By Akane Otani and Michael Wursthorn

The Nasdaq Composite Index overcame an early slump in the second

quarter and is on course to book its eighth straight quarter of

gains, as fears of a trade war stifling global growth pushed

investors to dump industrial stalwarts and increase their bets on

shares of large technology companies.

The tech-heavy index thrived in a tumultuous three months for

U.S. stocks, which struggled to gain ground as investors were

buffeted by worries about trade tensions, political uncertainty in

the eurozone and signs of slowing momentum in the global

economy.

The S&P 500 and the Dow Jones Industrial Average rose 2.9%

and 0.5%, respectively, for the quarter through Thursday, trailing

the Nasdaq's 6.2% advance. The first two remain well below their

January records, while the Nasdaq notched a series of all-time

highs in June.

The one-directional nature of the stock rally has left investors

increasingly worried that a market whose gains have been heavily

dependent on technology stocks could reverse sharply in the second

half of the year.

"A lot of the investing public is piling into the same things,"

said Jim Paulsen, chief market strategist at Leuthold Group, who

added that the S&P 500 would be mostly flat this year without

technology companies. "There's a lot of sheep following one

another."

Investors remained steadfast in holding the shares of

technology-driven companies over much of the second quarter. That

reflects bets firms such as Amazon.com Inc., Netflix Inc., Facebook

Inc. and Twitter Inc. will continue growing, even as many believe

stock gains will slow as monetary policy tightens and the boost

from the tax-overhaul fades. In fact, technology stocks remain

among the best-performing sectors in the S&P 500 even after

recently tumbling on fears that the White House could move to curb

foreign investment in technology firms and sliding at the start of

the quarter on worries the sector could get hit by tighter

regulations.

The five largest publicly traded companies in the world by

market capitalization are now all tech-related, a stark change from

2009, when firms such as General Electric Co. and Exxon Mobil Corp.

dominated the list. Nearly half of global fund managers now say

betting on the FAANG names -- Facebook, Amazon, Apple Inc., Netflix

and Alphabet Inc. -- and their Chinese equivalents ranks as the

most crowded trade in the market, according to a June survey from

Bank of America Merrill Lynch. That marked the highest share of

investors since 2015 to agree that one trade was becoming too

popular.

Tech's growing dominance has skewed the broader S&P 500 away

from so-called defensive stocks -- sectors such as utilities,

consumer staples and health care -- that investors have

traditionally gravitated toward during bouts of market volatility.

That has left some analysts worried investors in index-tracking

funds could be dangerously exposed to a pullback.

The degree of defensiveness within the S&P 500, which

Leuthold Group calculated by using the percentage of the index's

market capitalization comprised of defensive sectors, has fallen

nearly 60% from 1991 through early June, according to the group's

data. That has increased the weighting of highflying growth stocks

within the S&P 500, reducing its overall effectiveness as a

diversified portfolio for investors who opt to passively track the

broad index, Mr. Paulsen said.

The S&P 500 is "not the same index it was when your father

bought it," he added.

Some investors have begun viewing technology stocks as a safety

play, betting that companies that have produced double-digit

percentage gains this year will be able to continue growing

earnings even under more restrictive global trade conditions. While

the broader stock market tends to take a hit following the

announcement of a trade action, technology stocks are among the

best-performing stocks in the 30 days after a trade action is

announced, implemented or ended, according to BofA Merrill Lynch

data going back to 1995.

To many investors, the technology sector's track record of

earnings growth supersedes risks like trade tensions and the

possibility of tighter regulations. Amazon's quarterly profit

topped $1 billion for the first time in the most recent quarter,

while Facebook's earnings soared even after its user-data crisis

and Microsoft posted double-digit growth in profit and revenue.

"Long term, it looks like a legit growth story," said Paul

Christopher, head of global market strategy for Wells Fargo

Investment Institute.

Yet some analysts worry that, with uncertainty swirling over

whether the U.S. will ratchet up trade tensions with China, the

European Union and others, investors have mispriced the risk that

the sector faces.

Technology companies in the S&P 500 have the highest share

of overseas revenue of the broad index's 11 sectors, with a

foreign-exposure level of about 59%, according to FactSet and BofA

Merrill Lynch data. That is greater than the broader S&P 500,

which gets about one-third of its revenue from overseas and

indirect exposure via commodities, the bank added.

That makes the sector particularly vulnerable to restrictions on

trade and investment. The Nasdaq on Monday posted its biggest

one-day decline since April after reports suggested the Trump

administration was planning to curb foreign investment in U.S.

technology firms. The tech sector's high exposure to foreign

revenue also exposes it to swings in the foreign-exchange market:

Should the recent rebound in the U.S. dollar continue, that could

hurt multinationals whose goods will become more expensive to

foreign buyers, and overseas revenue will be worth less when

converted back into dollars.

Even as investors say technology firms as a whole appear to be

on more stable footing than they were at the height of the dot-com

era in 2000, many remain cautious, citing the tendency for the

stock market to contract when it is led by just a handful of

outperformers.

"Whenever the market narrows like this and everyone wants to own

the same stocks like the [FAANG] stocks, there is a feeding frenzy

that can go on for a while," said Mike Balkin, a portfolio manager

at William Blair. "When it ends, it usually doesn't end well."

Write to Akane Otani at akane.otani@wsj.com and Michael

Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

June 29, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

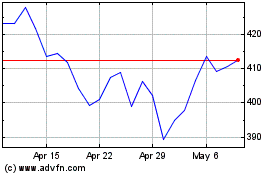

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024