Current Report Filing (8-k)

February 23 2018 - 4:13PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: February

23, 2018

(Date of earliest event reported)

|

Commission

File Number

|

Exact

Name of Registrant

as specified in its charter

|

State

or Other Jurisdiction of

Incorporation or Organization

|

IRS

Employer

Identification Number

|

|

1-12609

|

PG&E CORPORATION

|

California

|

94-3234914

|

|

1-2348

|

PACIFIC GAS AND ELECTRIC COMPANY

|

California

|

94-0742640

|

|

|

|

77 Beale Street

P.O. Box 770000

San Francisco, California

94177

(Address of principal executive

offices) (Zip Code)

(415) 973-1000

(Registrant’s telephone number,

including area code)

|

77 Beale Street

P.O. Box 770000

San Francisco, California

94177

(Address of principal executive

offices) (Zip Code)

(415) 973-7000

(Registrant’s telephone

number, including area code)

|

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

☐

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting

Material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company PG&E Corporation

☐

Emerging growth company Pacific Gas and Electric

Company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Emerging growth company PG&E Corporation

☐

Emerging growth company Pacific Gas and Electric

Company ☐

Item

1.01. Entry into a Material Definitive Agreement

On February 23, 2018, Pacific

Gas and Electric Company (the “Utility”) obtained a $250 million unsecured term loan (the “Term Loan”)

under a loan agreement (the “Term Loan Agreement”) with The Bank of Tokyo-Mitsubishi UFJ, Ltd. (“BTMU”)

and U.S. Bank National Association, as lenders (in such capacity, “Lenders”), joint lead arrangers and joint bookrunners

and BTMU, as administrative agent (in such capacity, the “Administrative Agent” ). The Utility plans to use the loan

proceeds for general corporate purposes.

The Term Loan matures on February

22, 2019. The Term Loan will bear interest based, at the Utility’s election, on (1) LIBOR plus an applicable margin or (2)

ABR plus an applicable margin. ABR will equal the highest of the following: the Administrative Agent’s announced base rate,

0.5% above the overnight federal funds rate, and the one-month LIBOR plus an applicable margin. The applicable margin for LIBOR

loans is 0.60%. The applicable margin for ABR loans is the greater of (1) zero and (2) 1% less than the applicable margin for LIBOR

loans.

The Term Loan Agreement includes

usual and customary covenants for loan agreements of this type, including covenants limiting: (1) liens to those permitted under

the Utility’s senior bond indenture, (2) mergers, (3) sales of all or substantially all of the Utility’s assets, and

(4) other fundamental changes. In addition, the Term Loan Agreement requires that the Utility maintain a ratio of total consolidated

debt to total consolidated capitalization of not more than 0.65 to 1.00 as of the end of each fiscal quarter.

In the event of a default by

the Utility under the Term Loan Agreement, including cross-defaults relating to specified other debt of the Utility or any of its

significant subsidiaries in excess of $200 million, the Administrative Agent may, with the consent of the required Lenders (or

upon the request of the required Lenders, shall), declare the amounts outstanding under the Term Loan Agreement, including all

accrued interest, payable immediately. For events of default relating to insolvency, bankruptcy or receivership, the amounts outstanding

under the Term Loan Agreement become payable immediately.

The foregoing description of

the Term Loan Agreement is qualified in its entirety by reference to the full text of the Term Loan Agreement, which is attached

as Exhibit 10.1 hereto and incorporated by reference herein.

The Lenders and/or their affiliates

have in the past provided, and may in the future provide, investment banking, underwriting, lending, commercial banking and other

advisory services to the Utility. The Lenders have received, and may in the future receive, customary compensation from the Utility

for such services.

Item 2.03. Creation of a Direct Financial

Obligation or an Obligation under an Off-balance Sheet Arrangement of a Registrant

The information set forth above

in Item 1.01 regarding the Term Loan and the Term Loan Agreement is hereby incorporated into this Item 2.03 by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

PG&E CORPORATION

|

|

|

|

|

|

|

By:

|

/S/ DAVID S. THOMASON

|

|

|

|

DAVID S. THOMASON

|

|

Dated: February 23, 2018

|

|

Vice President and Controller

|

|

|

|

|

|

|

|

|

|

|

PACIFIC GAS AND ELECTRIC COMPANY

|

|

|

|

|

|

|

By:

|

/S/ DAVID S. THOMASON

|

|

|

|

DAVID S. THOMASON

|

|

Dated: February 23, 2018

|

|

Vice President, Chief Financial Officer and Controller

|

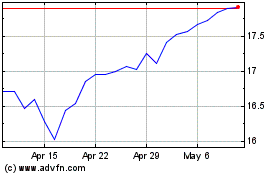

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

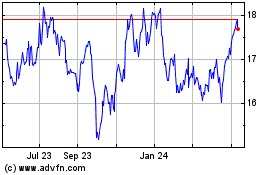

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024