14% EPS Growth and 40-Basis Point Operating

Margin Expansion

Watsco, Inc. (NYSE: WSO) reported record results for the second

quarter and six months ended June 30, 2017. The results reflect

continued investment in a variety of technologies to revolutionize

Watsco’s customer-experience, create a data-driven culture, to

empower more insightful decision-making and enhance productivity

and operational efficiency. The Company has also made additional

investments in products and people to grow and develop market share

for supplier partners.

Second Quarter Results

Key performance metrics:

- 14% increase in earnings per share to a

record $2.07

- 10% increase in operating income to a

record $129 million

- 40 basis-point expansion in operating

margins to 10.1%

- 30 basis-point improvement in gross

profit margin

- 10 basis-point reduction in SG&A as

a percentage of sales

Sales trends:

- 5% sales growth to a record $1.28

billion

- 7% increase in HVAC equipment (67% of

sales), including 8% growth in the U.S.

- 2% increase in other HVAC products (28%

of sales)

- 3% growth in commercial refrigeration

products (5% of sales)

Albert H. Nahmad, Watsco’s Chairman and CEO stated: “Our second

quarter performance produced the highest sales and profits of any

quarter in Watsco's history. Earnings growth and margin expansion

were driven by a combination of solid sales growth, improved

selling margins and operating efficiencies."

Mr. Nahmad added: “We believe technology changes progressing in

our industry will accelerate and our industry-specific focus, scale

and leadership position will serve us well. In time, we believe

peers and competitors will realize that Watsco is an attractive

succession plan and join forces with us to adapt and evolve in the

changing environment. In this regard, we continue to actively seek

acquisitions and investments to grow our network and leverage

investments across an expanding enterprise.”

First-Half Results

Key performance metrics:

- 10% increase in earnings per share to a

record $2.80

- 6% increase in operating income to a

record $178 million

- 20 basis-point expansion in operating

margins to 8.3%

- 20 basis-point improvement in gross

profit margin

- Flat SG&A as a percentage of

sales

Sales trends:

- 4% sales growth to a record $2.15

billion

- 5% increase in HVAC equipment (66% of

sales)

- 1% increase in other HVAC products (29%

of sales)

- 4% growth in commercial refrigeration

products (5% of sales)

Mr. Nahmad added: “First-half results reflect further

investments in technology and additional headcount of approximately

150 customer-facing employees intended to enhance long-term sales

growth and market share. We remain optimistic that 2017 will be a

record year for our company.”

Acquisition of 35% of Russell Sigler, Inc.

On June 21, 2017, Watsco’s Carrier Enterprise business unit, a

joint venture between Watsco and Carrier Corporation, acquired 35%

ownership of Russell Sigler, Inc. (RSI). RSI was established in

1950 and is one of the largest HVAC distributors in North America

with annual sales of approximately $650 million. It serves over

10,000 customers from 30 locations throughout Arizona, California,

Idaho, New Mexico, Nevada and portions of Texas. Products sold

include residential and commercial HVAC equipment manufactured by

Carrier as well as parts, supplies and accessories sourced from

over 700 other vendors. Consideration for the purchase was $63.6

million paid in cash (the Company contributed 80%, or $50.9

million). Carrier Enterprise has the exclusive right to purchase

shares if and when any current RSI owner wishes to sell shares in

the future.

Acquisition of Joint Venture Interests

In February 2017, Watsco raised its ownership

of Carrier Enterprise Northeast LLC, also a joint venture with

Carrier Corporation, to 80% for approximately $43

million in cash. The incremental investment builds on a

November 2016 transaction, which increased Watsco’s controlling

interest from 60% to 70%. Carrier Enterprise Northeast had sales in

2016 of approximately $500 million from 41 locations in

the northeastern United States and 12 locations

in Mexico. First-half results include a contribution of 8

cents per share from the increased ownership interest.

Technology Strategy

Watsco is actively transforming its business into the digital

age by investing in scalable platforms for mobile apps, e-commerce,

business intelligence and supply chain optimization. Strategic

goals are to further strengthen Watsco’s leadership position,

accelerate sales and profit growth, increase the speed and

convenience of serving customers and extend the Company’s reach

into new geographies and sales channels. Technology-related

spending over the last twelve months was approximately $23

million.

Dividends & Cash Flow

In April 2017, Watsco’s Board of Directors approved a 19%

increase in its annual dividend to $5.00 per share on each

outstanding share of its Common and Class B common stock. The

increase will be reflected in the Company’s dividend payment on

July 31, 2017.

Watsco has paid dividends for over 40 consecutive years with the

philosophy of sharing increasing amounts of cash flow through

higher dividends while maintaining a conservative financial

position. Future increases in dividends, if any, will be considered

in light of investment opportunities, cash flow, general economic

conditions and the Company’s overall financial condition.

The Company has targeted cash flow from operations to exceed net

income in 2017. From 2000 to 2016, Watsco’s operating cash flow was

approximately $1.9 billion compared to net income of approximately

$1.8 billion, surpassing the Company’s stated goal of generating

cash flow in excess of net income.

Conference Call Information

Date: July 25, 2017Time: 10:00 a.m. (EDT)Webcast:

http://investors.watsco.comDial-in number: United States (844)

883-3908 / International (412) 317-9254

A replay of the conference call will be available on the

Company's website.

About Watsco

Watsco provides comfort to homes and businesses regardless of

the outdoor climate. There are approximately 92 million central air

conditioning and heating systems installed in the United States

that have been in service more than 10 years. Older systems often

operate below today’s government mandated energy efficiency and

environmental standards. Watsco has an opportunity to accelerate

the replacement of these systems at a scale greater than its

competitors as the movement toward reducing energy consumption and

its environmental impact continues. This is especially important

since heating and cooling accounts for approximately half of the

energy consumed in a typical U.S. home.

Watsco’s traditional sales channel is the industry’s largest and

currently serves 88,000 contractor businesses through 562 locations

in the United States, Canada, Mexico and Puerto Rico, and on an

export basis to Latin America and the Caribbean. Watsco is a

technology company, operating scalable platforms for mobile apps,

e-commerce, business intelligence and supply chain. Strategic goals

are to accelerate sales and profit growth, increase the speed and

convenience of serving customers and to extend its reach into new

geographies and sales channels. Watsco is also developing

technologies to address the evolving buying habits of consumers in

the digital economy. Over the long-term, Watsco believes its focus,

scale and innovative culture offer significant advantages to

address the consumer market, which is estimated to be $88 billion

annually. Additional information about Watsco may be found at

http://www.watsco.com.

This document includes certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements may be identified by the use of

words such as “will,” “would,” “anticipate,” “expect,” “believe,”

“plan,” “optimistic,” “goal” or “intend,” the negative of these

terms and similar references to future periods. These statements

are based on management's current expectations and are subject to

uncertainty and changes in circumstances. Actual results may differ

materially from these expectations due to changes in economic,

business, competitive market, new housing starts and completions,

capital spending in commercial construction, consumer spending and

debt levels, regulatory and other factors, including, without

limitation, the effects of supplier concentration, competitive

conditions within Watsco’s industry, seasonal nature of sales of

Watsco’s products, the ability of the Company to expand its

business, insurance coverage risks and final GAAP adjustments.

Forward-looking statements speak only as of the date the statement

was made. Watsco assumes no obligation to update forward-looking

information to reflect actual results, changes in assumptions or

changes in other factors affecting forward-looking information,

except as required by applicable law. Detailed information about

these factors and additional important factors can be found in the

documents that Watsco files with the Securities and Exchange

Commission, such as Form 10-K, Form 10-Q and Form 8-K.

WATSCO, INC.

Condensed Consolidated Results of

Operations

(In thousands, except per share

data)

(Unaudited)

Quarter Ended June 30, Six Months Ended June 30, 2017

2016 2017 2016 Revenues $1,275,924 $1,214,435 $2,148,019

$2,065,859 Cost of sales 965,646 922,574 1,619,185

1,561,551 Gross profit 310,278 291,861 528,834

504,308 Gross profit margin 24.3 % 24.0 % 24.6 % 24.4 % SG&A

expenses (1) 180,930 174,271 350,787 336,050

Operating income 129,348 117,590 178,047 168,258 Operating

margin 10.1 % 9.7 % 8.3 % 8.1 % Interest expense, net 1,647

1,054 2,902 2,040 Income before income taxes

127,701 116,536 175,145 166,218 Income taxes 36,854 35,112

50,530 50,620 Net income 90,847 81,424 124,615

115,598 Less: net income attributable to noncontrolling interest

17,091 16,803 24,678 25,440 Net income

attributable to Watsco $73,756 $64,621 $99,937

$90,158 Diluted earnings per share: Net income

attributable to Watsco shareholders $73,756 $64,621 $99,937 $90,158

Less: distributed and undistributed earnings allocated to

non-vested (restricted) common stock 6,186 5,251

8,374 7,302 Earnings allocated to Watsco shareholders

$67,570 $59,370 $91,563 $82,856

Weighted-average Common and Class B common shares and equivalent

shares used to calculate diluted earnings per share 32,708,646

32,606,336 32,694,306 32,576,326 Diluted earnings per share

for Common and Class B common stock $2.07 $1.82 $2.80

$2.54

(1) Selling, general and administrative

expenses.

WATSCO, INC.

Condensed Consolidated Balance

Sheets

(Unaudited, in thousands)

June 30, 2017

December 31, 2016 Cash and cash equivalents $51,034 $56,010

Accounts receivable, net 613,193 475,974 Inventories 770,012

685,011 Other 17,502 23,161 Total current assets 1,451,741

1,240,156 Property and equipment, net 92,255 90,502

Goodwill, intangibles, net and other 610,422 543,991 Total assets

$2,154,418 $1,874,649 Accounts payable and accrued expenses

$422,556 $314,688 Current portion of long-term obligations 1,880

200 Total current liabilities 424,436 314,888 Borrowings

under revolving credit agreement 379,300 235,294 Deferred income

taxes and other liabilities 70,322 72,719 Total liabilities 874,058

622,901 Watsco's shareholders’ equity 1,018,665 1,005,828

Non-controlling interest 261,695 245,920 Shareholders’ equity

1,280,360 1,251,748 Total liabilities and shareholders’ equity

$2,154,418 $1,874,649

WATSCO, INC.

Condensed Consolidated Statements of

Cash Flows

(Unaudited, in thousands)

Six Months Ended June 30, 2017 2016 Cash flow from

operating activities: Net income $124,615 $115,598 Non-cash items

21,677 21,099 Changes in working capital (114,053 ) (94,764 ) Net

cash provided by operating activities 32,239 41,933

Cash flow from investing activities:

Investment in unconsolidated entity

(63,600 ) - Capital expenditures, net (10,237 ) (4,994 ) Net cash

used in investing activities (73,837 ) (4,994 ) Cash flow

from financing activities: Net proceeds under revolving credit

agreement 144,006 22,025

Proceeds from non-controlling interest for

investment in unconsolidated entity

12,720 - Dividends on Common and Class B Common stock (74,835 )

(60,164 ) Purchase of additional ownership from non-controlling

interest (42,688 ) - Distributions to non-controlling interest

(6,799 ) (7,114 ) Other 3,488 3,575 Net cash provided

by (used in) financing activities 35,892 (41,678 ) Effect of

foreign exchange rate changes on cash and cash equivalents 730

54 Net decrease in cash and cash equivalents (4,976 )

(4,685 ) Cash and cash equivalents at beginning of period 56,010

35,229 Cash and cash equivalents at end of period

$51,034 $30,544

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170725005494/en/

Watsco, Inc.Barry S. Logan, 305-714-4102Senior Vice

Presidentblogan@watsco.com

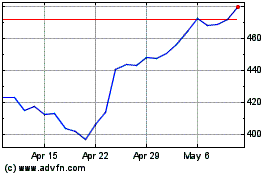

Watsco (NYSE:WSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

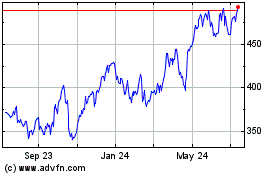

Watsco (NYSE:WSO)

Historical Stock Chart

From Apr 2023 to Apr 2024