Cooper® and Xome® brands,

reported third quarter GAAP net loss of $(64) million, $(0.65) per

diluted share for the one month ended July 31, 2018 (Predecessor),

and reported GAAP net income of $1,011 million, $10.99 per diluted

share for the two months ended September 30, 2018 (Successor). On

an adjusted basis, the Company reported combined earnings for the

third quarter of $54 million, $0.58 per diluted share.

“This was an extraordinary quarter for our company as we

completed the WMIH Corp. merger and renamed the Company. We've made

strides in all our business segments. Servicing achieved 6.5 basis

points of adjusted profitability, Originations maintained

profitability and Xome increased its third-party revenue to 56%

with the acquisition of Assurant Mortgage Solutions,” said Jay

Bray, Chairman and Chief Executive Officer of Mr. Cooper Group Inc.

“We are continuing to make strategic investments to grow all our

segments, and we are excited to announce our plans to acquire

Pacific Union Financial, LLC. We believe this acquisition is

complementary to our business and significantly increases our

originations volume and capabilities. Subject to regulatory

approvals, the transaction will also allow us to grow our Servicing

portfolio by approximately $25 billion upon closing in early

2019.”

Servicing

The Servicing business is focused on providing a best-in-class

home loan experience for our 3.2 million customers while also

strengthening asset performance for investors. The segment earns

recurring revenues from mortgage servicing rights (MSR) and

subservicing. In the third quarter, Servicing earned $81 million

combined adjusted pretax income or 6.5 basis points of adjusted

profitability. Combined adjusted pretax profitability improved 12%

from the prior quarter. Combined other income (expense) improved by

$9 million primarily due to a decrease in interest expense related

to MSR financing and higher float income.

Mr. Cooper boarded $37 billion UPB in the quarter to close the

third quarter servicing portfolio at $514 billion UPB. The Company

is on track to achieve its previously stated goal of 5% growth for

the year with an expectation to end the year at $535 billion

UPB.

Mr. Cooper remains confident in achieving adjusted servicing

profitability in excess of 6.0 basis points on average for the full

year 2018 which will be propelled by a lower prepayment environment

and continued efficiencies.

Quarter Ended ($ in millions)

Q2'18

Q3'18 Combined $ BPS $ BPS Operational

revenue $ 277 22.3 $ 278 22.2 Amortization, net of accretion (48 )

(3.9 ) (47 ) (3.8 ) Mark-to-market 19 1.5

49 3.9 Total revenues 248 20.0

280 22.4 Expenses (166 ) (13.4 ) (230 ) (18.4 ) Total other income

(expenses), net 6 0.5 15

1.2 Income before taxes 88 7.1 65 5.2 Mark-to-market

(19 ) (1.5 ) (49 ) (3.9 ) Adjustments 3 0.2

65 5.2 Adjusted pretax income $

72 5.8 $ 81 6.5

Quarter Ended Q2'18 Q3'18 Combined

Ending UPB ($B) $ 498 $ 514 Average UPB ($B) $ 497 $ 500 60+ day

delinquency rate 2.8 % 2.5 % Annualized CPR 12.1 % 11.1 %

Annualized CPR, net of recapture 10.5 % 9.6 % Modifications and

workouts 14,715 14,448

Originations

The Originations business focuses on creating servicing assets

at attractive margins through recapture of existing customers, new

customer acquisitions, and correspondent originations. The

Originations segment earned $33 million combined adjusted pretax

income. Originations earnings remained stable and revenue margins

improved slightly primarily due to gain on sale revenue.

Mr. Cooper funded nearly 23,000 loans combined in the third

quarter, totaling approximately $5.1 billion UPB with $2.4 billion

from the consumer direct channel and $2.7 billion from the

correspondent channel. In the consumer direct channel, refinance

recapture increased 8% quarter-over-quarter to 57%. The

correspondent channel has grown over the past year making Mr.

Cooper the 10th largest correspondent lender in the U.S.

The consumer direct channel continues to focus on improving cash

flow for customers and identifying opportunities for customer

recapture. Despite the rise in interest rates, there are

approximately 750,000 current Mr. Cooper customers who could see

value in refinancing their loan to capitalize on home equity for

debt optimization. To help our customers better understand their

options, we are launching our upgraded mobile app, Mr. Cooper with

Home Intelligence, which places the home, rather than the loan, at

the center. The Home Intelligence app provides customers with

valuable insights on how their homes fit into their broader

financial picture. Within the Home Intelligence app, customers can

more easily view the value of their homes, the equity they hold and

personalized ways to use that equity to save money and manage their

debts. The new app is planned to launch next month to all Mr.

Cooper customers.

Given the current interest rate and market environment, Mr.

Cooper is targeting Originations adjusted pretax income of $115

million for the full year 2018.

Quarter Ended ($ in millions)

Q2'18

Q3'18 Combined Income before taxes $ 32 $ 32

Adjustments 1 1 Adjusted pretax income $ 33 $ 33

Quarter Ended ($ in millions)

Q2'18 Q3'18 Combined Total pull through

adjusted volume $ 5,440 $ 5,027 Funded volume $ 5,542 $ 5,147

Refinance recapture percentage 53 % 57 % Recapture percentage 22 %

22 % Purchase volume as a percentage of funded volume 51 % 53 %

Xome

Xome provides real estate solutions including property

disposition, asset management, title, close, valuation, and field

services to Mr. Cooper and third-party businesses. The Xome segment

earned $11 million combined adjusted pretax income.

On August 1, 2018, Xome acquired Assurant Mortgage Solutions

(AMS) to strategically expand revenues and third-party sales. The

AMS acquisition complements Xome and grows its third-party client

portfolio across its valuation, title, and field services

businesses, evidenced by the third-party revenue percentage growing

from 28% in the second quarter to an exit rate of 56% at the end of

the third quarter. Xome made a strategic decision to discontinue

the internal build-out of the field services platform once the AMS

acquisition was imminent. Xome will continue to focus on the AMS

integration and transformation throughout 2019, and expects to

fully ramp up the capture of Mr. Cooper's field services

opportunities by mid-2019.

Quarter Ended ($ in millions)

Q2'18

Q3'18 Combined Income before taxes $ 10 $ 4

Adjustments 3 7 Adjusted pretax income $ 13 $ 11

Quarter Ended Q2'18 Q3'18

Combined Exchange property listings sold 3,720 3,230 Exchange

property listings at period end 7,417 6,917 Services orders

completed 117,093 312,536 Percentage of revenue earned from

third-party customers 28 % 49 %

Conference Call Webcast and Investor

Presentation

The Company will host a conference call on November 8, 2018 at

9:00 A.M. Eastern Time. The conference call may be accessed by

dialing 855-874-2685, or 720-634-2923 internationally. Please use

the participant passcode 2272713 to access the conference call. A

simultaneous audio webcast of the conference call will be available

in the Investors section of www.mrcoopergroup.com. A replay will

also be available by dialing 855-859-2056, or 404-537-3406

internationally. Please use the passcode 2272713 to access the

replay. The replay will be accessible through November 22, 2018 at

12:00 P.M. Eastern Time.

Non-GAAP Financial

Measures

The Company utilizes non-GAAP (or “adjusted”) financial measures

as the measures provide additional information to assist investors

in understanding and assessing the Company’s and our business

segments’ ongoing performance and financial results, as well as

assessing our prospects for future performance. The adjusted

financial measures facilitate a meaningful analysis and allow more

accurate comparisons of our ongoing business operations because

they exclude items that may not be indicative of or are unrelated

to the Company’s and our business segments’ core operating

performance, and are better measures for assessing trends in our

underlying businesses. These adjustments are consistent with how

management views our businesses. Management uses these non-GAAP

financial measures in making financial, operational and planning

decisions and evaluating the Company’s and our business segment’s

ongoing performance. Adjusted pre-tax income (loss) in the

servicing segment eliminates the effects of mark-to-market

adjustments which primarily reflects unrealized gains or losses

based on the changes in fair value measurements of MSRs and their

related financing liabilities for which a fair value accounting

election was made. These adjustments, which can be highly volatile

and material due to changes in credit markets, are not necessarily

reflective of the gains and losses that will ultimately be realized

by the Company. Adjusted pre-tax income (loss) in each segment also

eliminates, as applicable, transition and integration costs, gains

(losses) on sales of fixed assets, certain settlement costs that

are not considered normal operational matters, and other

adjustments based on the facts and circumstances that would provide

investors a supplemental means for evaluating the Company’s core

operating performance.

Forward Looking

Statements

Any statements in this release that are not historical or

current facts are forward looking statements. These forward looking

statements include, but are not limited to, statements regarding

the acquisition of Pacific Union, estimates of Servicing's

profitability and growth, Originations and Xome adjusted pre-tax

income and the integration of Assurant Mortgage Solutions. Forward

looking statements involve known and unknown risks, uncertainties

and other factors that may cause our actual results, performance,

or achievements to be materially different from any future results,

performance or achievements expressed or implied by the forward

looking statements. Results for any specified quarter are not

necessarily indicative of the results that may be expected for the

full year or any future period. Certain of these risks and

uncertainties are described in the “Business” and “Risk Factors”

sections of WMIH Corp.'s and Nationstar's most recent annual

reports and other required documents as filed with the SEC which

are available at the SEC’s website at http://www.sec.gov. Mr.

Cooper undertakes no obligation to publicly update or revise any

forward looking statement or any other financial information

contained herein, and the statements made in this press release are

current as of the date of this release only.

Basis of Presentation

For purpose of Mr. Cooper's financial statement presentation,

Mr. Cooper was determined to be the accounting acquirer in the WMIH

Corp. merger and Nationstar is considered the “Predecessor” and its

assets and liabilities are reflected at fair values as of the

merger date of July 31, 2018. Mr. Cooper's interim Consolidated

Financial Statements for periods following the close of the Merger

are labeled “Successor” and reflect the acquired assets and

liabilities from Nationstar. The presentation discusses the results

of the Company for the three months ended September 30, 2018

compared to the three months ended June 30, 2018. The financial

results for the three months ended June 30, 2018 reflect the

results of the Predecessor entity for that time period. With

respect to the three months ended September 30, 2018, the Company

has separately provided the financial results of the Predecessor

for the period from July 1, 2018 through July 31, 2018 and the

financial results of the Successor for the period from August 1,

2018 through September 30, 2018, where both are presented under

GAAP. The presentation also includes a “Combined” column that

combines the Predecessor and Successor results referenced above

with respect to the three months ended September 30, 2018. Although

the separate financial results of the Predecessor and Successor for

the three months ended September 30, 2018 are presented under GAAP,

the results reported in the “Combined” column reflect non-GAAP

financial measures, as a different basis of accounting was used

with respect to the financial results for the Predecessor as

compared to the financial results of the Successor. The Company

believes that non-GAAP financial measures should be considered in

addition to, and not a substitute for, financial information

prepared in accordance with GAAP. The Company presents non-GAAP

financial measures in reporting its financial results to provide

additional and supplemental disclosure to evaluate operating

results. In particular, the Company believes that providing this

“Combined” information is useful as a supplement to its standard

GAAP financial presentation as it significantly enhances the

period-over-period comparability of the Company’s financial

results. See the Financial Tables for further information.

Financial Tables

MR. COOPER GROUP INC. AND

SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS

(millions of dollars, except for earnings

per share data)

Predecessor Predecessor Successor

Combined

Three MonthsEnded June 30,2018

For the PeriodJuly 1-July 31,2018

For the PeriodAugust 1-September

30,2018

Three MonthsEndedSeptember 30,2018

Revenues: Service related, net $ 298 $

95 $ 235 $ 330 Mark-to-market 19 25 24 49 Net gain on mortgage

loans held for sale 127 44

83 127 Total revenues 444

164 342 506

Total expenses 339 242 275 517

Other

income (expense): Interest income 140 48 90 138 Interest

expense (164 ) (53 ) (122 ) (175 ) Other income (expenses)

(2 ) — 6 6

Total other income (expenses), net (26 ) (5 )

(26 ) (31 ) Income before income tax expense

(benefit) 79 (83 ) 41 (42 ) Income tax expense (benefit) 21

(19 ) (979 ) (998 ) Net

income (loss) attributable to Successor/Predecessor 58

(64 ) 1,020 956

Undistributed earnings attributable to participating

stockholders — — 9

9

Net income attributable to Mr. Cooper

Group $ 58 $ (64 ) $ 1,011 $ 947

Earnings per share attributable to

common stockholders: Basic $ 0.59 $ (0.65 ) $ 11.13

Diluted $ 0.59 $ (0.65 ) $ 10.99

Weighted average shares of common stock outstanding (in thousands):

Basic 98,203 98,164

90,808 Diluted 99,130 98,164

91,992

MR. COOPER GROUP INC. AND

SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE

SHEETS

(millions of dollars)

Predecessor Successor June 30, 2018

September 30, 2018

Assets

Cash and cash equivalents $ 185 $ 198 Restricted cash 310

332 Mortgage servicing rights 3,356 3,500 Advances and other

receivables, net 1,317 1,174 Reverse mortgage interests, net 9,477

8,886 Mortgage loans held for sale at fair value 1,635 1,681

Mortgage loans held for investment 132 122 Property and equipment,

net 123 102 Deferred tax asset — 934 Other assets 655

799 Total assets $ 17,190 $ 17,728

Liabilities and

Stockholders' Equity

Unsecured senior notes, net $ 1,815 $ 2,457 Advance facilities, net

516 596 Warehouse facilities, net 3,086 2,888 Payables and accrued

liabilities 1,297 1,342 MSR related liabilities - nonrecourse at

fair value 1,063 1,123 Mortgage servicing liabilities 27 79 Other

nonrecourse debt, net 7,445 7,165 Total liabilities

15,249 15,650 Total stockholders' equity 1,941 2,078

Total liabilities and stockholders' equity $ 17,190 $ 17,728

UNAUDITED SEGMENT STATEMENT OF

OPERATIONS & EARNINGS

RECONCILIATION

(millions of dollars, except for earnings

per share data)

Predecessor Three Months Ended for June 30, 2018

Servicing Originations Xome Corporate and

Other Elim. Consolidated

REVENUES:

Service related, net $ 248 $ 17 $ 62 $ 1 $ (11 ) $ 317 Net gain on

mortgage loans held for sale — 116

— — 11 127

Total revenues 248 133 62

1

— 444

Total

expenses 166 102 52 19

— 339 Other income (expense):

Interest income 121 17

— 2

— 140 Interest expense

(115 ) (16 ) — (33 ) — (164 ) Other expense —

— — (2 ) — (2 ) Total

other income (expense) 6 1 —

(33 )

— (26 )

Pretax income

(loss) $ 88 $ 32

$ 10 $ (51 ) $ —

$

79 Income tax expense (Benefit) 21 Net income

attributable to common stockholders $ 58 Earnings per share

Basic $ 0.59 Diluted $ 0.59

Adjusted

Earnings: Pretax income (loss) $ 88 $ 32 $ 10 $ (51 ) $

— $ 79 MTM (19 ) — — — — (19 ) Adjustments 3 1

3 2 — 9

Adjusted pretax income (loss) $ 72 $ 33 $ 13 $ (49 )

$ — $ 69 Income tax expense (17 ) Adjusted earnings $

52 Adjusted diluted EPS $ 0.53

UNAUDITED SEGMENT STATEMENT OF

OPERATIONS & EARNINGS

RECONCILIATION

(millions of dollars, except for earnings

per share data)

Combined Three Months Ended for September 30, 2018

Servicing Originations Xome Corporate and

Other Elim. Consolidated

REVENUES:

Service related, net $ 280 $ 14 $ 95 $ — $ (10 ) $ 379 Net gain on

mortgage loans held for sale — 117

— — 10 127

Total revenues 280 131

95 —

— 506

Total expenses 230 100 90 97

— 517 Other income

(expense): Interest income 119 16

— 3

— 138 Interest

expense (109 ) (16 ) (1 ) (49 ) — (175 ) Other expense 5

1 — — —

6 Total other income (expense) 15

1 (1 ) (46 )

—

(31 )

Pretax income (loss) $ 65

$ 32 $ 4 $

(143 ) $ —

$ (42 )

Adjusted Earnings: Pretax income (loss) $ 65 $ 32 $ 4

$ (143 ) $ — $ (42 ) MTM (49 ) — — — — — (49 ) Adjustments

65 — 1 7 75

— 148 Adjusted pretax income (loss) $ 81

$ 33 $ 11 $ (68 ) $ — $ 57

Income tax expense (3 ) Adjusted earnings $ 54

Adjusted diluted EPS $ 0.58

UNAUDITED SEGMENT STATEMENT OF

OPERATIONS & EARNINGS

RECONCILIATION

(millions of dollars, except for earnings

per share data)

Predecessor For the Period July 1-July 31, 2018 Servicing

Originations Xome Corporate and Other

Elim. Consolidated

REVENUES: Service related,

net $ 97 $ 4 $ 22 $ — $ (3 ) $ 120 Net gain on mortgage loans held

for sale — 41 — —

3 44

Total revenues 97

45

22 —

— 164

Total expenses 126 34 19 63

— 242 Other income

(expense): Interest income 41 6

— 1

— 48 Interest

expense (35 ) (6 ) — (12 ) — (53 ) Other expense —

— — — — —

Total other income (expense) 6 —

— (11 )

— (5 )

Pretax

income (loss) $ (23 ) $ 11

$ 3 $ (74 ) $ —

$ (83 ) Income tax expense (benefit)

(19 ) Undistributed earnings attributable to participating

stockholders $ — Net income attributable to common

stockholders $ (64 ) Earnings per share Basic $ (0.65 ) Diluted $

(0.65 )

UNAUDITED SEGMENT STATEMENT OF

OPERATIONS & EARNINGS

RECONCILIATION

(millions of dollars, except for earnings

per share data)

Successor For the Period August 1 - September 30,

2018 Servicing Originations Xome Corporate and

Other Elim. Consolidated

REVENUES:

Service related, net $ 183 $ 10 $ 73 $ — $ (7 ) $ 259 Net gain on

mortgage loans held for sale — 76

— — 7 83

Total revenues 183 86

73 —

— 342

Total expenses 104 66 71 34

— 275 Other income

(expense): Interest income 78 10

— 2

— 90 Interest

expense (74 ) (10 ) (1 ) (37 ) — (122 ) Other expense 5

1 — — —

6 Total other income (expense) 9

1 (1 ) (35 )

—

(26 )

Pretax income (loss) $ 88

$ 21 $ 1 $

(69 ) $ —

$ 41 Income tax

expense (benefit) (979 ) Undistributed earnings attributable to

participating stockholders $ 9 Net income attributable to

common stockholders of Mr. Cooper Group $ 1,011 Earnings per

share Basic $ 11.13 Diluted $ 10.99

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181108005318/en/

Mr. Cooper Group Inc.Rich Delgado, 214-687-4844

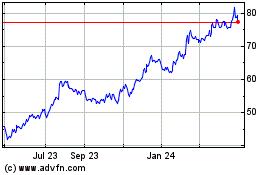

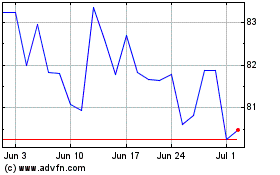

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Apr 2023 to Apr 2024