ADRs End Mixed; Criteo, ASML Holding, ArcelorMittal Trade Actively

September 07 2018 - 5:57PM

Dow Jones News

International stocks trading in New York closed mixed on

Friday.

The BNY Mellon index of American depositary receipts fell 0.3%

to 140.15. The European index decreased 0.6% to 130.38. The Asian

index rose 0.1% to 167.42. The Latin American index rose 1.3% to

210.00. And the emerging-markets index increased 0.7% to

297.07.

Criteo SA (CRTO), ASML Holding NV (ASML) and ArcelorMittal SA

(MT) were among those with ADRs that traded actively.

Criteo shares fell on news the company had been decertified as a

Facebook Inc. (FB) marketing partner, but Criteo said late Friday

that its change in "partner status" doesn't affect its ability to

buy advertising inventory for clients on the Facebook platform.

Criteo said second-quarter revenue excluding traffic acquisition

costs from inventory on the Facebook platform was 4% of Criteo's

total. According to a Bloomberg report, a Goldman Sachs analyst

said Friday that Criteo was decertified on July 1. ADRs of Criteo

SA fell 9.1% to $23.15.

Demand concerns weighed on ASML Holding shares, making the Dutch

semiconductor company one of the biggest losers of the Stoxx Europe

50 this week. Liberum analyst Janardan Menon attributes the ASML

share fall to an industrywide trend of concerns about peaking

demand and chip pricing. According to NIBC Bank's Edwin de Jong,

ASML shares have been hit by fears that trade tensions could

disrupt supply chains. Forecasts that Intel will adopt extreme

ultraviolet lithography technology, or EUV, later than expected and

Globalfoundries putting a semiconductor program on hold have also

dragged down ASML, which supplies equipment to both. These issues

could hurt a key driver of growth, Mr. de Jong says. ADRS of ASML

fell 1.9% to $180.87.

The agreement ArcelorMittal reached with Italian unions Thursday

"should pave the way for a closing of the deal, as the Italian

government no longer seems to oppose it," Kepler Cheuvreux says.

The company said under the terms of the agreement, it will

initially hire 10,700 workers based on their existing contractual

terms of employment. In addition, between 2023 and 2025 the company

has committed to hire any workers who remain under Ilva's

extraordinary administration. "An Ilva deal is a mild positive for

stock sentiment, particularly as there are no major deviations from

the initial plan," Kepler says. ADRS of ArcelorMittal fell 0.6% to

$28.74.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

September 07, 2018 17:42 ET (21:42 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

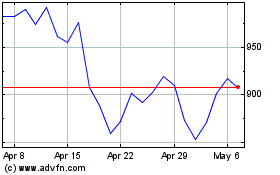

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Apr 2023 to Apr 2024