Chipotle Mexican Grill, Inc. (NYSE: CMG) today reported

financial results for its second quarter ended June 30, 2017.

Overview for the three months ended June 30, 2017 as compared

to the three months ended June 30, 2016:

- Revenue increased 17.1% to $1.17

billion

- Comparable restaurant sales increased

8.1%

- Restaurant level operating margin

increased to 18.8% from 15.5%

- Net income was $66.7 million, an

increase from $25.6 million

- Diluted earnings per share was $2.32,

an increase from $0.87

- Opened 50 new restaurants, and closed

two restaurants

Overview for the six months ended June 30, 2017 as compared

to the six months ended June 30, 2016:

- Revenue increased 22.1% to $2.24

billion

- Comparable restaurant sales increased

12.5%

- Restaurant level operating margin was

18.3%, an increase from 11.6%

- Net income was $112.9 million, an

increase from a net loss of $0.8 million

- Diluted earnings per share was $3.92,

an increase from diluted loss per share of $0.03

- Opened 107 new restaurants and closed

or relocated 18 restaurants, including the closure of 15 ShopHouse

locations

“We saw encouraging signs in our improved financial results

during the first half of the year. Recent events, however, have

shown that we still have a lot of opportunity to improve our

operations and deliver the outstanding experience that our

customers expect,” said Steve Ells, Founder, Chairman and CEO of

Chipotle. “We will continue to strengthen our teams, enhance our

technology, and expand our menu offerings in order to delight every

customer who visits us.”

Second quarter 2017 results

Revenue for the quarter was $1.17 billion, up 17.1% from the

second quarter of 2016. The increase in revenue was driven by new

restaurant openings and an 8.1% increase in comparable restaurant

sales. Comparable restaurant sales improved primarily due to an

increase in customer visits, along with an increase in average

check as a result of a reduction in promotional activity. We opened

50 new restaurants during the quarter, and closed two restaurants,

bringing the total restaurant count to 2,339.

Food costs were 34.1% of revenue, a decrease of 10 basis points

as compared to the second quarter of 2016. Higher avocado costs

were offset by lower costs from bringing the preparation of lettuce

and bell peppers back into our restaurants, as well as the benefit

of menu price increases in select restaurants in the second quarter

of 2017, and a decrease in paper usage and costs.

Restaurant level operating margin was 18.8% in the quarter, an

improvement from 15.5% in the second quarter of 2016. The increase

was driven primarily by sales leverage along with more efficient

scheduling and deployment of our managers and crew. Marketing and

promotional expenses were 3.7% of sales, or 70 basis points lower

than the second quarter of 2016, due primarily to lower promotional

costs and sales leverage.

General and administrative expenses were 6.0% of revenue for the

second quarter of 2017, a decrease of 110 basis points over the

second quarter of 2016 primarily due to sales leverage. In dollar

terms, general and administrative expenses decreased $0.7 million

compared to the second quarter of 2016 due to lower legal expenses,

partially offset by increased bonus expenses and non-cash stock

based compensation expense.

Net income for the second quarter of 2017 increased 161% to

$66.7 million, or $2.32 per diluted share, compared to net income

of $25.6 million, or $0.87 per diluted share, in the second quarter

of 2016.

Results for the six months ended June 30, 2017

Revenue for the first six months of 2017 was $2.24 billion, up

22.1% from the first six months of 2016. The increase in revenue

was driven by a 12.5% increase in comparable restaurant sales and

to a lesser extent by new restaurant openings. Comparable

restaurant sales improved primarily due to an increase in customer

visits, along with an increase in average check as a result of a

reduction in promotional activity.

We opened 107 new restaurants during the first six months of

2017, and closed or relocated 18 restaurants, including the closure

of 15 ShopHouse restaurants, bringing the total restaurant count to

2,339.

Food costs were 34.0% of revenue, a decrease of 70 basis points

as compared to the first six months of 2016. The decrease was

driven by cost savings from bringing the preparation of lettuce and

bell peppers back to our restaurants, and lower food waste and

testing costs. These combined cost savings were partially offset by

higher avocado prices.

Restaurant level operating margin was 18.3% for the six months

ended June 30, 2017, an improvement from 11.6% in the first six

months of 2016. The increase was driven by sales leverage, labor

efficiencies, and a decrease in promotional expenses. Marketing and

promotional expenses were 3.5% of revenue during the first six

months of 2017 compared to 5.4% of revenue during the first six

months of 2016.

General and administrative expenses were 6.2% of revenue for the

first six months of 2017, a decrease of 100 basis points compared

to the first six months of 2016, primarily due to sales leverage.

In dollar terms, general and administrative costs increased $6.8

million compared to the first six months of 2016 due to increased

non-cash stock based compensation expense and bonus expense,

partially offset by lower legal costs, and lower meeting costs due

to an all-team employee meeting held in February 2016. Stock

compensation expense was higher during the first six months of 2017

because the first six months of 2016 included a reduction in

expense for performance share awards that were no longer expected

to vest against performance criteria.

Net income for the first six months of 2017 was $112.9 million,

or $3.92 per diluted share, compared to net loss of $0.8 million,

or $0.03 per diluted share, for the six months ended June 30,

2016.

Update on Data Security Investigation

Chipotle also reported today the completion of a forensic

investigation into the previously-disclosed payment card security

incident involving Chipotle restaurants. Based on the findings of

the investigation as of May 26, 2017, Chipotle posted a list of

restaurants apparently affected and specific time frames, along

with steps guests can take, at www.chipotle.com/security and

www.chipotle.ca/security. The time frames that were initially

listed varied by restaurant but began no earlier than March 24,

2017, and ended no later than April 18, 2017. Updated findings from

the completed investigation have confirmed the original time frames

listed for almost 99% of the restaurants, or found that some were

even shorter than what was originally reported. For 1.2% of the

affected restaurants, the time frames were slightly broadened from

what was initially listed, although still within the March 24,

2017, to April 18, 2017, time frame. Additionally, for one

restaurant, the time frame may include March 17, 2017, and two

additional restaurants have been added to the list of affected

restaurants in Canada.

To view the updated time frames by restaurant, guests can visit

www.Chipotle.com/security (U.S. locations) or

www.chipotle.ca/security (Canada locations).

Outlook

For 2017, management targets:

- Comparable restaurant sales increases

in the high single digits

- 195 – 210 new restaurant openings

- An estimated effective full year tax

rate of approximately 38.4%

Definitions

The following definitions apply to these terms as used

throughout this release:

Comparable restaurant sales, or sales comps, represent

the change in period-over-period sales for restaurants in operation

for at least 13 full calendar months.

Comparable restaurant transactions represent the change

in period-over-period transactions, including transactions with no

sales dollars due to promotional discounts, for restaurants in

operation for at least 13 full calendar months.

Restaurant level operating margin represents total

revenue less restaurant operating costs, expressed as a percent of

total revenue.

Conference Call

Chipotle will host a conference call to discuss its second

quarter 2017 financial results on Tuesday, July 25, 2017, at 4:30

PM Eastern time.

The conference call can be accessed live over the phone by

dialing 1-877-451-6152 or for international callers by dialing

1-201-389-0879. The call will be webcast live from the company's

website at chipotle.com under the investor relations section. An

archived webcast will be available approximately one hour after the

end of the call.

About Chipotle

Steve Ells, Founder, Chairman and CEO, started Chipotle with the

idea that food served fast did not have to be a typical fast food

experience. Today, Chipotle continues to offer a focused menu of

burritos, tacos, burrito bowls, and salads made from fresh,

high-quality raw ingredients, prepared using classic cooking

methods and served in an interactive style allowing people to get

exactly what they want. Chipotle seeks out extraordinary

ingredients that are not only fresh, but that are raised

responsibly, with respect for the animals, land, and people who

produce them. Chipotle prepares its food using real, whole

ingredients, and is the only national restaurant brand that

prepares its food using no added colors, flavors or other

industrial additives typically found in fast food. Chipotle opened

with a single restaurant in Denver in 1993 and now operates more

than 2,300 restaurants. For more information, visit

chipotle.com.

Forward-Looking Statements

Certain statements in this press release, including statements

under the heading “Outlook” of our expected comparable restaurant

sales increases, number of new restaurant openings, and effective

tax rate for 2017, are forward-looking statements as defined in the

Private Securities Litigation Reform Act of 1995. We use words such

as “anticipate,” “believe,” “could,” “continue,” “should,”

“estimate,” “expect,” “intend,” “may,” “predict,” “project,”

“target,” and similar terms and phrases, including references to

assumptions, to identify forward-looking statements. The

forward-looking statements in this press release are based on

information available to us as of the date any such statements are

made and we assume no obligation to update these forward-looking

statements. These statements are subject to risks and uncertainties

that could cause actual results to differ materially from those

described in the statements. These risks and uncertainties include,

but are not limited to, the following: the uncertainty of our

ability to achieve expected levels of comparable restaurant sales

due to factors such as changes in consumers’ perceptions of our

brand, including as a result of food-borne illness incidents,

the impact of competition, including from sources outside the

restaurant industry, decreased overall consumer spending, or our

possible inability to increase menu prices or realize the benefits

of menu price increases; the risk of food-borne illnesses and other

health concerns about our food or dining out generally; factors

that could affect our ability to achieve and manage our planned

expansion, such as the availability of a sufficient number of

suitable new restaurant sites and the availability of qualified

employees; the performance of new restaurants and their impact on

existing restaurant sales; increases in the cost of food

ingredients and other key supplies or higher food costs due to

changes in supply chain protocols; the potential for increased

labor costs or difficulty retaining qualified employees, including

as a result of market pressures, enhanced food safety procedures in

our restaurants, or new regulatory requirements; risks related to

our marketing and advertising strategies, which may not be

successful and may expose us to liabilities; security risks

associated with the acceptance of electronic payment cards or

electronic storage and processing of confidential customer or

employee information; risks relating to our expansion into new

markets; the impact of federal, state or local government

regulations relating to our employees, our restaurant design, or

the sale of food or alcoholic beverages; risks associated with our

Food With Integrity philosophy, including supply shortages and

potential liabilities from advertising claims and other marketing

activities related to Food With Integrity; risks relating to

litigation, including possible governmental actions related to

food-borne illness incidents, as well as class action litigation

regarding employment laws, advertising claims or other matters;

risks relating to our insurance coverage and self-insurance; our

dependence on key personnel and uncertainties arising from recent

changes in our leadership; risks regarding our ability to protect

our brand and reputation; risks associated with our ability to

effectively manage our growth; and other risk factors described

from time to time in our SEC reports, including our most recent

annual report on Form 10-K and subsequent quarterly reports on Form

10-Q, all of which are available on the investor relations page of

our website at ir.chipotle.com.

Chipotle Mexican Grill, Inc. Condensed Consolidated

Statement of Operations and Comprehensive Income (in

thousands, except per share data) (unaudited)

Three months ended June 30, 2017

2016 Revenue $ 1,169,409

100.0

%

$ 998,383

100.0

%

Restaurant operating costs (exclusive of depreciation and

amortization shown separately below): Food, beverage and packaging

399,152 34.1 341,902 34.2 Labor 305,851 26.2 276,926 27.7 Occupancy

80,321 6.9 72,354 7.2 Other operating costs 163,685 14.0 152,156

15.2 General and administrative expenses 70,075 6.0 70,756 7.1

Depreciation and amortization 41,081 3.5 36,074 3.6 Pre-opening

costs 2,903 0.2 4,133 0.4 (Gain) loss on disposal and impairment of

assets (384 ) - 3,187 0.3 Total

operating expenses 1,062,684 90.9

957,488 95.9 Income from operations 106,725 9.1

40,895 4.1 Interest and other income, net 1,049 0.1

786 0.1 Income before income taxes

107,774 9.2 41,681 4.2 Provision for income taxes (41,044 )

(3.5 ) (16,085 ) (1.6 ) Net income $ 66,730

5.7

%

$ 25,596

2.6

%

Other comprehensive income (loss), net of income taxes Foreign

currency translation adjustments 2,136 (765 ) Unrealized gain

(loss) on investments, net of tax benefit (expense) of $37 and

($348) (58 ) 509 Other comprehensive income

(loss), net of income taxes 2,078 (256 )

Comprehensive income $ 68,808 $ 25,340 Earnings per

share: Basic $ 2.33 $ 0.88 Diluted $ 2.32 $

0.87 Weighted average common shares outstanding: Basic

28,649 29,207 Diluted 28,800

29,340

Chipotle Mexican

Grill, Inc. Condensed Consolidated Statement of Operations

and Comprehensive Income (in thousands, except per share

data) (unaudited) Six months

ended June 30, 2017 2016 Revenue $

2,238,238

100.0

%

$ 1,832,842

100.0

%

Restaurant operating costs (exclusive of depreciation and

amortization shown separately below): Food, beverage and packaging

760,947 34.0 636,068 34.7 Labor 593,702 26.5 534,607 29.2 Occupancy

159,283 7.1 142,946 7.8 Other operating costs 314,294 14.0 307,345

16.8 General and administrative expenses 139,516 6.2 132,766 7.2

Depreciation and amortization 80,360 3.6 70,862 3.9 Pre-opening

costs 6,972 0.3 8,554 0.5 Loss on disposal and impairment of assets

3,266 0.1 5,403 0.3 Total

operating expenses 2,058,340 92.0

1,838,551 100.3 Income (loss) from operations 179,898

8.0 (5,709 ) (0.3 ) Interest and other income, net 2,237

0.1 2,912 0.2 Income (loss)

before income taxes 182,135 8.1 (2,797 ) (0.2 ) Benefit (provision)

for income taxes (69,285 ) (3.1 ) 1,961 0.1

Net income (loss) $ 112,850

5.0

%

$ (836 )

(0.0

)%

Other comprehensive income, net of income taxes Foreign currency

translation adjustments 2,811 1,164 Unrealized gain (loss) on

investments, net of income taxes of $131 and ($1,531) (240 )

2,402 Other comprehensive income, net of income taxes

2,571 3,566 Comprehensive income $

115,421 $ 2,730 Earnings per share: Basic $ 3.93

$ (0.03 ) Diluted $ 3.92 $ (0.03 ) Weighted average

common shares outstanding: Basic 28,699 29,550

Diluted 28,825 29,550

Chipotle Mexican Grill, Inc. Condensed

Consolidated Balance Sheet (in thousands, except per share

data) June 30,

December 31, 2017 2016 (unaudited)

Assets Current assets: Cash and cash equivalents $ 175,137 $

87,880 Accounts receivable, net of allowance for doubtful accounts

of $39 and $259 as of June 30, 2017 and December 31, 2016,

respectively 24,940 40,451 Inventory 19,126 15,019 Prepaid expenses

and other current assets 50,296 44,080 Income tax receivable -

5,108 Investments 394,466 329,836 Total

current assets 663,965 522,374 Leasehold improvements, property and

equipment, net 1,328,280 1,303,558 Long term investments - 125,055

Other assets 54,367 53,177 Goodwill 21,939

21,939 Total assets $ 2,068,551 $ 2,026,103

Liabilities and shareholders' equity Current liabilities:

Accounts payable $ 80,976 $ 78,363 Accrued payroll and benefits

85,169 76,301 Accrued liabilities 98,311 127,129 Income tax payable

3,329 - Total current liabilities

267,785 281,793 Deferred rent 301,825 288,927 Deferred income tax

liability 12,866 18,944 Other liabilities 35,879

33,946 Total liabilities 618,355

623,610 Shareholders' equity: Preferred stock, $0.01 par

value, 600,000 shares authorized, no shares issued as of June 30,

2017 and December 31, 2016, respectively - - Common stock $0.01 par

value, 230,000 shares authorized, and 35,849 and 35,833 shares

issued as of June 30, 2017 and December 31, 2016, respectively 358

358 Additional paid-in capital 1,276,285 1,238,875 Treasury stock,

at cost, 7,264 and 7,019 common shares at June 30, 2017 and

December 31, 2016, respectively (2,154,517 ) (2,049,389 )

Accumulated other comprehensive income (loss) (5,591 ) (8,162 )

Retained earnings 2,333,661 2,220,811

Total shareholders' equity 1,450,196 1,402,493

Total liabilities and shareholders' equity $ 2,068,551

$ 2,026,103

Chipotle Mexican Grill,

Inc. Condensed Consolidated Statement of Cash Flows

(unaudited) (in thousands)

Six months ended June 30, 2017

2016 Operating activities Net income (loss) $ 112,850

$ (836 ) Adjustments to reconcile net income (loss) to net cash

provided by operating activities: Depreciation and amortization

80,360 70,862 Deferred income tax (benefit) provision (5,939 )

3,789 Loss on disposal and impairment of assets 3,266 5,403 Bad

debt allowance 181 (120 ) Stock-based compensation expense 36,846

30,038 Excess tax benefit on stock-based compensation - (1,982 )

Other (107 ) (352 ) Changes in operating assets and liabilities:

Accounts receivable 15,372 15,201 Inventory (4,530 ) (1,921 )

Prepaid expenses and other current assets (6,143 ) (12,267 ) Other

assets (984 ) 1,832 Accounts payable 8,271 (13,675 ) Accrued

liabilities (21,856 ) 31,973 Income tax payable/receivable 8,480

34,919 Deferred rent 15,463 16,944 Other long-term liabilities

2,052 (143 ) Net cash provided by operating

activities 243,582 179,665

Investing

activities Purchases of leasehold improvements, property and

equipment (113,715 ) (126,712 ) Purchases of investments (19,922 )

- Maturities of investments 80,000 45,000 Proceeds from sale of

investments - 540,648 Net cash provided

by (used in) investing activities (53,637 ) 458,936

Financing activities Acquisition of treasury stock

(103,827 ) (700,036 ) Excess tax benefit on stock-based

compensation - 1,982 Stock plan transactions and other financing

activities 9 12 Net cash used in

financing activities (103,818 ) (698,042 ) Effect of

exchange rate changes on cash and cash equivalents 1,130 1,396 Net

change in cash and cash equivalents 87,257 (58,045 ) Cash and cash

equivalents at beginning of period 87,880

248,005 Cash and cash equivalents at end of period $ 175,137

$ 189,960

Chipotle Mexican Grill,

Inc. Supplemental Financial and Other Data (dollars

in thousands) For the three months

ended Jun. 30, Mar. 31,

Dec. 31, Sep. 30,

Jun. 30, 2017 2017 2016 2016

2016 Number of restaurants opened 50 57 72 55 58 Restaurant

relocations/closures (2 ) (16 ) - (1 ) - Number of restaurants at

end of period 2,339 2,291 2,250 2,178 2,124 Average restaurant

sales $ 1,957 $ 1,931 $ 1,868 $ 1,914 $ 2,067 Comparable restaurant

sales increase (decrease) 8.1 % 17.8 % (4.8 %) (21.9 %) (23.6 %)

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170725006381/en/

Chipotle Mexican Grill, Inc.Mark Alexee,

303-605-1042malexee@chipotle.com

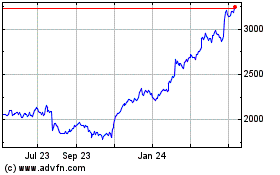

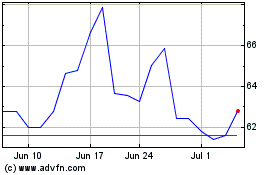

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Apr 2023 to Apr 2024