Moody's Says Sky Auction Outcome Positive for Disney Bonds

September 24 2018 - 2:00PM

Dow Jones News

By Colin Kellaher

Moody's Investors Service on Monday said Comcast Corp.'s (CMCSA)

victory over 21st Century Fox Inc. (FOX) in the bidding for Sky PLC

(SKY.LN) is credit positive for bondholders of Walt Disney Co.'s

(DIS), which in the process of acquiring the majority of Fox's

assets, including its stake in Sky.

The ratings firm said a Fox win of Sky would have been all

debt-financed, adding more leverage to Disney, which is paying

$70.4 billion in stock, debt-financed cash and assumed debt in the

Fox deal.

Comcast topped Fox in a weekend auction for Sky, winning the

British broadcaster with a $38.8 billion bid. That makes Fox's

39.6% stake in Sky worth about $15.2 billion.

Moody's said that should Disney and Fox tender the Sky stake to

Comcast, the proceeds, along with funds from the regulatory

required sale of Fox's regional sports networks, could make the

acquisition of Fox a nearly all-stock deal, giving Disney the best

chance of avoiding weakening its balance sheet and credit

metrics.

Moody's currently rates Disney "A2" but has the company on

review for a possible downgrade.

The ratings firm noted that Disney also could hold onto the Sky

stake and negotiate later for a possible swap for Comcast's 30%

stake in the video-streaming service Hulu. Disney and Fox own 60%

of Hulu.

"In either scenario, we believe Disney bondholders are much

better positioned than they would be had they successfully acquired

the remainder of Sky," Moody's said.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

September 24, 2018 13:45 ET (17:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

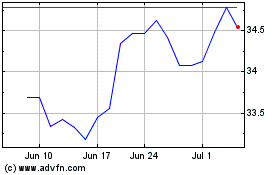

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Mar 2024 to Apr 2024

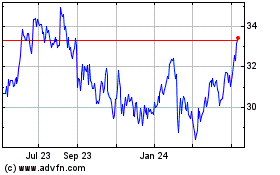

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Apr 2023 to Apr 2024