GRAIN HIGHLIGHTS: Top Stories of the Day

March 05 2018 - 5:51PM

Dow Jones News

TOP STORIES:

Grains, Soybeans Rise as Dry Weather Lingers

Grain futures rebounded and soybeans marked a new high Monday as

global weather forecasts show little relief in sight for

drought-afflicted crops.

Wheat prices moved higher, resuming a more than weeklong rally

spurred by dry weather in the U.S. Plains that is hurting the

nation's crop. Private weather forecasters said farmers growing

hard-red winter wheat likely wouldn't see rain for the next two

weeks, exacerbating a drought that already has dented crop

conditions in key growing regions like Kansas.

Investor Continental Grain Is Set to Pressure Bunge to Sell

Itself -- Update

Agricultural investment firm Continental Grain Co. is preparing

to push Bunge Ltd. to consider strategic options, ramping up

pressure on the commodity-trading giant to strike a deal.

Continental Grain, which owns more than 1% of Bunge, on Monday

secured approval from U.S. antitrust regulators to purchase more

stock, according to people familiar with the matter. That clearance

would only be needed under the Hart-Scott-Rodino Act if the firm

intended to attempt to influence management. Such a filing is often

a precursor to an activist campaign -- public or private.

STORIES OF INTEREST:

Bunge Shares Bounce on Investor Filing -- Market Talk

13:14 ET - Bunge shares rise 4% after agricultural investment

firm Continental Grain secures FTC approval to acquire more shares

in the grain giant and potentially engage with management, perking

up speculation that a deal could come for Bunge. Continental five

years ago publicly pressured pork supplier Smithfield Foods to

consider a breakup, and that company wound up selling itself. Bunge

shares jump to their highest in two weeks, though remain lower than

the level in early February, following reports that Archer Daniels

Midland had approached Bunge about a takeover. Talks between the

companies are ongoing but at a slow pace, people familiar with the

matter told The Wall Street Journal. (jacob.bunge@wsj.com;

@jacobbunge)

Albertsons Hires Former Starbucks CEO For Rite Aid Marriage --

Market Talk

10:47 ET - Albertsons and Rite Aid are bringing in a retail

veteran to steer the grocery and pharmacy chains through their

complex, roughly $24B merger. Executives of the new company tell

WSJ they have named former Starbucks CEO, Jim Donald, as president

and COO. Retailers are looking to deals outside their comfort zones

to defend themselves from Amazon and Walmart. Rite Aid shares are

up 1.1%. (heather.haddon@wsj.com; @heatherhaddon)

THE MARKETS:

Cattle Futures Snap Losing Streak -- Market Talk

14:56 ET - Cattle and hog futures recovered on Monday after

falling for most of last week on concerns over expanding U.S. meat

supplies. April-dated live cattle futures closed near $1.23 a pound

on Monday at the CME, up 0.8% from Friday when the contract fell

for a third consecutive day. April-dated lean hog futures also

gained on Monday, closing up 1.3% at 68.80 cents a pound.

(patrick.mcgroarty@wsj.com; @patmcgroarty)

(END) Dow Jones Newswires

March 05, 2018 17:36 ET (22:36 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

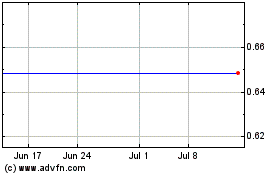

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Sep 2023 to Sep 2024