United States Steel Corporation (NYSE: X) reported second

quarter 2018 net earnings of $214 million, or $1.20 per diluted

share. Adjusted net earnings were $262 million, or $1.46 per

diluted share. This compares to second quarter 2017 net

earnings of $261 million, or $1.48 per diluted share.

Adjusted net earnings for second quarter 2017 were $189 million, or

$1.07 per diluted

share.

| |

| Earnings Highlights |

| |

| |

Quarter Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

| (Dollars in millions, except per share amounts) |

2018 |

2017 |

|

2018 |

2017 |

| Net Sales |

$ |

3,609 |

$ |

3,144 |

|

$ |

6,758 |

$ |

5,869 |

| Segment earnings (loss) before interest and

income taxes |

|

|

|

|

|

| Flat-Rolled |

$ |

224 |

$ |

220 |

|

$ |

257 |

$ |

132 |

| U. S. Steel Europe |

115 |

55 |

|

225 |

142 |

| Tubular |

(35) |

(29) |

|

(62) |

(86) |

| Other Businesses |

17 |

9 |

|

28 |

22 |

| Total segment earnings before interest and

income taxes |

$ |

321 |

$ |

255 |

|

$ |

448 |

$ |

210 |

| Other items not allocated to segments |

(20) |

72 |

|

(10) |

37 |

| Earnings before interest and income

taxes |

$ |

301 |

$ |

327 |

|

$ |

438 |

$ |

247 |

| Net interest and other financial

costs |

75 |

82 |

|

193 |

163 |

| Income tax provision (benefit) |

12 |

(16) |

|

13 |

3 |

| Net earnings |

$ |

214 |

$ |

261 |

|

$ |

232 |

$ |

81 |

| Earnings per diluted share |

$ |

1.20 |

$ |

1.48 |

|

$ |

1.30 |

$ |

0.46 |

| |

|

|

|

|

|

| Adjusted net earnings (a) |

$ |

262 |

$ |

189 |

|

$ |

319 |

$ |

44 |

| Adjusted net earnings per diluted share

(a) |

$ |

1.46 |

$ |

1.07 |

|

$ |

1.79 |

$ |

0.25 |

| Adjusted earnings before interest, income

taxes, depreciation and amortization (EBITDA) (a) |

$ |

451 |

$ |

376 |

|

$ |

706 |

$ |

468 |

(a) Please refer to the non-GAAP Financial Measures section of

this document for the reconciliation of these amounts.

Commenting on U. S. Steel's results, President

and Chief Executive Officer David B. Burritt said, "In the second

quarter, our team performed well by responding quickly to customer

demand. We restarted steelmaking at Granite City ahead of schedule

and safely ramped up production and shipments faster than planned.

In addition, a very strong shipping performance in late June

enabled us to deliver higher than expected earnings."

2018 Guidance

Commenting on U. S. Steel’s guidance for 2018,

Burritt said, "The success to date of our ongoing $2 billion asset

revitalization program, as well as our earnings power in the

current market, makes us increasingly optimistic about future

investments that will drive long-term profitable growth.”

We currently expect that third quarter 2018

adjusted EBITDA will be approximately $525 million. We expect our

Flat-rolled segment results to continue to improve as more of our

adjustable contract and spot shipments realize the benefit of

second quarter increases in index prices, partially offset by

higher planned outage costs. We expect results for our Tubular

segment to turn positive as selling price increases catch up to the

rising substrate costs we saw in the first half of the year. We

expect results for our European segment to be lower in the third

quarter, primarily due to planned outages that coincide with normal

seasonal customer demand patterns.

Based on our progress to date, we are increasing

full-year 2018 adjusted EBITDA guidance to approximately $1.85 -

$1.90 billion.The Company will conduct a conference call on second

quarter 2018 earnings on Thursday, August 2, at 8:30 a.m. Eastern

Daylight. To listen to the webcast of the conference call,

and to access the company's slide presentation and prepared

remarks, visit the U. S. Steel website, www.ussteel.com,

and click on the “Investors” section. Replays of the conference

call will be available on the website after 10:30 a.m. on August

2.

Please refer to the non-GAAP Financial Measures

section of this document for the reconciliation of Guidance net

earnings to consolidated Guidance adjusted EBITDA.

| |

| |

| UNITED STATES STEEL

CORPORATION |

| PRELIMINARY SUPPLEMENTAL STATISTICS

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Quarter Ended |

|

Six Months Ended |

| |

|

|

|

June 30, |

|

June 30, |

| |

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| OPERATING STATISTICS |

|

|

|

|

|

|

|

| |

Average realized price: (a) |

|

|

|

|

|

|

|

| |

|

Flat-Rolled ($/net ton) |

819 |

|

742 |

|

780 |

|

731 |

| |

|

U. S. Steel Europe ($/net ton) |

707 |

|

620 |

|

707 |

|

607 |

| |

|

U. S. Steel Europe (euro/net ton) |

593 |

|

563 |

|

584 |

|

561 |

| |

|

Tubular ($/net ton) |

1,449 |

|

1,234 |

|

1,420 |

|

1,173 |

| |

Steel Shipments (thousands of net tons): (a) |

|

|

|

|

|

|

|

| |

|

Flat-Rolled |

2,584 |

|

2,497 |

|

5,118 |

|

4,901 |

| |

|

U. S. Steel Europe |

1,156 |

|

1,157 |

|

2,283 |

|

2,266 |

| |

|

Tubular |

201 |

|

180 |

|

382 |

|

324 |

| |

|

|

Total Steel

Shipments |

3,941 |

|

3,834 |

|

7,783 |

|

7,491 |

| |

|

|

|

|

|

|

|

|

|

|

| |

Intersegment Shipments (thousands of net tons): |

|

|

|

|

|

|

|

| |

|

Flat-Rolled to Tubular |

65 |

|

94 |

|

132 |

|

94 |

| |

|

U. S. Steel Europe to Flat-Rolled |

22 |

|

25 |

|

22 |

|

47 |

| |

Raw Steel Production (thousands of net tons): |

|

|

|

|

|

|

|

| |

|

Flat-Rolled |

2,841 |

|

2,711 |

|

5,626 |

|

5,425 |

| |

|

U. S. Steel Europe |

1,308 |

|

1,285 |

|

2,600 |

|

2,543 |

| |

Raw Steel Capability Utilization: (b) |

|

|

|

|

|

|

|

| |

|

Flat-Rolled |

67% |

|

64% |

|

67% |

|

64% |

| |

|

U. S. Steel Europe |

105% |

|

103% |

|

105% |

|

103% |

| |

|

|

|

|

|

|

|

|

|

|

| CAPITAL EXPENDITURES |

|

|

|

|

|

|

|

| |

Flat-Rolled |

$ |

142 |

|

$ |

47 |

|

$ |

318 |

|

$ |

72 |

| |

U. S. Steel Europe |

17 |

|

20 |

|

38 |

|

34 |

| |

Tubular |

13 |

|

4 |

|

24 |

|

11 |

| |

Other Businesses |

1 |

|

2 |

|

1 |

|

3 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Total |

$ |

173 |

|

$ |

73 |

|

$ |

381 |

|

$ |

120 |

(a) Excludes intersegment

shipments. (b) Based on annual raw steel production capability

of 17.0 million net tons for Flat-Rolled and 5.0 million net tons

for U. S. Steel Europe.

| |

| |

| UNITED STATES STEEL

CORPORATION |

| STATEMENT OF OPERATIONS (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Quarter Ended |

|

Six Months Ended |

| |

|

|

June 30, |

|

June 30, |

| (Dollars in millions, except per share

amounts) |

2018 |

|

2017 |

|

2018 |

|

2017 |

| NET SALES |

|

$ |

3,609 |

|

|

$ |

3,144 |

|

|

$ |

6,758 |

|

|

$ |

5,869 |

|

| |

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES (INCOME): |

|

|

|

|

|

|

|

| |

Cost of sales (excludes items shown below) |

3,121 |

|

|

2,723 |

|

|

5,929 |

|

|

5,282 |

|

| |

Selling, general and administrative expenses |

92 |

|

|

67 |

|

|

170 |

|

|

148 |

|

| |

Depreciation, depletion and amortization |

130 |

|

|

121 |

|

|

258 |

|

|

258 |

|

| |

Earnings from investees |

(19) |

|

|

(16) |

|

|

(22) |

|

|

(20) |

|

| |

Gain associated with retained interest in U. S. Steel Canada

Inc. |

— |

|

|

(72) |

|

|

— |

|

|

(72) |

|

| |

Restructuring and other charges |

— |

|

|

(1) |

|

|

— |

|

|

32 |

|

| |

Net gain on disposal of assets |

(17) |

|

|

— |

|

|

(16) |

|

|

(1) |

|

| |

Other expense (income), net |

1 |

|

|

(5) |

|

|

1 |

|

|

(5) |

|

| |

|

|

|

|

|

|

|

|

|

| |

Total operating expenses |

3,308 |

|

|

2,817 |

|

|

6,320 |

|

|

5,622 |

|

| |

|

|

|

|

|

|

|

|

|

| EARNINGS BEFORE INTEREST AND INCOME TAXES |

301 |

|

|

327 |

|

|

438 |

|

|

247 |

|

| Net interest and other financial costs (a) |

75 |

|

|

82 |

|

|

193 |

|

|

163 |

|

| |

|

|

|

|

|

|

|

|

|

| |

EARNINGS BEFORE INCOME TAXES |

226 |

|

|

245 |

|

|

245 |

|

|

84 |

|

| Income tax provision (benefit) |

12 |

|

|

(16) |

|

|

13 |

|

|

3 |

|

| |

|

|

|

|

|

|

|

|

|

| Net earnings |

214 |

|

|

261 |

|

|

232 |

|

|

81 |

|

| |

Less: Net earnings (loss) attributable to noncontrolling

interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

| NET EARNINGS ATTRIBUTABLE TO |

|

|

|

|

|

|

|

| |

UNITED STATES STEEL CORPORATION |

$ |

214 |

|

|

$ |

261 |

|

|

$ |

232 |

|

|

$ |

81 |

|

| |

|

|

|

|

|

|

|

|

|

| COMMON STOCK DATA: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net earnings per share attributable to |

|

|

|

|

|

|

|

| United States Steel Corporation stockholders: |

|

|

|

|

|

|

|

| |

Basic |

|

$ |

1.21 |

|

|

$ |

1.49 |

|

|

$ |

1.32 |

|

|

$ |

0.46 |

|

| |

Diluted |

|

$ |

1.20 |

|

|

$ |

1.48 |

|

|

$ |

1.30 |

|

|

$ |

0.46 |

|

| Weighted average shares, in thousands |

|

|

|

|

|

|

|

| |

Basic |

|

177,027 |

|

|

174,797 |

|

|

176,594 |

|

|

174,521 |

|

| |

Diluted |

|

178,903 |

|

|

176,028 |

|

|

178,485 |

|

|

176,319 |

|

| Dividends paid per common share |

$ |

0.05 |

|

|

$ |

0.05 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

(a) Includes $17 million and $14 million for the

three months ended June 30, 2018 and 2017, respectively, and $34

million and $32 million for the six months ended June 30, 2018 and

2017, respectively, of postretirement benefit expense (other than

service cost) related to the retrospective presentation change of

net periodic benefit cost of our defined benefit pension and other

post-employment benefits as a result of the adoption of Accounting

Standards Update 2017-07, Compensation - Retirement Benefits on

January 1, 2018.

| |

| |

| UNITED STATES STEEL

CORPORATION |

| CASH FLOW STATEMENT (Unaudited) |

| |

|

|

|

|

|

|

| |

|

|

|

Six Months Ended |

| |

|

|

|

June 30, |

| (Dollars in millions) |

|

2018 |

|

2017 |

| Cash provided by (used in) operating activities: |

|

|

|

| |

Net earnings |

|

$ |

232 |

|

|

$ |

81 |

|

| |

Depreciation, depletion and amortization |

258 |

|

|

258 |

|

| |

Gain associated with retained interest in U. S. Steel Canada

Inc. |

— |

|

|

(72) |

|

| |

Restructuring and other charges |

— |

|

|

32 |

|

| |

Loss on debt extinguishment |

74 |

|

|

1 |

|

| |

Pensions and other postretirement benefits |

37 |

|

|

31 |

|

| |

Deferred income taxes |

(1) |

|

|

2 |

|

| |

Net gain on disposal of assets |

(16) |

|

|

(1) |

|

| |

Working capital changes |

(242) |

|

|

(199) |

|

| |

Income taxes receivable/payable |

(2) |

|

|

20 |

|

| |

Other operating activities |

(47) |

|

|

90 |

|

| |

|

Total |

|

293 |

|

|

243 |

|

| |

|

|

|

|

|

|

| Cash used in investing activities: |

|

|

|

| |

Capital expenditures |

|

(381) |

|

|

(120) |

|

| |

Disposal of assets |

|

1 |

|

|

— |

|

| |

Other investing activities |

|

(1) |

|

|

— |

|

| |

|

Total |

|

(381) |

|

|

(120) |

|

| |

|

|

|

|

|

|

| Cash provided by (used in) financing activities: |

|

|

|

| |

Issuance of long-term debt, net of financing costs |

|

640 |

|

|

— |

|

| |

Repayment of long-term debt |

|

(874) |

|

|

(108) |

|

| |

Receipts from exercise of stock options |

|

33 |

|

|

13 |

|

| |

Dividends paid |

|

(18) |

|

|

(18) |

|

| |

Taxes paid for equity compensation plans |

|

(8) |

|

|

(10) |

|

| |

|

Total |

|

(227) |

|

|

(123) |

|

| |

|

|

|

|

|

|

| Effect of exchange rate changes on cash |

(10) |

|

|

10 |

|

| |

|

|

|

|

|

|

| Net (decrease) increase in cash, cash equivalents and

restricted cash |

(325) |

|

|

10 |

|

| Cash, cash equivalents and restricted cash at beginning of

the year (a) |

1,597 |

|

|

1,555 |

|

| |

|

|

|

|

|

|

| Cash, cash equivalents and restricted cash

at end of the period (a) |

$ |

1,272 |

|

|

$ |

1,565 |

|

(a) Includes restricted cash in the

beginning-of-period and end-of-period amounts as a result of the

retrospective adoption of Accounting Standards Update 2016-18,

Statement of Cash Flows (Topic 230): Restricted Cash on January 1,

2018.

| |

| |

| UNITED STATES STEEL

CORPORATION |

| CONDENSED BALANCE SHEET (Unaudited) |

| |

|

|

|

|

|

| |

|

|

June 30 |

|

Dec. 31 |

| (Dollars in millions) |

|

2018 |

|

2017 |

| Cash and cash equivalents |

$ |

1,231 |

|

$ |

1,553 |

|

| Receivables, net |

1,656 |

|

1,379 |

|

| Inventories |

1,848 |

|

1,738 |

|

| Other current assets |

77 |

|

85 |

|

| |

Total current assets |

4,812 |

|

4,755 |

|

| Property, plant and equipment, net |

4,401 |

|

4,280 |

|

| Investments and long-term receivables, net |

498 |

|

480 |

|

| Intangible assets, net |

162 |

|

167 |

|

| Other assets |

185 |

|

180 |

|

| |

|

|

|

|

|

| |

Total

assets |

|

$ |

10,058 |

|

$ |

9,862 |

|

| |

|

|

|

|

|

| Accounts payable and other accrued liabilities |

$ |

2,331 |

|

$ |

2,170 |

|

| Payroll and benefits payable |

386 |

|

347 |

|

| Short-term debt and current maturities of long-term debt |

4 |

|

3 |

|

| Other current liabilities |

181 |

|

201 |

|

| |

Total current liabilities |

2,902 |

|

2,721 |

|

| Long-term debt, less unamortized discount and debt issuance

costs |

2,541 |

|

2,700 |

|

| Employee benefits |

692 |

|

759 |

|

| Other long-term liabilities |

317 |

|

361 |

|

| United States Steel Corporation stockholders' equity |

3,605 |

|

3,320 |

|

| Noncontrolling interests |

1 |

|

1 |

|

| |

|

|

|

|

|

| |

Total liabilities and stockholders'

equity |

$ |

10,058 |

|

$ |

9,862 |

|

| |

| UNITED STATES STEEL

CORPORATION |

| NON-GAAP FINANCIAL MEASURES |

| RECONCILIATION OF ADJUSTED EBITDA |

| |

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

| (Dollars in millions) |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Reconciliation to Adjusted EBITDA |

|

|

|

|

|

|

|

| |

Net

earnings attributable to United States Steel Corporation |

$ |

214 |

|

|

$ |

261 |

|

|

$ |

232 |

|

|

$ |

81 |

|

| |

Income tax

provision (benefit) |

12 |

|

|

(16) |

|

|

13 |

|

|

3 |

|

| |

Net

interest and other financial costs |

75 |

|

|

82 |

|

|

193 |

|

|

163 |

|

| |

Depreciation, depletion and amortization expense |

130 |

|

|

121 |

|

|

258 |

|

|

258 |

|

| |

EBITDA |

431 |

|

|

448 |

|

|

696 |

|

|

505 |

|

| |

Gain on

equity investee transactions |

(18) |

|

|

— |

|

|

(18) |

|

|

— |

|

| |

Granite

City Works restart costs |

36 |

|

|

— |

|

|

36 |

|

|

— |

|

| |

Granite

City Works adjustment to temporary idling charges |

2 |

|

|

— |

|

|

(8) |

|

|

— |

|

| |

Gain

associated with retained interest in U. S. Steel Canada Inc. |

— |

|

|

(72) |

|

|

— |

|

|

(72) |

|

| |

Loss on

shutdown of certain tubular assets |

— |

|

|

— |

|

|

— |

|

|

35 |

|

| |

Adjusted EBITDA |

$ |

451 |

|

|

$ |

376 |

|

|

$ |

706 |

|

|

$ |

468 |

|

| |

| UNITED STATES STEEL

CORPORATION |

| NON-GAAP FINANCIAL MEASURES |

| RECONCILIATION OF ADJUSTED NET

EARNINGS |

| |

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

| (Dollars in millions, except per share

amounts) (a) |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Reconciliation to adjusted net earnings (loss)

attributable to United States Steel Corporation |

|

|

|

|

|

|

|

| |

Net

earnings attributable to United States Steel Corporation |

$ |

214 |

|

|

$ |

261 |

|

|

$ |

232 |

|

|

$ |

81 |

|

| |

Gain on

equity investee transactions |

(18) |

|

|

— |

|

|

(18) |

|

|

— |

|

| |

Granite

City Works restart costs |

36 |

|

|

— |

|

|

36 |

|

|

— |

|

| |

Granite

City Works adjustment to temporary idling charges |

2 |

|

|

— |

|

|

(8) |

|

|

— |

|

| |

Loss on

debt extinguishment and other related costs |

28 |

|

|

— |

|

|

77 |

|

|

— |

|

| |

Gain

associated with retained interest in U. S. Steel Canada Inc. |

— |

|

|

(72) |

|

|

— |

|

|

(72) |

|

| |

Loss on

shutdown of certain tubular assets |

— |

|

|

— |

|

|

— |

|

|

35 |

|

| |

Total

adjustments |

48 |

|

|

(72) |

|

|

87 |

|

|

(37) |

|

| |

Adjusted

net earnings attributable to United States Steel Corporation |

$ |

262 |

|

|

$ |

189 |

|

|

$ |

319 |

|

|

$ |

44 |

|

| |

|

|

|

|

|

|

|

|

| Reconciliation to adjusted diluted net earnings

(loss) per share |

|

|

|

|

|

|

|

| |

Diluted net

earnings per share |

$ |

1.20 |

|

|

$ |

1.48 |

|

|

$ |

1.30 |

|

|

$ |

0.46 |

|

| |

Gain on

equity investee transactions |

(0.10) |

|

|

— |

|

|

(0.10) |

|

|

— |

|

| |

Granite

City Works restart costs |

0.20 |

|

|

— |

|

|

0.20 |

|

|

— |

|

| |

Granite

City Works adjustment to temporary idling charges |

0.01 |

|

|

— |

|

|

(0.04) |

|

|

— |

|

| |

Loss on

debt extinguishment and other related costs |

0.15 |

|

|

— |

|

|

0.43 |

|

|

— |

|

| |

Gain

associated with retained interest in U. S. Steel Canada Inc. |

— |

|

|

(0.41) |

|

|

— |

|

|

(0.41) |

|

| |

Loss on

shutdown of certain tubular assets |

— |

|

|

— |

|

|

— |

|

|

0.20 |

|

| |

Total

adjustments |

0.26 |

|

|

(0.41) |

|

|

0.49 |

|

|

(0.21) |

|

| |

Adjusted diluted net earnings per share |

$ |

1.46 |

|

|

$ |

1.07 |

|

|

$ |

1.79 |

|

|

$ |

0.25 |

|

(a) The adjustments included in this table have

been tax effected at a 0% tax rate due to the recognition of a full

valuation allowance.

| |

| |

| UNITED STATES STEEL

CORPORATION |

| RECONCILIATION OF ADJUSTED EBITDA

GUIDANCE |

| |

|

|

Year Ended |

Year Ended |

| |

|

Quarter Ended |

Dec. 31 |

Dec. 31 |

| |

|

Sept. 30 |

2018 |

2018 |

| (Dollars in millions) |

2018 |

(Low end of range) |

(High end of range) |

| Reconciliation to Projected Adjusted EBITDA Included

in Guidance |

|

|

|

| |

Projected

net earnings attributable to United States Steel Corporation

included in Guidance |

$ |

288 |

|

$ |

925 |

|

$ |

975 |

|

| |

Estimated

income tax expense |

22 |

|

50 |

|

50 |

|

| |

Estimated

net interest and other financial costs |

61 |

|

315 |

|

315 |

|

| |

Estimated

depreciation, depletion and amortization |

129 |

|

520 |

|

520 |

|

| |

Gain on

equity investee transactions |

— |

|

(18) |

|

(18) |

|

| |

Granite

City Works blast furnace B restart costs |

— |

|

36 |

|

36 |

|

| |

Estimated

Granite City Works blast furnace A restart costs |

25 |

|

30 |

|

30 |

|

| |

Granite City Works adjustment to temporary idling

charges |

— |

|

(8) |

|

(8) |

|

| |

Projected adjusted EBITDA included in Guidance |

$ |

525 |

|

$ |

1,850 |

|

$ |

1,900 |

|

| |

|

|

|

|

|

|

|

|

|

|

We present adjusted net earnings (loss),

adjusted net earnings (loss) per diluted share, earnings (loss)

before interest, income taxes, depreciation and amortization

(EBITDA) and adjusted EBITDA, which are non-GAAP measures, as

additional measurements to enhance the understanding of our

operating performance. We believe that EBITDA, considered

along with net earnings (loss), is a relevant indicator of trends

relating to our operating performance and provides management and

investors with additional information for comparison of our

operating results to the operating results of other

companies. EBITDA is also used by analysts to refine and

improve the accuracy of their financial models that utilize

enterprise value.

Adjusted net earnings (loss) and adjusted net

earnings (loss) per diluted share are non-GAAP measures that

exclude the effects of gains (losses) on the sale of ownership

interests in equity investees, facility restart costs, gains

(losses) associated with our retained interest in U. S. Steel

Canada Inc., restructuring charges, significant temporary idling

charges and debt extinguishment and other related costs that are

not part of the Company's core operations. Adjusted EBITDA is

also a non-GAAP measure that excludes the effects of gains (losses)

on the sale of ownership interests in equity investees, facility

restart costs, gains (losses) associated with our retained interest

in U. S. Steel Canada Inc., restructuring charges and significant

temporary idling charges. We present adjusted net earnings

(loss), adjusted net earnings (loss) per diluted share and adjusted

EBITDA to enhance the understanding of our ongoing operating

performance and established trends affecting our core operations,

by excluding the effects of gains (losses) on the sale of ownership

interests in equity investees, facility restart costs, gains

(losses) associated with our retained interest in U. S. Steel

Canada Inc., restructuring charges, significant temporary idling

charges and debt extinguishment and other related costs that can

obscure underlying trends. U. S. Steel's management considers

adjusted net earnings (loss), adjusted net earnings (loss) per

diluted share and adjusted EBITDA as alternative measures of

operating performance and not alternative measures of the Company's

liquidity. U. S. Steel’s management considers adjusted net

earnings (loss), adjusted net earnings (loss) per diluted share and

adjusted EBITDA useful to investors by facilitating a comparison of

our operating performance to the operating performance of our

competitors. Additionally, the presentation of adjusted net

earnings (loss), adjusted net earnings (loss) per diluted share and

adjusted EBITDA provides insight into management’s view and

assessment of the Company’s ongoing operating performance, because

management does not consider the adjusting items when evaluating

the Company’s financial performance or in preparing the Company’s

annual financial guidance. Adjusted net earnings (loss),

adjusted net earnings (loss) per diluted share and adjusted EBITDA

should not be considered a substitute for net earnings (loss),

earnings (loss) per diluted share or other financial measures as

computed in accordance with U.S. GAAP and is not necessarily

comparable to similarly titled measures used by other

companies. A consolidated statement of operations

(unaudited), consolidated cash flow statement (unaudited),

condensed consolidated balance sheet (unaudited) and preliminary

supplemental statistics (unaudited) for U. S. Steel are

attached.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This release contains information that may

constitute “forward-looking statements” within the meaning of

Section 27 of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. We

intend the forward-looking statements to be covered by the safe

harbor provisions for forward-looking statements in those

sections. Generally, we have identified such forward-looking

statements by using the words “believe,” “expect,” “intend,”

“estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,”

“should,” “will” and similar expressions or by using future dates

in connection with any discussion of, among other things, operating

performance, trends, events or developments that we expect or

anticipate will occur in the future, statements relating to volume

growth, share of sales and earnings per share growth, and

statements expressing general views about future operating

results. However, the absence of these words or similar

expressions does not mean that a statement is not

forward-looking. Forward-looking statements are not

historical facts, but instead represent only the Company’s beliefs

regarding future events, many of which, by their nature, are

inherently uncertain and outside of the Company’s control. It

is possible that the Company’s actual results and financial

condition may differ, possibly materially, from the anticipated

results and financial condition indicated in these forward-looking

statements. Management believes that these forward-looking

statements are reasonable as of the time made. However,

caution should be taken not to place undue reliance on any such

forward-looking statements because such statements speak only as of

the date when made. Our Company undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except

as required by law. In addition, forward-looking statements

are subject to certain risks and uncertainties that could cause

actual results to differ materially from our Company's historical

experience and our present expectations or projections. These

risks and uncertainties include, but are not limited to the risks

and uncertainties described in “Item 1A. Risk Factors” in our

Annual Report on Form 10-K for the year ended

December 31, 2017, in our Quarterly Report on Form 10-Q for

the quarter ended June 30, 2018, and those described from

time to time in our future reports filed with the Securities and

Exchange Commission. References to "we," "us," "our," the

"Company," and "U. S. Steel," refer to United States Steel

Corporation and its consolidated subsidiaries.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT: |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Media |

|

|

|

|

|

|

|

|

|

|

|

Investors/Analysts |

| Meghan Cox |

|

|

|

|

|

|

|

|

|

|

|

Dan Lesnak |

| Manager |

|

|

|

|

|

|

|

|

|

|

|

General Manager |

| Corporate

Communications |

|

|

|

|

|

|

|

|

|

|

|

Investor Relations |

| T - (412) 433-6777 |

|

|

|

|

|

|

|

|

|

|

|

T - (412) 433-1184 |

| E - mmcox@uss.com |

|

|

|

|

|

|

|

|

|

|

|

E -

dtlesnak@uss.com |

| |

|

|

|

|

|

|

|

|

|

|

|

|

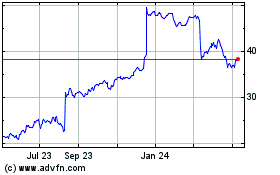

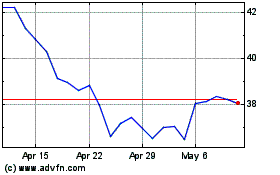

US Steel (NYSE:X)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Steel (NYSE:X)

Historical Stock Chart

From Apr 2023 to Apr 2024