Iovance Biotherapeutics, Inc. (NASDAQ:IOVA), a biotechnology

company developing novel cancer immunotherapies based on

tumor-infiltrating lymphocyte (TIL) technology, today reported its

second quarter 2017 financial results and provided a corporate

update.

“During the second quarter of 2017, we made significant progress

with our robust immuno-oncology pipeline based on our TIL

technology, and reached important milestones. Patient dosing is now

ongoing in two of our three Phase 2 programs and we initiated

dosing patients in cohort 2 of our C-144-01 metastatic melanoma

study, which allows for administration of LN-144 generated through

a shorter manufacturing process,” said Dr. Maria Fardis, Ph.D.,

MBA, Chief Executive Officer of Iovance Biotherapeutics. “In

addition, we presented encouraging interim data at ASCO in June

from cohort 1 of our ongoing C-144-01 Phase 2 study in metastatic

melanoma. The responses were presented by overall response rate and

disease control rate in a heavily pre-treated patient population.

This data also demonstrated that we can manufacture TIL at our

central GMP facilities and treat a patient population with a high

unmet medical need at multiple clinical sites. We plan on selecting

the optimal manufacturing process for our clinical programs based

on the available data from the C-144-01 study, by the end of

2017.

Second Quarter 2017 and Recent Highlights and

Anticipated Milestones

Corporate News:

- Corporate name changed to Iovance

Biotherapeutics: In June, the Company changed its

corporate name from Lion Biotechnologies, Inc. to Iovance

Biotherapeutics, Inc. This new name better represents the company’s

leadership in the field of immuno-oncology and reflects the recent

advancements in evaluating TIL therapy in new indications as well

as initiatives to begin trials in Europe.

- Seeking patents for recent advancements in TIL

technology: Iovance has filed for patent protection on its

generation 2 TIL manufacturing process, methods of using TIL

therapies, as well as other technologies that can lead to

production of better TIL products.

Clinical Trial Progress:

- Patient dosing began in second cohort of C-144-01 Phase

2 metastatic melanoma study: In May,

the Company began patient dosing in the second cohort of its

ongoing Phase 2 trial investigating LN-144 for the treatment of

patients with metastatic melanoma. This cohort has a shorter

manufacturing process, and reduces the time from excision to

infusion from approximately six weeks to just over three weeks, by

utilizing the company’s generation 2 manufacturing process which

includes cryopreservation of the outbound products.

Cryopreservation of the product offers greater flexibility for

physicians and patients in scheduling the time of the infusion, and

the shorter process increases the manufacturing flexibility leading

to lower production costs.

- Two Phase 2 trials

investigating LN-145 are underway: In June, the

Company began patient dosing in its Phase 2 trial of LN-145 for the

treatment of patients with recurrent and/or metastatic squamous

cell carcinoma of the head and neck. The Company is also actively

screening patients in the Phase 2 trial for LN-145 in cervical

cancer.

- New Clinical Grant Agreement with Moffitt Cancer Center

for trial in lung cancer: In July, Iovance entered into a

new Clinical Grant Agreement with the Moffitt Cancer Center to fund

a Phase 1 clinical trial of TIL therapy in combination with

nivolumab in metastatic non-small cell lung cancer (NSCLC) in an

effort to continue to understand the potential power of TIL

technology to treat various cancers in areas of high unmet medical

need.

Manufacturing Updates:

- Technology transfer initiated at PharmaCell in the

Netherlands (now Lonza) for generation 1 and 2 TIL manufacturing

processes: In anticipation of the initiation of clinical

studies in Europe in early 2018, a technology transfer for both the

generation 1 and 2 TIL manufacturing processes was commenced at

PharmaCell.

- Increasing manufacturing capacity:

Manufacturing at Wuxi, in suites capable of manufacturing

late-stage clinical and commercial products, was initiated in May.

Regulatory News:

- Expansion of clinical trials globally: The

Company engaged local health authorities in Europe to seek feedback

in support of submission of a Clinical Trial Authorisation for

melanoma and cervical cancer studies in that region.

Data Presentations:

- Interim data presented at ASCO highlighting first

cohort in ongoing C-144-01 study: The Company presented a

poster at the 2017 American Society of Clinical Oncology (ASCO)

Annual Meeting in June 2017 with data from 16 patients enrolled in

the first cohort of its ongoing Phase 2 study of LN-144 for the

treatment of metastatic melanoma. The data reported showed

clinically-meaningful outcomes, of the evaluable patients, with a

29% ORR including one complete response continuing beyond 15 months

post-administration of a single TIL treatment, and 77% of patients

reported a reduction in target tumor size. The Phase 2 study was

conducted in a heavily pre-treated patient group, all of which had

received prior anti-PD-1 therapy and 88% with prior anti-CTLA-4

checkpoint inhibitors, with a median of three prior therapies. For

the full data, please view the release here.

- Data to be presented at the upcoming European Society

for Medical Oncology (ESMO) 2017 Congress in Madrid, Spain in

September 2017: Data will be presented at the upcoming

ESMO congress demonstrating phenotypic and functional

characterization of TIL grown from lymphoma tumors.

Second Quarter 2017 Financial and Operating

Results

As of June 30, 2017, the Company held $129.0 million in cash and

cash equivalents and short-term investments, compared to $166.5

million as of December 31, 2016.

In connection with hiring Maria Fardis Ph.D. as the new Chief

Executive Officer, on June 1, 2016 the Company granted to Dr.

Fardis 550,000 non-transferrable restricted stock units as an

inducement of employment pursuant to the exception to The NASDAQ

Global Market rules. The 550,000 restricted stock units vest in

installments as follows: (i) 137,500 restricted stock units vested

June 1, 2017; (ii) 275,000 restricted stock units vested upon the

satisfaction of certain clinical and manufacturing milestones; and

(iii) the remaining 137,500 restricted stock units will vest in

equal monthly installments over the 36-month period after June 1,

2017.

The Company is providing both GAAP and non-GAAP financial

information. All non-GAAP information excludes amounts related to

stock-based compensation. See “Use of Non-GAAP Financial Measures”

below for a description of the Company’s non-GAAP Financial

Measures. Reconciliation between certain GAAP and non-GAAP measures

is provided at the end of this press release.

GAAP and Non-GAAP Net Loss

GAAP net loss for the quarter ended June 30, 2017 was $23.4

million, or ($0.37) per share, compared to GAAP net loss of $11.6

million or ($0.23) per share for the quarter ended June 30,

2016.

Non-GAAP net loss for the quarter ended June 30, 2017 was $20.1

million, or ($0.32) per share, compared to non-GAAP net loss of

$6.2 million, or ($0.13) per share for the quarter ended June 30,

2016. The non-GAAP net loss for the quarters ended June 30, 2017

and June 30, 2016 excludes $3.3 million and $5.4 million of

non-cash stock-based compensation, respectively.

GAAP net loss for the six months ended June 30, 2017 was $44.1

million, or ($0.71) per share, compared to GAAP net loss of $18.5

million or ($0.37) per share for the six months ended June 30,

2016. Non-GAAP net loss for the six months ended June 30, 2017 was

$37.5 million, or ($0.60) per share, compared to non-GAAP net loss

of $11.3 million or ($0.23) per share for the six months ended June

30, 2016.

GAAP and Non-GAAP Expenses GAAP

research and development (R&D) expenses were $19.7 million for

the quarter ended June 30, 2017, an increase of $15.2 million

compared to the quarter ended June 30, 2016. The increase in

R&D expense is due to increased spending on clinical activities

and manufacturing. In addition, R&D-associated stock based

expenses were $1.9 million for the three months ended June 30, 2017

and $3.3 million for the six months ended June 30, 2017. Non-GAAP

R&D expenses were $17.8 million for the quarter ended June 30,

2017, an increase of $13.9 million, compared to $3.9 million for

the quarter ended June 30, 2016.

GAAP general and administrative (G&A) expenses were $3.9

million for the quarter ended June 30, 2017, a decrease of $3.4

million compared to the quarter ended June 30, 2016. Non-GAAP

G&A expenses for both quarters ended June 30, 2017 and June 30,

2016 remained unchanged at $2.5 million.

Use of Non-GAAP Financial Measures

This press release contains non-GAAP financial measures,

including expenses adjusted to exclude certain non-cash expenses.

These measures are not in accordance with, or an alternative to,

generally accepted accounting principles, or GAAP, and may be

different from non-GAAP financial measures used by other companies.

The item included in GAAP presentations but excluded for purposes

of determining non-GAAP financial measures for the periods

presented in this press release relates to the non-cash stock-based

compensation expense which may fluctuate from period to period

based on factors including the timing and accounting of grants for

stock options and changes in the Company’s stock price which

impacts the fair value of options granted. The Company believes the

presentation of non-GAAP financial measures provides useful

information to management and investors regarding various financial

and business trends relating to the Company’s financial condition

and results of operations. When GAAP financial measures are viewed

in conjunction with non-GAAP financial measures, investors are

provided with a more meaningful understanding of Iovance’s ongoing

operating performance. In addition, these non-GAAP financial

measures are among those indicators the Company uses as a basis for

evaluating operational performance, allocating resources and

planning and forecasting future periods. Non-GAAP financial

measures are not intended to be considered in isolation or as a

substitute for GAAP financial measures. To the extent this release

contains historical or future non-GAAP financial measures, the

Company has also provided corresponding GAAP financial measures for

comparative purposes. Reconciliation between certain GAAP and

non-GAAP measures is provided at the end of this press release.

Webcast and Conference Call

Iovance will host a conference call today at 5:00 p.m. ET to

discuss these second quarter 2017 results. The conference call

dial-in numbers are: 1-844-646-4465 (domestic) or 1-615-247-0257

(international). The conference ID access number for the call is

47307932. The live webcast can be accessed under “News &

Events” in the “Investors” section of the Company’s website at

http://www.iovance.com/ or you may use the link:

http://edge.media-server.com/m/p/so22t2sr.

A replay of the call will be available one hour after the end of

the call on August 1, 2017 until 8:00 p.m. ET on August 31, 2017.

To access the replay, please dial 1-855-859-2056 (domestic) or

1-404-537-3406 (international). The conference ID number for the

replay is 47307932. The archived webcast will be available for

thirty days in the Investors section of Iovance Biotherapeutics’

website at http://www.iovance.com/

About Iovance Biotherapeutics, Inc. (formerly

Lion Biotechnologies, Inc.)Iovance Biotherapeutics, Inc. is a

clinical-stage biotechnology company focused on the development of

cancer immunotherapy products for the treatment of various cancers.

The Company's lead product candidate is an adoptive cell therapy

using tumor-infiltrating lymphocyte (TIL) technology being

investigated for the treatment of patients with metastatic

melanoma, recurrent and/or metastatic squamous cell carcinoma of

the head and neck and recurrent and metastatic or persistent

cervical cancer. For more information, please

visit http://www.iovance.com.

Forward-Looking Statements Certain matters

discussed in this press release are “forward-looking statements”.

We may, in some cases, use terms such as “predicts,” “believes,”

“potential,” “continue,” “estimates,” “anticipates,” “expects,”

“plans,” “intends,” “may,” “could,” “might,” “will,” “should” or

other words that convey uncertainty of future events or outcomes to

identify these forward-looking statements. In particular, the

Company’s statements regarding trends and potential future results

are examples of such forward-looking statements. The

forward-looking statements include risks and uncertainties,

including, but not limited to, the success, timing and cost of our

ongoing clinical trials and anticipated clinical trials for our

current product candidates, including statements regarding the

timing of initiation and completion of the trials; the timing of

and our ability to obtain and maintain U.S. Food and Drug

Administration or other regulatory authority approval of, or other

action with respect to, our product candidates; the strength of

Company’s product pipeline; the successful implementation of the

Company’s research and development programs and collaborations; the

success of the Company’s license or development agreements; the

acceptance by the market of the Company’s product candidates, if

approved; and other factors, including general economic conditions

and regulatory developments, not within the Company’s control. The

factors discussed herein could cause actual results and

developments to be materially different from those expressed in or

implied by such statements. A further list and description of

the Company’s risks, uncertainties and other factors can be found

in the Company’s most recent Annual Report on Form 10-K and the

Company's subsequent filings with the Securities and Exchange

Commission. Copies of these filings are available online at

www.sec.gov or www.iovance.com. The forward-looking statements are

made only as of the date of this press release and the Company

undertakes no obligation to publicly update such forward-looking

statements to reflect subsequent events or circumstance.

| |

|

|

|

|

|

|

|

| Iovance Biotherapeutics, Inc. |

| Selected Consolidated Balance Sheet

Data |

| (unaudited; in thousands) |

| |

|

|

|

|

|

|

|

| |

|

|

June 30, |

|

|

|

December 31, |

| |

|

|

2017 |

|

|

|

2016 |

| Cash, cash equivalents

and short-term investments |

|

$ |

129,017 |

|

|

$ |

166,470 |

| Total assets |

|

$ |

138,012 |

|

|

$ |

171,886 |

| Stockholders'

equity |

|

$ |

129,152 |

|

|

$ |

166,918 |

| |

|

|

|

|

|

|

|

| |

| Condensed Consolidated Statements of Operations |

| (in thousands, except per share

information) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended

June 30, |

|

|

For the Six Months Ended June

30, |

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Costs and

expenses* |

|

|

|

|

|

|

|

|

|

|

|

| Research

and development |

|

19,653 |

|

|

|

4,463 |

|

|

|

36,276 |

|

|

|

8,655 |

|

| General

and administrative |

|

3,928 |

|

|

|

7,264 |

|

|

|

8,188 |

|

|

|

10,082 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

costs and expenses |

|

23,581 |

|

|

|

11,727 |

|

|

|

44,464 |

|

|

|

18,737 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(23,581 |

) |

|

|

(11,727 |

) |

|

|

(44,464 |

) |

|

|

(18,737 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

income |

|

|

|

|

|

|

|

|

|

|

|

| Interest

income |

|

204 |

|

|

|

164 |

|

|

|

403 |

|

|

|

290 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Loss |

$ |

(23,377 |

) |

|

$ |

(11,563 |

) |

|

$ |

(44,061 |

) |

|

$ |

(18,447 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss Per

Common Share, Basic and Diluted |

$ |

(0.37 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.71 |

) |

|

$ |

(0.37 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-Average Common Shares Outstanding,

Basic and Diluted |

|

62,457 |

|

|

|

51,082 |

|

|

|

62,371 |

|

|

|

49,807 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| * Includes

stock-based compensation as follows |

|

|

|

|

|

|

|

|

|

|

|

| Research

and development |

$ |

1,896 |

|

|

$ |

593 |

|

|

$ |

3,283 |

|

|

$ |

1,178 |

|

| General

and administrative |

|

1,397 |

|

|

|

4,764 |

|

|

|

3,306 |

|

|

|

5,958 |

|

| |

$ |

3,293 |

|

|

$ |

5,357 |

|

|

$ |

6,589 |

|

|

$ |

7,136 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

| Iovance Biotherapeutics, Inc.

(1) |

| Reconciliation of Selected GAAP Measures to

Non-GAAP |

| (unaudited; in thousands, except per share

data) |

| |

| |

|

For the Three Months Ended

June 30, |

|

|

For the Six Months Ended June

30, |

| |

|

|

2017 |

|

|

|

|

2016 |

|

|

|

|

2017 |

|

|

|

|

2016 |

|

| Reconciliation

of GAAP to non-GAAP Research and development |

|

|

|

|

|

|

|

|

|

|

|

| GAAP Research and

development |

$ |

|

19,653 |

|

|

$ |

|

4,463 |

|

|

$ |

|

36,276 |

|

|

$ |

|

8,655 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

| Non-cash

stock-based compensation (2) |

|

|

(1,896 |

) |

|

|

|

(593 |

) |

|

|

|

(3,283 |

) |

|

|

|

(1,178 |

) |

| Non-GAAP Research and

development |

$ |

|

17,757 |

|

|

$ |

|

3,870 |

|

|

$ |

|

32,993 |

|

|

$ |

|

7,477 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation

of GAAP to non-GAAP General and administrative |

|

|

|

|

|

|

|

|

|

|

|

| GAAP General and

administrative |

$ |

|

3,928 |

|

|

$ |

|

7,264 |

|

|

$ |

|

8,188 |

|

|

$ |

|

10,082 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

| Non-cash

stock-based compensation (2) |

|

|

(1,397 |

) |

|

|

|

(4,764 |

) |

|

|

|

(3,306 |

) |

|

|

|

(5,958 |

) |

| Non-GAAP General and

administrative |

$ |

|

2,531 |

|

|

$ |

|

2,500 |

|

|

$ |

|

4,882 |

|

|

$ |

|

4,124 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Net

loss reconciliation |

|

|

|

|

|

|

|

|

|

|

|

| GAAP Net loss |

$ |

|

(23,377 |

) |

|

$ |

|

(11,563 |

) |

|

$ |

|

(44,061 |

) |

|

$ |

|

(18,447 |

) |

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

| Non-cash

stock-based compensation (2) |

|

|

3,293 |

|

|

|

|

5,357 |

|

|

|

|

6,589 |

|

|

|

|

7,136 |

|

| Non-GAAP Net loss |

$ |

|

(20,084 |

) |

|

$ |

|

(6,206 |

) |

|

$ |

|

(37,472 |

) |

|

$ |

|

(11,311 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended

June 30, |

|

|

For the Six Months Ended June

30, |

| |

|

|

2017 |

|

|

|

|

2016 |

|

|

|

|

2017 |

|

|

|

|

2016 |

|

| Non-GAAP net

loss per share reconciliation |

|

|

|

|

|

|

|

|

|

|

|

| GAAP net loss per basic

and diluted share: |

$ |

|

(0.37 |

) |

|

$ |

|

(0.23 |

) |

|

$ |

|

(0.71 |

) |

|

$ |

|

(0.37 |

) |

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

| Non-cash

stock-based compensation (2) |

|

|

0.05 |

|

|

|

|

0.10 |

|

|

|

|

0.11 |

|

|

|

|

0.14 |

|

| Non-GAAP net loss per

basic and diluted share |

$ |

|

(0.32 |

) |

|

$ |

|

(0.13 |

) |

|

$ |

|

(0.60 |

) |

|

$ |

|

(0.23 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-Average Common Shares Outstanding,

Basic and Diluted |

|

|

62,457 |

|

|

|

|

51,082 |

|

|

|

|

62,371 |

|

|

|

|

49,807 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

- This presentation includes non-GAAP measures. The Company’s

non-GAAP measures are not meant to be considered in isolation or as

a substitute for comparable GAAP measures and should be read only

in conjunction with its financial statements prepared in accordance

with GAAP.

- All stock-based compensation was excluded for the non-GAAP

analysis.

Investor Relations Contact:

Sarah McCabe

Stern Investor Relations, Inc.

212-362-1200

sarah@sternir.com

Media Relations Contact:

Evan Smith/Kotaro Yoshida

FTI Consulting

212-850-5622/212-850-5690

evan.smith@fticonsulting.com

kotaro.yoshida@fticonsulting.com

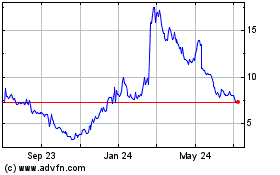

Iovance Biotherapeutics (NASDAQ:IOVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

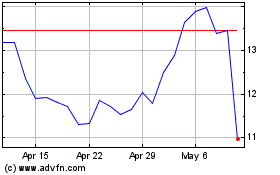

Iovance Biotherapeutics (NASDAQ:IOVA)

Historical Stock Chart

From Apr 2023 to Apr 2024