By Paul Ziobro

MESQUITE, Texas -- In the sticky Southern heat, hundreds of

workers streamed in for the 11 a.m. shift last month at United

Parcel Service Inc.'s local package-sorting facility, one of dozens

nationwide that help it move millions of parcels daily.

In a windowless room, a 30-year-old analog control panel about

the size of a chest freezer monitors operations, with rows of green

and red lights indicating when something goes awry in the

building's web of conveyor belts.

"Thirty years ago, this was top-notch," UPS plant engineering

manager Dean Britt said of the control panel. Today, the panel's

computing capabilities "can probably fit on your phone," he said,

"and not even a good phone."

The site, and other similar UPS facilities, haven't automated

much over decades -- despite a rush of new warehouse technology in

many industries. Today, the company is paying a price.

As UPS tries to satisfy America's 21st-century

shopping-and-shipping mania, parts of its network are stuck in the

20th century. The company still relies on some outdated equipment

and manual processes of the type rival FedEx Corp. discarded or

that newer entrants, including Amazon.com Inc., never had.

UPS says about half its packages are processed through automated

facilities today. At FedEx, 96% of ground packages move through

automated sites. UPS workers are unionized; FedEx's

ground-operations workers aren't.

Now, the century-old delivery giant is playing catch-up. As part

of that effort it plans capital spending of more than $20 billion

over the next three years. Much of that will go toward opening new

automated facilities, UPS says, and technology upgrades to route

packages around bottlenecks. It is a bigger annual expense,

adjusted for inflation, than when UPS broadened from a ground

operation and built up its cargo airline in the 1980s.

UPS says it plans to process all packages, aside from some

larger ones or those that travel a short distance, through

automated hubs by 2022. "We definitely need to do these kinds of

things to remain competitive," says UPS's chief information

officer, Juan Perez.

The reason for the intensive push is the way in which UPS's

business has been flipped on its head. The bulk of its shipments

once went to corporations or retailers. Now, its brown-clad U.S.

drivers deliver more than half of its packages to homes, thanks to

e-commerce. Drop-offs at suburban homes generally aren't as

profitable as delivering large orders to an office or downtown

shop, UPS says.

UPS embraced e-commerce early even though some executives

worried about chasing lower-margin deliveries, say some former UPS

executives. Bottlenecks caused by online orders have led to delays

and sent some industrial, health-care and other corporate shippers

into the arms of FedEx, they say.

UPS also faces competition from Amazon, which is building out a

delivery network of planes, trucks and vans to handle more of its

online orders, especially in cities and suburbs. UPS spokesman

Steve Gaut says the company has won business customers from rivals

in recent years and declined to discuss Amazon's strategy. "There

is tremendous opportunity" in delivering online orders, he says,

"irrespective of how other companies may shift their strategies

with respect to UPS."

Profit margins at UPS's domestic unit fell to 12.1% last year

from 13.5% in 2013, while the unit in the same period added more

than $6 billion in revenue, which hit $40.7 billion last year.

Investors, accustomed to UPS's low spending, sent its stock

tumbling in January after executives disclosed they would increase

capital outlays.

"You have to do it," says Jerome Dodson, chairman of Parnassus

Investments, owner of roughly $800 million of UPS shares, speaking

of capital spending, "but I was amazed as to how high it was."

UPS is negotiating with the International Brotherhood of

Teamsters to renew a five-year contract, which expires July 31.

Representing 260,000 UPS drivers, sorters and other workers, the

union wants UPS to hire more full-time workers to help handle the

surge in packages. It has opposed technology such as autonomous

vehicles and drones and is wary of projects that do work with fewer

employees.

"The problem with technology is that it does ultimately

streamline jobs, " says Sean O'Brien, a Teamsters leader in Boston.

"It does eliminate jobs. And once they're replaced, it's pretty

tough to get them back."

FedEx, with no unionized workforce in its ground network,

doesn't have to worry as much about labor strife. And because it

built its ground network more recently, it hasn't had to retrofit

older facilities with automation. "For an older hub, automating is

like heart surgery," says Ted Dengel, FedEx Ground's managing

director of operations technology. "We can drop automation in

before a package hits a facility."

UPS acknowledges that its older base and unionized workforce

present challenges that rivals such as FedEx don't have.

Blue chip

UPS founder James E. "Jim" Casey spoke about the dilemma of

change 70 years ago. "A hard part of management's problem," he said

in an annual speech, "is to know when to make changes and when to

hold fast to what is good."

UPS grew out of Mr. Casey's small Seattle bicycle delivery

service, American Messenger Co., in 1907. It used Model T Fords to

deliver local department-store orders, eventually crossing state

lines and building a company that now has a fleet of more than

100,000 vehicles and nearly 600 aircraft. He was chief executive

for five decades and a director until his 1983 death at 95.

The company avoided flashiness and was known for its steady

approach to business. It was employee-owned until an initial public

offering in 1999. A reliable blue chip, it rewarded public

shareholders with steady performance, dividend payments and share

buybacks.

Then e-commerce happened.

As online-shopping volume grew, UPS relied on what a former UPS

executive calls "a Band-Aid" approach to upgrading its network,

patching it up by adding extra shifts or extending hours, or

retrofitting parts of older buildings with new equipment. UPS says

the union hasn't impeded spending on automation. The cost and size

of the machines needed to automate an older facility are now low

enough to allow UPS to retrofit older facilities and build new

ones, it says.

The company's prior capital-spending strategy was appropriate

when e-commerce growth created a 2% uptick in volume in 2015, says

UPS finance chief Richard Peretz. But America's appetite for online

shopping only grew. "When you're under 2%," he says, "you're

thinking a lot different about putting up these buildings than when

you're up 4 or 5%."

In short order, facilities such as the 34-year-old Mesquite hub

emerged as weak links. While some 80,000 UPS delivery drivers fan

out almost every day, UPS relies on an unseen army of workers to

process packages through its sorting centers, some who work in ways

that haven't been updated much since the founder ran the

business.

In Mesquite, the process starts with unloading boxes from trucks

onto conveyor belts. A worker must align each box so a scanner can

read the delivery label on the front, top or one side. That's in

contrast to the more-modern six-sided scanners used in newer hubs,

which can scan a package no matter how it is loaded on the

belt.

The packages move inside to a line of about 50 workers. Nine

conveyor belts turn -- three along the ground, three waist-high and

three just overhead. A sorter must pick a package, quickly decipher

the label and place the box onto the correct belt. Around the

corner, a worker sorts packages down chutes, where loaders fill

truck trailers.

By contrast, automated sorting facilities use scanners to read a

box's destination and equipment called shoe pucks push packages

down the proper chute.

A medium-size package at Mesquite gets four "touches," as

warehouse operators refer to acts of handling. Each touch adds a

chance for a sorting error or damage. With 40,000 pieces processed

an hour out of Mesquite, even rare human misfires can add up.

Mis-sorted packages can add an extra day to a delivery, UPS

says.

Automated hubs

All FedEx ground hubs are automated. Typical of its processes is

how packages are handled in a one-year-old facility in Edison,

N.J., where FedEx workers touch most packages twice -- for the

unload and the load.

Amazon's operations, too, bristle with automation. It has been

years ahead of many logistics firms in warehouse automation, from

driverless forklifts to robots that bring shelves to workers.

UPS's effort to catch up can be seen 36 miles from Mesquite in

Fort Worth, where machines scan boxes, sort them by destination and

send them to outbound vehicles. New equipment such as six-sided

scanners mean workers don't have worry about which side is up. The

facility, with 750 workers, can process about the same number of

packages daily as Mesquite, which has 1,170. In Fort Worth,

packages get two touches.

The building's brain is an air-conditioned control room where 10

UPS employees sit before a wall of flat-screen monitors showing

live video feeds. The computer system detects jams and other

malfunctions. Workers can reroute where the conveyors send

packages. "There's no human element" in rerouting a package in the

building, says UPS engineer Travis Jensen. "There's a keyboard." A

few workers walk alongside the belts to do tasks such as replacing

any package that falls off, a rare occurrence.

Newer automated hubs are slowly arriving at UPS. It is adding

about 5 million square feet of automated processing capacity, or

6.7% in additional capacity, to its network this year.

UPS says automated equipment isn't enough. Jack Levis, UPS

director of process management, oversees about three dozen

employees adding a layer of software over UPS's sorting network

that would help manage package flows, including between automated

facilities and older ones.

Such capability is critical as it handles more packages,

including during the peak holiday season. The technology would

divert additional packages from heading to areas overwhelmed by

volume. "Imagine systems that will predict problems before they

happen," Mr. Levis says. "You'll look like Sherlock Holmes."

Some analysts and consultants say the upgrades are overdue,

especially as UPS has in recent years faced capacity crunches

during the holiday season. In 2017, UPS was overwhelmed for a few

days after Thanksgiving while FedEx was able to more easily reroute

traffic. UPS says an unexpected surge in online orders backed up

the network temporarily.

Morgan Stanley analyst Ravi Shankar says investors have

questioned how UPS got by with less spending than FedEx, asking,

"What took you guys so long?"

While UPS spends heavily on automation, FedEx is winding down a

period of heavy investment in its ground network, having spent

about $10 billion since 2005. The Memphis, Tenn., company started

as an express airline in the 1970s, adding ground deliveries in

1998 with the acquisition of Roadway Package System, which was

created in 1985 to rival UPS by using new bar-code-scanning

technologies. UPS began using bar codes the next year.

FedEx is now honing its network of 37 ground hubs in the U.S.

and Canada, paring back in some places. It mothballed its $259

million ground hub in Indianapolis. It built its Edison, N.J.,

ground hub to be flexible: It uses only about a third of the

building's space, with room to expand in short order with whatever

equipment it may add. It installed a sorting system quickly last

year ahead of the holiday season.

The setup lets FedEx adjust its network based on the more

volatile flows of online orders, something UPS hopes to do more

adeptly with increased automation.

On Atlanta's west side, UPS's spending is taking shape in a 1.2

million-square-foot hub. Inside the concrete frame, engineers are

testing six-sided scanners while contractors weld chutes and line

the rafters with wires. The building, if all remains on schedule,

will handle truckloads of holiday orders this year from Amazon and

other retailers. It will be UPS's second-largest U.S. ground hub

after one in the Chicago area.

Martha Molina, 50, a UPS sorter in Mesquite for the past 20

years, says she isn't worried about the addition of automated sort

centers that require fewer workers. "It's something that we need to

do to progress."

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

June 15, 2018 10:34 ET (14:34 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

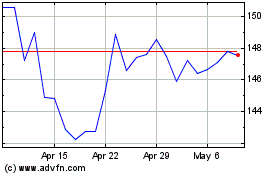

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Aug 2024 to Sep 2024

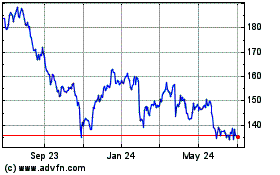

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Sep 2023 to Sep 2024