BP to Buy BHP Shale Assets for More Than $10 Billion -- Update

July 26 2018 - 8:54PM

Dow Jones News

By Rhiannon Hoyle and Sarah Kent

SYDNEY -- BP PLC will buy the bulk of BHP Billiton Ltd.'s U.S.

onshore oil-and-gas unit for US$10.5 billion, as the U.K. oil major

rebuilds in the U.S. after the Deepwater Horizon disaster and BHP

exits a business it has called a costly and mistimed

investment.

The sale accelerates a reshuffling of assets among global energy

companies as oil prices surge to levels not seen since 2014.

Chesapeake Energy Corp. said Thursday it is selling oil and gas

fields in Ohio for $2 billion, while Royal Dutch Shell PLC has

nearly completed a $30 billion asset-sale program begun after its

roughly $50 billion acquisition of BG Group in 2016.

The deal is an important milestone for BP, which is in the

middle of an ambitious growth plan. The company is on track to

stage an impressive comeback after years of retrenchment following

its fatal blowout in the Gulf of Mexico in 2010.

The acquisition will grant the British oil giant access to some

of the hottest acreage in the U.S. shale patch. Big oil companies

have historically focused more on giant offshore projects, but they

are increasingly sinking money into shale developments that start

producing and throwing off cash faster.

In a second deal, BHP said it would sell its Fayetteville shale

business in Arkansas to closely held Merit Energy Co., in an

agreement worth $300 million.

"The sale of our onshore U.S. assets is consistent with our

long-term plan to continue to simplify and strengthen our portfolio

to generate shareholder value and returns for decades to come,"

said BHP Chief Executive Andrew Mackenzie. The world's biggest

miner by market value said it intends to return the sale proceeds

to shareholders, because net debt is at the lower end of a target

range.

BHP said both deals need to be approved by regulators. It

expects to complete them by the end of October, but that the right

to economic profits would transfer from July 1.

After months of pressure from activist hedge fund Elliott

Management Corp. and other investors, BHP last August announced

plans to exit businesses that included more than 838,000 acres in

shale-rich U.S. regions. Elliott, which built up a stake of more

than 5% in BHP's U.K.-listed shares, declined to comment on news of

the shale sales.

"Our priority with this transaction is to maximize value and

returns to shareholders," Mr. Mackenzie said.

A posttax impairment charge of about $2.8 billion against the

carrying value of the U.S. assets will be booked for the 2018

fiscal year, said BHP.

BP Chief Executive Bob Dudley described the deal as

transformational for the company's shale business and a major step

toward delivering on BP's growth strategy.

While BP already has a sizable position onshore the U.S., its

portfolio mostly comprises gas. BHP's assets will substantially

boost the company's output of more valuable oil.

The deal will add 190,000 barrels a day of oil and gas

production and 4.6 billion barrels of discovered resources to BP's

asset base, promising output growth into the next decade.

In striking the deal, BP is attempting a delicate balancing act.

Despite rising oil prices, investors have signaled they want

companies to remain financially disciplined and reward shareholders

that stuck with them through a dramatic industry slump in 2014.

Alongside the acquisition, BP announced plans to raise its

second quarter dividend by 2.5% -- the first such increase in 15

quarters. It has structured the deal with 50% of the payment

deferred over six months after completion, funded through equity.

The company said that will allow the acquisition to fit within its

current spending budget and targets for gearing.

Robb M. Stewart in Melbourne contributed to this article.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com and Sarah Kent

at sarah.kent@wsj.com

(END) Dow Jones Newswires

July 26, 2018 20:39 ET (00:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

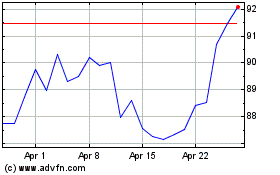

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

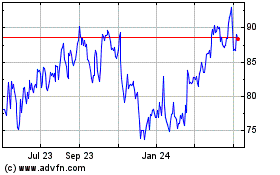

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024