Current Report Filing (8-k)

May 08 2018 - 4:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 3, 2018

FedEx Corporation

(Exact name of registrant as specified in its charter)

Commission

File Number

1-15829

|

|

|

|

|

Delaware

|

|

62-1721435

|

|

(State or other jurisdiction

of incorporation)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

942 South Shady Grove Road, Memphis, Tennessee

|

|

38120

|

|

(Address of principal executive offices)

|

|

(ZIP Code)

|

Registrant’s telephone number, including area code: (901)

818-7500

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

EXPLANATORY NOTE

The information in Item 7.01 of this Report, including the exhibit, is being furnished pursuant to Item 7.01 of Form

8-K

and General Instruction B.2 thereunder. Such information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the

liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

SECTION 1. REGISTRANT’S BUSINESS AND OPERATIONS.

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On May 3, 2018, FedEx Corporation (the

“Company”) entered into a commitment agreement (the “Agreement”), by and among the Company, Metropolitan Life Insurance Company (“MetLife”) and State Street Global Advisors Trust Company (“State Street”),

acting solely in its capacity as the independent fiduciary of the FedEx Corporation Employees’ Pension Plan and the FedEx Freight Pension Plan (the “Pension Plans”). State Street Bank and Trust Company serves as trustee to the Pension

Plans. Under the Agreement, the Company will purchase a group annuity contract from MetLife and transfer to MetLife the future benefit obligations and annuity administration for certain retirees and beneficiaries under the Pension Plans

(“Transferred Participants”).

Upon issuance of the group annuity contract, the pension benefit obligations and annuity

administration for approximately 41,000 Transferred Participants will be irrevocably transferred from the Pension Plans to MetLife, which will guarantee the pension benefits of the Transferred Participants. By transferring these obligations to

MetLife, the Company will reduce its U.S. pension plan liabilities by approximately $6 billion. The purchase of the group annuity contract will be funded directly by assets of the Pension Plans. As a result of the transaction, the Company

expects to recognize a

one-time

non-cash

pension settlement charge, which will be included in the fiscal 2018

year-end

mark-to-market

pension accounting adjustments that will be reported in the Company’s fiscal 2018 fourth quarter earnings release.

The transaction contemplated by the Agreement is subject to closing conditions that are customary for transactions of this nature, including

certain termination clauses. Assuming all of the closing conditions are met, the Company expects the purchase of the irrevocable group annuity contract to be completed on May 10, 2018. At that time, MetLife will become responsible for payment

of Transferred Participants’ monthly pension benefits. Transferred Participants will continue to receive their benefits from the Pension Plans’ trustee until August 1, 2018, at which time it is intended that MetLife will assume

responsibility for administrative services, including distribution of payments to the Transferred Participants.

The foregoing summary of

the Agreement is qualified in its entirety by reference to the text of the Agreement, which will be filed as an exhibit to the Company’s Annual Report on

Form 10-K for

the fiscal year ending

May 31, 2018.

Certain statements in this Current Report on

Form 8-K

may be considered forward-looking statements, such as statements regarding management’s views with respect to future events relating to and the financial impact of the Agreement. Such

forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from historical experience or from future results expressed or implied by such forward-looking statements.

Potential risks and uncertainties include, but are not limited to, the satisfaction or waiver of all closing conditions contained in the Agreement, without unexpected delays or conditions; FedEx’s ability to realize, or realize in the expected

time frame, the anticipated benefits from the transaction, or the amount of the expected settlement charge; and other factors that can be found in FedEx Corp.’s and its subsidiaries’ press releases and FedEx Corp.’s filings with the

SEC. Any forward-looking statement speaks only as of the date on which it is made. We do not undertake or assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

SECTION 7. REGULATION FD.

|

Item 7.01.

|

Regulation FD Disclosure.

|

Attached as Exhibit 99.1 and incorporated herein by reference

is a copy of the Company’s press release, dated May 8, 2018, announcing the Agreement described above under Item 1.01.

SECTION 8. OTHER

EVENTS.

As previously announced, FedEx realigned its specialty logistics and

e-commerce solutions in a new organizational structure under FedEx Trade Networks, Inc., which includes FedEx Custom Critical, FedEx Cross Border, FedEx Supply Chain, FedEx Trade Networks Transport & Brokerage and a new company called FedEx

Forward Depots. Beginning in the fourth quarter of fiscal 2018, FedEx Trade Networks, Inc. will report to the executive management of FedEx Corporate Services, Inc. Accordingly, its results will no longer be included in the FedEx Express reportable

segment, and prior period segment results will be recast.

SECTION 9. FINANCIAL STATEMENTS AND EXHIBITS.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits. The following

exhibit is being furnished as part of this Report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

FedEx Corporation

|

|

|

|

|

|

|

Date: May 8, 2018

|

|

|

|

By:

|

|

/s/ John L. Merino

|

|

|

|

|

|

|

|

John L. Merino

|

|

|

|

|

|

|

|

Corporate Vice President and

|

|

|

|

|

|

|

|

Principal Accounting Officer

|

EXHIBIT INDEX

E-1

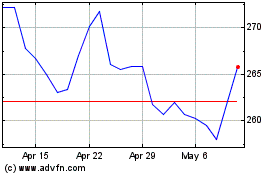

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

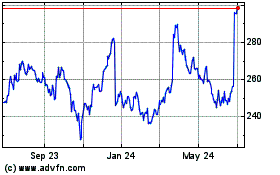

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024