As filed with the Securities and Exchange Commission on June

20, 2018

Registration No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MAGIC

SOFTWARE ENTERPRISES LTD.

(Exact name of registrant as specified in

its charter)

|

Israel

|

|

Not Applicable

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

5 Haplada Street,

Or Yehuda 6021805, Israel

Tel: +972 (3) 538 9322

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

CoreTech Consulting Group, LLC

Attn: Yakov Tsaroya

500 North Gulph Road

Suite 110

King of Prussia, PA 19406

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copies of all Correspondence to:

|

Steven J. Glusband, Esq.

Carter Ledyard & Milburn LLP

2 Wall Street

New York, NY 10005

Tel: 212-238-8605

Fax: 212-732-3232

|

|

Amit Birk, Adv.

Magic Software Enterprises Ltd.

5 Haplada Street

Or-Yehuda, 6021805, Israel

972-3-538-9322

|

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered

on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box:

☐

If any of the securities being registered

on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please

check the following box:

☒

If this form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

☐

If this form is

a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

☐

If this Form is

a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

☐

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company

☐

If an emerging growth company that prepares

its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B)

of the Securities Act .

☐

The term “new

or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its

Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

Title of each class of

securities to be registered

|

|

Amount to be Registered

(1) (2)

|

|

|

Proposed

maximum

offering price per unit

(3)

|

|

|

Proposed maximum aggregate offering price

(3)

|

|

|

Amount of

registration fee

|

|

|

Ordinary shares, par value NIS 0.1 per share

|

|

|

4,268,293

|

|

|

$

|

8.33

|

|

|

$

|

35,554,881

|

|

|

$

|

4,427

|

|

|

|

(1)

|

All of the ordinary shares being registered hereby are offered

for the account of certain selling shareholders who acquired such shares in private transactions approved by our board of directors.

|

|

|

(2)

|

Pursuant to Rule 416 under the Securities Act of 1933, this

registration statement also covers an indeterminate number of additional ordinary shares as may be issuable with respect to the

shares being issued hereunder as a result of a stock split, stock dividend, capitalization or similar event.

|

|

|

(3)

|

Estimated pursuant to Rule 457(c) under the Securities Act

of 1933, as amended, solely for the purposes of calculating the amount of the registration fee, based on the average of the high

and low prices of the registrant's ordinary shares reported as of June 15, 2018 on the Nasdaq Global Select Market.

|

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the SEC, acting pursuant

to said Section 8(a), may determine.

The information contained in

this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with

the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

JUNE 20, 2018

PRELIMINARY PROSPECTUS

MAGIC SOFTWARE ENTERPRISES LTD.

4,268,293

Ordinary Shares

NIS 0.1 per share

This

prospectus relates to the resale, from time to time, by the selling shareholders named in this prospectus or its pledgees, donees,

transferees, or other successors in interest of up to

4

,268,293 ordinary shares

of Magic Software Enterprises Ltd. The selling shareholders agreed to acquire these shares from us pursuant to purchase orders

that were accepted by us on May 28, 2018.

Our

ordinary shares trade on the Nasdaq Global Select Market and on the Tel Aviv Stock Exchange under the symbol "MGIC."

On June 19, 2018, the last reported sale price of our ordinary shares on the NASDAQ Stock Market was $8.30 per share. The selling

shareholders may offer and sell any of the ordinary shares from time to time at fixed prices, at market prices or at negotiated

prices, and may engage a broker, dealer or underwriter to sell the shares. For additional information on the possible methods of

sale that may be used by the selling shareholders, you should refer to the section entitled "Plan of Distribution" elsewhere

in this prospectus. We will not receive any proceeds from the sale of any ordinary shares by the selling shareholders. We do not

know when or in what amount the selling shareholders may offer the ordinary shares for sale. The selling shareholders may sell

any, all or none of the ordinary shares offered by this prospectus.

INVESTING IN

OUR ORDINARY SHARES OR OTHER SECURITIES INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” ON PAGE 3 AND UNDER

SIMILAR HEADINGS IN THE OTHER DOCUMENTS THAT ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS FOR A DISCUSSION OF CERTAIN

FACTORS THAT SHOULD BE CONSIDERED BY PROSPECTIVE PURCHASERS OF THE SECURITIES OFFERED HEREBY.

NONE OF THE U.S.

SECURITIES AND EXCHANGE COMMISSION, THE ISRAELI SECURITIES AUTHORITY OR ANY STATE SECURITIES COMMISSION HAVE APPROVED OR DISAPPROVED

OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

The date of this prospectus is

You

should rely only on the information contained or incorporated by reference in this prospectus or any supplement. Neither we nor

the selling shareholders have authorized anyone else to provide you with different information. The ordinary shares offered by

this prospectus are being offered only in jurisdictions where the offer is permitted. You should not assume that the information

in this prospectus or any supplement is accurate as of any date other than the date on the front of each document. Our business,

financial condition, results of operations and prospects may have changed since that date.

TABLE OF CONTENTS

SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS

This prospectus, including

the information incorporated by reference into this prospectus, contains, and any prospectus supplement may contain, forward-looking

statements within the meaning of the federal securities laws. The use of the words “projects,” “expects,”

“may,” “plans” or “intends,” or words of similar import, identifies a statement as “forward-looking.”

The forward-looking statements included herein are based on current expectations that involve a number of risks and uncertainties.

These forward-looking statements are based on the assumption that the Company will not lose a significant customer or customers

or experience increased fluctuations of demand or rescheduling of purchase orders, that our markets will be maintained in a manner

consistent with our historical experience, that our products will remain accepted within their respective markets and will not

be replaced by new technology, that competitive conditions within our markets will not change materially or adversely, that we

will retain key technical and management personnel, that our forecasts will accurately anticipate market demand, and that there

will be no material adverse change in our operations or business. Assumptions relating to the foregoing involve judgments with

respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which

are difficult or impossible to predict accurately and many of which are beyond our control. In addition, our business and operations

are subject to substantial risks which increase the uncertainty inherent in the forward-looking statements. In light of the significant

uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded

as a representation by us or any other person that our objectives or plans will be achieved. Factors that could cause actual results

to differ from our expectations or projections include the risks and uncertainties relating to our business described in this

prospectus at “Risk Factors.” We caution you to carefully consider these risks and not to place undue reliance on

our forward-looking statements. Except as required by applicable law, including the securities laws of the United States, we do

not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise,

and we assume no responsibility for updating any forward-looking statements.

ABOUT THIS PROSPECTUS

This

prospectus is part of a registration statement on Form F-3 we filed with the Securities Exchange Commission, or the SEC.

The Selling Shareholders named in this prospectus may, from time to time, sell the securities described in this prospectus in one

or more offerings. This prospectus and the documents incorporated by reference herein include important information about us, the

ordinary shares being offered by the selling shareholders and other information you should know before investing. Any prospectus

supplement may also add, update, or change information in this prospectus. If there is any inconsistency between the information

contained in this prospectus and any prospectus supplement, you should rely on the information contained in that particular prospectus

supplement.

The

selling shareholders may offer and sell the ordinary shares directly to purchasers, through agents selected by the selling shareholders,

or to or through underwriters or dealers. A prospectus supplement, if required, may describe the terms of the plan of distribution

and set forth the names of any agents, underwriters or dealers involved in the sale of ordinary shares. See "Plan of Distribution."

This prospectus does

not contain all of the information provided in the registration statement that we filed with the Commission. For further

information about us or our securities, you should refer to that registration statement, which you can obtain from the Commission

as described below under “Where You Can Find More Information and Incorporation of Certain Information by Reference.”

You should rely only

on the information contained or incorporated by reference in this prospectus or a prospectus supplement. We have not authorized

any other person to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it. This prospectus is not an offer to sell these securities and it is not soliciting an offer to

buy these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information

contained in this prospectus and the accompanying prospectus supplement is accurate on any date subsequent to the date set forth

on the front of the document or that any information that we have incorporated by reference is correct on any date subsequent to

the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects

may have changed since those dates.

Unless we have indicated

otherwise or the context otherwise requires, references in this prospectus and any supplement to this prospectus to “the

Company,” “Magic,” “we,” “us” and “our” refer to Magic Software Enterprises

Ltd., a company organized under the laws of the State of Israel, and its wholly owned subsidiaries. All references in this prospectus

to “dollars” or “$” are to United States dollars, and all references to “Shekels” or “NIS”

are to New Israeli Shekels.

PROSPECTUS SUMMARY

You should read the

following summary together with the more detailed information about us, the ordinary shares that may be sold from time to time,

and our financial statements and the notes to them, all of which appear elsewhere in this prospectus or in the documents incorporated

by reference in this prospectus.

We are a global provider

of proprietary application development and business process integration platforms, selected packaged vertical software solutions,

as well as a vendor of software services and IT outsourcing software services. Our software technology is used by customers to

develop, deploy and integrate on-premise, mobile and cloud-based business applications quickly and cost effectively. In addition,

our technology enables enterprises to accelerate the process of delivering business solutions that meet current and future needs

and allow customers to dramatically improve their business performance and return on investment. With respect to software services

and IT outsourcing services, we offer a vast portfolio of professional services in the areas of infrastructure design and delivery,

application development, technology consulting planning and implementation services, support services, cloud computing for deployment

of highly available and massively-scalable applications and API’s and supplemental outsourcing services.

The Private Placement

On May 28, 2018, we

entered into a transaction for the sale of

4,268,293 of our

ordinary shares at a price

of $8.20 per share in a private placement transaction, or the Private Placement, for gross proceeds of approximately $35.0 million

in the aggregate to Israeli institutional investors and

to our controlling shareholder, Formula

Systems (1985) Ltd., or Formula Systems

. Barak Capital Underwriting Ltd. served as placement agent in the Private

Placement. We expect to receive payment from the investors on or about the time of effectiveness of the registration statement.

In connection with the Private Placement,

we agreed to file a registration statement on Form F-3 to cover the resale of the ordinary shares issued in the Private Placement

to

the

Israeli institutional investors and Formula Systems, or

the

Selling Shareholders

. This prospectus forms a part of the registration statement.

Corporate Information

Our legal and commercial

name is Magic Software Enterprises Ltd., and we were organized and registered under the law of the state of Israel on February

10, 1983 and began operations in 1986. We are a public limited liability company and operate under the provisions of the state

of Israel. Our Ordinary Shares have been listed on the NASDAQ Stock Market (symbol: MGIC) since our initial public offering in

the United States on August 16, 1991. On January 3, 2011, our shares were transferred to the NASDAQ Global Select Market. Since

November 16, 2000, our Ordinary Shares have also traded on the Tel Aviv Stock Exchange, or the TASE, and since December 15, 2011,

our shares have been included in the TASE’s TA-125 Index.

Our registered offices

and principal place of business are located at 5 Haplada Street, Or-Yehuda 6021805, Israel, and our telephone number is +972-3-538-9292.

Our website address is

www.magicsoftware.com

. The information on our website is not incorporated by reference into this

prospectus.

THE OFFERING

|

Ordinary shares offered (by the Selling Shareholders)

|

4,268,293 shares

|

|

|

|

|

NASDAQ Global Select Market symbol

|

“MGIC”

|

|

|

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of the ordinary shares offered hereby.

|

|

|

|

|

Ordinary shares outstanding as of June

20, 2018

|

48,757,496 shares

|

|

|

|

|

Risk factors

|

Prospective investors should carefully consider the Risk Factors incorporated by reference into this prospectus for a discussion of certain factors that should be considered before buying the ordinary shares offered hereby.

|

RISK FACTORS

Investing in our ordinary

shares or other securities involves risks. Before making an investment decision, you should carefully consider the risks described

under “Risk Factors” in the applicable supplemental prospectus shelf offering reports, our 2017 Form 20-F, and in our

updates, if any, to those risk factors in our reports of foreign private issuer on Form 6-K, together with all of the other information

appearing in this prospectus or incorporated by reference into this shelf prospectus and any applicable supplemental prospectus

shelf offering report, in light of your particular investment objectives and financial circumstances. In addition to those risk

factors, there may be additional risks and uncertainties of which management is not aware or focused on or that management deems

immaterial. Our business, financial condition or results of operations could be materially adversely affected by any of these risks.

The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment.

CAPITALIZATION AND INDEBTEDNESS

The following table

sets forth the actual capitalization of our company at March 31, 2018 and as adjusted to give effect to the receipt of approximately

$ 35,000,000 in gross proceeds in the Private Placement.

|

|

|

As of March 31, 2018

|

|

|

|

|

Actual

|

|

|

As Adjusted

|

|

|

|

|

(in thousands)

|

|

|

Cash and Cash Equivalents

|

|

$

|

72,741

|

|

|

$

|

107,250

|

|

|

Short-term debt to financial institutions

|

|

|

10,135

|

|

|

|

10,135

|

|

|

Long-term debt

|

|

|

26,962

|

|

|

|

26,962

|

|

|

SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Share capital

|

|

|

|

|

|

|

|

|

|

Ordinary shares of NIS 0.01 par value

|

|

|

|

|

|

|

|

|

|

Authorized: 50,000,000 shares at March 31, 2018; Issued and outstanding: 44,489,203 at March 31, 2018 and 48,757,496 as of June 20, 2018

|

|

|

1,040

|

|

|

|

1,161

|

|

|

Additional paid in capital

|

|

|

183,451

|

|

|

|

217,839

|

|

|

Accumulated other comprehensive loss

|

|

|

(82

|

)

|

|

|

(82

|

)

|

|

Retained earnings

|

|

|

24,509

|

|

|

|

24,509

|

|

|

Total equity attributable to Magic Software Enterprises shareholders

|

|

|

208,918

|

|

|

|

243,427

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest

|

|

|

3,708

|

|

|

|

3,708

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity

|

|

|

212,626

|

|

|

|

247,135

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

|

378,153

|

|

|

|

414,439

|

|

USE OF PROCEEDS

All

of the proceeds from the sale of any ordinary shares offered under this prospectus are for the account of the Selling Shareholders.

Accordingly, we will not receive any proceeds from the sales of these securities. We have agreed to bear all the expenses

relating to the registration of the securities registered pursuant to this prospectus.

DIVIDEND POLICY

Our Board of Directors’

dividend policy is to distribute dividends of up to 75% of our annual distributable profits each year (amended on August 9, 2017

from previously 50% of our annual distributable profits each year), subject to any applicable law. Our Board of Directors may in

its discretion and at any time, whether as a result of a one-time decision or a change in policy, change the rate of dividend distributions

or decide not to distribute a dividend. Please see “Item 8. Financial Information—A. Consolidated Statements and Other

Financial Information—Dividend Policy” in the 2017 Form 20-F for further information concerning the factors that help

to determine whether and under what circumstances we may distribute dividends.

In February 2015, we

declared a cash dividend in the amount of US $0.081 per share ($3.6 million in the aggregate), that was paid on March 11, 2015.

In August 2015, we

declared a cash dividend in the amount of $0.095 per share ($4.2 million in the aggregate) that was paid on September 10,

2015.

In February 2016, we

declared a cash dividend in the amount of $0.09 per share ($4.0 million in the aggregate) that was paid on March 17, 2016.

In August 2016, we

declared a cash dividend in the amount of $0.085 per share ($3.8 million in the aggregate) that was paid on September 22,

2016.

In February 2017, we

declared a cash dividend in the amount of $0.085 per share ($3.8 million in the aggregate) that was paid on April 5, 2017.

In August 2017, we

declared a cash dividend in the amount of $0.13 per share ($5.8 million in the aggregate) that was paid on September 13, 2017.

In February 2018, we

declared a cash dividend in the amount of $0.13 per share ($5.8 million in the aggregate) that was paid on March 26, 2018.

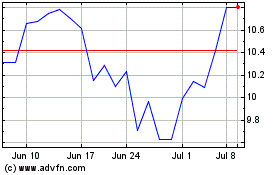

PRICE RANGE OF OUR ORDINARY SHARES

Our ordinary shares

are quoted on the NASDAQ Global Select Market under the symbol “MGIC” and are listed on the Tel Aviv Stock Exchange,

or the TASE. On June 19, 2018 the last reported sale price of our ordinary shares on the NASDAQ Global Select Market was $8.30,

and the last reported sale price of our ordinary shares on the Tel Aviv Stock Exchange was $8.28.

Annual Share Price Information

The following table sets

forth, for each of the years indicated, the range of high ask and low bid prices of our ordinary shares on the NASDAQ Global Select

Market and the TASE:

|

|

|

NASDAQ

|

|

|

Tel Aviv Stock Exchange*

|

|

|

Year

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013

|

|

$

|

7.18

|

|

|

$

|

4.53

|

|

|

$

|

7.06

|

|

|

$

|

4.73

|

|

|

2014

|

|

$

|

9.60

|

|

|

$

|

5.94

|

|

|

$

|

9.30

|

|

|

$

|

6.40

|

|

|

2015

|

|

$

|

7.04

|

|

|

$

|

5.26

|

|

|

$

|

7.26

|

|

|

$

|

5.29

|

|

|

2016

|

|

$

|

7.89

|

|

|

$

|

5.29

|

|

|

$

|

7.79

|

|

|

$

|

5.35

|

|

|

2017

|

|

$

|

9.40

|

|

|

$

|

6.75

|

|

|

$

|

9.13

|

|

|

$

|

7.19

|

|

|

|

*

|

The dollar price of shares on the TASE is determined by

dividing the price of an ordinary share in NIS by the representative exchange rate of the NIS against the dollar on the same date.

|

Quarterly Share Price Information

The following table

sets forth, for each of the financial quarters in the two most recent financial years, the range of high ask and low bid prices

of our ordinary shares on the NASDAQ Global Select Market and the TASE:

|

|

|

NASDAQ

|

|

|

Tel Aviv Stock Exchange*

|

|

|

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First quarter

|

|

$

|

7.12

|

|

|

$

|

5.29

|

|

|

$

|

7.05

|

|

|

$

|

5.25

|

|

|

Second quarter

|

|

$

|

6.98

|

|

|

$

|

6.39

|

|

|

$

|

7.00

|

|

|

$

|

6.38

|

|

|

Third quarter

|

|

$

|

7.89

|

|

|

$

|

6.60

|

|

|

$

|

7.86

|

|

|

$

|

6.69

|

|

|

Fourth quarter

|

|

$

|

7.50

|

|

|

$

|

6.67

|

|

|

$

|

7.49

|

|

|

$

|

6.84

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First quarter

|

|

$

|

8.05

|

|

|

$

|

6.75

|

|

|

$

|

7.82

|

|

|

$

|

6.93

|

|

|

Second quarter

|

|

$

|

8.45

|

|

|

$

|

7.50

|

|

|

$

|

8.46

|

|

|

$

|

7.60

|

|

|

Third quarter

|

|

$

|

8.95

|

|

|

$

|

7.70

|

|

|

$

|

8.60

|

|

|

$

|

7.73

|

|

|

Fourth quarter

|

|

$

|

9.40

|

|

|

$

|

8.00

|

|

|

$

|

9.36

|

|

|

$

|

8.07

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First quarter

|

|

$

|

9.15

|

|

|

$

|

7.85

|

|

|

$

|

9.02

|

|

|

$

|

7.96

|

|

|

Second quarter (through June 15)

|

|

$

|

8.85

|

|

|

$

|

8.00

|

|

|

$

|

8.77

|

|

|

$

|

7.91

|

|

|

|

*

|

The dollar price of shares on the TASE is determined by

dividing the price of an ordinary share in NIS by the representative exchange rate of the NIS against the dollar on the same date.

|

Monthly Share Price Information

The following table

sets forth, for the most recent six months, the range of high ask and low bid prices of our ordinary shares on the NASDAQ Global

Select Market and the TASE:

|

|

|

NASDAQ

|

|

|

Tel Aviv Stock Exchange*

|

|

|

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

January 2018

|

|

$

|

9.15

|

|

|

$

|

8.63

|

|

|

$

|

8.99

|

|

|

$

|

8.60

|

|

|

February 2018

|

|

$

|

9.10

|

|

|

$

|

7.85

|

|

|

$

|

8.94

|

|

|

$

|

8.21

|

|

|

March 2018

|

|

$

|

8.60

|

|

|

$

|

7.95

|

|

|

$

|

8.47

|

|

|

$

|

8.10

|

|

|

April 2018

|

|

$

|

8.50

|

|

|

$

|

8.10

|

|

|

$

|

8.39

|

|

|

$

|

7.98

|

|

|

May 2018

|

|

$

|

8.85

|

|

|

$

|

8.00

|

|

|

$

|

8.71

|

|

|

$

|

8.04

|

|

|

June 2018 (through June 15)

|

|

$

|

8.85

|

|

|

$

|

8.20

|

|

|

$

|

8.74

|

|

|

$

|

8.38

|

|

|

|

*

|

The dollar price of shares on the TASE is determined by

dividing the price of an ordinary share in NIS by the representative exchange rate of the NIS against the dollar on the same date.

|

SELLING SHAREHOLDERS

We have prepared this

prospectus to allow the Selling Shareholders or their donees, pledgees, transferees or other successors in interest to sell or

otherwise dispose of, from time to time, of ordinary shares issued

pursuant to a Private

Placement that was consummated in June 2018. We issued 4,268,293 ordinary shares in the Private Placement, including 1,117,734 to

our controlling shareholder, Formula Systems.

The table below presents

information regarding the Selling Shareholders, the ordinary shares beneficially owned prior to this offering and the ordinary

shares that they may sell or otherwise dispose of from time to time under this prospectus.

We do not know when

or in what amounts the Selling Shareholders may sell or otherwise dispose of the common shares covered hereby. The Selling Shareholders

may not sell any or all of the shares covered by this prospectus or may sell or dispose of some or all of the shares other than

pursuant to this prospectus. Because the Selling Shareholders may not sell or otherwise dispose of some or all of the shares covered

by this prospectus and because there are currently no agreements, arrangements or understandings with respect to the sale or other

disposition of any of the shares, we cannot estimate the number of the shares that will be held by the Selling Shareholders after

completion of the offering. However, for purposes of this table, we have assumed that all of the ordinary shares covered by this

prospectus will be sold by the Selling Shareholders.

|

|

|

Beneficial Ownership

(1)

|

|

|

Name

of Selling Shareholder

(2)

|

|

Number of

Shares

Beneficially

Owned Prior

to the

Offering

|

|

|

Percent

Of

Class

Prior

to the

Offering

|

|

|

Number of

Shares

Offered

Hereby

|

|

|

Number of

Shares

Beneficially

Owned

After this

Offering

|

|

|

Percent

of

Class

After

this

Offering

|

|

|

Formula Systems

(3)

|

|

|

22,080,468

|

|

|

|

45.29

|

%

|

|

|

1,117,734

|

|

|

|

20,962,734

|

|

|

|

42.99

|

%

|

|

Clal Insurance Company Ltd.

(4)

|

|

|

1,779,932

|

|

|

|

3.65

|

%

|

|

|

718,674

|

|

|

|

1,061,258

|

|

|

|

2.18

|

%

|

|

Atudot Pension Fund For Employees and

Independents Ltd.

(5)

|

|

|

75,452

|

|

|

|

*

|

|

|

|

23,609

|

|

|

|

51,843

|

|

|

|

*

|

|

|

Clal Pension and Provident Fund Ltd.

(6)

|

|

|

1,669,066

|

|

|

|

3.42

|

%

|

|

|

453,935

|

|

|

|

1,215,131

|

|

|

|

2.49

|

%

|

|

Shtofut - Menayot Israel Phoenix Amitim.

(7)

|

|

|

2,843,315

|

|

|

|

5.83

|

%

|

|

|

649,403

|

|

|

|

2,193,912

|

|

|

|

4.50

|

%

|

|

The Phoenix Investement and Finance Ltd

(8)

|

|

|

226,348

|

|

|

|

*

|

|

|

|

47,106

|

|

|

|

179,242

|

|

|

|

*

|

|

|

Yelin Lapidot Mutual Funds Ltd

(9)

|

|

|

2,194,314

|

|

|

|

4.50

|

%

|

|

|

487,805

|

|

|

|

1,706,509

|

|

|

|

3.50

|

%

|

|

Yelin Lapidot Provident Funds Management Ltd

(10)

|

|

|

1,148,506

|

|

|

|

2.36

|

%

|

|

|

170,000

|

|

|

|

978,506

|

|

|

|

2.01

|

%

|

|

Shomera Insurance Company

(11)

|

|

|

17,650

|

|

|

|

*

|

|

|

|

17,650

|

|

|

|

-

|

|

|

|

-

|

|

|

Menora Mivtachim Insurance Ltd

(12)

|

|

|

108,657

|

|

|

|

*

|

|

|

|

104,301

|

|

|

|

4,356

|

|

|

|

*

|

|

|

Psagot Provident Fund Ltd

(13)

|

|

|

482,394

|

|

|

|

0.99

|

%

|

|

|

478,076

|

|

|

|

4,318

|

|

|

|

*

|

|

|

(1)

|

Beneficial ownership is determined in accordance with Section 13(d) of the Exchange Act and generally includes voting and investment power with respect to securities and including any securities that grant the selling shareholder the right to acquire ordinary shares within 60 days of this June 20, 2018. Percentage ownership is based on an aggregation of the 48,757,496 ordinary shares issued and outstanding as of June 20, 2018.

|

|

(2)

|

Unless otherwise indicated, this table is based on information supplied to us by the Selling Shareholders and our records.

|

|

|

|

|

(3)

|

Asseco Poland S.A., or Asseco, owned 26.31% of the outstanding shares of Formula Systems based on the Schedule 13D filed by Asseco with the SEC on October 19, 2017. As such, Asseco may be deemed to be the beneficial owner of the Ordinary Shares held directly by Formula Systems. Guy Bernstein owns 13.4% of the outstanding shares of Formula Systems. In addition, on October 4, 2017 Asseco entered into a shareholders agreement with Mr. Bernstein, under which agreement Asseco has been granted an irrecoverable proxy to vote an additional 1,971,973 Ordinary Shares of Formula Systems, thereby effectively giving Asseco beneficial ownership (voting power) over an aggregate of 39.7% of Formula Systems’s outstanding ordinary shares. Therefore, based on the foregoing beneficial ownership by each of Formula Systems and Asseco, each of Formula Systems and Asseco may be deemed to directly or indirectly (as appropriate) control us. The address of Formuila Systems is 5 Haplada St., Or-Yehuda 6021805, Israel. The address of Asseco is 35-322 Rzeszow, ul. Olchowa 14, Poland.

|

|

|

|

|

(4)

|

Based on written notification received from Clal Insurance Company Ltd. Its address is 36 Raul Wallenberg St., Tel Aviv 6136902, Israel.

|

|

|

|

|

(5)

|

Based on written notification received from Atudot Pension Fund For Employees and Independents Ltd. Its address is 36 Raul Wallenberg St., Tel Aviv 6136902, Israel.

|

|

|

|

|

(6)

|

Based on written notification received from Clal Pension and Provident Fund Ltd. Its address is 36 Raul Wallenberg St., Tel Aviv 6136902, Israel.

|

|

|

|

|

(7)

|

Based on written notification received from Shtofut - Menayot Israel Phoenix Amitim. Its address is 53 Derech Hashalom St., Givatayim 5345433, Israel

|

|

|

|

|

(8)

|

Based on written notification received from The Phoenix Investement and Finance Ltd. Its address is 53 Derech Hashalom St., Givatayim 5345433, Israel.

|

|

|

|

|

(9)

|

Based on written notification received from Yelin Lapidot Mutual Funds Ltd. Its address is 50 Dizengoff St., Tel Aviv, Israel.

|

|

|

|

|

(10)

|

Based on written notification received from Yelin Lapidot Provident Funds Management Ltd. Its address is 50 Dizengoff St., Tel Aviv, Israel.

|

|

|

|

|

(11)

|

Based on written notification received from Shomera Insurance Company. Its address is 23 Hasivim St., Petach Tikwa, Israel.

|

|

|

|

|

(12)

|

Based on written notification received from Menora Mivtachim Insurance Ltd. Its address is 23 Jabotinski St., Ramat Gan, Israel.

|

|

|

|

|

(13)

|

Based on written notification received from Psagot Provident Fund Ltd. Its address is 14 Ehad Ha’am St., Tel Aviv, Israel.

|

PLAN OF DISTRIBUTION

We

are registering the ordinary shares hereby to permit the resale of the ordinary shares by the selling shareholders. We will not

receive any of the proceeds from the sale by the Selling Shareholders of the ordinary shares. We will bear all fees and expenses

incident to our obligation to register the ordinary shares.

The

Selling Shareholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling ordinary

shares or interests in ordinary shares received after the date of this prospectus from a selling shareholder as a gift, pledge,

partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their

ordinary shares or interests in ordinary shares on any stock exchange, market or trading facility on which the shares are traded

or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices

related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The Selling Shareholders

may use any one or more of the following methods when disposing of shares or interests therein:

|

|

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

|

|

|

|

●

|

block trades in which the broker-dealer will

attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the

transaction;

|

|

|

|

|

|

|

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

|

|

|

|

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

|

|

|

|

●

|

privately negotiated transactions;

|

|

|

|

|

|

|

●

|

short

sales effected after the date the registration statement of which this prospectus is a part is declared effective by the

SEC;

|

|

|

|

|

|

|

●

|

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

|

|

|

|

●

|

broker-dealers may agree with the Selling Shareholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

|

|

|

|

●

|

a combination of any such methods of sale; and

|

|

|

|

|

|

|

●

|

any other method permitted by applicable law.

|

If

the Selling Shareholders effect such transactions by selling ordinary shares to or through underwriters, broker-dealers or agents,

such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the

Selling Shareholders or commissions from purchasers of the ordinary shares for whom they may act as agent or to whom they may sell

as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess

of those customary in the types of transactions involved). The Selling Shareholders may, from time to time, pledge or grant a security

interest in some or all of the ordinary shares owned by them and, if they default in the performance of their secured obligations,

the pledgees or secured parties may offer and sell the ordinary shares, from time to time, under this prospectus, or under an amendment

to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of Selling Shareholders

to include the pledgee, transferee or other successors in interest as Selling Shareholders under this prospectus. The Selling Shareholders

also may transfer the ordinary shares in other circumstances, in which case the transferees, pledgees or other successors in interest

will be the selling beneficial owners for purposes of this prospectus.

In

connection with the sale of our ordinary shares or interests therein, the Selling Shareholders may enter into hedging transactions

with broker-dealers or other financial institutions, which may in turn engage in short sales of the ordinary shares in the course

of hedging the positions they assume. The Selling Shareholders may also sell shares of our ordinary shares short and deliver these

securities to close out their short positions, or loan or pledge the ordinary shares to broker-dealers that in turn may sell these

securities. The Selling Shareholders may also enter into option or other transactions with broker-dealers or other financial institutions

or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution

of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this

prospectus (as supplemented or amended to reflect such transaction).

The

aggregate proceeds to the Selling Shareholders from the sale of the ordinary shares offered by them will be the aggregate purchase

price of the ordinary shares less aggregate discounts or commissions, if any. Each of the Selling Shareholders reserves the right

to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of ordinary

shares to be made directly or through agents.

The

Selling Shareholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under

the Securities Act, provided that they meet the criteria and conform to the requirements of that rule.

The

Selling Shareholders and any underwriters, broker-dealers or agents that participate in the sale of the ordinary shares or interests

therein may be, “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions,

concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities

Act. Selling Shareholders who are “underwriters” within the meaning of Section 2(11) of the Securities Act will be

subject to the prospectus delivery requirements of the Securities Act.

To

the extent required, the ordinary shares to be sold, the names of the Selling Shareholders, the respective purchase prices and

public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to

a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to

the registration statement that includes this prospectus.

In

order to comply with the securities laws of some states, if applicable, the ordinary shares may be sold in these jurisdictions

only through registered or licensed brokers or dealers. In addition, in some states the ordinary shares may not be sold unless

it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is

complied with.

We

have advised the Selling Shareholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales

of shares in the market and to the activities of the Selling Shareholders and their affiliates. In addition, to the extent applicable

we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the Selling Shareholders

for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling Shareholders may indemnify

any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities

arising under the Securities Act.

We

have agreed to indemnify the Selling Shareholders against liabilities, including liabilities under the Securities Act and state

securities laws, relating to the registration of the shares offered by this prospectus.

We

have agreed with the Selling Shareholders to keep the registration statement of which this prospectus constitutes a part effective

until the earlier of (i) such time as all of the shares covered by this prospectus have been disposed of pursuant to and in accordance

with the registration statement or (ii) six months from the date of this prospectus.

DESCRIPTION OF SHARE CAPITAL

The following description

of our ordinary shares and provisions of our articles of association is a summary and does not purport to be complete.

Purposes and Objects

of the Company

We are a public company

registered with the Israeli Companies Registry as Magic Software Enterprises Ltd., registration number 52-003674-0. Section 2 of

our memorandum of association provides that we were established for the purpose of engaging in all fields of the computer business

and in any other lawful activity permissible under Israeli law.

The Powers of the

Directors

According to our articles

of association, and under the limitations described therein, our board of directors may cause the company to borrow or secure the

payment of any sum or sums of money for the purposes of the company, and set aside any amount out of our profits as a reserve for

any purpose.

Under our articles

of association, retirement of directors from office is not subject to any age limitation and our directors are not required to

own shares in our company in order to qualify to serve as directors.

Rights Attached to

Shares

Our authorized share

capital consists of 50,000,000 ordinary shares of a nominal value of NIS 0.1 each. All outstanding ordinary shares are validly

issued, fully paid and non-assessable. Our ordinary shares are not redeemable and do not have any preemptive rights. The rights

attached to the ordinary shares are as follows:

Dividend rights.

Holders of our ordinary shares are entitled to the full amount of any cash or share dividend subsequently declared. The board of

directors may declare interim dividends and propose the final dividend with respect to any fiscal year only out of the retained

earnings, in accordance with the provisions of the Israeli Companies Law. All unclaimed dividends or other monies payable in respect

of a share may be invested or otherwise made use of by the Board of Directors for our benefit until claimed. Any dividend unclaimed

after a period of three years from the date of declaration of such dividend will be forfeited and will revert to us; provided,

however, that the Board of Directors may, at its discretion, cause us to pay any such dividend to a person who would have been

entitled thereto had the same not reverted to us. We are not obligated to pay interest or linkage differentials on an unclaimed

dividend.

Voting rights.

Holders of ordinary shares have one vote for each ordinary share held on all matters submitted to a vote of shareholders. Such

voting rights may be affected by the grant of any special voting rights to the holders of a class of shares with preferential rights

that may be authorized in the future.

The quorum required

at any meeting of shareholders consists of at least two shareholders present in person or represented by proxy who hold or represent,

in the aggregate, at least one-third (33%) of the voting rights in the company. A meeting adjourned for lack of a quorum is generally

adjourned to the same day in the following week at the same time and place or any time and place as the directors designate in

a notice to the shareholders. At the reconvened meeting, the required quorum consists of any two members present in person or by

proxy.

Under our articles

of association, all resolutions require approval of no less than a majority of the voting rights represented at the meeting in

person or by proxy and voting thereon.

Pursuant to our articles

of association, our directors (except external directors) are elected at our annual general meeting of shareholders by a vote of

the holders of a majority of the voting power represented and voting at such meeting and hold office until the next annual general

meeting of shareholders and until their successors have been elected. All the members of our Board of Directors (except the external

directors) may be reelected upon completion of their term of office. Asseco, controlling shareholder of Formula Systems, and Formula

Systems, our parent company, are able to exercise control over the election of our directors (subject to a special majority required

for the election of external directors).

Rights to share

in the company’s profits.

Our shareholders have the right to share in our profits distributed as a dividend and any other

permitted distribution.

Rights to share

in surplus in the event of liquidation.

In the event of our liquidation, after satisfaction of liabilities to creditors, our

assets will be distributed to the holders of ordinary shares in proportion to the nominal value of their holdings. This right may

be affected by the grant of preferential dividend or distribution rights to the holders of a class of shares with preferential

rights that may be authorized in the future.

Liability to capital

calls by the company.

Under our memorandum of association and the Israeli Companies Law, the liability of our shareholders

to provide us with additional funds is limited to the par value of the shares held by them.

Changing Rights Attached to Shares

According to our articles

of association, the rights attached to any class of shares may be modified or abrogated by us, subject to the consent in writing

of, or sanction of a resolution passed by, the holders of a majority of the issued shares of such class at a separate general meeting

of the holders of the shares of such class.

Annual and Extraordinary Meetings

Under the Israeli Companies

Law a company must convene an annual meeting of shareholders at least once every calendar year and within fifteen months of the

last annual meeting. Depending on the matter to be voted upon, notice of at least 21 days or 35 days prior to the date of the meeting

is required. Our board of directors may, in its discretion, convene additional meetings as “extraordinary general meetings.”

In addition, the board must convene an extraordinary general meeting upon the demand of two of the directors, 25% of the nominated

directors, one or more shareholders holding at least 5% of the outstanding share capital and at least 1% of the voting power in

the company, or one or more shareholders having at least 5% of the voting power in the company.

Limitations on the Rights to Own Securities in Our Company

Neither our memorandum

of association or our articles of association nor the laws of the State of Israel restrict in any way the ownership or voting of

shares by non-residents, except with respect to subjects of countries which are in a state of war with Israel.

Provisions Restricting Change in Control of Our Company

The Israeli Companies

Law requires that mergers between Israeli companies be approved by the board of directors and general meeting of shareholders of

both parties to the transaction. The approval of the board of directors of both companies is subject to such boards’ confirmation

that there is no reasonable doubt that following the merger the surviving company will be able to fulfill its obligations towards

its creditors. Each company must notify its creditors about the contemplated merger. Under the Israeli Companies Law, our articles

of association are deemed to include a requirement that such merger be approved by an extraordinary resolution of the shareholders,

as explained above. The approval of the merger by the general meetings of shareholders of the companies is also subject to additional

approval requirements as specified in the Israeli Companies Law and regulations promulgated thereunder.

Disclosure of Shareholders Ownership

The Israeli Securities

Law and the regulations promulgated thereunder require that a company whose shares are traded on a stock exchange in Israel, as

in the case of our company, report the share ownership of its interested parties. An interested party is defined under the Israeli

Securities Law as any one of the following: (i) a person holding 5% or more of the company’s issued capital stock or voting

power, or who is entitled to appoint one or more of the company’s directors or its general manager; or (ii) any person acting

as a director or general manager of the company; or (iii) any company, in which any of the above persons either holds 25% or more

of its capital stock or voting power or is entitled to appoint 25% or more of its directors.

Changes in Our Capital

Changes in our capital

are subject to the approval of the shareholders by a majority of the votes of shareholders present at the meeting, in person or

by proxy, and voting on the matter.

The transfer agent and

registrar for the ordinary shares is American Stock Transfer & Trust Company,

6201 15th Ave, Brooklyn,

N.Y. 11219

.

FOREIGN EXCHANGE CONTROLS AND OTHER

LIMITATIONS

Israeli law and regulations

do not impose any material foreign exchange restrictions on non-Israeli holders of our ordinary shares.

Non-residents of Israel

who purchase our ordinary shares will be able to convert dividends, if any, thereon, and any amounts payable upon our dissolution,

liquidation or winding up, as well as the proceeds of any sale in Israel of our ordinary shares to an Israeli resident, into freely

repatriable dollars, at the exchange rate prevailing at the time of conversion, provided that the Israeli income tax has been withheld

(or paid) with respect to such amounts or an exemption has been obtained.

TAXATION

The

below discussion does not purport to be an official interpretation of the tax law provisions mentioned therein or to be a comprehensive

description of all tax law provisions which might apply to our securities or to reflect the views of the relevant tax authorities,

and it is not meant to replace professional advice in these matters. The below discussion is based on current, applicable tax law,

which may be changed by future legislation or reforms. Non-residents should obtain professional tax advice with respect to the

tax consequences under the laws of their countries of residence of holding or selling our securities.

Israeli Capital Gains Tax

Israeli law generally imposes a capital

gain tax on the sale of capital assets by residents of Israel, as defined for Israeli tax purposes, and on the sale of assets located

in Israel, including shares of Israeli companies, by both residents and non-residents of Israel, unless a specific exemption is

available or unless a tax treaty between Israel and the seller’s country of residence provides otherwise. The Ordinance distinguishes

between “Real Capital Gain” and “Inflationary Surplus”. The Inflationary Surplus is a portion of the total

capital gain, which is equivalent to the increase of the relevant asset’s purchase price, which is attributable to the increase

in the Israeli consumer price index or, in certain circumstances, a foreign currency exchange rate, between the date of purchase

and the date of sale. The Real Capital Gain is the excess of the total capital gain over the Inflationary Surplus.

Israeli Resident Shareholders

As of January 1, 2006, the tax rate

applicable to Real Capital Gain derived by Israeli individuals from the sale of shares which had been purchased on or after January

1, 2003, whether or not listed on a stock exchange, is 20%, unless such shareholder claims a deduction for interest and linkage

differences expenses in connection with the purchase and holding of such shares, in which case the gain will generally be taxed

at a rate of 25%. Additionally, if such shareholder is considered a Substantial Shareholder (i.e., a person who holds, directly

or indirectly, alone or together with another, 10% or more of any of the company’s “means of control” (including,

among other things, the right to receive profits of the company, voting rights, the right to receive the company’s liquidation

proceeds and the right to appoint a director)) at the time of sale or at any time during the preceding 12-month period, such gain

will be taxed at the rate of 25%. Individual shareholders dealing in securities in Israel are taxed at their marginal tax rates

applicable to business income (up to 50% in 2017).

Notwithstanding the foregoing, pursuant

to the Law for Change in the Tax Burden (Legislative Amendments) (Taxes), 2011, the capital gain tax rate applicable to individuals

was raised from 20% to 25% from 2012 and onwards (or from 25% to 30% if the selling individual shareholder is a Substantial Shareholder

at any time during the 12-month period preceding the sale and/or claims a deduction for interest and linkage differences expenses

in connection with the purchase and holding of such shares). With respect to assets (not shares that are listed on a stock exchange)

purchased on or after January 1, 2003, the portion of the gain generated from the date of acquisition until December 31, 2011 will

be subject to the previous capital gain tax rates (20% or 25%) and the portion of the gain generated from January 1, 2012 until

the date of sale will be subject to the new tax rates (25% or 30%).

Under current Israeli tax legislation,

the tax rate applicable to Real Capital Gain derived by Israeli resident corporations from the sale of shares of an Israeli company

is the general corporate tax rate. As described above, the regular corporate tax rate was 24% in 2017 and in 2018 the corporate

tax rate is 23%.

Non-Israeli Resident Shareholders

Israeli capital gain tax is imposed on

the disposal of capital assets by a non-Israeli resident if such assets are either (i) located in Israel; (ii) shares or rights

to shares in an Israeli resident company; or (iii) represent, directly or indirectly, rights to assets located in Israel, unless

a tax treaty between Israel and the seller’s country of residence provides otherwise. As mentioned above, Real Capital Gain

is generally subject to tax at the corporate tax rate (24% in 2017 and 23% in 2018 and thereafter) if generated by a company, or

at the rate of 25% (for assets other than shares that are listed on stock exchange – 20% for the portion of the gain generated

up to December 31, 2011) or 30% (for any asset other than shares that are listed on stock exchange – 25% with respect to

the portion of the gain generated up to December 31, 2011), if generated by an individual from the sale of an asset purchased on

or after January 1, 2003. Individual and corporate shareholders dealing in securities in Israel are taxed at the tax rates applicable

to business income (a corporate tax rate for a corporation and a marginal tax rate of up to 50% for an individual in 2017).

Notwithstanding the foregoing, shareholders

who are non-Israeli residents (individuals and corporations) are generally exempt from Israeli capital gain tax on any gains derived

from the sale, exchange or disposition of shares publicly traded on the Tel Aviv Stock Exchange or on a recognized stock exchange

outside of Israel, provided, among other things, that (i) such gains are not generated through a permanent establishment that

the non-Israeli resident maintains in Israel, (ii) the shares were purchased after being listed on a recognized stock exchange,

and (iii) with respect to shares listed on a recognized stock exchange outside of Israel, such shareholders are not subject to

the Israeli Income Tax Law (Inflationary Adjustments) 5745-1985. However, non-Israeli corporations will not be entitled to the

foregoing exemptions if Israeli residents (a) have a controlling interest of more than 25% in such non-Israeli corporation, or

(b) are the beneficiaries of or are entitled to 25% or more of the revenues or profits of such non-Israeli corporation, whether

directly or indirectly. Such exemption is not applicable to a person whose gains from selling or otherwise disposing of the shares

are deemed to be business income.

In addition, a sale of shares may be exempt

from Israeli capital gain tax under the provisions of an applicable tax treaty. For example, under the U.S.-Israel Tax Treaty,

or the U.S-Israel Treaty, the sale, exchange or disposition of shares of an Israeli company by a shareholder who is a U.S. resident

(for purposes of the U.S.-Israel Treaty) holding the shares as a capital asset is exempt from Israeli capital gain tax unless either

(i) the shareholder holds, directly or indirectly, shares representing 10% or more of the voting rights during any part of the

12-month period preceding such sale, exchange or disposition; (ii) the shareholder, if an individual, has been present in Israel

for a period or periods of 183 days or more in the aggregate during the applicable taxable year; or (iii) the capital gain arising

from such sale are attributable to a permanent establishment of the shareholder which is maintained in Israel. In each case, the

sale, exchange or disposition of such shares would be subject to Israeli tax, to the extent applicable; however, under the U.S.-Israel

Treaty, a U.S. resident would be permitted to claim a credit for the Israeli tax against the U.S. federal income tax imposed with

respect to the sale, exchange or disposition, subject to the limitations in U.S. laws applicable to foreign tax credits. The U.S-Israel

Treaty does not provide such credit against any U.S. state or local taxes.

In some instances, where our shareholders

may be liable for Israeli tax on the sale of their ordinary shares, the payment of the consideration may be subject to the withholding

of Israeli tax at source. Shareholders may be required to demonstrate that they are exempt from tax on their capital gains in order

to avoid withholding at source at the time of sale. Specifically, in transactions involving a sale of all of the shares of an Israeli

resident company, in the form of a merger or otherwise, the Israel Tax Authority may require from shareholders who are not liable

for Israeli tax to sign declarations in forms specified by this authority or obtain a specific exemption from the Israel Tax Authority

to confirm their status as non-Israeli resident, and, in the absence of such declarations or exemptions, may require the purchaser

of the shares to withhold taxes at source.

Israeli Tax on Dividend Income

Israeli Resident Shareholders

Israeli residents who are individuals are

generally subject to Israeli income tax for dividends paid on our Ordinary Shares (other than bonus shares or share dividends)

at 25%, or 30% if the recipient of such dividend is a Substantial Shareholder at the time of distribution or at any time during

the preceding 12-month period. However, dividends distributed from taxable income accrued during the benefits period of an Approved

Enterprise, or AE, are subject to withholding tax at the rate of 15% (if the dividend is distributed during the tax benefits period

under the Investment Law or within 12 years after such period) or 20% with respect to Preferred Enterprise, or PFE. An average

rate will be set in case the dividend is distributed from mixed types of income (regular and Approved/ Preferred income).

Israeli resident corporations are generally

exempt from Israeli corporate tax for dividends paid on shares of Israeli resident corporations (like our Ordinary Shares). However,

dividends distributed from taxable income accrued during the benefits period of an Approved Enterprise are subject to withholding

tax at the rate of 15%, if the dividend is distributed during the tax benefits period under the Investment Law or within 12 years

after such period.

Non-Israeli Resident Shareholders

Non-Israeli residents (whether individuals

or corporations) are generally subject to Israeli income tax on the receipt of dividends paid on ordinary shares, like our Ordinary

Shares, at the rate of 25% or 30% (if the dividend recipient is a Substantial Shareholder at the time of distribution or at any

time during the preceding 12-month period) or 15% if the dividend is distributed from income attributed to our AE or 20% with respect

to PFE. Such dividends are generally subject to Israeli withholding tax at a rate of 25% so long as the shares are registered with

a Nominee Company (whether the recipient is a Substantial Shareholder or not), and 15% if the dividend is distributed from income

attributed to an AE or 20% if the dividend is distributed from income attributed to a PFE, unless a reduced rate is provided under

an applicable tax treaty (subject to the receipt in advance of a valid certificate from the Israel Tax Authority allowing for a

reduced tax rate). For example, under the U.S-Israel Treaty, the maximum rate of tax withheld in Israel on dividends paid to a

holder of our Ordinary Shares who is a U.S. resident (for purposes of the U.S.-Israel Treaty) is 25%. However, generally,

the maximum rate of withholding tax on dividends, not generated by our Approved Enterprise, that are paid to a U.S. corporation

holding at least 10% or more of our outstanding voting capital from the start of the tax year preceding the distribution of the

dividend through (and including) the distribution of the dividend, is 12.5%, provided that no more than 25% of our gross income

for such preceding year consists of certain types of dividends and interest. Notwithstanding the foregoing, dividends distributed

from income attributed to an AE are subject to a withholding tax rate of 15% for such a U.S. corporation shareholder, provided

that the condition related to our gross income for the previous year (as set forth in the previous sentence) is met. If the dividend

is attributable partly to income derived from an AE, or a PFE, and partly to other sources of income, the withholding rate will

be a blended rate reflecting the relative portions of the two types of income. U.S. residents who are subject to Israeli withholding

tax on a dividend may be entitled to a credit or deduction for U.S. federal income tax purposes in the amount of the taxes withheld,

subject to detailed rules contained in United States tax legislation.

A non-Israeli resident who receives dividends

from which tax was withheld is generally exempt from the obligation to file tax returns in Israel with respect to such income,

provided that (i) such income was not generated from business conducted in Israel by the taxpayer, and (ii) the taxpayer

has no other taxable sources of income in Israel with respect to which a tax return is required to be filed.

Excess Tax

Individuals who are subject to tax in Israel

(whether any such individual is an Israeli resident or non-Israeli resident) are also subject to an additional tax for income exceeding

a certain level. For 2016, the rate of such additional tax was 2% on annual taxable income exceeding NIS 810,720, and for 2017

and onwards, the additional tax is at a rate of 3% on annual income exceeding NIS 640,000, which amount is linked to the annual

change in the Israeli consumer price index, including, but not limited to, dividends, interest and capital gain.

OFFERING EXPENSES

We estimate the following

expenses in connection with this prospectus:

|

SEC Registration Fee

|

|

$

|

4,427

|

|

|

Legal fees and expenses

|

|

|

31,000

|

|

|

Accountants’ fees and expenses

|

|

|

39,000

|

|

|

Miscellaneous

|

|

|

7,500

|

|

|

Total

|

|

$

|

81,927

|

|

We

have agreed to bear all expenses relating to the registration of the resale of the securities registered pursuant to this prospectus.

LEGAL MATTERS

The validity of the

securities

being reoffered

hereunder will be passed upon for us by Amit Birk, Advocate,

our General Counsel. Certain legal matters relating to United States law will be passed upon for us by Carter Ledyard &

Milburn LLP, New York, New York.

EXPERTS

Our consolidated financial

statements as of December 31, 2016 and 2017 and for each of the three years ended December 31, 2017 included in our Annual

Report on Form 20-F have been audited by Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, an independent