Fresh Oversupply Worries Jolt Copper

April 27 2018 - 10:31AM

Dow Jones News

By Amrith Ramkumar and David Hodari

Copper prices fell Friday on worries that the market will

continue to be well supplied, limiting future gains.

Copper for July delivery shed 2.5% to $3.061 a pound on the

Comex division of the New York Mercantile Exchange. Prices had

risen in four straight weeks entering this one but have tumbled of

late and are down more than 7% in 2018, after hitting a nearly

four-year high late last year.

Investors are worried that the supply disruptions that buoyed

prices last year from mining labor contract renegotiations and

other conflicts with host governments haven't materialized yet in

2018, meaning the market could continue to be well supplied.

On Friday, the International Copper Study Group said it now

expects a small supply surplus in 2018, after previously projecting

a deficit

"The switch to surplus is due to stronger than previously

anticipated growth in refined copper production," the group said in

a statement with its latest forecasts.

Traders were also reacting to news from U.S. giant

Freeport-McMoRan Inc. that its latest spat with the Indonesian

government regarding control over the world's second-largest copper

mine, Grasberg, hasn't yet affected production. Indonesia recently

said it wanted Freeport to meet new environmental standards in just

six months, the latest barb in an extended back-and-forth between

the two sides.

Another prominent copper producer, Norilsk Nickel, said Thursday

that first-quarter copper production rose 18% from a year

earlier.

Still, some analysts expect the uncertainty surrounding

Freeport's negotiations with Indonesia and labor negotiations at

the BHP Billiton-operated Escondida mine in Chile to boost copper

moving forward as consumption data from China, the world's largest

consumer, picks up steam.

Long-term investors have also been encouraged by the lack of

growth projects that could boost copper supply in future years, and

the ICSG reiterated Friday that it expects a supply deficit in

2019.

Elsewhere in base metals, aluminum for delivery in three months

on the London Metal Exchange declined 1.4% to $2,244 a metric ton,

continuing a recent bout of extreme volatility. Prices surged

Thursday on a Bloomberg report that sanctioned Russian metals

tycoon Oleg Deripaska, who controls aluminum giant United Co.

Rusal, wants to keep control of the company, potentially creating a

standoff with the U.S. government.

The U.S. has said it might relieve sanctions if Mr. Deripaska

sells his stake. Rusal denied the report was accurate, and some

analysts think it is a negotiating tactic by Mr. Deripaska to

pressure the U.S. or get a better deal if he sells.

Worries about supply tied to Rusal has jolted the aluminum,

palladium and nickel markets this months, but some analysts expect

a resolution to calm traders moving forward.

Among precious metals, gold for June delivery inched up 0.3% to

$1,321.80 a troy ounce from its lowest close in more than a month.

Prices have fallen recently with the dollar rising, as a stronger

dollar makes commodities denominated in the U.S. currency more

expensive for overseas buyers.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com and David

Hodari at David.Hodari@dowjones.com

(END) Dow Jones Newswires

April 27, 2018 10:16 ET (14:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

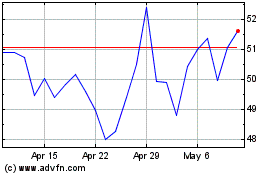

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024