Today's Top Supply Chain and Logistics News From WSJ

February 27 2018 - 6:21AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

CSX Corp. isn't the only freight railroad trying to win back

shippers following the service-slashing leadership of the late

Hunter Harrison. Canadian Pacific Railway Ltd. is turning to a

charm offensive to woo customers back to its fold after many felt

alienated by the hard-nosed style of Mr. Harrison, who led CP

before moving to CSX last year. The WSJ's David George-Cosh and

Paul Ziobro write that Mr. Harrison's efforts to impose a

"precision railroading" strategy across operations are still widely

applauded for transforming the railroads he headed, improving

profits and boosting share price. But the approach also was partly

responsible for CP losing lose some key shipping contracts to its

bigger rival Canadian National Railway Co., pushing down revenue

even as the railroad's operating ratio improved. CP CEO Keith

Creel, who took over from Mr. Harrison, has been crisscrossing the

U.S. and Canada to meet customers, assuring them that operations

are changing along with improved relationships with shippers.

Labor isn't easing up its push against the independent-driver

model in port trucking. A new lawsuit filed on behalf of three

truck drivers is taking aim at a subsidiary of XPO Logistics Inc.,

and seeks class-action status in a case alleging the business

denies drivers wages and benefits because they are wrongly

classified as independent contractors instead of employees. It is

the latest in a series of action aimed at trucking companies that

haul goods at Southern California ports, WSJ Logistics Report's

Jennifer Smith writes, including a suit last month by the city of

Los Angeles targeting three trucking firms over the practice. The

lawsuit filed Monday in Los Angeles says XPO Logistics Cartage LLC

and a predecessor firm, XPO Cartage Inc., repeatedly misclassified

drivers. The case targets lost wages, but it also addresses broader

issues in trucking operations that include lengthy, unpaid periods

waiting for loads that are coming under more scrutiny under

California's labor laws.

New U.S. sanctions aimed at North Korea provide a kind of

warning shot for the shipping world. The U.S. issued an advisory on

shipping practices along with new restrictions on dozens of North

Korean shipping and trading companies as part of an offensive on

the country's nuclear weapons and ballistic missile programs. The

State Department warning goes well beyond the North Korean

operators, the WSJ's Samuel Rubenfeld writes, saying an array of

shipping businesses risk sanctions if they help support Pyongyang's

attempt to evade restrictions. That includes insurers, flag

registries, financial institutions and other shipping companies

that may work in operations with the targeted companies. The idea,

says one legal expert, is to "make North Korean shipping

radioactive" by ensuring that companies have too much to lose if

they work with the country in the sometimes turbulent world of

Asia-Pacific.

TRANSPORTATION

Seadrill Ltd. is getting help from big shipbuilders in the

troubled offshore energy company's bid to stay afloat. Samsung

Heavy Industries Co. Ltd. and Daewoo Shipbuilding & Marine

Engineering Co. agreed to set aside for now contracts together

accounting for about $1 billion in potential claims against

Seadrill, allowing the new rigs to be marketed for sale. The WSJ's

Peg Brickley writes the peace with the shipyards comes as the

company run by Norwegian billionaire John Fredriksen quells

opposition to its bankruptcy exit plan by making room for more

creditors to invest in getting Seadrill back on its feet. The

company has staggered under a downturn in the energy business that

left it saddled with some $8 billion in debt. Mr. Fredriksen, who

had negotiated immunity from lawsuits over his handling of the

company's affairs in the original turnaround strategy, remains

protected from litigation, and there won't be any move against some

$23 million in salaries and bonuses paid to high-ranking company

leaders.

QUOTABLE

IN OTHER NEWS

Sales of new homes in the U.S. fell 7.8% in January, the fourth

decline in the past six months. (WSJ)

Manufacturing growth across Texas accelerated this month.

(WSJ)

Qualcomm Inc. says it is getting closer to negotiating a buyout

of fellow semiconductor maker Broadcom Ltd. (WSJ)

French auto parts maker Faurecia SA say it will take a financial

hit if the U.S. pulls out of the North American Free Trade

Agreement. (WSJ)

FedEx Corp. says it is keeping its discounts to National Rifle

Association members as several companies leave the NRA's list of

supporting companies. (Memphis Commercial Appeal)

Slowing smartphone sales are hitting the earnings of parts

suppliers that have bet heavily on electronics. (Nikkei Asian

Weekly)

U.S. and Canada customs officials are testing a plan to

pre-inspect cargo at factories and other sites in the host country

to speed cross-border trade. (Automotive News)

BAIC Motor Corp. and Daimler AG plan will build a $1.9 billion

factory in China as the German automaker deepens its ties there.

(Industry Week)

Royal Dutch Shell expects international liquefied natural gas

transport to double by 2035. (Lloyd's List)

The Eurasian Rail Alliance plans to expand its rail container

service connecting China and Europe this year. (Splash 24/7)

Shippers are reporting unprecedented delays in intermodal

services moving through Chicago. (Journal of Commerce)

Logistics provider Geodis says productivity doubled at its

Indianapolis warehouse serving an apparel retailer after installing

robots. (WWD)

Ship broker Braemer ACM says new shipping operations using big

oil tankers from the U.S. will provide benefits to refiners in

Asia. (Bloomberg)

Krone Commercial Vehicle opened a 400,000-square-foot parts

distribution center in northwest Germany to serve an area from

Scandinavia to Turkey. (Logistics Manager)

Walmart Inc. is launching a standalone online bedding brand.

(New York Times)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

February 27, 2018 06:06 ET (11:06 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

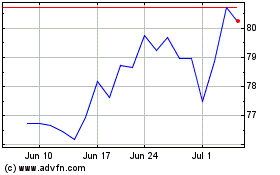

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

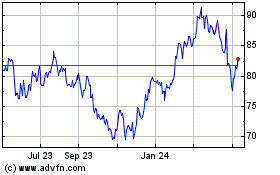

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024