First Trust MLP & Energy Income Fund, First Trust New Opportunities MLP & Energy Fund & First Trust Energy Income & Growth Fu...

December 26 2017 - 5:00PM

Business Wire

First Trust MLP and Energy Income Fund (NYSE: FEI), First Trust

New Opportunities MLP & Energy Fund (NYSE: FPL) and First Trust

Energy Income and Growth Fund (NYSE MKT: FEN) (the “Funds”)

announced that as of December 22, 2017, their NAV’s now reflect the

estimated impact of the “Tax Cuts and Jobs Act” (the “Act”).

The change in NAV is primarily due to the Act’s reduction of the

top corporate tax rate from 35% to 21%, reducing the Funds accrual

rate for deferred federal income taxes. The change increased FEN’s

NAV by $2.016 or approximately 8.75%, and FEI’s NAV was adjusted

higher by $0.2436 or approximately 1.72%. Each fund was impacted

differently based on the composition of their deferred tax assets

and liabilities. FPL’s NAV was not adjusted as the fund did not

have any deferred tax assets or liabilities on its books at the

time of the adjustment.

FEI is a non-diversified, closed-end management investment

company which commenced investment operations in November 2012.

FEI’s investment objective is to seek a high level of total return

with an emphasis on current distributions paid to common

shareholders.

FPL is a non-diversified, closed-end management investment

company which commenced investment operations in March 2014. FPL’s

investment objective is to seek a high level of total return with

an emphasis on current distributions paid to common

shareholders.

FEN is a non-diversified, closed-end management investment

company which commenced investment operations in June 2004. FEN’s

investment objective is to seek a high level of after-tax total

return with an emphasis on current distributions paid to

shareholders.

First Trust Advisors L.P., the Funds’ investment advisor, along

with its affiliate, First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management and financial advisory services, with collective

assets under management or supervision of approximately $117.3

billion as of November 30, 2017, through unit investment trusts,

exchange-traded funds, closed-end funds, mutual funds and separate

managed accounts.

Energy Income Partners, LLC (“EIP”) serves as the Funds’

investment sub-advisor and provides advisory services to a number

of investment companies and partnerships for the purpose of

investing in MLPs and other energy infrastructure securities. EIP

is one of the early investment advisors specializing in this area.

As of November 30, 2017, EIP managed or supervised approximately

$6.0 billion in client assets.

Principal Risk Factors: The Funds are subject to risks,

including the fact that each Fund is a non-diversified closed-end

management investment company. Investment return and market value

of an investment in the Funds will fluctuate. Shares, when sold,

may be worth more or less than their original cost.

Because the Funds are concentrated in securities issued by MLPs,

MLP-related entities, and other energy and utilities companies,

they will be more susceptible to adverse economic or regulatory

occurrences affecting those industries, including high interest

costs, high leverage costs, the effects of economic slowdown,

surplus capacity, increased competition, uncertainties concerning

the availability of fuel at reasonable prices, the effects of

energy conservation policies and other factors.

The Funds invest in securities of non-U.S. issuers which are

subject to higher volatility than securities of U.S. issuers.

Because the Funds invest in non-U.S. securities, you may lose money

if the local currency of a non-U.S. market depreciates against the

U.S. dollar.

The Funds’ use of derivatives may result in losses greater than

if they had not been used, may require the Funds to sell or

purchase portfolio securities at inopportune times, may limit the

amount of appreciation the Funds can realize on an investment, or

may cause the Funds to hold a security that they might otherwise

sell.

Use of leverage can result in additional risk and cost, and can

magnify the effect of any losses.

The risks of investing in the Funds are spelled out in the

prospectus, shareholder reports and other regulatory filings.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA

and the Internal Revenue Code. First Trust has no knowledge of and

has not been provided any information regarding any investor.

Financial advisors must determine whether particular investments

are appropriate for their clients. First Trust believes the

financial advisor is a fiduciary, is capable of evaluating

investment risks independently and is responsible for exercising

independent judgment with respect to its retirement plan

clients.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press

release contains "forward- looking statements" as defined under the

U.S. federal securities laws. Generally, the words "believe,"

"expect," "intend," "estimate," "anticipate," "project," "will" and

similar expressions identify forward-looking statements, which

generally are not historical in nature. Forward-looking statements

are subject to certain risks and uncertainties that could cause

actual results to differ from the Fund’s historical experience and

its present expectations or projections indicated in any

forward-looking statements. These risks include, but are not

limited to, changes in economic and political conditions;

regulatory and legal changes; MLP industry risk; leverage risk;

valuation risk; interest rate risk; tax risk; and other risks

discussed in the Funds’ filings with the SEC. You should not place

undue reliance on forward-looking statements, which speak only as

of the date they are made. The Funds undertake no obligation to

publicly update or revise any forward-looking statements made

herein. There is no assurance that the Funds’ investment objective

will be attained.

The Funds’ daily closing New York Stock Exchange prices and net

asset values per share as well as other information, including

information relating to the Funds’ investment objectives and

policies, risk considerations and expenses, can be found at

www.ftportfolios.com or by calling 1-800-988-5891.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171226005226/en/

First Trust MLP and Energy Income Fund, First Trust New

Opportunities MLP & Energy Fund and First Trust Energy Income

and Growth FundPress Inquiries: Jane Doyle, 630-765-8775Analyst

Inquiries: Jeff Margolin, 630-915-6784Broker Inquiries: Jeff

Margolin, 630-915-6784

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From Apr 2024 to May 2024

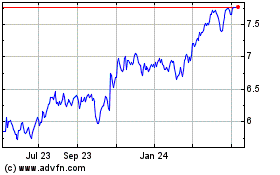

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From May 2023 to May 2024