By Matthew Dalton in Paris and Laura Stevens in San Francisco

Swatch Group executives earlier this year were planning to sell

some of the Swiss conglomerate's higher-end watches through

Amazon.com Inc.

But after months of talks, the two companies hit a wall. Swatch,

whose brands include Longines, Omega and Blancpain, demanded a

commitment that Amazon proactively police its site for counterfeits

and unauthorized retailers. Amazon refused, according to Swatch

Chief Executive Nick Hayek, putting a deal between the two on

ice.

"We add value to them," Mr. Hayek said. "But they should also

add value to the brand."

Amazon declined to comment on Swatch.

Amazon is courting companies across the retail spectrum, but one

sector is still mostly holding out: the world's club of luxury

brands. Swatch and other high-end retailers say Amazon's online

marketplace undermines the strict control they say is key to

maintaining a sense of exclusivity -- and keeping prices high.

While some makers of luxury products have decided to join Amazon,

many of the industry's biggest players -- including Swatch, Gucci

owner Kering, luxury-watch maker Cie. Financière Richemont SA and

LVMH Moët Hennessy Louis Vuitton SE -- are staying away for

now.

The absence of high-end products has hampered Amazon's push to

be a force in the fashion industry, despite years of working to

expand the merchandise it sells officially though its website.

Adding luxury goods would help Amazon boost margins and build

loyalty among customers of Amazon Prime, its premium service

favored by higher-income shoppers that offers faster delivery and

other perks, according to former executives familiar with the

company's shopper base.

Amazon has been investing heavily in the fashion industry in

recent years. It opened a large fashion photo studio in Brooklyn,

started its own private-label brands and sponsored glittering

events such as the Met Ball at the Metropolitan Museum of Art. The

company also has introduced a "luxury beauty storefront" within its

site to draw customers looking for high-end brands.

Amazon has won over some of the world's biggest lifestyle

companies by pledging action against unauthorized retailers and

knockoffs. Earlier this year, Nike Inc. agreed to make some of its

products available for sale directly from Amazon, in exchange for a

promise for limited policing. But Amazon typically only does that

for the biggest brands, people familiar with the arrangements say.

Nike sales the last fiscal year were $34 billion, nearly five times

Swatch's annual revenue.

Amazon is concerned about counterfeit goods, but it is also

reluctant to help brands stop legitimate products from being sold

outside approved distribution channels, said James Thomson, a

former senior manager in business development at Amazon and now

partner at brand consultancy Buy Box Experts. A multitude of

third-party sellers -- which often sell at discounts -- helps keep

prices low on the site with legitimate merchandise, too.

"Amazon will say to any brand, 'your distribution problem is

your distribution problem,'" Mr. Thomson said.

An Amazon spokeswoman said it works with brands and

manufacturers to improve its counterfeit detection systems. She

said the company has automated systems in place that constantly

scan for and block potential counterfeiters. "We take this fight

very seriously," she said.

Amazon does have programs to help protect brands, such as one

introduced last year requiring fees from third-party sellers and

invoices proving goods are legitimate. But many sellers were

grandfathered in under the old rules, and the programs offer brands

varying levels of protection against unauthorized merchandise.

The Amazon spokeswoman said the Amazon Brand Registry program

provides rights owners access to tools including proprietary text

and image search and more authority over product listings.

Luxury brands want more. Swatch, in its talks with Amazon,

demanded a written commitment from Amazon to deploy its "best

efforts" to fight knockoffs. Amazon's approach, former employees

and analysts say, is often reactive, depending on brands to

complain first before a listing is removed.

"Amazon doesn't want to be a policeman," says Cynthia Stine,

president of eGrowth Partners, which works with third-party Amazon

sellers to fight account suspensions and improve daily

operations.

Some of the more affordable designer brands, including Nicole

Miller and Calvin Klein, have moved to Amazon anyway. Kate Spade

had, too, before shifting course in February, according to a

spokeswoman, stopping the sale of handbags and small leather goods

though the site. Joshua Schulman, a senior executive at Coach Inc.,

which bought Kate Spade in July, has said the company wants to

focus on selling through its own e-commerce channels, rather than

Amazon.

"For the time being, we don't see [Amazon] as a true luxury

play," Mr. Schulman told analysts.

Representatives for Nicole Miller and Calvin Klein didn't

respond to requests for comment.

LVMH, which owns Louis Vuitton and Christian Dior, said it sees

little opportunity for dealing with Amazon.

"We believe the business of Amazon does not fit with LVMH, full

stop," LVMH's chief financial officer told analysts last October.

Kering, owner of Gucci and Yves Saint Laurent, says it has no

relationship with Amazon and declined to comment further.

One of the biggest worries for these luxury companies: The

difficulty of segregating their product listings from the rest of

the goods sold through the site. That means a $5,000 suit from

luxury Italian menswear company Brioni, a subsidiary of Kering, can

appear next to a $200 suit from Kenneth Cole.

"That contradicts the essence of luxury selling and shopping,

where the product is the product also because of its environment,"

says Jean Cailliau, executive adviser at Paris-based investment

bank Bryan, Garnier & Co.

Some luxury companies have struck out on their own, funding

e-commerce sites. LVMH recently launched 24sevres.com, which offers

24-hour delivery of select LVMH products in 70 countries.

Richemont, the Swiss conglomerate whose portfolio includes Cartier,

owns a 49% stake in Yoox Net-a-Porter Group, a London-based company

that specializes in online luxury retail.

Still, Amazon's massive customer base makes it difficult for the

luxury industry to ignore. It now sells more than 40 cents of every

dollar spent online in the U.S., according to market research firm

Slice Intelligence. More than half of all product searches start on

Amazon, too, according to BloomReach. No other retailer comes

close.

Write to Matthew Dalton at Matthew.Dalton@wsj.com and Laura

Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

October 08, 2017 07:14 ET (11:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

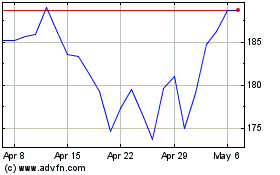

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

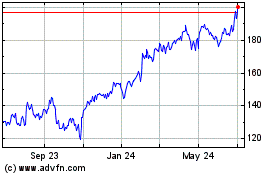

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024