Discover Misses Earnings Expectations as Profit Falls 11%

July 26 2017 - 6:03PM

Dow Jones News

By AnnaMaria Andriotis

Discover Financial Services reported second-quarter earnings

after the market close Wednesday that fell short of analysts'

expectations largely due to the company setting aside more cash to

cover future loan losses.

Profit for the quarter fell 11% to $546 million, or $1.40 a

share, from $616 million, or $1.47 a share a year earlier. Analysts

polled by Thomson Reuters expected profit of $551 million and

earnings of $1.45 a share.

Discover shares fell 3.8% in after-hours trading.

The company's revenue net of interest expense came in at $2.42

billion, slightly above analysts' expectations and up 9% from a

year ago. That was driven by higher net interest income, helped by

rising interest rates and growing balances. The company's

credit-card yield increased 0.24 of a percentage point from a year

ago due to the rising prime rate.

Provisions for loan losses increased 55% from a year earlier to

$640 million.

Discover reported a total net charge-off rate, which reflects

losses on credit cards, personal and student loans, of 2.71% for

the second quarter, up 0.53 percentage point from a year ago.

Discover revised its 2017 guidance for charge-offs to a range of

2.7% to 2.8%. In the first quarter, management guided to a 0.3 to

0.35 percentage point increase in the credit-loss rate for the full

year with an implied a credit-loss rate between 2.55%-2.60%

Net charge-offs for credit cards increased to 2.94% in the

second quarter, up from 2.84% in the first quarter and 2.39% a year

ago

Operating expenses remained fairly steady at $912 million,

rising 1% year over year.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

July 26, 2017 17:48 ET (21:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

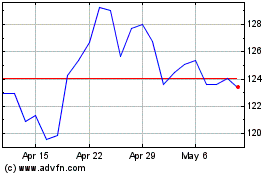

Discover Financial Servi... (NYSE:DFS)

Historical Stock Chart

From Mar 2024 to Apr 2024

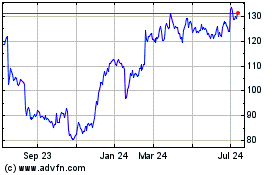

Discover Financial Servi... (NYSE:DFS)

Historical Stock Chart

From Apr 2023 to Apr 2024