KKR Releases “Diverging Paths” by Henry H. McVey

March 08 2018 - 7:00AM

Business Wire

New Macro Outlook Piece Highlights

Investment Shift Away from U.S. and Increased Confidence in Europe

and Asia

KKR today announced the release of a new macro Insights piece by

Henry McVey, Head of Global Macro and Asset Allocation (GMAA). In

Diverging Paths, McVey and his team outline the many compelling

opportunities in global asset allocation that they are seeing

abroad.

“While many of the conversations we are having with investors in

the U.S. these days are championing the merits of more U.S.-centric

strategies, this approach does not seem to dovetail well with the

way we are seeing the world in terms of asset allocation,” Henry

McVey said. “To be sure, we believe that the recent tax cuts are

constructive for the positioning of U.S. corporations and we fully

appreciate that sentiment across both consumers and executives in

the U.S. toward the future is booming. Nonetheless, as we position

our portfolio for the later stages of the economic recovery, our

shift in relative value is weighted towards non-U.S. assets.”

In his latest report, Henry McVey and his team share the

following insights from recent trips to Europe and Asia that

support their geographical bet as well as asset allocation

preferences:

- Central bank policy is less hawkish

outside of the U.S. (e.g. Japan and Europe), which makes it easier

to lock in low-cost liabilities – a key macro priority for us in

2018.

- Corporations in both Europe and Asia

are benefitting more directly from our belief that China has

already crashed in nominal terms.

- Our quantitative models for both

European growth and Emerging Market Public Equity outperformance

both suggest favorable outcomes for investors.

- Both Europe and Asia have emerged as

elegant plays on two of our most important macro themes:

‘Deconglomeratization’ and ‘Experiences over Things.’

- In addition, we see the fixed income

‘Illiquidity Premium,’ particularly in overseas markets, as a

compelling feature to earn solid risk-adjusted returns in today’s

low interest rate environment.

Links to access this report as well as an archive of Henry

McVey's previous publications follow:

- To read the latest Insights: click

here.

- To download a PDF version: click

here.

- To download the KKR Insights app for

iOS click here, and for Android click here.

- For an archive of previous publications

please visit www.KKRinsights.com.

About Henry McVey

Henry H. McVey joined KKR in 2011 and is Head of the Global

Macro and Asset Allocation team. Mr. McVey also serves as Chief

Investment Officer for the Firm’s Balance Sheet and oversees

Firmwide Risk at KKR. Prior to joining KKR, Mr. McVey was a

managing director, lead portfolio manager and head of global macro

and asset allocation at Morgan Stanley Investment Management

(MSIM). Prior to that he was a portfolio manager at Fortress

Investment Group and chief U.S. investment strategist for Morgan

Stanley. While at Morgan Stanley, Mr. McVey was also a member of

the asset allocation committee and was the top-ranked asset

management and brokerage analyst by Institutional Investor for four

consecutive years before becoming the firm's strategist in January

2004. He earned his B.A. from the University of Virginia and an

M.B.A. from the Wharton School of the University of Pennsylvania.

Mr. McVey is a member of the TEAK Fellowship Board of Trustees

after previously serving as co-chair of the board for five years.

Henry is also a member of the Pritzker Foundation Investment

Committee, a board member of the University of Virginia Investment

Management Company (UVIMCO), a member of the national advisory

board for the Jefferson Scholarship at the University of Virginia,

and a member of the Council on Foreign Relations Corporate Leader

Program.

About KKR

KKR is a leading global investment firm that manages multiple

alternative asset classes, including private equity, energy,

infrastructure, real estate and credit, with strategic manager

partnerships that manage hedge funds. KKR aims to generate

attractive investment returns for its fund investors by following a

patient and disciplined investment approach, employing world-class

people, and driving growth and value creation with KKR portfolio

companies. KKR invests its own capital alongside the capital it

manages for fund investors and provides financing solutions and

investment opportunities through its capital markets business.

References to KKR’s investments may include the activities of its

sponsored funds. For additional information about KKR & Co.

L.P. (NYSE: KKR), please visit KKR’s website at www.kkr.com and on

Twitter @KKR_Co.

The views expressed in the report and summarized herein are the

personal views of Henry McVey of KKR and do not necessarily reflect

the views of KKR or the strategies and products that KKR offers or

invests. This release contains projections or other forward-looking

statements, which are based on beliefs, assumptions and

expectations that may change as a result of many possible events or

factors. If a change occurs, actual results may vary materially

from those expressed in the forward-looking statements. All

forward-looking statements speak only as of the date such

statements are made, and neither KKR nor Mr. McVey assumes any duty

to update such statements except as required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180308005323/en/

KKRKristi Huller or Cara Kleiman

Major212-750-8300media@kkr.com

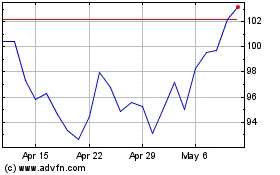

KKR (NYSE:KKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

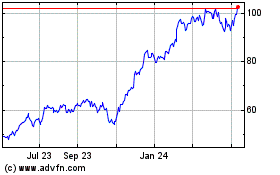

KKR (NYSE:KKR)

Historical Stock Chart

From Apr 2023 to Apr 2024