UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Report on Form 6-K for September 21, 2017

Commission File Number 1-31615

Sasol Limited

50 Katherine Street

Sandton 2196

South Africa

(Name and address of registrant's principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Form 20-F __X__ Form 40-F _____

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in

paper of a Form 6-K if submitted solely to provide an attached

annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in

paper of a Form 6-K if submitted to furnish a report or other

document that the registrant foreign private issuer must furnish and

make public under the laws of the jurisdiction in which the

registrant is incorporated, domiciled or legally organized (the

registrant's "home country"), or under the rules of the home country

exchange on which the registrant's securities are traded, as long as

the report or other document is not a press release, is not required

to be and has not been distributed to the registrant's security

holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on

EDGAR.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes _____ No __X__

If "Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

82-_______________.d

Enclosures: Sasol announcement regarding broad-based black economic

empowerment

Incorporated in the Republic of South Africa)

Registration number 1979/003231/06

Sasol Ordinary Share codes: JSE: SOL NYSE: SSL

Sasol Ordinary ISIN codes: ZAE000006896 US8038663006

Sasol BEE Ordinary Share code: JSE: SOLBE1

Sasol BEE Ordinary ISIN code: ZAE000151817

("Sasol" or the "Company")

SASOL LIMITED - SASOL ANNOUNCEMENT REGARDING BROAD-BASED BLACK ECONOMIC

EMPOWERMENT

SASOL ANNOUNCEMENT REGARDING BROAD-BASED BLACK ECONOMIC EMPOWERMENT

As a company proudly rooted in our South African heritage, we

embrace broad-based black economic empowerment ("B-BBEE") as a key

enabler for economic transformation and inclusive growth. We are

committed to contributing meaningfully to sustainable

transformation and view this as both a social and business

imperative. As part of our ongoing commitment to transformation, we

are pleased to introduce Sasol Khanyisa, our proposed new B-BBEE

ownership structure.

OUR SASOL INZALO BLACK ECONOMIC EMPOWERMENT TRANSACTION NEARS THE END OF ITS

10-YEAR TERM

Sasol shareholders are reminded that the Sasol Inzalo B-BBEE

transaction ("the Sasol Inzalo Transaction"), which was created in

2008 with the objective of providing many South Africans with the

opportunity to own an equity interest in Sasol, will come to an end

in 2018. The Sasol Inzalo Transaction included the following

participants:

- the Sasol Inzalo employee trusts ("Sasol Inzalo employee

trusts");

- the Sasol Black Economic Empowerment ("BEE") ordinary ("SOLBE1")

shareholders ("Inzalo Cash Element" or "SOLBE1 shareholders");

- the Sasol Inzalo Groups funded element ("Inzalo Groups element"

or "Inzalo Groups") and the Sasol Inzalo Public funded element

("Inzalo Public Funded element" or "Inzalo Public"); and

- the Sasol Inzalo Foundation.

54 different selected entities participated in Inzalo Groups, which

included groups comprising Sasol customers, suppliers, franchisees

and non-governmental organisations. In addition, more than 200 000

members of the South African black public participated in the

Inzalo Public Funded element and Sasol Limited has more than 50 000

SOLBE1 shareholders. Approximately 23 000 Sasol employees

participated in the Sasol Inzalo employee trusts.

The Sasol Inzalo employee trusts will come to an end in 2018 and

separately the new Sasol Khanyisa Employee Share Ownership plan

("ESOP"), as described in paragraph 3.3 below, will be implemented.

Since 2008, the Sasol Inzalo employee trusts received dividends in

the amount of approximately R1,6 billion equivalent to approximately

R52 000 per participant. Based on the closing Sasol Ordinary share

price (SOL) of R389 on 4 September 2017 there will be no

distribution of SOL shares to participants in the Sasol Inzalo

employee trusts when the Sasol Inzalo Transaction ends in 2018.

SOLBE1 shareholders will, subject to the requisite Sasol

shareholder approval being obtained, be given the right to

participate in Sasol Khanyisa in accordance with the terms and

conditions described in paragraph 3.1 below.

In relation to the Inzalo Groups element and the Inzalo Public

Funded element, the acquisition through subsidiaries ("Inzalo

FundCos") of preferred ordinary shares in Sasol ("Preferred

Ordinary Shares") by Sasol Inzalo Groups (RF) Limited and Sasol

Inzalo Public (RF) Limited (together "Inzalo") was partly funded by

way of equity contributions from Inzalo shareholders, with a

large portion of the required funding being raised by the issue of

preference shares by the Inzalo FundCos to Sasol and various banks.

Sasol and its wholly-owned subsidiary, Sasol Financing (Pty) Ltd

("Sasol Financing"), provided a residual guarantee for the full

redemption and cumulative dividends of a portion of the preference

share funding taken up by various banks.

The Inzalo FundCos will be required to dispose of the Preferred

Ordinary Shares in order to be in a position to redeem the

preference share funding and cumulative dividends in 2018. Any

shortfall in the value of the Preferred Ordinary Shares held by the

Inzalo FundCos will be made good through a subscription of shares by

Sasol in the Inzalo FundCos. Based on the closing SOL share price of

R389 on 4 September 2017, there is a shortfall (backed by the

guarantee referred to above) and a funding commitment for the Sasol

Group of approximately R2,1 billion, and as a result there will be

no distribution of SOL shares to Inzalo Groups and the Inzalo Public

Funded element participants when the Sasol Inzalo Transaction ends

in 2018.

Sasol's preferred funding option, subject to shareholder approval,

is that Sasol repurchases the Preferred Ordinary Shares from the

Inzalo FundCos at the 30 day volume weighted average price ("VWAP")

of a SOL share at the relevant time utilising cash raised through an

issue of up to 43 million SOL shares through an accelerated book-

build to facilitate the issue. Sasol will only issue such number of

SOL shares which are required for the above purpose.

The Sasol Inzalo Foundation will be renamed and will continue as a

public benefit organisation, driving excellence in science,

technology, engineering and mathematics (STEM) education at all

levels of the education value chain. The Sasol Inzalo Foundation

benefitted over 20 million learners in South African public schools

by way of 118 natural science, technology and mathematics school

work books that were developed. In addition, more than 800

bursaries and fellowships have been awarded to students at 16 South

African universities, to name but a few examples.

PROPOSED IMPLEMENTATION BY SASOL OF SASOL KHANYISA, A R21 BILLION

BROAD-BASED BLACK ECONOMIC EMPOWERMENT TRANSACTION

1. OVERVIEW

Separately from the termination of the Sasol Inzalo Transaction,

the board of directors of Sasol (the "Board") intends, subject

to, inter alia, shareholder approval, to implement the Sasol

Khanyisa transaction ("Sasol Khanyisa") in fulfilment of the

ownership requirements of the Revised Codes of Good Practice

(the "Codes"), which came into effect on 1 May 2015. The Sasol

Khanyisa ownership structure is intended to achieve

approximately 20% direct black ownership in Sasol South Africa

Proprietary Limited ("SSA"), currently a wholly-owned subsidiary

of Sasol, for a period of up to ten years (the "Khanyisa

Empowerment Period") which, along with black ownership at

Sasol, translates (for measurement purposes) into at least 25%

black ownership at SSA level for the Khanyisa Empowerment

Period. Sasol Khanyisa will enable Sasol to meet its net

ownership objectives under the Codes and to achieve empowerment

on an ongoing basis thereafter due to an automatic exchange at

the end of the Khanyisa Empowerment Period of shares in Sasol

Khanyisa or SSA for SOLBE1 shares listed on the Johannesburg

Stock Exchange, as more fully described in paragraph 4 below.

2. CREATION OF A SUSTAINABLE B-BBEE STRUCTURE THROUGH SASOL KHANYISA

Sasol's contributor status in terms of the Codes is based on the

Sasol Group's performance across each of the following pillars:

equity ownership, management control, skills development,

enterprise and supplier development (which includes preferential

procurement expenditure as a sub-component) and socio-economic

development.

By implementing Sasol Khanyisa, Sasol will seek to ensure

ongoing and sustainable equity ownership of Sasol by black South

Africans. Whilst Sasol Khanyisa will have a finite period of

ownership as regards SSA, the transaction has been structured to

have a long-lasting effect on Sasol after the Khanyisa

Empowerment Period. To this end, shareholders in Inzalo

Public and Inzalo Groups ("Inzalo Shareholders"), holders of

SOLBE1 shares on the requisite record dates for participation,

and qualifying Sasol employees who are beneficiaries in the

Sasol Inzalo employee trusts ("Sasol Inzalo employee trust

participants") and who are in the employ of the Sasol Group on

18 May 2018, will have an opportunity to participate in Sasol

Khanyisa with effect from 1 June 2018 (or such other date as

Sasol may determine) ("Effective Date").

In addition to the above, Sasol employees, who are Black Persons

as defined in the B-BBEE Act ("Black Persons") and who are

employed by the Sasol Group on 18 May 2018, and new such

employees joining the Sasol Group between 19 May 2018 and the

5th anniversary of the Effective Date, will also be afforded the

opportunity to further participate in the Sasol Khanyisa ESOP.

Sasol has been primarily guided by the following design

principles in structuring Sasol Khanyisa:

2.1 achieving effective (direct and indirect) B-BBEE ownership

credentials of at least 25% for SSA and, ultimately, after

the settlement of any residual funding obligations

outstanding at that date, achieving ongoing and sustained,

unencumbered B-BBEE ownership of SOLBE1 shares;

2.2 achieving a sustainable B-BBEE transaction at an acceptable

economic cost and within market norms;

2.3 maintaining appreciable involvement of broad-based women's

groups for the duration of the Khanyisa Empowerment Period;

2.4 incentivising qualifying Inzalo participants (as defined in

paragraph 3.2 below) and eligible SOLBE1 shareholders (as

defined in paragraph 3.2 below) to participate in Sasol

Khanyisa by offering ordinary shares in Sasol Khanyisa Public

(RF) Proprietary Limited ("Sasol Khanyisa Public") for no

consideration payable by them, which will result in them

holding shares indirectly in SSA;

2.5 providing Sasol Inzalo employee trust participants and

qualifying Sasol employees the opportunity to participate in

Sasol Khanyisa by acquiring vested rights through a new

employee share ownership plan in SSA;

2.6 Sasol will be providing notional and other vendor funding for

Sasol Khanyisa; and

2.7 promoting direct, unencumbered investment in Sasol in the

form of SOLBE1 shares from the date of implementation of

Sasol Khanyisa.

3. TERMS OF SASOL KHANYISA

Sasol Khanyisa consists of three distinct elements:

3.1 SOLBE1 shareholders to elect not to re-designate their

SOLBE1 shares to Sasol ordinary shares

Current SOLBE1 shareholders will, subject to the requisite

Sasol shareholder approval being obtained, be given the

right, by way of a specific invitation to be extended by

Sasol to elect that their entire holding of SOLBE1 shares

will not re-designate to SOL shares in accordance with their

existing rights ("the Election"). This opportunity to make

the Election will be made available by Sasol to all SOLBE1

shareholders recorded on the share register at a date to be

selected by Sasol in its sole discretion (the "Election

Record Date").

SOLBE1 shareholders, pursuant to having made the Election,

will retain their existing SOLBE1 shares and will receive

from Sasol one additional SOLBE1 share, by way of a bonus

award, for every four SOLBE1 shares beneficially owned on the

Election Record Date, with fractional entitlements rounded

up where necessary ("SOLBE1 Bonus Award"). The SOLBE1 shares

held by such SOLBE1 shareholders will remain listed on the

Empowerment Segment of the Main Board of the Johannesburg

Stock Exchange ("JSE"). Application will be made to the

JSE for the listing of the shares comprising the SOLBE1

Bonus Award with effect from the Effective Date.

In order to effectively facilitate the process, Sasol will

determine an earlier date than originally envisaged,

occurring during the period from 1 April 2018 to 27 June

2018, to be the date on which the SOLBE1 shares re-designate

to SOL shares.

Those SOLBE1 shares held by SOLBE1 shareholders who do not

make the Election will re-designate to SOL shares and they

will accordingly not participate in Sasol Khanyisa.

Application will be made to the JSE to amend the listing of

the requisite number of SOLBE1 shares that have re-

designated to SOL shares with effect from the date of re-

designation.

3.2 Sasol Khanyisa Invitation to SOLBE1 shareholders and

Sasol Inzalo participants

Separately, Sasol Khanyisa Public will extend an invitation

to eligible SOLBE1 shareholders and qualifying Sasol Inzalo

participants ("Sasol Khanyisa Invitation"). Invitees will be

deemed to have accepted the invitation unless they have

indicated in writing that they do not wish to participate.

Eligible SOLBE1 shareholders are the holders of SOLBE1

shares on the Sasol Khanyisa invitation record date (the

"Sasol Khanyisa Invitation Record Date"), being the day after

the date on which the SOLBE1 shares held by those SOLBE1

shareholders who do not exercise the Election, re-designate

as SOL shares.

Qualifying Sasol Inzalo participants are all Inzalo

Shareholders who are shareholders in Inzalo Public and

Inzalo Groups at the Sasol Khanyisa Invitation Record Date.

Sasol Khanyisa Public will extend the Sasol Khanyisa

Invitation as follows:

- Eligible SOLBE1 shareholders will be issued on the

Effective Date, for no consideration payable by them:

- by Sasol Khanyisa Public, one share in Sasol Khanyisa

Public for every one SOLBE1 share beneficially owned on

the Sasol Khanyisa Invitation Record Date; and

- by Sasol, one SOLBE1 share for every ten Sasol Khanyisa

Public shares to be beneficially owned.

- Qualifying Sasol Inzalo participants will be issued on

the Effective Date, for no consideration payable by them:

- by Sasol Khanyisa Public, one share in Sasol Khanyisa

Public for every one Sasol Inzalo share beneficially

owned on the Sasol Khanyisa Invitation Record Date; and

- by Sasol, one SOLBE1 share for every ten Sasol Khanyisa

Public shares to be beneficially owned.

Application will be made to the JSE for the listing of the

SOLBE1 shares, issued in respect of the Sasol Khanyisa

Invitation, on the JSE on the Effective Date.

3.3 Sasol Khanyisa Employee Share Ownership Plan

The Sasol Khanyisa ESOP consists of two employee share

ownership plans, one for Sasol Inzalo employee trust

participants and the other for qualifying Black Sasol

employees, both of whom will become vested beneficiaries of

the Sasol Khanyisa ESOP Trust, unless they 'opt out', for no

consideration to them. The Sasol Khanyisa ESOP Trust will

subscribe for the requisite number of SOLBE1 shares, SOL

shares and SSA shares, as further described below.

3.3.1 Participation by Sasol Inzalo employee trust

participants in the Sasol Khanyisa ESOP The Sasol

Inzalo employee trust participants in the

Sasol Khanyisa ESOP comprise:

a)Black Persons who are existing Sasol Inzalo employee

trust participants and who are employed by the Sasol

Group on 18 May 2018, who will be entitled to elect

to acquire upfront vested rights, and subject to

certain conditions, will receive R100 000's worth of

SOLBE1 shares or SOL shares based on an election by

black employees; and

b) other employees, who are existing Sasol Inzalo

employee trust participants but who are not Black

Persons, and who are employed by the Sasol Group on

18 May 2018, who will acquire upfront vested rights,

subject to certain conditions, will receive R100

000's worth of SOL shares.

The number of shares or SOLBE1 shares to which each

such Sasol Inzalo employee trust participant will

acquire vested rights will depend on the 30 day

VWAP of the shares or the SOLBE1 shares, as the

case may be.

Application will be made to the JSE for the listing of

the requisite number of SOLBE1 and SOL shares with

effect from the Effective Date. Sasol Khanyisa ESOP

beneficiaries, who remain employed for the periods

specified in the Sasol Khanyisa ESOP Trust deed, will

obtain ownership of the SOLBE1 or SOL shares to which

they acquired vested rights.

3.3.2 Participation by qualifying Black Sasol employees

in the Sasol Khanyisa ESOP

In addition to participation by Sasol Inzalo employee

trust participants as set out in paragraph 3.3.1, Sasol

employees who are Black Persons and who are employed by

the Sasol Group on 18 May 2018, and such employees

joining the Sasol Group between 19 May 2018 and the 5th

anniversary of the Effective Date ("Qualifying Sasol

Employees"), will acquire vested rights to SSA shares.

They will become owners of the shares in which they have

vested rights if, subject to various exceptions, they

remain employed for the required period.

A maximum of 28 385 647 SSA shares will be made

available to the Sasol Khanyisa ESOP, with Qualifying

Sasol Employees in the employ of the Sasol Group on 18

May 2018, each obtaining an equal number of vested

rights to SSA shares.

The Sasol Khanyisa ESOP Trust will receive a trickle

dividend from SSA, as determined in accordance with a

formula set out in the Sasol Khanyisa ESOP Trust deed,

(less any withholding tax) in respect of the SSA shares

in which the participants have vested rights.

Qualifying Sasol Employees, subject to some exceptions,

who remain employed for the required period, will obtain

ownership of the SSA shares in which the participant has

vested rights. Beneficiaries of the Sasol Khanyisa ESOP

Trust will participate indirectly in any resolution of

the shareholders of SSA or Sasol (as the case may be)

that the trustees are entitled to vote on.

4.AUTOMATIC EXCHANGE OF SASOL KHANYISA PUBLIC SHARES FOR SOLBE1

SHARES

At the end of the Khanyisa Empowerment Period, holders of Sasol

Khanyisa shares and participants in the Sasol Khanyisa ESOP will

ultimately receive SOLBE1 shares for their Sasol Khanyisa shares

and vested rights to SSA shares. This will occur via a share

exchange (the "Share Exchange") on the basis of a ratio that

will be determined by an independent expert taking into account

the relative value of Sasol and SSA at that time. Participants

who receive SOLBE1 shares following the Share Exchange will then

be free to trade their SOLBE1 shares on the Empowerment Segment

of the JSE as they deem fit.

5. FINANCING OF SASOL KHANYISA

5.1 Sasol Khanyisa Public

Sasol Khanyisa Public will establish Khanyisa Fundco as its

wholly-owned subsidiary, which will:

- issue preference shares ("Khanyisa Fundco Preference

Shares") to Sasol for a subscription consideration of up

to a maximum of R10 billion;

- use the entire proceeds of such issue to subscribe for up

to a maximum of 28 385 647 SSA shares, resulting in

Khanyisa Fundco directly, and Sasol Khanyisa Public

indirectly, owning up to a maximum of 10,75% of the total

issued share capital of SSA; and

- receive distributions on its SSA shares in accordance with

SSA's dividend policy, when such distributions are made.

The Khanyisa Fundco Preference Shares will be redeemed at the

end of the Khanyisa Empowerment Period. Dividends on the

Khanyisa Fundco Preference Shares are calculated daily and

are compounded monthly on the subscription price of each

Khanyisa Fundco Preference Share at a rate equal to 75% of

the prime rate (as defined in the funding agreements relating

to Khanyisa Fundco). Dividends in respect of the Khanyisa

Fundco Preference Shares will be required to be paid to

Sasol on 1 April and 1 October of each year.

For so long as the Khanyisa Fundco Preference Shares have

not been redeemed, unless Sasol agrees to a higher

percentage, a maximum of 2,5% of the dividend which Khanyisa

Fundco receives from SSA will be declared to Sasol Khanyisa

Public, as its sole ordinary shareholder. These dividends may

be distributed to the shareholders of Sasol Khanyisa Public

(after the deduction of dividend withholding tax). Khanyisa

Fundco will not be entitled to declare any further dividend

to Sasol Khanyisa Public for so long as the Khanyisa Fundco

Preference Shares have not been redeemed.

5.2 Sasol Khanyisa ESOP

The SSA shares to be issued to the Sasol Khanyisa ESOP Trust

will be the subject of notional vendor funding by SSA. For

so long as the notional vendor funding is in existence, 2.5%

(which could be adjusted upwards in accordance with an

objective formula) of the dividend declared by SSA to its

ordinary shareholders (other than the Sasol Khanyisa ESOP

Trust) will be declared on the SSA shares held by the Sasol

Khanyisa ESOP Trust.

SSA has the right to repurchase a number of SSA shares from

the Sasol Khanyisa ESOP Trust on the basis of a

predetermined formula at the issue price thereof.

6. FAIRNESS OPINION

The Sasol Board has appointed Deloitte & Touche as an independent

expert to provide a voluntary fairness opinion to assist Sasol

shareholders in determining the fairness of Sasol Khanyisa to

Sasol shareholders. The opinion of Deloitte & Touche will be

included in the circular to shareholders referred to in

paragraph 10 below ("Circular").

7. PRO FORMA FINANCIAL EFFECTS

The table below sets out the pro forma financial effects of the

Sasol Inzalo Transaction and Sasol Khanyisa (the "Transactions")

on, inter alia, Sasol's basic earnings per share, headline

earnings per share, weighted average number of shares in issue,

diluted earnings per share, diluted headline earning per share,

weighted average number of diluted shares in issue, net asset

value per share and net tangible asset value per share, based on

the most recently published audited consolidated financial

results of the Sasol Group for the financial year ended 30 June

2017.

The pro forma financial effects assume that the Transactions had

been fully implemented on 1 July 2016 for purposes of presenting

the pro forma financial effects thereof on the pro forma

consolidated income statement, and 30 June 2017 for purposes of

the pro forma consolidated statement of financial position and

the pro forma consolidated statement of changes in equity.

The pro forma financial effects are presented in a manner

consistent in all respects with International Financial

Reporting Standards ("IFRS") and Sasol Group's accounting

policies. The pro forma financial effects are presented in

accordance with the JSE Listings Requirements and the Guide on

Pro Forma Financial Information issued by the South African

Institute of Chartered Accountants.

The pro forma financial information is the responsibility of the

Directors and was prepared for illustrative purposes only and

may not, because of its nature, fairly present Sasol Group's

financial position, changes in equity and results of its

operations or cash flows, nor the effect and impact of the

Proposed Transactions going forward. It does not purport to be

indicative of what the financial results would have been, had

the Transactions been implemented on a different date.

Per share Before(1) Pro forma %

information after the change

(3)**** transaction

(2)

Basic earnings

pershare Rand 33.36 26.88 -19%

|

Headline

earnings per

share Rand 35.15 28.57 -19%

Weighted

average number

of shares in

issue(4) Million 610.7 644.9 6%

Diluted

earnings per

share(5) Rand 33.27 26.74 -20%

Diluted

headline

earnings

per share(5) Rand 35.05 28.43 -19%

Weighted

average

number of

diluted

shares(4)(5) Million 612.4 648.2 6%

Net asset

value per

share* Rand 348.27 349.47 0%

Net tangible

asset

value per

share** Rand 339.31 340.96 0%

Gearing

ratio*** % 26.7% 20.0% 6.7%

|

* Net asset value per share is defined as SOL Shareholder's

equity per issued share, excluding treasury shares.

** Net tangible assets are defined as Shareholders' equity less

Goodwill & intangible assets and Deferred tax assets.

*** The gearing ratio is calculated as net borrowings (total

borrowings less cash) divided by Shareholders' equity.

**** The Sasol Khanyisa Transaction has an indicative total IFRS2

cost of R7,3 billion included in the pro forma financial effects.

Notes and assumptions:

1. The "Before" column is based on the published audited

consolidated financial statements of the Sasol Group for the

year ended 30 June 2017.

2. The "Pro forma after the Transactions" column has been

calculated on the basis that all of the steps to execute the

Sasol Inzalo transaction termination and to implement Sasol

Khanyisa have been completed; and is based on the following

assumptions for each of the three distinct elements of the

Sasol Khanyisa Transaction:

i.The Election pursuant to which the SOLBE1 Bonus Award will be

made:

This has been assumed to occur on the basis that 15% of

the SOLBE1 shareholders will elect that his/her SOLBE1 shares

do not automatically re-designate to SOL shares. Any re-

designation from SOLBE1 to SOL shares is inconsequential for

the purposes of the per share information contained in the

pro forma financial effects, as the SOL shares and SOLBE1

shares are treated as issued shares;

ii.Sasol Khanyisa Invitation:

It has been assumed that 100% of

Qualifying Sasol Inzalo participants and eligible SOLBE1

shareholders do not reject the Sasol Khanyisa Invitation;and

iii.Sasol Khanyisa ESOP:

- For the benefit of the Sasol Inzalo employee trust

participants: It has been assumed that no such employee

notifies the trustees that he/she does not wish to become a

vested beneficiary, and that 15% of the Black Persons who

are Sasol Inzalo employee trust participants will not elect

to acquire vested rights in SOL shares instead of acquiring

vested rights in SOLBE1 shares; and

- For the benefit of the Qualifying Sasol Employees: It has

been assumed that no such employees reject participation in

the Sasol Khanyisa ESOP.

The Directors have considered a number of scenarios and, based on

comparative precedent from a recent similar transaction, consider

that the most likely outcome (as summarised above) is that 15% of

the SOLBE1 shareholders will make the Election and that 15% of

Black Persons who are Sasol Inzalo employee trust participants

will not elect to acquire vested rights in SOL shares instead of

acquiring vested rights in SOLBE1 shares. In note 5 below, a

scenario has been presented to illustrate the financial effects

should:

- 100% of the SOLBE1 shareholders make the Election;and

- 100% of the Black Persons who are Sasol Inzalo employee trust

participants will not elect to acquire vested rights in SOL

shares and instead acquire vested rights in SOLBE1 shares.

3.The effects on basic earnings, diluted earnings, headline

earnings, and diluted headline earnings per share are calculated

on the basis that the proposed Transactions were effective on 1

July 2016, while the effects on net asset value and net tangible

asset value per share are calculated on the basis that the

proposed Transactions were effective on 30 June 2017 for purposes

of presenting the pro forma financial effects thereof on the

Sasol Group.

4.The increase in the weighted average number of issued shares is

congruent with:

i. the assumed specific issue of sufficient SOL shares in terms of

the accelerated book-build to fund the A, B and C preference

share funding, the Inzalo shortfall, as well as any related

costs and taxes (31,25 million shares)1;

ii. the 2,92 million SOLBE1 Shares will be included in the weighted

average number of shares in relation to the SOLBE1 Bonus Award

and the Khanyisa Invitation as it relates to eligible SOLBE1

shareholders and eligible Inzalo shares.

1 For purposes of the pro forma financial effects, the assumed

specific issue of SOL shares has been calculated based on the

number of SOL shares to be issued as at the Last Practicable

Price, in order to settle the outstanding balance on the A, B

and C preference shares outstanding as at 30 June 2017, plus

related costs and taxes that would ensue upon the issue.

However, the final number of SOL shares required to be issued

at the Inzalo Transaction Termination dates will depend on the

SOL share price at the Inzalo Transaction Termination dates,

dividends declared and paid between 30 June 2017 and the Inzalo

Transaction Termination dates as well as dividends which

accrues on the A, B and C preference shares between 30 June

2017 and the Inzalo Transaction Termination dates. This cannot

be reliably estimated as at the Last Practicable Date and

consequently, this could result in additional SOL shares

being issued to cover the additional funding costs and taxes

not yet accrued at 30 June 2017.

5.The increase in the weighted average number of diluted shares

includes the impact of the SOL/SOLBE1 shares to be issued, as

calculated in terms of IAS 33: Earnings per share, in terms of

the Sasol Khanyisa ESOP for the benefit of the Sasol Inzalo

employee trust participants.

As described in note 2 above, a scenario has been presented below

to illustrate the financial effects pertaining to the following:

- 100% of the SOLBE1 shareholders make the Election; and

- 100% of the Black Persons who are Sasol Inzalo employee trust

participants elect not to acquire vested rights in SOL shares

and instead acquire vested rights in SOLBE1 shares.

However, the pro forma financial effects do not consider the

impact of the shares to be issued pursuant to the Automatic Share

Exchange as this cannot currently be reliably estimated. This

increase in the weighted average number of diluted shares is

dependent on the SOLBE1 share price, and its relative net fair

value to a SSA share, which considers the underlying funding

(FundCo preference share funding and ESOP notional vendor

funding), at the date of the termination of the Sasol Khanyisa

Transaction. At each reporting date, the diluted earnings per

share impact will be determined by calculating the number of

SOLBE1 shares which would be issued for no consideration. This

will be based on the difference between the average SOLBE1 share

price for the reporting period, and the unexpensed share-based

payment charge at the reporting date.

The following table provides the illustrative financial effects

of the potential issues of SOLBE1 shares, on basic earnings per

share, headline earnings per share, weighted average number of

shares in issue, diluted earnings per share, diluted headline

earning per share, weighted average number of diluted shares in

issue, net asset value per share and net tangible asset value per

share, should the assumptions applied above be increased to 100%.

Per share

information(5) 15% 100% % Change

Basic earnings per

share Rand 26.88 27.6 3%

Headline earnings

per share Rand 28.57 29.29 3%

Weighted average

number of shares in

issue Million 644.9 645.8 0%

Diluted earnings

per share Rand 26.74 27.46 3%

Diluted headline

earnings per share Rand 28.43 29.14 2%

Weighted average

number of diluted

shares Million 648.2 649.3 0%

Net asset value per

share Rand 349.47 349.47 0%

Net tangible asset

value per share Rand 340.96 340.96 0%

Gearing ratio % 20% 20% 0%

|

* Net asset value per share is defined as Shareholder's equity per

issued SOL share, excluding treasury shares.

** Net tangible assets are defined as Shareholders' equity less

Goodwill & intangible assets and Deferred tax assets.

*** The gearing ratio is calculated as net borrowings (total

borrowings less cash) divided by Shareholders' equity.

8.IMPORTANT DATES AND TIMES

Circular distribution record date, being in terms of section

59(1)(b) of the Companies Act, the date by which a Sasol

shareholder is required to be recorded as such in the relevant

Register in order to be eligible to receive this Circular and

Notice of General Meeting Friday, 13 October 2017

Circular and Notice of General Meeting distributed to Sasol

shareholders on Wednesday, 18 October 2017

Details of the date, time and venue for the General Meeting on

SENS Wednesday, 18 October 2017

General Meeting announced in two national newspapers

Thursday, 19 October 2017

General Meeting Last Day to Trade in order for Sasol

shareholders to be recorded in the relevant Register in order

to be eligible to attend, participate in and vote at the General

Meeting Tuesday, 7 November 2017

General Meeting Record Date in order for Sasol shareholders to

be recorded in the relevant Register in order to be eligible to

participate in and vote at the General Meeting

Friday, 10 November 2017

Last day to lodge requests for participation in the General

Meeting via electronic participation being 9:00 on

Friday, 10 November 2017

For administrative purposes, date by which Forms of Proxy for the

General Meeting are requested to be lodged, by 10:00Thursday,

16 November 2017

Forms of Proxy may be handed in before or during the General

Meeting, up to the time that the relevant resolution on which the

proxy is to vote, is considered Friday, 17 November 2017

General Meeting to be held at the Hilton Sandton Hotel, 138

Rivonia Road, Sandton, 2196, at 10:00 on Friday, 17 November 2017

Results of the General Meeting released on SENS on Friday,

17 November 2017

Results of the General Meeting published in national newspapers

Monday, 20 November 2017

9. GENERAL MEETING

A general meeting of Sasol shareholders ("General Meeting") will be

held immediately after the conclusion, adjournment or postponement

of the Annual General Meeting convened to take place at the Hilton

Sandton Hotel, 138 Rivonia Road, Sandton, 2196, South Africa on

Friday, 17 November 2017 at 09:00, for the purpose of considering,

and if deemed fit, passing, with or without modification, the

resolutions required from Sasol shareholders.

10. FURTHER DOCUMENTATION

A Circular setting out the full terms of Sasol Khanyisa and

convening the General Meeting will be posted to Sasol shareholders

on or about 18 October 2017.

A complete version of this announcement, incorporating illustrations

demonstrating the various elements of Sasol Khanyisa, is available

on Sasol's website at www.sasol.com.

Sandton

20 September 2017

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant, Sasol Limited, has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 21, 2017 By: /s/ V D Kahla

Name: Vuyo Dominic Kahla

Title: Company Secretary

|

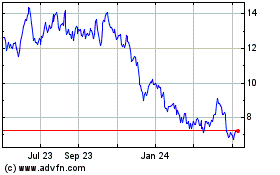

Sasol (NYSE:SSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

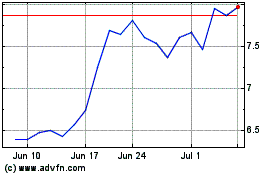

Sasol (NYSE:SSL)

Historical Stock Chart

From Apr 2023 to Apr 2024