Report of Foreign Issuer (6-k)

May 15 2018 - 9:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

Report of

Foreign Private Issuer

Pursuant to Rule

13a-16

or

15d-16

under

the Securities Exchange Act of 1934

For the month of May 2018

Commission File

No. 000-54189

MITSUBISHI

UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1,

Marunouchi

2-chome,

Chiyoda-ku

Tokyo

100-8330,

Japan

(Address of principal executive office)

Indicate by

check mark whether the registrant files or

will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F

X

Form

40-F

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7):

THIS REPORT ON FORM

6-K

SHALL BE DEEMED TO BE INCORPORATED BY

REFERENCE IN THE REGISTRATION STATEMENT ON FORM

F-3

(NO.

333-209455)

OF MITSUBISHI UFJ FINANCIAL GROUP, INC. AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT

IS FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED WITH OR FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 15, 2018

|

|

|

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

By:

|

|

/s/ Zenta Morokawa

|

|

Name:

|

|

Zenta Morokawa

|

|

Title:

|

|

Managing Director, Head of

Documentation & Corporate

Secretary Department,

|

|

|

|

Corporate Administration Division

|

Mitsubishi UFJ Financial Group, Inc.(MUFG)

Notice on Continuation of Performance-Based

Stock Compensation Plan and

Additional Trust for Stock Acquisition

Tokyo, May 15, 2018

— MUFG resolved at the Compensation Committee’s meeting held on May 16, 2016, to introduce a

performance-based stock compensation plan using a trust structure (“the Plan”) as a new Group-wide incentive plan for directors, corporate executive officers, executive officers, and senior fellows (outside directors and directors serving

as audit committee members are excluded; the eligible directors and other executives are hereinafter collectively referred to as “Directors, etc.”) of MUFG and its four subsidiaries comprising the core of the MUFG Group (MUFG Bank, Ltd.,

Mitsubishi UFJ Trust and Banking Corporation, Mitsubishi UFJ Securities Holdings Co., Ltd., and Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.; the four companies are hereinafter collectively referred to as the “Core Business

Companies”, and MUFG and the Core Business Companies are hereinafter collectively referred to as the “Covered Companies.”). At the Compensation Committee meeting held today (hereinafter referred to as “the Compensation Committee

Meeting”), MUFG resolved to continue with the Plan while amending it in part.

Please see “Introduction of Performance-Based

Stock Compensation Plan for Directors, etc.” dated May 16, 2016, for a description of the Plan.

|

1.

|

Continuation of the Plan

|

|

(1)

|

In 2016, MUFG introduced the Plan as a new stock compensation plan for Directors, etc. of the Covered Companies in order to further enhance the incentive to contribute to the improvement of business performance of the

MUFG Group not only over the short term but also the medium to long term, in order to enable the MUFG Group as a whole to achieve sustainable growth and increase its corporate value over the medium to long term corporate value while controlling

excessive risk taking. MUFG seeks to share profits with shareholders from a medium to long-term perspective by partially linking the Plan on the goals specified in its

mid-term

business plan, thus providing an

incentive for Directors, etc. to manage business with an awareness of medium to long-term business performance and share value.

|

|

(2)

|

The Plan uses a structure referred to as a Board Incentive Plan trust (the “BIP Trust”). A BIP Trust, like the performance share plans and restricted stock plans in the U.S. and Europe, is a plan under which

MUFG shares acquired through the BIP Trust and money equivalent to the liquidation value of MUFG shares (hereinafter referred to as “MUFG Shares, etc.”), along with dividends arising from MUFG shares, are delivered or paid (hereinafter

collectively expressed as “Distributed”) to Directors, etc. in accordance with their rank, level of achievement in terms of the business performance goals set forth in the applicable

mid-term

business plan, and other relevant factors.

|

|

(3)

|

The continuation of the Plan was resolved today by the Compensation Committee, of which the chair and a majority of the members are outside directors. The Compensation Committee has evaluated and continues to evaluate

fairly the appropriateness of the business performance goals, the achievement status thereof and other relevant matters to ensure the transparency and objectivity of the decision-making process and the resulting decisions pertaining to the incentive

plans for board members.

|

1

|

2.

|

Partial Revision of the Plan

|

In continuing with the Plan from FY2018 onward, MUFG will

be extending the trust period of the existing BIP Trust while partially revising the Plan. The details of the Plan established in FY2016 will be maintained with the exception of the following.

|

(1)

|

Extension of the trust period, additional trust funds and inheritance of residual Shares, etc.

|

The Plan comprises Trust I, under which MUFG Shares, etc. are to be Distributed to Directors, etc. of Covered Companies upon their resignation

or retirement, and Trust II, under which MUFG Shares, etc. are to be Distributed upon expiration of three consecutive fiscal years corresponding to the period covered by the relevant MUFG

mid-term

business

plan (hereinafter referred to as the “Period Covered”; Trust I and Trust II are hereinafter collectively referred to as “Trusts”). While both Trusts are to expire on August 31, 2018, the Plan will be continued by extending

the trust period of each and entrusting additional funds as approved at the Compensation Committee Meeting. In cases where additional funds are to be entrusted, any MUFG shares (excluding MUFG shares to be delivered to Directors, etc. of Covered

Companies which still have not been Distributed) or money remaining in trust as of the last day of the trust period prior to the extension thereof (hereinafter collectively referred to as “Residual Shares, etc.”) will be inherited by the

Trusts following extension.

|

(2)

|

Upper limit of the amount of trust money to be contributed to the Trusts

|

For each

Period Covered, each of the Covered Companies is to contribute money to the Trusts, in an amount not to exceed the prescribed upper limit applicable, as compensation for Directors, etc. Said upper limits will be changed as set forth below.

Upper limit of the amount of trust money to be contributed to Trust I:

1.4 billion yen (*1)

Upper limit of the amount of trust money to be contributed to Trust II: 3.0 billion yen (*1)

|

(ii)

|

Core Business Companies (total for the four companies)

|

Upper limit of the amount of

trust money to be contributed to Trust I: 5.2 billion yen (*1)

Upper limit of the amount of trust money to be contributed to Trust

II: 7.1 billion yen (*1)

|

|

(*1)

|

This is the aggregate amount of the funds for the acquisition of shares by the Trusts, as well as the trust fees and expenses, during the trust period.

|

2

|

(3)

|

Business performance indicators linked to Trust II

|

The Shares, etc. to be Distributed

from Trust II to Directors, etc. of the Covered Companies are determined based on the points awarded in accordance with the business performance during a given fiscal year (hereinafter referred to as “Single Year Points”) and points

awarded in accordance with the level of achievement of the relevant

mid-term

business plan (hereinafter referred to as “Medium to Long-Term Points”). A prescribed number of Single Year Points and

Medium to Long-Term Points are awarded to Directors, etc. each month during the Period Covered in accordance with their executive position. The total number of Single Year Points accumulated is adjusted after the conclusion of the relevant fiscal

year and that of Medium to Long-Term Points accumulated is adjusted after the conclusion of the relevant Period Covered by adding or deducting points on the basis of business performance during the respective periods. MUFG Shares, etc. are then

Distributed in about July, immediately following the end of the relevant Period Covered. The coefficient linked to business performance, which is used to add or deduct points, fluctuates within a range of 0% to 150% depending on the level of

achievement in terms of business performance. The indicators and methods used to evaluate this level of achievement, in terms of business performance, are as specified below.

|

|

|

(i) Single year evaluation (evaluation weight: 50%)

Comparison of the

year-on-year

growth rate of the following indicators with that of the competitors

• Net consolidated business profits (evaluation weight: 25%)

• Net income attributable to

owners of the parent (evaluation weight: 25%)

(ii) Medium to Long-Term Evaluation (evaluation weight: 50%)

Level of achievement of the target percentage specified in the

mid-term

business plan for the following indicators

• Consolidated ROE (evaluation weight: 25%)

• Consolidated expense ratio

(evaluation weight: 25%)

|

- End -

About MUFG

Mitsubishi UFJ Financial Group, Inc. (MUFG)

is one of the world’s leading financial groups. Headquartered in Tokyo and with over 360 years of history, MUFG has a global network with over 2,000 offices in more than 50 countries. The Group has over 150,000 employees and offers services

including commercial banking, trust banking, securities, credit cards, consumer finance, asset management, and leasing. The Group aims to “be the world’s most trusted financial group” through close collaboration among our operating

companies and flexibly respond to all of the financial needs of our customers, serving society, and fostering shared and sustainable growth for a better world. MUFG’s shares trade on the Tokyo, Nagoya, and New York stock exchanges.

For more information, visit

https://www.mufg.jp/english

.

3

On April 1, 2018 the name of MUFG’s commercial bank changed from “The Bank of Tokyo-Mitsubishi

UFJ, Ltd.” to “MUFG Bank, Ltd.” Many of the bank’s overseas subsidiaries followed suit on the same day, but branches and subsidiaries in some countries will carry out the name change at a later date. MUFG’s New York Stock

Exchange ticker symbol also changed to “MUFG.”

For more information regarding overseas subsidiaries, visit

http://www.bk.mufg.jp/global/newsroom/announcements/pdf/201803_namechange.pdf

Press contact:

Kana Nagamitsu

Public Relations Division

Tokyo/Head Office

Mitsubishi UFJ Financial Group, Inc.

T

+81-3-3240-7651

E

kana_nagamitsu@mufg.jp

4

(Reference)

[Outline of the trust agreement]

|

|

|

|

|

|

|

|

|

Trust I

|

|

Trust II

|

|

(i) Trust type

|

|

An individually-operated designated trust of cash other than cash trust (third party benefit

trust)

|

|

(ii) Trust purpose

|

|

Providing incentives to Directors, etc. of the Covered Companies

|

|

(iii) Settlor

|

|

MUFG

|

|

(iv) Trustee

|

|

Mitsubishi UFJ Trust and Banking Corporation

(Co-trustee:

The Master Trust Bank of Japan, Ltd.)

|

|

(v) Beneficiaries

|

|

Directors, etc. of the Covered Companies satisfying the beneficiary requirements

|

|

(vi) Trust caretaker

|

|

A third party that does not have any interest in the Covered Companies (certified public

accountant)

|

|

(vii) Trust agreement date

|

|

May 17, 2016 (revision planned for May 16, 2018)

|

|

(viii) Trust period

|

|

May 17, 2016 to August 31, 2018 (extension until August 31, 2021 planned pursuant to

a revision of the trust agreement to take place on May 16, 2018)

|

|

(ix) Plan start date

|

|

July 1, 2016

|

|

(x) Exercise of voting rights

|

|

No exercise

|

|

(xi) Type of acquired shares

|

|

Ordinary shares of MUFG

|

|

(xii) Amount of trust money

|

|

Approximately 6.6 billion yen

(planned)

(including trust fees and expenses)

|

|

Approximately 10.1

billion yen (planned)

(including trust fees and expenses)

|

|

(xiii) Timing of acquisition of shares

|

|

May 17, 2018 (planned) to June 15, 2018 (planned)

|

|

(xiv) Method of acquisition of shares

|

|

Acquisition in the stock market

|

|

(xv) Holder of a vested right

|

|

MUFG

|

|

(xvi) Residual property

|

|

Residual property that can be received by MUFG, which is the holder of a vested right, shall be

within the limit of the trust expense reserve calculated by deducting the cost for acquiring the shares from the Trust from trust money.

|

|

[Trust/share-related administration]

|

|

(i) Trust-related administration

|

|

Mitsubishi UFJ Trust and Banking Corporation, which will be the trustee of the Trust, will perform

trust-related administrative tasks.

|

|

(ii) Share-related administration

|

|

Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. will perform administrative tasks necessary for

the delivery of shares of MUFG to the beneficiaries based on an administration service agreement.

|

5

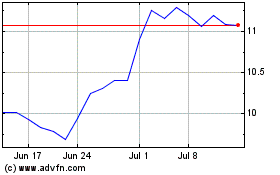

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

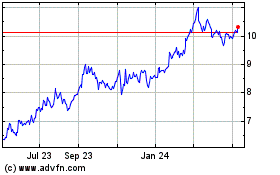

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024