Amended Statement of Beneficial Ownership (sc 13d/a)

August 18 2017 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

TENET HEALTHCARE CORPORATION

(Name of Issuer)

Common Stock, $0.05 par value per share

(Title of Class of Securities)

88033G407

(CUSIP Number)

Mark Horowitz

Co-President

Glenview Capital Management

767 Fifth Avenue, 44th Floor

New York, NY 10153

(212) 812-4700

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

August 17, 2017

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

§§

240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [ ]

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

GLENVIEW CAPITAL MANAGEMENT, LLC

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

AF

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Delaware

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

17,942,624 (1)

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

17,942,624 (1)

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

17,942,624 (1)

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

17.79% (2)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

(1) Includes 52,394 Shares (as defined herein) payable to Glenview Capital Management, LLC upon settlement of Restricted Stock Units (as defined herein).

(2)

Based on a total of 100,872,933 Shares outstanding, which is the sum of (i) the 100,820,539

Shares reported as outstanding

as of July 31, 2017 in the Company’s Form 10-Q, filed August 7, 2017, and (ii

) the

52,394

Shares issuable by the Company upon settlement of the Restricted Stock Units which have been added to the Shares reported as outstanding in accordance with Rule 13d-3(d)(1)(i) under the Act.

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

LARRY ROBBINS

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

AF

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Delaware

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

17,942,624 (1)

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

17,942,624 (1)

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

17,942,624 (1)

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

17.79% (2)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

IN, HC

|

|

|

|

|

|

(1) Includes 52,394 Shares (as defined herein) payable to Glenview Capital Management, LLC upon settlement of Restricted Stock Units (as defined herein).

(2)

Based on a total of 100,872,933 Shares outstanding, which is the sum of (i) the 100,820,539

Shares reported as outstanding

as of July 31, 2017 in the Company’s Form 10-Q, filed August 7, 2017, and (ii

) the

52,394

Shares issuable by the Company upon settlement of the Restricted Stock Units which have been added to the Shares reported as outstanding in accordance with Rule 13d-3(d)(1)(i) under the Act.

|

Item 1.

|

Security and Issuer

|

This Amendment No. 2 to Schedule 13D (“Amendment No. 2) amends and supplements the information set forth in the Schedule 13D filed by the Reporting Persons with the U.S. Securities and Exchange Commission (the “SEC”) on January 19, 2016 (the “Original Schedule 13D”), as amended by Amendment No. 1 filed on February 1, 2016 (collectively the “Schedule 13D”) relating

to

the Common Stock, par value $0.05 per share (the “Shares”), of Tenet Healthcare Corporation, (the “Issuer” or the “Company”), whose principal executive offices are located at 1445 Ross Avenue, Suite 1400, Dallas, Texas 75202.

All capitalized terms contained herein but not otherwise defined shall have the meanings ascribed to such terms in the Schedule 13D. Except as specifically provided herein, this Amendment No. 2 does not modify any of the information previously reported in the Schedule 13D.

|

Item 4.

|

Purpose of Transaction

|

Item 4 of the Schedule 13D is hereby amended and restated in its entirety as follows:

The Reporting Persons acquired the Shares for investment purposes, and such purchases have been made in the Reporting Persons’ ordinary course of business. On January 18, 2016, Glenview Capital Management and the Glenview Funds (collectively, the “Glenview Parties”) entered into a Support Agreement with the Company, pursuant to which, among other things, the Company agreed to increase the size of its Board by two directors and appoint two senior employees of Glenview Capital Management, Matthew Ripperger (“Mr. Ripperger”) and Randy Simpson (“Mr. Simpson” and, together with Mr. Ripperger, the “Glenview Designees”), to fill the newly-created vacancies, effective as of the date of Support Agreement. The Support Agreement was previously summarized in, and filed as an exhibit to, this Statement.

Resignations of Glenview Designees

The Glenview Designees have resigned from the Company’s Board of Directors, effective as of August 17, 2017, due to irreconcilable differences regarding significant matters impacting the Company and its stakeholders. A copy of the resignation letter is attached hereto as Exhibit F. Pursuant to the Support Agreement, the Standstill Period (as defined in the Support Agreement) expires 15 days after the date that Mr. Ripperger and Mr. Simpson cease to serve as directors. After the expiration of the Standstill Period, the Reporting Persons may engage in communications with shareholders of the Company and other relevant parties regarding the Company in an effort to further explore ways to strengthen the Company and enhance shareholder value. Subsequently, the Reporting Persons may determine to take any or all customary steps to pursue opportunities, which could include consideration of the following:

|

|

i)

|

alternatives for strengthening patient satisfaction and operating efficiency at the Company;

|

|

|

ii)

|

alternatives to strengthen the Company’s financial performance and position;

|

|

|

iii)

|

alternatives for strengthening leadership and governance at the Company; and/or

|

|

|

iv)

|

strategic alternatives for one or more of the Company’s assets, divisions or the Company as a whole.

|

Additionally, the Reporting Persons may take other action, either alone or in coordination with other shareholders of the Company or other parties. The Reporting Persons may acquire additional shares of the Company or may sell some or all of the shares of the Company currently beneficially owned by the Reporting Persons. Except as described above, the Reporting Persons have no plans or proposals that relate to or would

result

in any of the matters referred to in paragraphs (a) through (j), inclusive, of Item 4 of Schedule 13D.

|

Item 5.

|

Interest in Securities of the Issuer

|

Item 5 of the Schedule 13D is hereby amended and supplemented as follows:

(a, b) Each of Glenview Capital Management and Mr. Robbins may be deemed to share voting and dispositive power over 17,942,624 Shares, which equates to approximately 17.79% of the total number of Shares outstanding. The beneficial ownership percentage is based on a total of 100,872,933 Shares outstanding, which is the sum of (i) the 100,820,539 Shares reported as outstanding as of July 31, 2017 in the Company’s Form 10-Q, filed August 7, 2017, and (ii) the

52,394

Shares issuable by the Company upon settlement of the Restricted Stock Units

which have been added to the Shares reported as outstanding in accordance with Rule 13d-3(d)(1)(i) under the Act.

(c)

Except as otherwise disclosed herein, no transactions in the Shares have been effected by the Reporting Persons within the past 60 days.

(d) Certain funds listed in Item 2 are known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Shares covered by this Statement that may be deemed to be beneficially owned by the Reporting Persons.

(e) This Item 5(e) is not applicable.

|

Item 7.

|

Material to be Filed as Exhibits.

|

|

|

Exhibit F:

|

Form of Resignation Letter dated August 17, 2017.

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

GLENVIEW CAPITAL MANAGEMENT, LLC

|

|

|

|

|

|

|

|

|

By:

|

/s/ Mark J. Horowitz

|

|

|

|

|

Mark J. Horowitz

|

|

|

|

|

Co-President of Glenview Capital Management, LLC

|

|

|

|

|

|

|

|

|

LARRY ROBBINS

|

|

|

|

|

|

|

|

|

By:

|

/s/ Mark J. Horowitz

|

|

|

|

|

Mark J. Horowitz, attorney-in-fact for Larry Robbins

|

|

|

|

|

|

|

|

|

|

|

|

August 18, 2017

EXHIBIT F

August 17, 2017

Tenet Healthcare Corporation

1445 Ross Avenue, Suite 1400

Dallas, TX 75202

Attention: Board of Directors

Dear Board Members:

We are writing to confirm our resignation from the Board of Directors of Tenet Healthcare Corporation, effective immediately, due to irreconcilable differences regarding significant matters impacting Tenet and its stakeholders. Prior to joining the Board, and in an even deeper manner today, we developed great respect for the core mission of Tenet in improving health outcomes and for so many of the 130,000 employees of Tenet who are directly engaged daily serving patients and communities in need.

We joined the Board nineteen months ago as nominees of our employer, Glenview Capital Management, in the interests of serving all of Tenet’s stakeholders and with a view towards building value for all shareholders. Both we as individuals, and Glenview as an owner, have determined that the most effective way forward to promote strong patient satisfaction and long-term value creation for Tenet is to step off this Board, which also triggers the expiration of Glenview’s restrictive “standstill” agreement in 15 days, after which Glenview may evaluate other avenues to be a constructive owner of Tenet. Glenview remains fully committed to its ownership stake in Tenet and its desire to drive improved performance, culture and value.

On a personal note, we both hope that you as individuals have come to respect and appreciate our methodical approach and our genuine desire to work constructively and cooperatively to find mutually agreeable solutions and strategies to enhance Tenet. While our resignation does confirm that this path has been fully exhausted as co-Directors, we all share a continued responsibility to move Tenet forward with urgency and veracity.

Respectfully yours,

|

Randy Simpson

|

Matt Ripperger

|

|

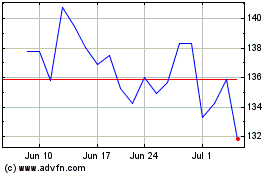

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Mar 2024 to Apr 2024

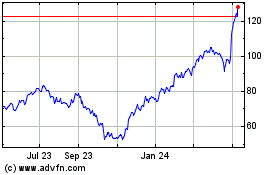

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Apr 2023 to Apr 2024