As filed with the Securities and Exchange Commission on August 14, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

General Mills, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

41-0274440

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

Number One General Mills Boulevard

Minneapolis, Minnesota 55426

(763) 764-7600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Richard C. Allendorf, Esq.

Senior Vice President and General Counsel

General Mills, Inc.

Number

One General Mills Boulevard

Minneapolis, Minnesota 55426

(763) 764-7600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Chris A.

Rauschl

Senior Corporate & Securities Counsel, Assistant Secretary

General Mills, Inc.

Number

One General Mills Boulevard

Minneapolis, MN 55426

(763)

764-7600

Approximate

date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the

only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D.

filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule

12b-2

of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☒

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check box if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

|

Amount

to be

registered

|

|

Proposed

maximum

offering price

per unit

|

|

Proposed

maximum

aggregate

offering price

|

|

Amount of

registration fee

|

|

Common Stock, par value $0.10 per share

|

|

1,750,000(1)

|

|

$55.755(2)

|

|

$97,571,250(2)

|

|

$11,308.51(3)

|

|

|

|

|

|

(1)

|

This number represents the maximum number of shares of common stock that can be offered under the Direct Purchase Plan. In addition to the shares set forth in the table, pursuant to Rule 416 under the Securities Act of

1933, as amended, the amount to be registered includes an indeterminate number of shares of common stock issuable upon stock splits, stock dividends and similar events.

|

|

(2)

|

Estimated solely for purposes of determining the filing fee. This amount was calculated in accordance with Rule 457(c) under the Securities Act of 1933, as amended, and based on the average high and low sale prices

of the registrant’s common stock as reported on the New York Stock Exchange on August 9, 2017.

|

|

(3)

|

We previously paid an aggregate registration fee of $10,513.18 in connection with the Registration Statement on

Form S-3

(Registration Statement

No. 333-198079)

filed on August 12, 2014 (the “Form

S-3”)

relating to the registration of 1,600,000 shares of Common Stock, 580,000 of which were never

sold or issued. Pursuant to Rule 457(p), the $11,308.51 registration fee associated with this filing is being partially offset by the $3,811.02 in fees that remain available under the Form

S-3.

|

PROSPECTUS

GENERAL MILLS, INC.

DIRECT PURCHASE PLAN

The Direct Purchase

Plan (the “Plan”) of General Mills, Inc. (“General Mills”) provides participants with a convenient and economical method of purchasing shares of General Mills’ common stock, par value $0.10 per share (“Common

Stock”), and reinvesting cash dividends paid on Common Stock in additional shares of Common Stock.

Participation in the Plan is open to any

registered holder of Common Stock and to any person who becomes a registered holder of Common Stock by enrolling in the Plan, paying a

one-time

account

set-up

fee of $15

and either making an initial investment of at least $250 or authorizing at least five automatic cash investments of at least $50. Beneficial owners of Common Stock whose only shares are registered in names other than their own (e.g., held in street

name in a brokerage account) are not eligible to participate in the Plan until they become stockholders of record either by withdrawing the shares from their brokerage account and registering the shares in their own name or by enrolling in the Plan

in the same manner as a

non-stockholder.

Participants in the Plan may elect to have the cash dividends paid on

all or a percentage of their shares of Common Stock automatically reinvested in additional shares of Common Stock. Holders of Common Stock who choose not to participate in the Plan’s dividend reinvestment feature will continue to receive cash

dividends on shares of Common Stock registered in their name, as declared, by check or direct deposit. Participants may also purchase additional shares of Common Stock by making optional cash investments in accordance with the provisions of the

Plan.

Shares of Common Stock purchased by participants in the Plan may be treasury or new issue Common Stock or, at General Mills’ option, Common

Stock purchased in the open market or in negotiated transactions. Treasury or new issue Common Stock is purchased from General Mills at the market price on the applicable investment date. The price of Common Stock purchased in the open market or in

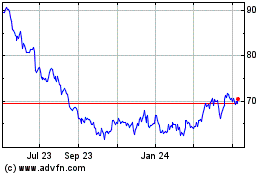

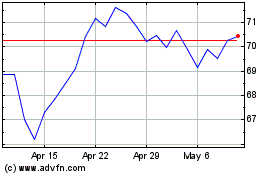

negotiated transactions is the weighted average price at which the shares are actually purchased. This prospectus relates to 1,750,000 shares of Common Stock. The Common Stock is listed on the New York Stock Exchange under the ticker symbol GIS, and

its closing price as of August 11, 2017 was $56.59 per share.

A complete description of the Plan begins on page 4 of this prospectus.

Shares of Common Stock offered under the Plan to persons who are not currently stockholders of General Mills are offered through a registered broker. The Plan

Administrator will furnish the name of the registered broker utilized in share transactions within a reasonable time upon written request from the participant.

Investing in our Common Stock involves risks. See “

Risk Factors

” beginning on page 1 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

August 14, 2017.

TABLE OF CONTENTS

i

General Mills, Inc. Direct Purchase Plan

ABOUT THIS PROSPECTUS

You should rely only on the information contained or incorporated by reference in this prospectus. Neither we nor the Plan Administrator have authorized

anyone else to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. This prospectus does not constitute an offer to sell, or a solicitation of an offer to

buy, any of the securities offered in this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation. Neither the delivery of this prospectus nor any sale made under this prospectus

of the securities described herein shall under any circumstances imply, and you should not assume, that the information contained in this prospectus or any document incorporated by reference is accurate as of any date other than the date on the

front cover of the applicable document, regardless of the time of delivery of this prospectus or of any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since those dates.

Except as otherwise indicated or required by the context, all references in this prospectus to “General Mills,” the “Company,”

“we,” “us” and “our” are to General Mills, Inc. and not to its subsidiaries.

All references in this prospectus to

“$” and “dollars” are to United States dollars.

ii

General Mills, Inc. Direct Purchase Plan

ABOUT GENERAL MILLS

General Mills, Inc. is a leading global manufacturer and marketer of branded consumer foods sold through retail stores. We are also a leading supplier of

branded and unbranded food products to the North American foodservice and commercial baking industries. As of May 28, 2017, we manufactured our products in 13 countries and marketed them in more than 100 countries. In addition to our

consolidated operations, we have 50 percent interests in two strategic joint ventures that manufacture and market food products sold in more than 130 countries worldwide.

We were incorporated under the laws of the State of Delaware in 1928. As of May 28, 2017, we employed approximately 38,000 persons worldwide. Our

principal executive offices are located at Number One General Mills Boulevard, Minneapolis, Minnesota 55426; our telephone number is (763)

764-7600.

General Mills provides a more detailed description of our business and important factors that could affect our financial performance in our annual report on

Form

10-K

and other reports filed with the Securities and Exchange Commission (“SEC”) and incorporated by reference herein. A copy of General Mills’ most recent annual report on Form

10-K

can be obtained without charge. See “Where You May Find More Information About General Mills.”

RISK FACTORS

An investment in the Common Stock involves risks. Before deciding whether to purchase any shares of Common Stock, you should consider the risks discussed

below or elsewhere in this prospectus, including those set forth under the heading “Cautionary Statement Regarding Forward-Looking Statements,” and in our filings with the SEC that we have incorporated by reference in this prospectus.

Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also impair our business operations.

Any of the risks discussed below or elsewhere in this prospectus or in our SEC filings incorporated by reference, and other risks we have not anticipated

or discussed, could have a material impact on our business, financial condition or results of operations. As a result, the trading price of the Common Stock could decline.

The price of the Common Stock may fluctuate significantly, and this may make it difficult for you to sell any shares of the Common Stock when you want or

at prices you find attractive.

The price of the Common Stock on the New York Stock Exchange constantly changes. We expect that the market price of

the Common Stock will continue to fluctuate.

In addition, the stock markets from time to time experience price and volume fluctuations that may be

unrelated or disproportionate to the operating performance of companies and that may be extreme. These fluctuations may adversely affect the trading price of the Common Stock, regardless of our actual operating performance.

For a further discussion of risks affecting the Common Stock, see the factors set forth below under “Cautionary Statement Regarding Forward-Looking

Statements” and the discussion of our business and related matters set forth in the information incorporated in this prospectus by reference.

1

General Mills, Inc. Direct Purchase Plan

Future sales of the Common Stock or equity-related securities in the public market could adversely affect the trading price of the Common Stock and our

ability to raise funds in new stock offerings.

In the future, we may sell additional shares of the Common Stock to raise capital. In addition, shares

of the Common Stock are reserved for issuance on the exercise of stock options and the vesting of restricted stock units and performance share units. We cannot predict the size of future issuances or the effect, if any, that they may have on the

market price for the Common Stock. Sales of significant amounts of the Common Stock or equity-related securities in the public market, or the perception that such sales will occur, could adversely affect prevailing trading prices of the Common Stock

and could impair our ability to raise capital through future offerings of equity or equity-related securities. Future sales of shares of the Common Stock or the availability of shares of the Common Stock for future sale could adversely affect the

trading price of the Common Stock.

We can issue shares of preference stock that may adversely affect your rights as a holder of the Common Stock.

Our certificate of incorporation currently authorizes the issuance of five million shares of cumulative preference stock. Our board of directors is

authorized to approve the issuance of one or more series of preference stock without further authorization of our stockholders and to fix the number of shares, the designations, the relative rights and the limitations of any series of preference

stock. As a result, our board, without stockholder approval, could authorize the issuance of preference stock with voting, conversion and other rights that could proportionately reduce, minimize or otherwise adversely affect the voting power and

other rights of holders of the Common Stock or other series of preference stock or that could have the effect of delaying, deferring or preventing a change in our control.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

We and our representatives may from time to time make written or oral forward-looking statements with respect to our annual or long-term goals, including

statements contained in this prospectus, the documents incorporated by reference in this prospectus, our filings with the SEC and our reports to stockholders.

The words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,”

“plan,” “project” or similar expressions identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties

that could cause actual results to differ materially from historical results and those currently anticipated or projected. We wish to caution you not to place undue reliance on any such forward-looking statements, which speak only as of the date

made.

In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we are identifying important

factors that could affect our financial performance and could cause our actual results in future periods to differ materially from any current opinions or statements.

Our future results could be affected by a variety of factors, such as:

|

|

•

|

|

competitive dynamics in the consumer foods industry and the markets for our products, including new product introductions, advertising activities, pricing actions and promotional activities of our competitors;

|

2

General Mills, Inc. Direct Purchase Plan

|

|

•

|

|

economic conditions, including changes in inflation rates, interest rates, tax rates or the availability of capital;

|

|

|

•

|

|

product development and innovation;

|

|

|

•

|

|

consumer acceptance of new products and product improvements;

|

|

|

•

|

|

consumer reaction to pricing actions and changes in promotion levels;

|

|

|

•

|

|

acquisitions or dispositions of businesses or assets;

|

|

|

•

|

|

changes in capital structure;

|

|

|

•

|

|

changes in the legal and regulatory environment, including labeling and advertising regulations and litigation;

|

|

|

•

|

|

impairments in the carrying value of goodwill, other intangible assets or other long-lived assets, or changes in the useful lives of other intangible assets;

|

|

|

•

|

|

changes in accounting standards and the impact of significant accounting estimates;

|

|

|

•

|

|

product quality and safety issues, including recalls and product liability;

|

|

|

•

|

|

changes in consumer demand for our products;

|

|

|

•

|

|

effectiveness of advertising, marketing and promotional programs;

|

|

|

•

|

|

changes in consumer behavior, trends and preferences, including weight loss trends;

|

|

|

•

|

|

consumer perception of health-related issues, including obesity;

|

|

|

•

|

|

consolidation in the retail environment;

|

|

|

•

|

|

changes in purchasing and inventory levels of significant customers;

|

|

|

•

|

|

fluctuations in the cost and availability of supply chain resources, including raw materials, packaging and energy;

|

|

|

•

|

|

disruptions or inefficiencies in the supply chain;

|

|

|

•

|

|

effectiveness of restructuring and cost saving initiatives;

|

|

|

•

|

|

volatility in the market value of derivatives used to manage price risk for certain commodities;

|

|

|

•

|

|

benefit plan expenses due to changes in plan asset values and discount rates used to determine plan liabilities;

|

|

|

•

|

|

failure or breach of our information technology systems;

|

|

|

•

|

|

foreign economic conditions, including currency rate fluctuations; and

|

|

|

•

|

|

political unrest in foreign markets and economic uncertainty due to terrorism or war.

|

You should also

consider the risk factors that we identify and incorporate by reference in this prospectus, which could also affect the price of the Common Stock.

We

undertake no obligation to publicly revise any forward-looking statements to reflect events or circumstances after the date of those statements or to reflect the occurrence of anticipated or unanticipated events.

3

General Mills, Inc. Direct Purchase Plan

DESCRIPTION OF THE PLAN

PURPOSES

The Plan provides

participants with a convenient and economical method of systematically increasing their ownership interest in General Mills through purchases of Common Stock and the reinvestment of cash dividends in additional shares of Common Stock. General Mills

may use the Plan to raise capital for general corporate purposes through the sale to participants of treasury or new issue Common Stock.

FEATURES

The Plan has the following features:

|

•

|

|

Open to

Non-Stockholders

– If you do not currently own shares of Common Stock you may become a participant in the Plan by paying an enrollment fee and either making an

initial investment of at least $250 or authorizing at least five automatic cash investments of at least $50.

|

|

•

|

|

Automatic Reinvestment of Dividends

– Cash dividends paid on all or a specified percentage of shares of Common Stock are automatically reinvested in additional shares of Common Stock.

|

|

•

|

|

Optional Cash Investments

– You may make optional cash investments in Common Stock of at least $50 per investment up to an aggregate of $250,000 per calendar year. Optional cash investments may be made by

automatic withdrawal or by check.

|

|

•

|

|

Full Investment of Plan Funds

– Funds invested in the Plan are fully invested through the purchase of fractional shares, computed to three decimals, as well as full shares. Cash dividends on fractional

shares are reinvested in additional shares of Common Stock.

|

|

•

|

|

Automated Requests

– You may establish automated privileges for your Plan account, enabling you to execute certain Plan orders online or by phone.

|

|

•

|

|

Share Safekeeping

– You may deposit for safekeeping certificates representing shares of Common Stock held in physical certificate form, whether or not the shares were issued under the Plan, at no cost to

you.

|

|

•

|

|

Account Statements

– Account statements detailing your Plan activities are mailed to you following each Plan transaction.

|

CONSIDERATIONS

You should

consider the following prior to participating in the Plan:

|

•

|

|

Fees

– See “Brokerage Commissions, Service Fees and Other Costs – Investment Summary and Fees.”

|

|

•

|

|

Investment Timing; Price Risks

– Because the prices at which Plan shares are purchased are determined as of specified dates or as of dates otherwise beyond your control, you may lose certain advantages

otherwise available from being able to select the timing of your investment. For example, because the price charged to you for shares purchased in the open market or in negotiated transactions is the weighted average price at which the shares are

actually purchased and may be over a period of days following an investment date, you may pay a higher price for shares purchased under the Plan than for shares purchased on the investment date outside of the Plan.

|

4

General Mills, Inc. Direct Purchase Plan

|

•

|

|

No Interest Pending Investment

– No interest is paid on optional cash investments pending their investment in Common Stock.

|

ADMINISTRATION

As of the date

of this prospectus, administration of the Plan is handled by Wells Fargo Shareowner Services, a division of Wells Fargo Bank, N.A. (the “Plan Administrator”). The Plan Administrator is responsible for the clerical and ministerial

administration of the Plan, including receiving initial and optional cash investments of participants, forwarding funds received from or on behalf of participants to a registered broker for purchases of Common Stock, issuing statements to

participants of their Plan account activities and performing certain other administrative duties related to the Plan.

Contact Information

Internet

shareowneronline.com

Available

24 hours a day, 7 days a week for access to account information and answers to many common questions and general inquiries.

To enroll in the Plan:

If you are an existing registered stockholder:

1. Go to shareowneronline.com

2. Select “Sign Up Now!”

3. Enter your Authentication ID* and Account Number

*If you do not have your Authentication ID, select “I do not have my Authentication ID.” For security, this number is required for

first time sign on.

If you are a new investor:

1. Go to shareowneronline.com

2. Under “Invest in a Plan,” select “Direct Purchase Plan”

3. Select “General Mills, Inc.”

4. Under “New Investors,” select “Invest Now”

5. Follow instructions on “Buy Shares”

Email

Go to

shareowneronline.com and select “Contact Us.”

Telephone

(800)

670-4763

Toll-Free

+1 (651)

450-4064

outside the United States

5

General Mills, Inc. Direct Purchase Plan

Shareowner Relations Specialists are available Monday through Friday, from 7:00 a.m. to 7:00 p.m. Central Time.

You may also access your account information 24 hours a day, 7 days a week using our automated voice response system.

Written correspondence

Wells Fargo Shareowner Services

P.O. Box 64856

St. Paul, MN

55164-0856

Registered, certified and overnight delivery and deposit of certificated shares**

Wells Fargo Shareowner Services

1110 Centre Pointe Curve, Suite 101

Mendota Heights, MN 55120-4100

**If sending in a certificate for deposit, see “Share Safekeeping.”

The Plan Administrator is responsible for purchasing and selling shares of Common Stock for your Plan account, including the selection of any broker through

which Plan purchases and sales are made. General Mills has no control over the times or prices at which the Plan Administrator effects transactions or the selection of any broker used by the Plan Administrator.

AUTOMATED REQUESTS

ONLINE

. You may establish automated privileges for your Plan account, enabling you to execute the following Plan orders online:

|

|

•

|

|

sell a portion or all of your Plan shares, if you have a United States bank account and, for joint accounts, you have previously authorized automated account access;

|

|

|

•

|

|

authorize, change or terminate automatic withdrawals from your financial institution; and

|

|

|

•

|

|

change your dividend reinvestment option (example: change from full reinvestment to partial reinvestment).

|

Certain restrictions may apply.

After you have successfully

signed up, you will be able to access your account immediately. You will also receive written confirmation to your mailing address on file that your account has been activated for online access.

6

General Mills, Inc. Direct Purchase Plan

TELEPHONE

. You may establish automated privileges for your Plan account, enabling you to execute the following Plan orders by telephone:

|

|

•

|

|

sell a portion or all of your Plan shares, if you have a United States bank account and, for joint accounts, you have previously authorized automated account access;

|

|

|

•

|

|

change or terminate automatic withdrawals from your bank account; and

|

|

|

•

|

|

change your dividend reinvestment option (example: change from full reinvestment to partial reinvestment).

|

Certain restrictions may apply.

FORMS

ACCOUNT

AUTHORIZATION FORM

. An Account Authorization Form is used to enroll in the Plan and for stockholders to change automatic cash withdrawal and investment dollar amounts, automated privileges and direct deposit of dividends. An Account

Authorization Form can be obtained from the Plan Administrator upon request, or you can enroll online at shareowneronline.com.

TRANSACTION REQUEST

FORM

. A Transaction Request Form is used to make optional cash investments, sell Plan shares, deposit physical certificate shares with the Plan Administrator, discontinue or change automatic cash withdrawal and investment dollar amounts, and

terminate participation in the Plan. A Transaction Request Form is attached to each account statement mailed to participants.

Additional Account

Authorization Forms and Transaction Request Forms can be obtained from the Plan Administrator upon request.

ELIGIBILITY

Any person or entity, whether or not currently a registered holder of Common Stock, may participate in the Plan by enrolling in accordance with the

procedures (see “Enrollment and Participation”). General Mills reserves the right to deny, modify, suspend or terminate participation by any person or entity (see “Other Information – Denial or Termination of Participation by

General Mills”).

We encourage you to access your account information online at shareowneronline.com to perform transactions. Accounts that are

registered in the name of an investment club, corporation or partnership will not be allowed online access. Please note that additional access restrictions may apply.

Note:

Regulations in certain countries may limit or prohibit participation in this type of Plan. Accordingly, persons residing outside the United

States who wish to participate in the Plan should first determine whether they are subject to any governmental regulation prohibiting their participation.

ENROLLMENT AND PARTICIPATION

You may enroll in the Plan at any time by going online (see “Automated Requests – Online”) or by completing the Account Authorization Form and

returning it to the Plan Administrator at the address set forth on the form.

7

General Mills, Inc. Direct Purchase Plan

STOCKHOLDERS

. If you are a registered holder of Common Stock, you may go online at shareowneronline.com (see “Automated Requests –

Online”) or complete an Account Authorization Form to participate in the Plan. If you are a beneficial owner of Common Stock whose only shares are held in the name of a bank, broker or other nominee, you must either (a) arrange for the

bank, broker or nominee to register in your name the number of shares of Common Stock that you want to participate in the Plan and then go online or complete an Account Authorization Form to enroll in the Plan or (b) go online or complete an

Account Authorization Form and become a stockholder of record by enrolling in the Plan in the same manner as a

non-stockholder.

NON-STOCKHOLDERS

. If you are not a registered owner of Common Stock, you may go online at

shareowneronline.com (see “Automated Requests – Online”) or complete an Account Authorization Form and pay a

one-time

enrollment fee of $15 (see “Brokerage Commissions, Service Fees and

Other Costs – Investment Summary and Fees”). You must also make an initial cash investment of at least $250. The initial cash investment will be waived if you authorize at least five automatic cash investments of at least $50. You need

only include a check in the amount of the initial cash investment in United States dollars and drawn on a United States or Canadian financial institution (or authorization for automatic cash investment) plus the enrollment fee. If you enroll online,

your enrollment fee and initial cash investment or automatic cash investment funds will be automatically debited from your bank account and you need not send any check. A maximum of $250,000 may be invested in the Plan through optional cash

investments during any calendar year.

DIVIDEND REINVESTMENT

As described below, by participating in the Plan, you may have the cash dividends paid on all or a percentage of your shares of Common Stock automatically

reinvested in Common Stock on the dividend payment date.

The payment of dividends on common stock is at the discretion of General Mills’ Board of Directors.

General Mills’ Board of Directors has the right to stop paying or to change

the amount of dividends at any time.

REINVESTMENT OPTIONS

You may change your reinvestment option at any time by going online at shareowneronline.com (see “Automated Requests – Online”), calling (see

“Automated Requests – Telephone”) or sending written notice to the Plan Administrator. If you do not select an option, the Plan Administrator will default your choice to full reinvestment. Notices received on or before a dividend

record date will be effective for that dividend. Notices received after a dividend record date will not be effective until after that dividend has been paid.

FULL DIVIDEND REINVESTMENT

. If you elect this option online, by calling or on your Account Authorization Form, all cash dividends payable on

shares held in the Plan, along with any shares held in physical certificate form or through book-entry Direct Registration Shares (“DRS”), will be used to purchase additional shares. The participant will not receive cash dividends from the

Company; instead, all dividends will be reinvested. Whole and fractional shares will be credited to the Plan account.

PARTIAL DIVIDEND

REINVESTMENT

. If you elect this option online, by calling or on your Account Authorization Form, a participant may elect to reinvest a portion of the dividend and receive the remainder in cash. The percentage elected will be applied to the

total shares held in the Plan, along with any shares held in physical certificate form or held through book-entry DRS. A participant may elect percentages from 10% to 90%,

8

General Mills, Inc. Direct Purchase Plan

in increments of 10%. The cash portion of dividends will be sent by check unless the participant has elected to have those dividends deposited directly to a

designated financial institution.

An example of partial reinvestment by percentage: A participant has a total of 150 shares; 120 shares

are held in the Plan, 15 in physical certificate form and 15 shares in book-entry DRS. The participant chooses to have 50% of the total dividend reinvested. This will equate to 75 shares having dividends reinvested and 75 shares having dividends

paid in cash. Shares that are held in the Plan will have dividends reinvested before any shares held in physical certificate form or held through book-entry DRS.

CASH PAYMENTS ONLY

. If you elect this option online, by calling or on your Account Authorization Form, all dividends payable to the participant

will be paid in cash. This includes the dividend payable on all shares held in the Plan, in physical certificate form and through book-entry DRS. The participant’s dividend payment will be sent by check unless the participant has elected to

have those dividends deposited directly to a designated financial institution.

DIRECT DEPOSIT OF DIVIDENDS

. You can have your unreinvested

cash dividends transferred directly to your bank for deposit. For electronic direct deposit of dividend funds, contact the Plan Administrator to request a Direct Deposit of Dividends Authorization Form, and complete and return the form to the Plan

Administrator. Be sure to include a voided check for checking accounts or savings deposit slip for savings accounts. If your stock is jointly owned, all owners must sign the form.

DIVIDEND PAYMENT DATES

Dividends on Common Stock have historically been paid on the first day of February, May, August and November, and the tenth day of January, April, July and

October, respectively, have generally been the record dates for the payment of such dividends.

CASH INVESTMENTS

See “Brokerage Commissions, Service Fees and Other Costs – Investment Summary and Fees” for any fees that may apply. You are under no obligation

to make additional cash investments after the initial cash investment.

INITIAL CASH INVESTMENT

. If you are not a registered owner of Common

Stock, you must include an initial cash investment of at least $250 with your completed Account Authorization Form or authorize at least five automatic cash investments of at least $50. For automatic cash investments, your first investment of at

least $50 must be made by check. In either case, you must also pay a

one-time

enrollment fee of $15 (see “Brokerage Commissions, Service Fees and Other Costs – Investment Summary and Fees” and

“Enrollment and Participation”). If you enroll online, your enrollment fee and initial cash investment or automatic cash investment funds will be automatically debited from your bank account and you need not send any check. If you are

already a stockholder of record, no initial investment or enrollment fee is required.

OPTIONAL CASH INVESTMENTS

. You may make optional cash

investments at any time by personal check, along with a Transaction Request Form from one of your Account Statements, or by automatic cash withdrawals from a United States or Canadian financial institution. You may vary optional cash investments

from a minimum of $50 per investment up to a maximum of $250,000 per calendar year. Initial cash investments are included in the month in which they are made for purposes of determining whether the $250,000 maximum has been reached.

9

General Mills, Inc. Direct Purchase Plan

CHECK.

Optional cash investments made by check must be accompanied by a completed Transaction Request Form and received by the Plan Administrator

no later than one business day prior to an investment date for an initial cash investment and optional cash investments; otherwise, optional cash investments are held by the Plan Administrator for investment on the next investment date. Optional

cash investments made by check must be payable to “Shareowner Services” in United States dollars. Cash, money orders, traveler’s checks and third party checks are not accepted.

AUTOMATIC CASH WITHDRAWAL AND INVESTMENT

. A participant may set up a

one-time,

semi-monthly or monthly

automatic withdrawal from a designated bank account. The request may be submitted online, by telephone or by mailing an Account Authorization Form. Requests are processed and become effective as promptly as administratively possible. Once the

automatic withdrawal is initiated, funds will be debited from the participant’s designated bank account on or about the 9th and/or the 25th of each month and will be invested in Common Stock within five trading days. Changes or a

discontinuation of automatic withdrawals can be made online, by telephone or by using the Transaction Request Form attached to the participant’s statement. To be effective with respect to a particular investment date, a change request must be

received by the Plan Administrator at least 15 trading days prior to the investment date. Participants do not receive any confirmation of the transfer of funds other than as reflected in their Plan account statements and in their bank account

statements. The minimum withdrawal amount is $50 and the maximum aggregate optional cash investment, including an initial investment, during any calendar year is $250,000.

To authorize automatic cash withdrawals, go online or complete and sign the Bank Authorization Agreement section of the Account Authorization Form and return

it to the Plan Administrator together with a voided blank check for checking accounts or a deposit slip for savings accounts from which funds are to be transferred.

A participant may obtain the return of any cash investment upon request received by the Plan Administrator on or before the second business day prior to the

date on which it is to be invested. See “Investment Dates – Optional Cash Investments.”

NO INTEREST IS PAID ON FUNDS HELD BY THE PLAN

ADMINISTRATOR PENDING THEIR INVESTMENT IN COMMON STOCK. ALL OPTIONAL CASH INVESTMENTS, INCLUDING THE INITIAL CASH INVESTMENT, ARE SUBJECT TO THE COLLECTION BY THE PLAN ADMINISTRATOR OF FULL FACE VALUE IN UNITED STATES DOLLARS.

During the period that an optional cash investment is pending, the collected funds in the possession of the Plan Administrator may be invested in certain

Permitted Investments. For purposes of this Plan, “Permitted Investments” shall mean uninvested or invested in select Wells Fargo deposit products. The risk of any loss from such Permitted Investments shall be the responsibility of the

Plan Administrator. Investment income from such Permitted Investments shall be retained by the Plan Administrator.

If any optional cash contribution,

including payments by check or automatic withdrawal, is returned for any reason, the Plan Administrator will remove from the participant’s account any shares purchased upon prior credit of such funds, and will sell these shares. The Plan

Administrator may sell other shares in the account to recover the returned funds fee (see “Brokerage Commissions, Service Fees and Other Costs – Investment Summary and Fees”) for each optional cash contribution returned unpaid for any

reason and may sell additional shares as necessary to cover any market loss incurred by the Plan Administrator.

10

General Mills, Inc. Direct Purchase Plan

SOURCE OF SHARES

. Shares purchased by participants under the Plan are treasury or new issue Common Stock that General Mills has registered under

the Securities Act of 1933, as amended, or Common Stock purchased by the Plan Administrator in the open market or in negotiated transactions. The Plan Administrator purchases shares in the open market or in negotiated transactions as soon as

administratively possible (but in no event more than five trading days) after the applicable investment date, subject to any waiting periods required under applicable securities laws or stock exchange regulations. General Mills determines the source

or sources of shares used to fulfill Plan requirements and, subject to certain regulatory restrictions on the frequency with which it can change its determination, may change such determination from time to time without notice to Plan participants.

General Mills expects that generally all Plan purchases will be effected in open market transactions. The Plan Administrator will furnish the name of the registered broker utilized in share transactions within a reasonable time upon written request

from the participant.

PRICE OF SHARES

. The price per share of treasury or new issue Common Stock is the average of the high and low sale

prices of the Common Stock (as reported on the New York Stock Exchange Composite Tape) on the applicable investment date or, if the New York Stock Exchange is closed on the investment date, on the next business day the New York Stock Exchange is

open. The price of shares purchased in the open market or in negotiated transactions is the weighted average price at which the shares are actually purchased for the applicable investment date. The Plan Administrator may, in its discretion,

commingle participants’ funds for the purpose of purchasing shares. Because the prices at which shares are purchased under the Plan are determined as of specified dates or as of dates otherwise beyond the control of participants, participants

may lose any advantage otherwise available from being able to select the timing of their investment. Participants’ accounts will be credited with the number of full and fractional shares purchased, computed to three decimal places.

INVESTMENT DATES

DIVIDEND REINVESTMENT

. Cash dividends are reinvested on the applicable dividend payment date or, if the dividend payment date is not a business

day, the business day next following the dividend payment date. If a participant’s Account Authorization Form is received by the Plan Administrator on or before the record date for a particular dividend, dividend reinvestment will begin with

respect to dividends paid on the next dividend payment date. If the Account Authorization Form is received by the Plan Administrator after the record date, dividend reinvestment will not begin until the dividend payment date following the next

record date.

OPTIONAL CASH INVESTMENTS

. Any initial, recurring or

one-time

optional cash investment

will be invested generally within five trading days, except where postponement (not to exceed 35 trading days) is necessary to comply with Regulation M under the Securities Exchange Act of 1934 or other applicable provisions of securities law. In

making purchases for the participant’s account, the Plan Administrator may commingle the participant’s funds with those of other participants of the Plan. Purchases may be subject to certain fees (see “Brokerage Commissions, Service

Fees and Other Costs – Investment Summary and Fees”).

BROKERAGE COMMISSIONS, SERVICE FEES AND OTHER COSTS

BROKERAGE COMMISSIONS

. Brokerage commissions payable with respect to Plan purchases are paid by General Mills. Brokerage commissions

payable with respect to Plan sales are deducted from the proceeds payable to participants.

SERVICE FEES

. Dividend reinvestment and optional

cash investment service fees are paid by General Mills. Participants pay a service fee in connection with sales of Plan shares. The service fee is in addition to brokerage commissions and is deducted from the proceeds payable to the selling

participant.

11

General Mills, Inc. Direct Purchase Plan

COMMISSIONS AND FEES SUBJECT TO CHANGE

. General Mills may change from time to time the amount of commissions and fees charged participants upon

30 days’ prior notice to participants.

INVESTMENT SUMMARY AND FEES

Summary

|

|

|

|

|

|

|

Minimum cash investments

|

|

|

|

|

|

Minimum

one-time

initial purchase for new

investors*

|

|

|

$250.00

|

|

|

* Or five minimum recurring automatic investments

|

|

|

$50.00

|

|

|

Minimum

one-time

optional cash purchase

|

|

|

$50.00

|

|

|

Minimum recurring automatic investments

|

|

|

$50.00

|

|

|

|

|

|

Maximum cash investments

|

|

|

|

|

|

Maximum calendar year investment

|

|

|

$250,000.00

|

|

|

|

|

|

Dividend reinvestment options

|

|

|

|

|

|

Reinvest options

|

|

|

Full, Partial or None

|

|

Fees

|

|

|

|

|

|

|

Investment fees

|

|

|

|

|

|

Initial enrollment (new investors only)

|

|

|

$15.00

|

|

|

Dividend reinvestment

|

|

|

Company Paid

|

|

|

Check investment

|

|

|

Company paid

|

|

|

One-time

automatic investment

|

|

|

Company Paid

|

|

|

Recurring automatic investment

|

|

|

Company Paid

|

|

|

Dividend purchase trading commission per share

|

|

|

Company Paid

|

|

|

Optional cash purchase trading commission per share

|

|

|

Company Paid

|

|

|

|

|

|

Sales fees

|

|

|

|

|

|

Batch Order

|

|

|

$15.00

|

|

|

Market Order

|

|

|

$25.00

|

|

|

Limit Order per transaction (Day/GTD/GTC)

|

|

|

$30.00

|

|

|

Stop Order

|

|

|

$30.00

|

|

|

Sale trading commission per share

|

|

|

$0.12

|

|

|

Direct deposit of sale proceeds per transaction

|

|

|

$5.00

|

|

|

|

|

|

Other fees

|

|

|

|

|

|

Certificate issuance

|

|

|

Company Paid

|

|

|

Certificate deposit

|

|

|

Company Paid

|

|

|

Returned check / Rejected automatic bank withdrawal

|

|

|

$35.00 per item

|

|

|

Prior year duplicate statement

|

|

|

$20.00 per year

|

|

12

General Mills, Inc. Direct Purchase Plan

ACCOUNT STATEMENTS

Following

each purchase or other transaction involving your account, you will be furnished with a statement that includes:

|

•

|

|

the amount of any investment from:

|

|

|

•

|

|

cash dividends paid on shares registered in your name;

|

|

|

•

|

|

cash dividends paid on full and fractional Plan shares in your account;

|

|

•

|

|

the date of the transaction;

|

|

•

|

|

the number and price per share of any Plan shares purchased for your account;

|

|

•

|

|

the number and price per share of any Plan shares sold for your account;

|

|

•

|

|

the number of Plan shares withdrawn from or deposited to your account;

|

|

•

|

|

the fees and brokerage commission, if any, for the transaction;

|

|

•

|

|

the total number of book-entry (DRS) shares, shares held in certificate form and Plan shares in your account; and

|

|

•

|

|

a

year-to-date

summary of transactions in your account.

|

These statements contain information that is required for tax reporting purposes. Therefore, it is imperative that you keep the statements until Plan shares

have been disposed of and all tax obligations have been met. If this information is lost, a written request stating the information required may be sent to the Plan Administrator at the address contained in this prospectus. A fee for past account

information may be charged (see “Brokerage Commissions, Service Fees and Other Costs – Investment Summary and Fees”).

DIRECT REGISTRATION

General Mills is a participant in the Direct Registration System (“DRS”). DRS is a method of recording shares of

stock in book-entry form. Book-entry means that your shares are registered in your name on the books of the Company without the need for physical certificates and are held separately from any Plan shares you may own. Shares held in book-entry have

all the traditional rights and privileges of shares held in certificate form. With DRS, stockholders can:

|

•

|

|

eliminate the risk and cost of storing certificates in a secure place;

|

|

•

|

|

eliminate the cost associated with replacing lost, stolen or destroyed certificates; and

|

|

•

|

|

move shares electronically to their broker.

|

HOW TO BEGIN.

Any future share transactions will be

issued in book-entry form rather than physical certificates unless you specify otherwise. You may convert any stock certificate(s) you are currently holding into book-entry form. Send the stock certificate(s) to the Plan Administrator with a request

to deposit them to your DRS account. There is no cost to you for this custodial service and by doing so you will be relieved of the responsibility for loss or theft of your certificate(s).

13

General Mills, Inc. Direct Purchase Plan

General Mills strongly recommends that you use registered or certified mail to mail your certificates to the Plan Administrator, insuring the certificates for

3% of the current market value of the shares represented thereby. In any case, you bear the full risk of loss, regardless of the method used, in the event the certificates are lost.

You should not endorse your certificates prior to mailing.

(See “Share Safekeeping – Optional Mail Loss Insurance”).

ELECTRONIC SHARE MOVEMENT.

You may choose to have a portion or all

of your full book-entry (DRS) or Plan shares delivered directly to your broker by contacting your broker. When using your broker to facilitate a share movement, provide them with a copy of your DRS account statement.

S

HARE CERTIFICATES

Plan

purchases are credited to your account and shown on your account statement. You do not receive certificates for your Plan shares unless requested in writing. This protects against loss, theft or destruction of stock certificates and reduces General

Mills’ administrative costs associated with the Plan. You may obtain certificates for some or all full Plan shares by submitting a written request to the Plan Administrator. Your request should specify the number of full Plan shares to be

withdrawn from your account. Stock certificates will be issued and sent to the holder of record. Fractional shares are not issued under any conditions.

You may not pledge or grant a security interest in Plan shares unless certificates representing the shares have been issued by the Plan Administrator.

SHARE SAFEKEEPING

At any time

beginning with enrollment in the Plan, you may deposit with the Plan Administrator physical certificates representing shares of Common Stock, whether or not the shares were acquired under the Plan, at no cost to you. To use this service, you must

send your physical certificates to the Plan Administrator with a properly completed Transaction Request Form or Account Authorization Form. Shares represented by certificates deposited with the Plan Administrator are credited to your account and

thereafter are treated as if acquired under the Plan. You are responsible for maintaining your own records of the cost basis of certificated shares deposited with the Plan Administrator.

General Mills strongly recommends that you use registered or certified mail to mail your certificates to the Plan Administrator, insuring the certificates for

3% of the current market value of the shares represented thereby. In any case, you bear the full risk of loss, regardless of the method used, in the event the certificates are lost.

You should not endorse your certificates prior to mailing.

OPTIONAL

MAIL

LOSS

INSURANCE

.

Please be advised that choosing

registered, express or certified mail alone will not protect you should your certificates become lost or stolen.

The Plan Administrator can provide

low-cost

loss insurance for certificates being returned for conversion to book-entry form. Mail loss insurance covers the cost of the replacement surety bond only. Replacement transaction fees may also apply. To

take advantage of the optional mail loss insurance, include a $10.00 check made payable to WFSS Surety Program along with your certificates and instructions.

To qualify for this service you must choose to use an accountable mail delivery service such as Federal Express, United Parcel Service, DHL, Express Mail,

Purolator, TNT or United States Postal Service Registered Mail. Any one shipping package may not contain certificates exceeding a total value of $100,000.

14

General Mills, Inc. Direct Purchase Plan

The value of certificate shares is based on the closing market price of the common stock on the trading day prior to the mail date. Claims related to lost

certificates under this service must be made within 60 days of the mail date. This is specific coverage for the purpose of converting shares to book-entry form, and the surety is not intended to cover certificates being tendered for sale,

certificate breakdown or exchange for other certificates.

SHARE TRANSFERS WITHIN PLAN

Plan shares also may be transferred to a Plan account of another person subject to compliance with any applicable laws. To do this, you must complete and sign

a Stock Power Form and return it to the Plan Administrator. The signature of the transferring participant on the stock power must be medallion guaranteed by an eligible financial institution. Stock Power Forms can be obtained online at

shareowneronline.com or from the Plan Administrator. If the person to whom the shares are transferred is not a participant in the Plan, the Plan Administrator will automatically open an account for the person and enroll him or her in the Plan.

GIFTS OR SHARE TRANSFERS OUTSIDE PLAN

You can give or transfer shares from your Plan account to anyone you choose by:

|

|

•

|

|

making an initial cash investment of at least $250 (plus the $15 enrollment fee) to establish an account in the recipient’s name;

|

|

|

•

|

|

submitting an optional cash investment on behalf of an existing Plan participant in an amount of not less than $50 per investment or more than $250,000 per calendar year;

|

|

|

•

|

|

transferring shares from your Plan account to the account of an existing Plan participant; or

|

|

|

•

|

|

transferring a whole number of shares from your account to a recipient outside the Plan.

|

You may transfer

shares of Common Stock to the accounts of existing Plan participants or establish a new account. If your investments or transfers are made to an existing account, dividends on the shares credited pursuant to such investments or transfers will be

invested in accordance with the elections made by the existing account owner. New Plan participants may elect any of the Plan’s available dividend reinvestment options by completing an Account Authorization Form.

When authorizing a transfer of shares, you must send written instructions to the Plan Administrator and must have your signature on the letter of instruction

medallion guaranteed by a financial institution participating in the Medallion Signature Guarantee program. A Medallion Signature Guarantee is a special guarantee for securities that may be obtained through a financial institution such as a broker,

bank, savings and loan association, or credit union. The guarantee ensures that the individual requesting the transfer of securities is the owner of those securities. Most banks and brokers participate in the Medallion Signature Guarantee program.

If you need additional assistance regarding the transfer of your shares, please telephone the Plan Administrator. You also may find information and

obtain forms on the Plan Administrator’s website at shareowneronline.com.

15

General Mills, Inc. Direct Purchase Plan

SALE OF SHARES

You can sell

your Plan shares at any time by submitting a request to sell through the mail. You may also submit a request to sell either online or by telephone. A check will be issued for your sale proceeds, unless you elect to receive the funds by direct

deposit into your bank account.

Sales are usually made through a registered broker affiliated with the Plan Administrator, who will receive brokerage

commissions. Typically, the shares are sold through the exchange on which the Common Stock is traded. Depending on the number of shares of Common Stock to be sold and current trading volume, sale transactions may be completed in multiple

transactions and over the course of more than one day. All sales are subject to market conditions, system availability, restrictions and other factors. The actual sale date, time and price received for any shares sold through the Plan cannot be

guaranteed.

Participants may instruct the Plan Administrator to sell shares under the Plan through a Batch Order, Market Order, Day Limit Order,

Good-‘Til-Date/Canceled

Limit Order or Stop Order.

Batch Order (online, telephone or mail)

– The Plan Administrator will combine each request to sell through the Plan with other Plan participant sale requests for a Batch Order. Shares are then periodically submitted in bulk to a broker for sale on the open market. Shares will be sold

no later than five trading days (except where deferral is necessary under state or federal regulations) following the request by the participant. Bulk sales may be executed in multiple transactions and over more than one day depending on the number

of shares being sold and current trading volumes. A Batch Order request cannot be canceled after submission by a participant.

Market

Order (online or telephone)

– The participant’s request to sell shares in a Market Order will be at the prevailing market price when the trade is executed. If such an order is placed during market hours, the Plan Administrator will

promptly submit the shares to a broker for sale on the open market. A Market Order request cannot be canceled after submission by a participant. Sale requests submitted near the close of the market may be executed on the next trading day, along with

other requests received after market close.

Day Limit Order (online or telephone)

– The participant’s request to sell

shares in a Day Limit Order will be promptly submitted by the Plan Administrator to a broker. The broker will execute the request as a Market Order when and if the stock reaches or exceeds the specified price on the day the order was placed (for

orders placed outside of market hours, the next trading day). The order is automatically canceled if the price is not met by the end of that trading day. Depending on the number of shares being sold and current trading volumes, the order may only be

partially filled and the remainder of the order canceled. A Day Limit Order request cannot be canceled after submission by a participant.

Good-‘Til-Date/Canceled

(GTD/GTC) Limit Order (online or telephone)

– A GTD/GTC Limit

Order request will be promptly submitted by the Plan Administrator to a broker. The broker will execute the request as a Market Order when and if the stock reaches or exceeds the specified price at any time while the order remains open (up to the

date requested or 90 days for GTC). Depending on the number of shares being sold and current trading volumes, sales may be executed in multiple transactions and may be traded on more than one day. The order or any unexecuted portion will be

automatically canceled if the price is not met by the end of the order period. The order may also be canceled by the applicable stock exchange or the participant at any time prior to execution.

Stop Order (online or telephone)

– The Plan Administrator will promptly submit a participant’s request to sell shares in a

Stop Order to a broker. A sale will be executed when the stock reaches a specified price, at

16

General Mills, Inc. Direct Purchase Plan

which time the Stop Order becomes a Market Order and the sale will be at the prevailing market price when the trade is executed. The price

specified in the order must be below the current market price (generally used to limit a market loss). The order may be canceled by the participant at any time prior to execution.

Sales proceeds will be net of any fees and commissions to be paid by the participant (see “Brokerage Commissions, Service Fees and Other Costs –

Investment Summary and Fees” for details). The Plan Administrator will deduct any fees and commissions and applicable tax withholding from the sale proceeds. Sales processed on accounts without a valid Form

W-9

for United States citizens or Form

W-8BEN

for

non-United

States citizens will be subject to federal backup withholding. This

withholding can be avoided by furnishing the appropriate form prior to the sale. Forms are available online at shareowneronline.com.

A check for the

proceeds of the sale of shares (in United States dollars), less applicable taxes, commissions and fees, will generally be mailed by first class mail as soon as administratively possible after the settlement date. If a participant submits a request

to sell all or part of the Plan shares and the participant requests net proceeds to be automatically deposited to a checking or savings account, then the participant must provide a voided blank check for a checking account or blank savings deposit

slip for a savings account. If the participant is unable to provide a voided check or deposit slip, the participant’s written request must have the participant’s signature(s) medallion guaranteed by an eligible financial institution for

direct deposit. Requests for automatic deposit of sale proceeds that do not provide the required documentation will not be processed and a check for the net proceeds will be issued.

A participant who wishes to sell shares currently held in certificate form may send them in for deposit to the Plan Administrator and then proceed with the

sale. General Mills strongly recommends that you use registered or certified mail to mail your certificates to the Plan Administrator, insuring the certificates for 3% of the current market value of the shares represented thereby. In any case, you

bear the full risk of loss, regardless of the method used, in the event the certificates are lost. To sell shares through a broker of their choice, the participant may request the broker to transfer shares electronically from the Plan account to

their brokerage account. Alternatively, a stock certificate can be requested that the participant can deliver to their broker.

The Plan Administrator

shall not be liable for any claim arising out of failure to sell on a certain date or at a specific price. Neither the Plan Administrator nor any of its affiliates will provide any investment recommendations or investment advice with respect to

transactions made through the Plan. This risk should be evaluated by the participant and is a risk that is borne solely by the participant.

Selling

participants should be aware that the share price of Common Stock may fall or rise during the period between a request for sale, its receipt by the Plan Administrator and the ultimate sale in the open market. You should evaluate these possibilities

when deciding whether and when to sell any shares through the Plan. The price risk will be borne solely by you.

TERMINATION

Participants may

terminate their participation in the Plan. A participant may terminate their participation in the Plan online (see “Automated Requests – Online”) or by contacting the Plan Administrator via phone (see “Automated Requests –

Telephone”). A participant may also submit the appropriate information on a Transaction Request Form or submit a written request to the Plan Administrator. A participant’s written request for termination should be signed by the authorized

signer(s) as their name(s) appears on their account statement. If

17

General Mills, Inc. Direct Purchase Plan

your request to terminate participation in the Plan is received on or after a dividend record date, but before the dividend payment date, your termination will

be processed as soon as administratively possible, and a separate dividend check will be mailed to you. Future dividends will be paid in cash, unless you rejoin the Plan.

In addition, termination requests of participants making optional cash investments by automatic cash withdrawal must be received by the Plan Administrator at

least 15 business days prior to the scheduled investment date to ensure that the request is effective as to the next optional cash investment date.

Upon

termination of a participant’s participation in the Plan, unless you have requested that some or all Plan shares be sold, the Plan Administrator will convert your full Plan shares to book-entry (DRS) representing the number of full shares in

your Plan account and a check in the amount of the market value, less applicable taxes, commissions and fees, of any fractional share. If a participant so requests on the Transaction Request Form, the Plan Administrator will sell some or all Plan

shares on behalf of the participant (see “Sale of Shares”). After settlement of the sale, the Plan Administrator will send the participant a check (or provide for direct deposit to a bank checking or savings account, as appropriate) in the

amount of the proceeds of the sale, less applicable taxes, commissions and fees, of full and fractional shares and a certificate representing any full Plan shares not sold.

After termination, previous participants may

re-enroll

in the Plan by going online or submitting a new Account

Authorization Form and complying with all other enrollment procedures (see “Enrollment and Participation”). In order to minimize unnecessary Plan administrative costs and to encourage use of the Plan as a long-term investment vehicle,

General Mills reserves the right to deny participation in the Plan to previous participants who General Mills or the Plan Administrator believes have been excessive in their enrollments and terminations.

At the direction of General Mills, the Plan Administrator can terminate your participation in the Plan if you do not own at least one full share.

18

General Mills, Inc. Direct Purchase Plan

OTHER INFORMATION

STOCK

DIVIDENDS AND STOCK SPLITS

. Any shares distributable to a Plan participant pursuant to a stock dividend or stock split on Plan shares will be added to the participant’s Plan account and not mailed or delivered directly to the

participant. The participant, however, may request the Plan Administrator to issue certificates for such stock dividends or split shares once they are added to the participant’s account (see “Share Certificates”). If a participant

sends notice of termination or a request to sell to the Plan Administrator between the record date and the payment date for a stock distribution, the request will not be processed until the stock distribution is credited to the participant’s

account.

DIVIDEND AND VOTING RIGHTS

. Dividend and voting rights of shares purchased under the Plan commence upon settlement of the

transaction. Shares of Common Stock purchased on or within two business days prior to a dividend record date are considered

“ex-dividend”

and therefore not entitled to payment of that dividend.

VOTING OF PLAN SHARES

. For each meeting of stockholders, participants receive proxy materials that allow them to vote their Plan shares by

proxy. Alternatively, participants can elect to vote their Plan shares in person at the meeting.

LIMITATION OF LIABILITY

. In administering

the Plan, neither General Mills nor the Plan Administrator is liable for any good faith act or omission to act, including but not limited to any claim of liability (i) arising out of the failure to terminate a participant’s account upon

such participant’s death prior to receipt of a notice in writing of such death, (ii) with respect to the prices or times at which shares are purchased or sold or (iii) as to the value of the shares acquired for participants.

The Plan Administrator is acting solely as agent of General Mills and owes no duties, fiduciary or otherwise, to any other person by reason of the Plan, and

no implied duties, fiduciary or otherwise, shall be read into the Plan. The Plan Administrator undertakes to perform such duties and only such duties as are expressly set forth herein, to be performed by it, and no implied covenants or obligations

shall be read into the Plan against the Plan Administrator or General Mills.

In the absence of negligence or willful misconduct on its part, the Plan

Administrator, whether acting directly or through agents or attorneys, shall not be liable for any action taken, suffered or omitted or for any error of judgment made by it in the performance of its duties in connection with the Plan. In no event

shall the Plan Administrator be liable for special, indirect or consequential loss or damage of any kind whatsoever (including but not limited to lost profit), even if the Plan Administrator has been advised of the likelihood of such loss or damage

and regardless of the form of action.

The Plan Administrator shall: (i) not be required to and shall make no representations and have no

responsibilities as to the validity, accuracy, value or genuineness of any signatures or endorsements, other than its own and (ii) not be obligated to take any legal action hereunder that might, in its judgment, involve any expense or

liability, unless it has been furnished with reasonable indemnity.

The Plan Administrator shall not be responsible or liable for any failure or delay in

the performance of its obligations under the Plan arising out of or caused, directly or indirectly, by circumstances beyond its reasonable control, including, without limitation: acts of God; earthquakes; fires; floods; wars; civil or military

disturbances; sabotage; epidemics; riots; interruptions, loss or malfunctions of utilities or computer (hardware or software) or

19

General Mills, Inc. Direct Purchase Plan

communications services; accidents; labor disputes; acts of civil or military authority or governmental actions; it being understood that the Plan

Administrator shall use reasonable efforts which are consistent with accepted practices in the banking industry to resume performance as soon as administratively possible under the circumstances.

MODIFICATION OR TERMINATION OF THE PLAN

. General Mills may suspend, modify or terminate the Plan at any time in whole or in part or with respect

to participants in certain jurisdictions. Notice of such suspension, modification or termination will be sent to all affected participants. No such event will affect any shares then credited to a participant’s account. Upon any whole or partial

termination of the Plan by General Mills, each affected participant will have all full Plan shares converted to book-entry (DRS) or a physical certificate issued for all full Plan shares and a check, less applicable taxes, commissions and fees, in

the amount of the market value of any fractional Plan share.

DENIAL OR TERMINATION OF PARTICIPATION BY GENERAL MILLS

. The Plan

Administrator may terminate a participant’s participation in the Plan if the participant does not own at least one full share. General Mills also reserves the right to deny, modify, suspend or terminate participation in the Plan by otherwise

eligible persons to the extent General Mills deems it advisable or necessary in its discretion to comply with applicable laws or to eliminate practices that are not consistent with the purposes of the Plan. Participants whose participation in the

Plan is terminated will have all full Plan shares converted to book-entry (DRS) or a physical certificate issued for all full Plan shares and a check, less applicable taxes, commissions and fees, in the amount of the market value of any fractional

Plan share.

20

General Mills, Inc. Direct Purchase Plan

UNITED STATES FEDERAL INCOME TAX INFORMATION

THE INFORMATION SET FORTH BELOW IS ONLY A SUMMARY AND DOES NOT CLAIM TO BE A COMPLETE DESCRIPTION OF ALL TAX CONSEQUENCES OF PARTICIPATION IN THE PLAN. TAX

CONSEQUENCES VARY DEPENDING ON INDIVIDUAL CIRCUMSTANCES AND MAY BE AFFECTED BY FUTURE LEGISLATION, IRS RULINGS AND REGULATIONS AND COURT DECISIONS. ACCORDINGLY, PARTICIPANTS SHOULD CONSULT WITH THEIR OWN TAX ADVISORS WITH RESPECT TO THE FEDERAL,