Warren Buffett's Berkshire Hathaway Exits General Electric, Buys Into Synchrony Financial

August 14 2017 - 6:51PM

Dow Jones News

By Maria Armental

Warren Buffett's Berkshire Hathaway Inc. sold its shares in

General Electric Co. and opened a big investment in Synchrony

Financial, the largest U.S. store credit-card issuer, in the most

recent period.

The firm sold its roughly 10.6 million shares in General

Electric in the second quarter. The conglomerate, now under new

leadership, had vastly underperformed the stock market and faced

pressure from activist investor Trian Fund Management LP.

Berkshire also trimmed stakes in American Airlines Group Inc.,

Delta Air Lines Inc. and United Continental Holdings Inc. while

leaving Southwest Airlines Co. unchanged. Mr. Buffett, who had long

criticized airlines as a money-loser for investors after suffering

losses in a USAir stake purchased in the 1980s, bought stock in the

four airlines in 2016.

The holdings were disclosed Friday in a 13F filing with the

Securities and Exchange Commission, a quarterly requirement for

investors managing more than $100 million. The report indicates the

number of shares held and the value of each stake at the end of the

quarter.

In addition to a roughly 17 million share stake in GE spinoff

Synchrony Financial, an investment valued at nearly $521 million at

the end of the quarter, Mr. Buffett also bought 18.6 million shares

in real-estate investment trust Store Capital Corp.

The securities filing also showed that Mr. Buffett trimmed his

stakes in International Business Machines Corp. and Wells Fargo

& Co., moves that had also been previously disclosed.

The Omaha, Neb., investor had started lowering his IBM exposure

in the previous quarter and selling Wells Fargo shares to remain

under a 10% ownership threshold.

Berkshire, which for years avoided technology stocks, first

bought IBM stock in 2011, spending more than $10 billion for 5.4%

of the company. The 106-year-old tech company has been trying to

reinvent itself under Chief Executive Virginia "Ginni" Rometty, as

sales and profit have declined for three years straight.

Meanwhile, Mr. Buffett continued to build his position in Apple.

As of June 30, he held 130.2 million shares in the iPhone maker, an

investment valued at $18.75 billion at quarter's end.

Mr. Buffett's firm -- set to become Bank of America Corp.'s

largest shareholder when it exercises its right to buy 700 million

shares -- added 17.2 million shares to its Bank of New York Mellon

Corp. holdings while maintaining positions in U.S. Bancorp and

Goldman Sachs Group Inc.

In other notable moves, Mr. Buffett's firm sharply cut its stake

in Wabco Holdings Inc., which last month disclosed takeover talks

with German car parts maker ZF Friedrichshafen AG.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 14, 2017 18:36 ET (22:36 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

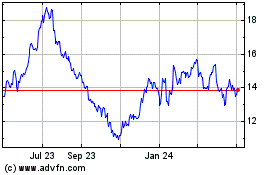

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

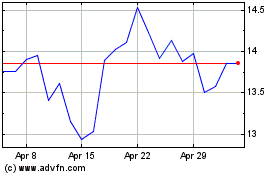

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024