General Mills Hit by Higher Food, Shipping Costs -- 2nd Update

March 21 2018 - 12:07PM

Dow Jones News

By Annie Gasparro

General Mills Inc. will raise prices on some of its packaged

foods as higher ingredient and shipping costs cut into

profitability.

The maker of Cheerios cereal and Yoplait yogurt said freight

costs in North America were near 20-year highs in February while

food prices were also higher than expected, prompting the

conglomerate to lower its earnings expectations for the year.

"We are seeing an unprecedented rise in logistics costs," Chief

Executive Jeff Harmening said in an interview. For food costs, he

said, "the inflation is not unprecedented, but we are a quarter

late in reacting."

General Mills shares fell more than 9% Wednesday to near a

five-year low. The stock is down 25% over the past year while the

S&P 500 is up 15%.

Mr. Harmening said he would raise prices on some products and

sell some products in smaller packages to make up for the rising

costs. He said the company would also tweak the discounts it

offers. Analysts questioned whether General Mills can afford to

raise prices without losing customers as competition for shelf

space at grocery stores intensifies.

"Investors just worry so much that the retail environment is so

difficult," Citibank analyst David Driscoll said.

Other big food companies such as Kellogg Co. and Kraft Heinz Co.

are also struggling to preserve profits while costs rise and

customers drift toward new brands, many of which market their

products as more wholesome and healthy. The S&P 500 packaged

foods and meats index fell 3% Wednesday.

General Mills' comparable sales rose 1% in the latest quarter,

including a bump in the U.S. as more people bought Nature Valley

granola bars and new flavors of Cheerios. But the higher costs

dragged down General Mills' adjusted operating margin 1.2

percentage points to 15.7%.

For its fiscal year ending in May, General Mills projects

adjusted earnings per share will rise by up to 1%, compared to

previous guidance for an increase up to 4%.

"We have been very effective in getting closer to the consumer,"

Chief Financial Officer Don Mulligan said. "We have to be just as

close to our cost structure."

General Mills' brands like Cheerios and Progresso soup have been

selling faster in stores lately than rival brands -- a sign of

progress for a company that hasn't seen that kind of success since

2014, according to J.P. Morgan analyst Ken Goldman.

But General Mills has had to pay more to use third-party

manufacturers for some of those products and to secure more

shipping capacity at the last minute to keep up with demand. That

has dented the company's profit from those higher sales.

"While we expected our new products to be better, but didn't

expect them to be this much better," Mr. Harmening said.

Mr. Harmening, who took over as CEO less than a year ago, also

said he plans to continue selling off the Minneapolis-based

conglomerate's weaker businesses while acquiring new brands with

more growth potential.

In February, General Mills agreed to buy pet-food maker Blue

Buffalo for $8 billion, giving it a foothold in the premium pet

food aisle, where sales are rising faster than for its legacy

products like baking mixes. He intends to expand Blue Buffalo to

more retail outlets and to expand the brand with new products like

treats.

Those acquisitions come alongside divestitures of older brands

like the Green Giant frozen and canned vegetable business that

General Mills sold to B&G Foods Inc. in 2015. Analysts have

speculated that Hamburger Helper or Bisquick could be the next to

go.

General Mills wouldn't say which brands it might sell.

Imani Moise contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

March 21, 2018 11:52 ET (15:52 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

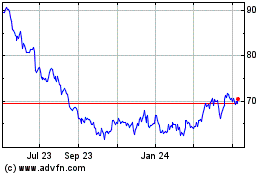

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

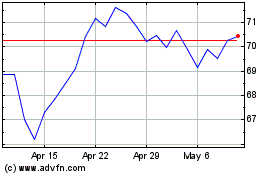

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024