Prologis Nears Deal to Buy DCT -- Update

April 29 2018 - 3:45PM

Dow Jones News

By Dana Mattioli

Prologis Inc. is nearing an agreement to buy logistics provider

DCT Industrial Trust Inc. in a deal that could be valued at about

$8 billion or more, according to people familiar with the

matter.

Terms of the talks couldn't be learned, but the two sides could

announce a deal as soon as Sunday, the people said. DCT has a

market value of nearly $6 billion.

The company, based in Denver, is an industrial real-estate

investment trust with a specialization in logistics.

Prologis, a big logistics provider based in San Francisco, has a

market value of $36 billion.

Prologis is the world's largest owner of distribution centers

and logistics properties, a market that has been changing rapidly

as e-commerce fulfillment needs have drawn more investment into the

field and warehouse development in the U.S., Europe and Asia has

boomed.

Both companies develop and manage logistics real-estate

properties in a market that has been surging in recent years as

e-commerce growth has fueled demand for more distribution centers,

including pricey sites near population centers that are used to

ship online purchases more rapidly to consumers.

Prologis is by far the world's biggest developer and owner of

distribution space, with an estimated 676 million square feet of

warehousing under its control at the end of 2016, according to

National Real Estate Investor. DCT was No. 10 in the world in the

same survey, with 74 million square feet of space.

A Chinese private equity consortium bought the logistics

real-estate market's second-biggest player, Singapore-based Global

Logistic Properties, last year for $16 billion. GLP is the biggest

operator of warehouses in Asia and holds significant properties in

China and Japan, as well as the U.S.

Rental rates in industrial real-estate markets have been

surging, growing at a more-than-5% annual rate in each of the last

seven quarters, as demand has outpaced supply, according to real

estate broker CBRE Inc. The firm said the 7.3% availability rate

for warehouse space in the U.S. in the first quarter was the lowest

in 17 years.

Paul Page contributed to this article

Write to Dana Mattioli at dana.mattioli@wsj.com

(END) Dow Jones Newswires

April 29, 2018 15:30 ET (19:30 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

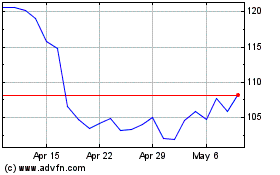

Prologis (NYSE:PLD)

Historical Stock Chart

From Aug 2024 to Sep 2024

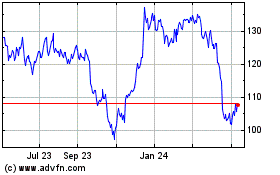

Prologis (NYSE:PLD)

Historical Stock Chart

From Sep 2023 to Sep 2024