Report of Foreign Issuer (6-k)

November 24 2017 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Report on Form 6-K for November 2017

Commission File Number 1-31615

Sasol Limited

50 Katherine Street

Sandton 2196

South Africa

(Name and address of registrant's principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F __X__ Form 40-F _____

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper

of a Form 6-K if submitted solely to provide an attached annual report to

security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper

of a Form 6-K if submitted to furnish a report or other document that the

registrant foreign private issuer must furnish and make public under the

laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant's "home country"), or under

the rules of the home country exchange on which the registrant's

securities are traded, as long as the report or other document is not a

press release, is not required to be and has not been distributed to the

registrant's security holders, and, if discussing a material event, has

already been the subject of a Form 6-K submission or other Commission

filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes _____ No __X__

If "Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

82-_______________.d

Enclosures: Sasol signs US$3,9 billion five-year Revolving Credit Facility

Sasol Limited

(Incorporated in the Republic of South Africa)

(Registration number 1979/003231/06)

Sasol Ordinary Share codes: JSE: SOL NYSE: SSL

Sasol Ordinary ISIN codes: ZAE000006896 US8038663006

Sasol BEE Ordinary Share code: JSE: SOLBE1

Sasol BEE Ordinary ISIN code: ZAE000151817

("Sasol" or the "Company")

|

Sasol signs US$3,9 billion five-year Revolving Credit Facility

Sasol, the South African chemicals and energy company, has increased its

existing US$1.5 billion Revolving Credit Facility ("the Facility")to

US$3,9 billion and extended the maturity to five years, with the inclusion

of two further extension options of one year each ("the Transaction").

Sasol launched the Transaction with a targeted facility size of US$3,0

billion, which was subsequently increased to US$3,9 billion, given the

notable oversubscription.

Sasol mandated Citi and Mizuho Bank, Ltd as Joint Global Co-ordinators for

the Transaction, which launched in early November 2017 to a targeted group

of banks. The Joint Global Co-ordinators each pre-committed to the

Transaction, and invited banks to commit at one of three ticket levels,

with the following titles: Bookrunner and Mandated Lead Arranger (BMLA),

Mandated Lead Arranger (MLA) and Lead Arranger. The Company also

accommodated a limited number of smaller tickets with the Arranger title.

Syndication closed oversubscribed with 17 banks committing, allowing Sasol

to increase the Facility and offer scale back to the Joint Global Co-

ordinators, BMLAs and the MLAs.

Along with the Joint Global Co-ordinators, there were eight other BMLAs:

ABN AMRO Bank N.V., Bank of America Merrill Lynch, BNP Paribas S.A. South

Africa Branch, Intesa SanPaolo Bank Luxembourg S.A., J.P. Morgan

Securities plc, The Bank of Tokyo-Mitsubishi UFJ, Ltd., Sumitomo Mitsui

Banking Corporation Europe Limited and UniCredit Bank Austria.

Barclays Bank PLC, Deutsche Bank and HSBC joined as MLAs, Export

Development Canada and Standard Chartered Bank joined as Lead Arrangers

and Wells Fargo Bank N.A., London Branch and Societe Generale joined as

Arrangers.

EY acted as Independent Financial Advisor to Sasol in respect of the

transaction.

23 November 2017

Sponsor

Deutsche Securities (SA) Proprietary Limited

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant, Sasol Limited, has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

Date: 23 November,2017 By: /s/ V D Kahla

Name: Vuyo Dominic Kahla

Title: Company Secretary

|

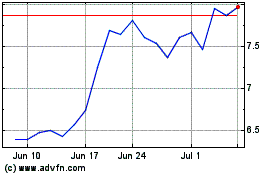

Sasol (NYSE:SSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

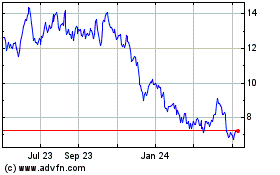

Sasol (NYSE:SSL)

Historical Stock Chart

From Apr 2023 to Apr 2024