Kite Realty Group Trust Announces Planned Opening of Levity Live Entertainment Venue at Parkside Town Commons

May 14 2018 - 4:17PM

Kite Realty Group Trust (NYSE:KRG) (the “Company”) announced today

that Levity Live is planning to open a live entertainment venue in

late 2018 at its Parkside Town Commons location near Raleigh, North

Carolina.

Parkside Town Commons is a two-phase ground-up

development project serving the Research Triangle Park area and is

located at the intersection of North Carolina Highway 55 and

Interstate 540. The 15,044 square foot Levity Live mixed-use, live

performance entertainment venue and attached restaurant concept

will join several existing anchors, including Target, Harris

Teeter, Frank Theatres CineBowl & Grille, Petco, Hobby Lobby,

Golf Galaxy, and Guitar Center.

“Levity Live’s unique entertainment venue provides

an unparalleled experience to the existing market. Our team’s focus

on attracting traffic-driving, experiential tenants to our

high-quality retail destinations pairs well with Levity Live’s

dedication to entertainment,” said Tom McGowan, Chief Operating

Officer of Kite Realty Group.

Levity Live is a vertically integrated media company that owns

and operates entertainment venues nationwide, including the iconic

Improv Comedy Club brand. With international reach and unparalleled

expertise, Levity Live serves talents, consumers and major brands

as well as identifies, develops, finances and produces original

content targeted for all distribution platforms.

“Raleigh and the surrounding communities are rich with

incredible culture and entertainment from live music to stand-up

comedy and theatrical performances; Levity Live is excited to be a

part of this diverse and growing arts community,” shared Alireza

Ghaemian, CEO of Levity Live. “We look forward to working with Kite

Realty Group alongside Parkside Town Commons local retailers, and

bringing an eclectic line-up of entertainment and dining options

for all who join us for an unforgettable experience.”

About Kite Realty Group Trust:

Kite Realty Group Trust is a full-service, vertically integrated

real estate investment trust (REIT) that provides communities with

convenient and beneficial shopping experiences. We connect

consumers to tenants in desirable markets through our diverse

portfolio of high-quality community, neighborhood, and lifestyle

centers. Using operational, development, and redevelopment

expertise, we continuously optimize our portfolio to maximize value

and return to our shareholders. As of March 31, 2018, the Company

owned interests in 115 operating and redevelopment properties

totaling approximately 22.5 million square feet and 2 development

projects currently under construction totaling 0.7 million square

feet.

For more information, please visit our website at

kiterealty.com.

Safe Harbor

Certain statements in this document that are not historical fact

may constitute forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Such statements are based on

assumptions and expectations that may not be realized and are

inherently subject to risks, uncertainties and other factors, many

of which cannot be predicted with accuracy and some of which might

not even be anticipated. Future events and actual results,

performance, transactions or achievements, financial or otherwise,

may differ materially from the results, performance, transactions

or achievements, financial or otherwise, expressed or implied by

the forward-looking statements. Risks, uncertainties and other

factors that might cause such differences, some of which could be

material, include, but are not limited to: national and local

economic, business, real estate and other market conditions,

particularly in light of low growth in the U.S. economy as well as

economic uncertainty caused by fluctuations in the prices of oil

and other energy sources and inflationary trends or outlook;

financing risks, including the availability of, and costs

associated with, sources of liquidity; the Company’s ability to

refinance, or extend the maturity dates of, its indebtedness; the

level and volatility of interest rates; the financial stability of

tenants, including their ability to pay rent and the risk of tenant

bankruptcies; the competitive environment in which the Company

operates; acquisition, disposition, development and joint venture

risks; property ownership and management risks; the Company’s

ability to maintain its status as a real estate investment trust

for federal income tax purposes; potential environmental and other

liabilities; impairment in the value of real estate property the

Company owns; the impact of online retail competition and the

perception that such competition has on the value of shopping

center assets; risks related to the geographical concentration of

the Company’s properties in Florida, Indiana and Texas; insurance

costs and coverage; risks associated with cybersecurity attacks and

the loss of confidential information and other business

interruptions; and other factors affecting the real estate industry

generally. The Company refers you to the documents filed by the

Company from time to time with the SEC, specifically the section

titled “Risk Factors” in the Company’s and the Operating

Partnership’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2017, which discuss these and other factors that could

adversely affect the Company’s results. The Company undertakes no

obligation to publicly update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise.

Contact Information: Kite Realty Group TrustBryan McCarthySVP,

Marketing & Communications(317)

713-5692bmccarthy@kiterealty.com

Ashley UnderwoodSenior Analyst, Investor Relations &

Strategy(317) 578-5156aunderwood@kiterealty.com

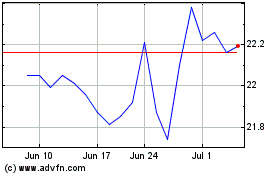

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

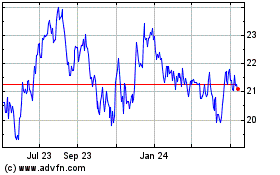

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024