Net Income Increases

15.7% on 10.2% Increase in Net Sales

Inter Parfums, Inc. (NASDAQ GS: IPAR) today reported results for

the second quarter ended June 30, 2017.

Second Quarter 2017 Compared to Second Quarter 2016:

- Net sales were $129.1 million, up 10.2%

from $117.2 million; at comparable foreign currency exchange rates,

net sales increased 11.3%;

- Net sales by European based operations

rose 20.5% to $106.7 million from $88.6 million;

- Net sales by U.S. based operations were

$22.4 million compared to $28.6 million;

- Gross margin was 65.0% compared to

63.6%;

- S,G&A expenses as a percentage of

net sales were 53.8% compared to 53.7%;

- Operating income increased 26.3% to

$14.5 million from $11.5 million;

- Operating margin rose to 11.2% compared

to 9.8%; and

- Net income attributable to Inter

Parfums, Inc. increased 15.7% to $6.7 million or $0.22 per diluted

share from $5.8 million or $0.19 per diluted share.

Discussing the 20.5% sales increase in European based

operations, Jean Madar, Chairman & CEO of Inter Parfums, Inc.,

stated, “Our three largest brands performed exceptionally well

during the second quarter. In the absence of a new product launch,

there was a 15% increase in Montblanc fragrance sales driven by the

men’s Legend and Lady Emblem fragrance lines. Similarly, there was

a 15% increase in Jimmy Choo brand sales, with two recent

extensions, Jimmy Choo L’Eau and Jimmy Choo Man Ice, layering new

sales upon the brand’s older, more established fragrances. Lanvin,

our third largest brand, grew sales by 22%, spurred by the rollout

of Modern Princess and a welcome upturn in brand sales in Russia

and China, where Lanvin is an especially desirable prestige

label.”

He continued, “The launch of Mademoiselle Rochas has been

especially gratifying with sales expanding beyond the brand’s

entrenched markets, France and Spain. Coach is showing exceptional

promise, with sales of the women’s signature scent benefitting from

wider distribution, adding approximately $9.0 million in

incremental sales for the quarter. We also expanded and refreshed

the Van Cleef & Arpels Collection Extraordinaire with Bois Doré

and Rêve de Cashmere during the second quarter.”

He went on to say, “In the second half of the year, we have

Coach for Men, debuting in the fall with actor James Franco as our

advertising model, and we will launch Montblanc Legend Night around

holiday time. As planned, we have a new duo for Karl Lagerfeld

called Les Parfums Matières debuting in the second half, but have

moved the brand extension for Lanvin’s Éclat d’Arpège to 2018.”

Discussing U.S. based operations, Mr. Madar noted, “In last

year’s second quarter, the launch of our first ever Abercrombie

& Fitch men’s scent, First Instinct and the Hollister fragrance

duo, Wave, drove the nearly 15% increase in sales by U.S. based

operations, setting a high bar for this year’s quarterly

comparison. With the planned introduction of Icon Racing by Dunhill

and Fantasia by Anna Sui, both in September, we look forward to

more favorable quarterly comparisons.”

Mr. Madar concluded, “Sales growth by region thus far this year

is especially encouraging. Sales in our three largest markets,

Western Europe, North America and Asia are up 3.8%, 25.3% and

19.9%, respectively, compared to the first half of 2016. Ranked by

size, our next three markets, the Middle East, Central and South

America and Eastern Europe, achieved sales growth of 30.9%, 15.6%

and 93.9%, respectively.”

Russell Greenberg, Executive Vice President and CFO of Inter

Parfums, Inc., stated, “The increase in gross margin was

attributable to a higher proportion of European based sales, and to

a lesser extent, the stronger dollar to euro exchange rate during

the period, offset somewhat by the reduction in sales of higher

margin Abercrombie & Fitch and Hollister prestige products by

U.S. based operations. While advertising and promotion increased

22.3% from last year’s second quarter, there was little change in

overall selling, general and administrative expenses as a percent

of sales.”

He continued, “The second quarter swing item was below the

operating income line, namely the $817,000 loss on foreign currency

this period versus a $661,000 gain in last year’s second quarter.

Also of note, our effective tax rate was 33% in the current second

quarter versus 36% in last year’s second quarter.”

Mr. Greenberg also pointed out, “We closed the quarter with

working capital of $358 million, including approximately $241

million in cash, cash equivalents and short-term investments, a

working capital ratio of 3.4 to 1 and $69.1 million of long-term

debt including current maturities incurred in connection with the

2015 Rochas brand acquisition.”

Affirms 2017 Guidance

Mr. Greenberg noted, “Our year-to-date performance, coupled with

better than previously anticipated sales of Jimmy Choo, Lanvin,

Rochas, and Coach brand products, motivated the recent increase in

our 2017 guidance. As we reported late last month, we are looking

for 2017 sales to be in the range of $560 million to $570 million

resulting in net income attributable to Inter Parfums, Inc. of

$1.25 to $1.27 per diluted share.” Guidance assumes the dollar

remains at current levels.

Dividend

The Company’s regular quarterly cash dividend of $0.17 per share

will be paid on October 13, 2017 to shareholders of record on

September 29, 2017.

Conference Call

Management will conduct a conference call to discuss financial

results and business developments at 11:00 AM ET on Tuesday, August

8, 2017. Interested parties may participate in the call by dialing

(201) 493-6749; please call in 10 minutes before the conference

call is scheduled to begin and ask for the Inter Parfums call. The

conference call will also be broadcast live over the Internet. To

listen to the live call, please go to www.interparfumsinc.com and

click on the Investor Relations section. If you are unable to

listen live, the conference call will be archived and can be

accessed for approximately 90 days at Inter Parfums’ website.

Founded more than 30 years ago, Inter Parfums, Inc. is a premier

fragrance company with a diverse portfolio of prestige brands that

includes Abercrombie & Fitch, Agent Provocateur, Anna Sui,

bebe, Boucheron, Coach, Dunhill, Hollister, Jimmy Choo, Karl

Lagerfeld, Lanvin, Montblanc, Oscar de la Renta, Paul Smith,

Repetto, Rochas, Shanghai Tang, S.T. Dupont and Van Cleef &

Arpels. The fragrance products developed, produced and distributed

by Inter Parfums are sold in more than 100 countries throughout the

world.

Statements in this release which are not historical in nature

are forward-looking statements. Although we believe that our plans,

intentions and expectations reflected in such forward-looking

statements are reasonable, we can give no assurance that such

plans, intentions or expectations will be achieved. In some cases

you can identify forward-looking statements by forward-looking

words such as "anticipate," "believe," "could," "estimate,"

"expect," "intend," "may," "should," "will," and "would," or

similar words. You should not rely on forward-looking statements,

because actual events or results may differ materially from those

indicated by these forward-looking statements as a result of a

number of important factors. These factors include, but are not

limited to, the risks and uncertainties discussed under the

headings “Forward Looking Statements” and "Risk Factors" in Inter

Parfums' annual report on Form 10-K for the fiscal year ended

December 31, 2016 and the reports Inter Parfums files from time to

time with the Securities and Exchange Commission. Inter Parfums

does not intend to and undertakes no duty to update the information

contained in this press release.

See Accompanying Tables

CONSOLIDATED STATEMENTS OF

INCOME

(In thousands except per share data)

(Unaudited)

Three Months EndedJune 30,

Six Months EndedJune 30,

2017 2016 2017 2016

Net sales $ 129,136

$ 117,157 $ 272,194 $ 228,679

Cost of sales

45,193 42,729 98,181

82,933

Gross margin 83,943 74,428 174,013

145,746

Selling, general and administrative expenses

69,468 62,969 133,367

116,757

Income from operations

14,475 11,459 40,646

28,989

Other expenses (income): Interest

expense 727 693 999 1,666 (Gain) loss on foreign currency 817 (661

) 973 53 Interest income (900 ) (602 ) (2,173

) (1,956 ) 644 (570 )

(201 ) (237 )

Income before income taxes

13,831 12,029 40,847 29,226 Income taxes 4,620

4,300 13,469 12,049

Net income 9,211 7,729 27,378 17,177 Less: Net

income attributable to the noncontrolling interest

2,467

1,898

7,261

4,012

Net income attributable to Inter

Parfums, Inc.

$

6,744

$

5,831

$

20,117

$

13,165

Earnings per share: Net income

attributable to Inter Parfums, Inc. common shareholders: Basic

$ 0.22 $ 0.19 $ 0.65 $ 0.42 Diluted $ 0.22 $ 0.19 $

0.64 $ 0.42

Weighted average number of

shares outstanding: Basic 31,169 31,055 31,157 31,047 Diluted

31,281 31,160 31,268

31,137

Dividends declared per share $

0.17 $ 0.15 $ 0.34 $ 0.30

CONSOLIDATED BALANCE SHEETS

(In thousands except share and per share

data)

(Unaudited)

ASSETS

June 30,2017

December 31,2016

Current assets: Cash and cash equivalents $ 116,772 $

161,828 Short-term investments 123,805 94,202 Accounts receivable,

net 119,364 104,819 Inventories 136,909 96,977 Receivables, other

1,810 7,433 Other current assets 10,246 6,240 Income tax receivable

765 626 Total current assets

509,671 472,125

Equipment and leasehold improvements,

net 10,370 10,076

Trademarks, licenses and other intangible

assets, net 195,596 183,868

Deferred tax assets 8,649

8,090

Other assets 8,184 8,250

Total assets $ 732,470 $ 682,409

LIABILITIES AND EQUITY Current liabilities: Current

portion of long-term debt $ 23,262 $ 21,498 Accounts payable –

trade 67,456 49,507 Accrued expenses 52,397 62,609 Income taxes

payable 3,489 3,331 Dividends payable 5,299

5,293 Total current liabilities 151,903

142,238

Long-term debt, less current

portion 45,881 53,064

Deferred

tax liability 4,286 3,449

Equity: Inter Parfums, Inc. shareholders’ equity:

Preferred stock, $.001 par;

authorized1,000,000 shares; none issued

--

--

Common stock, $.001 par; authorized

100,000,000 shares;outstanding 31,171,908 and 31,138,318 shares

at

June 30, 2017 and December 31, 2016,

respectively

31

31

Additional paid-in capital 64,196 63,103 Retained earnings 412,580

402,714 Accumulated other comprehensive loss (33,406 ) (57,982 )

Treasury stock, at cost, 9,864,805 common

shares atJune 30, 2017 and December 31, 2016, respectively

(37,475

)

(37,475

)

Total Inter Parfums, Inc. shareholders’ equity 405,926

370,391 Noncontrolling interest 124,474

113,267 Total equity 530,400

483,658

Total liabilities and equity $ 732,470

$ 682,409

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170807005782/en/

Inter Parfums, Inc.Russell Greenberg, Exec. VP & CFO(212)

983-2640rgreenberg@interparfumsinc.comwww.interparfumsinc.com-or-Investor

Relations CounselThe Equity Group Inc.Fred Buonocore, (212)

836-9607 / fbuonocore@equityny.comLinda Latman, (212) 836-9609 /

llatman@equityny.comwww.theequitygroup.com

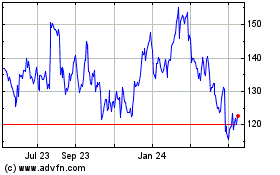

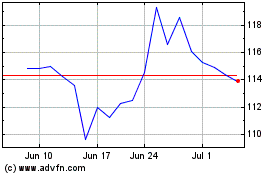

Inter Parfums (NASDAQ:IPAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Inter Parfums (NASDAQ:IPAR)

Historical Stock Chart

From Apr 2023 to Apr 2024