Hovnanian Enterprises, Inc. (NYSE:HOV) (the “Company”)

announced today that its wholly owned subsidiary, K. Hovnanian

Enterprises, Inc. (“K. Hovnanian”), has commenced the solicitation

of consents (the “Consent Solicitations”) to amend (the “Proposed

Amendments”) the indenture (the “Indenture”) governing K.

Hovnanian’s 10.000% Senior Secured Notes due 2022 (the “2022

Notes”) and 10.500% Senior Secured Notes due 2024 (the “2024

Notes,” each of the 2022 Notes and 2024 Notes, a “Series” of Notes,

and collectively, the “Notes”). The Consent Solicitation with

respect to each Series of Notes is a separate Consent Solicitation

and is not conditioned upon the other Consent Solicitation. The

Consent Solicitations are being made in accordance with the terms

and subject to the conditions stated in a Consent Solicitation

Statement, dated December 28, 2017 (the “Consent Solicitation

Statement”). As of the date of the Consent Solicitation Statement,

the aggregate outstanding principal amount of the 2022 Notes was

$440,000,000, and the aggregate outstanding principal amount of the

2024 Notes was $400,000,000.

Each Consent Solicitation is scheduled to expire

at 5:00 p.m., New York City time, on January 12, 2018, unless

extended or earlier terminated (with respect to each Series of

Notes, the “Expiration Date”). Holders of Notes who validly deliver

consents to the applicable Proposed Amendments in the manner

described in the Consent Solicitation Statement will be eligible to

receive consent consideration equal to $2.50 per $1,000 principal

amount of Notes for which consents have been validly delivered

prior to the applicable Expiration Date (and not validly revoked).

Holders providing consents after the applicable Expiration Date

will not receive consent consideration. Consent consideration will

be paid to consenting holders as promptly as practicable after the

satisfaction or waiver of the conditions to the Consent

Solicitations, as further described in the Consent Solicitation

Statement.

The purpose of the Consent Solicitations is to

obtain from holders approval of the Proposed Amendments to

eliminate the restrictions on the Company’s ability to purchase,

repurchase, redeem, acquire or retire for value K. Hovnanian’s

7.000% Senior Notes due 2019 and 8.000% Senior Notes due 2019 and

refinancing or replacement indebtedness in respect thereof

contained in the indenture governing the Notes.

The consummation of each Consent Solicitation is

subject to a number of conditions that are set forth in the Consent

Solicitation Statement, including, without limitation, (i) the

receipt of the consent of the holders of at least a majority in

aggregate principal amount of the outstanding Notes of the

applicable Series (with respect to each Series of Notes, the

“Requisite Consents”) prior to the applicable Expiration Date and

(ii) the execution and effectiveness of a supplemental

indenture effecting the Proposed Amendments to the applicable

Indenture.

Consents may be revoked prior to the date the

applicable supplemental indenture giving effect to the Proposed

Amendments is executed and becomes effective (which, in each case,

is expected to be promptly after receipt of the Requisite Consents

for the applicable Series of Notes and may occur prior to the

applicable Expiration Date if the Requisite Consents for such

Series of Notes are received before then). If the Requisite

Consents for a Series of Notes are received and the applicable

supplemental indenture is executed and becomes effective, upon

payment by K. Hovnanian of the consent consideration to the

consenting holders of Notes of the applicable Series, the

applicable Proposed Amendments will be operative and be binding

upon all holders of Notes of the applicable Series, whether or not

such holders have delivered Consents. A more comprehensive

description of the Consent Solicitations can be found in the

Consent Solicitation Statement.

Requests for copies of the Consent Solicitation

Statement and other related materials should be directed to Global

Bondholder Services Corporation, the Information and Tabulation

Agent for the Consent Solicitations, at (212) 430-3774 (collect) or

(866) 470-4300 (toll-free).

K. Hovnanian’s obligations to pay the consent

consideration are set forth solely in the Consent Solicitation

Statement. This press release and the Consent Solicitation

Statement shall not constitute an offer to sell nor a solicitation

of an offer to purchase any Notes or other securities. The Consent

Solicitations are being made only by, and pursuant to the terms of,

the Consent Solicitation Statement, and the information in this

news release is qualified by reference to the Consent Solicitation

Statement. No recommendation is made, or has been authorized to be

made, as to whether or not holders of Notes should consent to the

adoption of the Proposed Amendments pursuant to the Consent

Solicitations. Each holder of Notes must make its own decision as

to whether to give its consent to the Proposed Amendments. The

Consent Solicitations are not being made in any jurisdiction in

which the making thereof would not be in compliance with the

applicable laws of such jurisdiction. In any jurisdiction in which

the Consent Solicitations are required to be made by a licensed

broker or dealer, the Consent Solicitations will be deemed to be

made on behalf of K. Hovnanian by one or more registered brokers or

dealers licensed under the laws of such jurisdiction. None of the

Company, K. Hovnanian or the Information and Tabulation Agent

makes any recommendation in connection with the Consent

Solicitations. Subject to applicable law, K. Hovnanian may amend,

extend or terminate the Consent Solicitations.

About Hovnanian Enterprises

Hovnanian Enterprises, Inc., founded in 1959 by

Kevork S. Hovnanian, is headquartered in Red Bank, New Jersey. The

Company is one of the nation’s largest homebuilders with operations

in Arizona, California, Delaware, Florida, Georgia, Illinois,

Maryland, New Jersey, Ohio, Pennsylvania, South Carolina, Texas,

Virginia, Washington, D.C. and West Virginia. The Company’s homes

are marketed and sold under the trade names K. Hovnanian® Homes,

Brighton Homes® and Parkwood Builders. As the developer of K.

Hovnanian’s® Four Seasons communities, the Company is also one of

the nation’s largest builders of active lifestyle communities.

Forward-Looking Statements

All statements in this press release that are

not historical facts should be considered as “Forward-Looking

Statements.” Such statements involve known and unknown risks,

uncertainties and other factors that may cause actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Such

forward-looking statements include but are not limited to

statements related to the Company’s goals and expectations with

respect to its financial results for future financial periods.

Although we believe that our plans, intentions and expectations

reflected in, or suggested by, such forward-looking statements are

reasonable, we can give no assurance that such plans, intentions or

expectations will be achieved. By their nature, forward-looking

statements: (i) speak only as of the date they are made, (ii) are

not guarantees of future performance or results and (iii) are

subject to risks, uncertainties and assumptions that are difficult

to predict or quantify. Therefore, actual results could differ

materially and adversely from those forward-looking statements as a

result of a variety of factors. Such risks, uncertainties and other

factors include, but are not limited to, (1) changes in general and

local economic, industry and business conditions and impacts of a

sustained homebuilding downturn; (2) adverse weather and other

environmental conditions and natural disasters; (3) levels of

indebtedness and restrictions on the Company’s operations and

activities imposed by the agreements governing the Company’s

outstanding indebtedness; (4) the Company's sources of liquidity;

(5) changes in credit ratings; (6) changes in market conditions and

seasonality of the Company’s business; (7) the availability and

cost of suitable land and improved lots; (8) shortages in, and

price fluctuations of, raw materials and labor; (9) regional and

local economic factors, including dependency on certain sectors of

the economy, and employment levels affecting home prices and sales

activity in the markets where the Company builds homes; (10)

fluctuations in interest rates and the availability of mortgage

financing; (11) changes in tax laws affecting the after-tax costs

of owning a home; (12) operations through joint ventures with third

parties; (13) government regulation, including regulations

concerning development of land, the home building, sales and

customer financing processes, tax laws and the environment; (14)

product liability litigation, warranty claims and claims made by

mortgage investors; (15) levels of competition; (16) availability

and terms of financing to the Company; (17) successful

identification and integration of acquisitions; (18) significant

influence of the Company’s controlling stockholders; (19)

availability of net operating loss carryforwards; (20) utility

shortages and outages or rate fluctuations; (21) geopolitical

risks, terrorist acts and other acts of war; (22) increases in

cancellations of agreements of sale; (23) loss of key management

personnel or failure to attract qualified personnel; (24)

information technology failures and data security breaches; (25)

legal claims brought against us and not resolved in our favor; and

(26) certain risks, uncertainties and other factors described in

detail in the Company’s Annual Report on Form 10-K for the fiscal

year ended October 31, 2017 and subsequent filings with the

Securities and Exchange Commission. Except as otherwise required by

applicable securities laws, we undertake no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events, changed circumstances or

any other reason.

Contact:

Jeffrey T. O’Keefe

Vice

President of Investor Relations

732-747-7800

Ethan Lyle Teneo Strategy212-886-9376

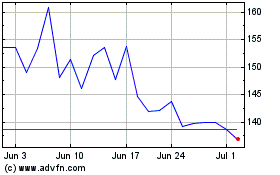

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Apr 2023 to Apr 2024