Company thumbs nose at suitor Broadcom by raising its bid for

NXP

By Ben Dummett and Ted Greenwald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 21, 2018).

Qualcomm Inc. pumped new life into its bid for NXP

Semiconductors NV, raising its offer to $44 billion and locking up

support from key stakeholders -- a move Broadcom Ltd. had warned

could prompt it to end its $121 billion pursuit of Qualcomm.

The $127.50-a-share price for NXP, announced Tuesday, is the

latest twist in months of maneuvering between Qualcomm and Broadcom

for an advantage in what would be the largest tech deal ever.

Broadcom Chief Executive Hock Tan had stressed his offer for

Qualcomm -- a deal that would forge the third-biggest chip maker by

revenue -- depended on his target not raising its price for NXP

beyond the original $110 a share. But as a higher price for NXP

seemed increasingly inevitable, Mr. Tan recently softened his

position, saying he would keep his options open.

Now the two rivals are headed toward a March 6 showdown in which

Qualcomm shareholders are scheduled to vote on a slate of directors

nominated by Broadcom. In another recent concession seemingly aimed

at getting a deal done, Mr. Tan reduced his number of candidates

from 11 to six, seeking a majority rather than trying to unseat the

entire Qualcomm board.

Glass Lewis & Co., which advises big shareholders on

corporate votes, recommended Tuesday that Qualcomm owners vote for

all six Broadcom candidates, which would hand Broadcom's selections

a board majority. The firm said Qualcomm's failure to achieve

profitable growth and its continuing disputes with regulators and

customers led it to "doubt the credibility of Qualcomm's

stand-alone plan."

Qualcomm didn't respond to a request for comment about the

advisory firms' criticisms. In its statement Tuesday, Qualcomm said

despite the higher NXP price, it is "highly confident" in its

fiscal 2019 road map to deliver between $6.75 and $7.50 in adjusted

per-share earnings.

Institutional Shareholder Services Inc., meanwhile, recently

recommended stockholders vote for four Broadcom candidates, leaving

Qualcomm's candidates with a majority. A mixed board would "require

appropriate and demonstrable flexibility on both sides," ISS

said.

Qualcomm is looking to NXP to broaden its product line beyond

its smartphone stronghold to automobiles, security and

internet-connected devices, combined markets the company has

projected will be worth $77 billion by 2020. Qualcomm believes

those markets will give it a rich payoff for its investments in

fifth-generation cellular technology, known as 5G, which will roll

out in coming years.

Building momentum on the NXP deal allows Qualcomm to enter its

shareholder meeting with evidence it can deliver on plans to move

into fast-growing markets. The acquisition rests on the approval of

Chinese officials, the last regulatory hurdle, and NXP investors

throwing their support behind the deal.

Qualcomm made significant progress on that front, winning over

Elliott Management Corp. and others, which had argued the original

$39 billion offer for NXP was too low. Elliott had argued NXP, the

world's largest developer of chips for automobiles, was worth $135

a share; shares of the Dutch company had traded above $110 since

the summer.

Elliott, which owns a 7.2% stake in NXP, said Tuesday it agreed

to tender its shares in response to Qualcomm's new $127.50-a-share

offer. Qualcomm said it obtained binding agreements from other

shareholders as well, for a total of 28% of outstanding NXP

shares.

The revised offer came nearly a week after Broadcom and Qualcomm

executives sat down together for the first time since Broadcom

launched its takeover effort in November. Qualcomm has consistently

maintained the $121 billion bid -- a price Broadcom lifted from

$105 billion in what it said was a "best and final" offer --

undervalues the company, and that a deal would run into regulatory

troubles. The meeting seemingly resulted in no progress toward an

agreement.

In a statement Tuesday, Broadcom said the higher NXP bid

"demonstrates the Qualcomm board's disregard for its fiduciary

duty." The statement didn't address whether Broadcom would continue

its pursuit, beyond saying the company was "evaluating its

options."

"Qualcomm's board is still clearly rejecting Broadcom's offer,

and by increasing its bid for NXP they're moving towards trying to

remain independent," said Mike Walkley, an analyst with Canaccord

Genuity Group Inc.

Broadcom could keep its bid or walk, but another option, he

said, is reducing its offer ahead of the shareholder meeting to

compensate for the additional $6 billion Qualcomm hopes to pay for

NXP. "I don't think it's over just because Qualcomm raised its bid

for NXP," Mr. Walkley said.

In raising its bid for NXP, Qualcomm also lowered the threshold

for shareholder support to 70% from 80%, making it easier to

complete the deal.

On Tuesday, Qualcomm shares fell 1.3% to $63.99, while shares of

NXP jumped 6% to $125.56. Broadcom shares were little changed.

The Wall Street Journal reported earlier Tuesday that Qualcomm

was set to sweeten its offer.

Qualcomm's NXP offer "reduces the chances that a Broadcom deal

would go through at $82 a share," weighing on Qualcomm's stock,

said Chris Caso, an analyst with Raymond James Financial Inc.

The NXP deal has been wending its way through international

regulatory approvals for more than a year. On its recent earnings

call, Qualcomm estimated it would take three weeks to wrap up the

acquisition once China approves the deal.

"We are working hard to complete this transaction

expeditiously," Qualcomm CEO Steve Mollenkopf said Tuesday.

Write to Ben Dummett at ben.dummett@wsj.com and Ted Greenwald at

Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

February 21, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

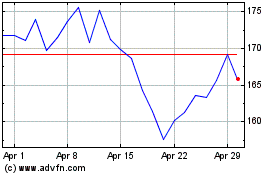

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024