GATX Corporation (NYSE:GATX) today reported 2017 second quarter net

income of $53.4 million or $1.35 per diluted share, compared to net

income of $61.2 million or $1.49 per diluted share in the second

quarter of 2016. Net income for the first six months of 2017 was

$110.9 million or $2.79 per diluted share, compared to $130.5

million or $3.15 per diluted share in the prior year period. The

2017 second quarter and year-to-date results include net gains of

approximately $1.1 million ($0.03 per diluted share) compared to

2016 second quarter and year-to date net gains of approximately

$0.2 million (no effect on per share diluted income) and $1.7

million ($0.04 per diluted share) respectively, associated with the

planned exit of the majority of Portfolio Management’s marine

investments. Details related to the exit of Portfolio

Management’s marine investments are provided in the attached

Supplemental Information.

Brian A. Kenney, president and chief executive

officer of GATX stated, “While North American railcar loadings and

railroad velocity have trended favorably over the last few

quarters, a recovery in the North American railcar leasing market

continues to be hampered by a significant oversupply of existing

railcars and a large railcar manufacturing backlog.”

“GATX’s fleet utilization decreased slightly to

98.8% in the quarter, although we continue to displace competitors

and protect high fleet utilization. The renewal lease rate

change of GATX’s Lease Price Index was a negative 21.4% in the

quarter, as absolute railcar lease rates have remained flat thus

far in 2017. Our commercial team has been successful in keeping

existing cars on lease, as evidenced by our renewal success rate of

75.1%.”

“Rail International is performing in line with

our original 2017 expectations. GATX Rail Europe’s fleet

utilization increased slightly to 95.7% in the quarter. At

American Steamship Company, 12 vessels are sailing under favorable

operating conditions. The Rolls-Royce and Partners Finance

affiliates continue their excellent performance, and 2017

investment volume is strong due to the solid demand for aircraft

spare engines.”

Mr. Kenney concluded, “Based on year-to-date

performance and our outlook for the remainder of the year, we

continue to expect our 2017 full-year earnings to be in the range

of $4.40 to $4.60 per diluted share.”

RAIL NORTH AMERICARail North

America reported segment profit of $74.9 million in the second

quarter of 2017, compared to $76.8 million in the second quarter of

2016. Year-to-date, Rail North America reported segment profit of

$167.9 million, compared to $185.5 million in the same period of

2016. Higher gains on asset dispositions in the second quarter of

2017 were more than offset by lower lease revenue and higher

maintenance expense, resulting in slightly lower segment

profit.

At June 30, 2017, Rail North America’s wholly

owned fleet comprised approximately 121,000 railcars, including

approximately 17,100 boxcars. The following fleet statistics and

performance discussion exclude the boxcar fleet.

Fleet utilization was 98.8% at the end of the

second quarter, compared to 99.1% at the end of the prior quarter

and 98.1% at the end of the second quarter of 2016. During the

second quarter of 2017, the GATX Lease Price Index (LPI), a

weighted-average lease renewal rate for a group of railcars

representative of Rail North America’s fleet, decreased 21.4% over

the weighted-average expiring lease rate. This compares to a 32.6%

decrease in the prior quarter and a 25.4% decrease in the second

quarter of 2016. The sequential improvement in LPI reflects some

unique lease renewals in the quarter and is not indicative of a

widespread improvement in absolute lease rates. The average

lease renewal term for cars included in the LPI during the second

quarter was 32 months, compared to 29 months in the prior quarter

and 34 months in the second quarter of 2016. Rail North America’s

investment volume during the second quarter was $127.6 million.

Additional fleet statistics, including

information about the boxcar fleet, and macroeconomic data related

to Rail North America’s business are provided on the last page of

this press release.

RAIL INTERNATIONALRail

International’s segment profit was $16.6 million in the second

quarter of 2017 compared to $13.0 million in the second quarter of

2016. Rail International reported segment profit of $30.0 million

year-to-date 2017, compared to $25.6 million for the same period of

2016. The improvement in segment profit was primarily driven by

lower maintenance expenses.

At June 30, 2017, GATX Rail Europe’s (GRE) fleet

consisted of approximately 23,000 cars and utilization was 95.7%,

compared to 95.0% at the end of the prior quarter and 94.8% at the

end of the second quarter of 2016. Additional fleet statistics for

GRE are provided on the last page of this press release.

AMERICAN STEAMSHIP

COMPANYAmerican Steamship Company (ASC) reported segment

profit of $6.5 million in the second quarter of 2017, compared to

$4.2 million in the second quarter of 2016. Segment profit

year-to-date 2017 was $6.3 million, compared to $5.1 million

year-to-date 2016. ASC carried 9.5 million net tons of cargo

through the second quarter of 2017, comparable to the prior year

period. The improvement in segment profit was primarily driven by

more efficient fleet performance.

PORTFOLIO MANAGEMENTPortfolio

Management reported segment profit of $19.8 million in the second

quarter of 2017, compared to $36.5 million in the second quarter of

2016. Segment profit year-to-date 2017 was $34.5 million, compared

to $55.1 million year-to-date 2016. The decline in segment profit

was predominantly driven by $21.7 million of higher residual

sharing fees earned in the second quarter of 2016. Second

quarter 2017 segment profit includes a net pre-tax gain of

approximately $1.8 million associated with the planned exit of the

majority of the marine investments compared with $0.3 million in

second quarter 2016.

COMPANY DESCRIPTIONGATX

Corporation (NYSE:GATX) strives to be recognized as the finest

railcar leasing company in the world by its customers, its

shareholders, its employees and the communities where it operates.

As the leading global railcar lessor, GATX has been providing

quality railcars and services to its customers for more than 118

years. GATX has been headquartered in Chicago, Illinois, since its

founding in 1898. For more information, please visit the Company’s

website at www.gatx.com.

TELECONFERENCE INFORMATION

GATX Corporation will host a teleconference to discuss 2017

second-quarter results. Call details are as follows:

Thursday, July 20th11:00

A.M. Eastern TimeDomestic Dial-In:

1-877-681-3378International Dial-In: 1-719-325-4761Replay:

1-888-203-1112 or 1-719-457-0820 /Access Code: 8027796

Call-in details, a copy of this press release and real-time

audio access are available at www.gatx.com. Please access the call

15 minutes prior to the start time. Following the call, a replay

will be available on the same site.

FORWARD-LOOKING STATEMENTSStatements in this

Earnings Release not based on historical facts are “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 and, accordingly, involve known and unknown

risks and uncertainties that are difficult to predict and could

cause our actual results, performance, or achievements to differ

materially from those discussed. These statements include

statements as to our future expectations, beliefs, plans,

strategies, objectives, events, conditions, financial performance,

prospects, or future events. In some cases, forward-looking

statements can be identified by the use of words such as “may,”

“could,” “expect,” “intend,” “plan,” “seek,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “continue,”

“likely,” “will,” “would”, and similar words and phrases.

Forward-looking statements are necessarily based on estimates and

assumptions that, while considered reasonable by us and our

management, are inherently uncertain. Accordingly, you should

not place undue reliance on forward-looking statements, which speak

only as of the date they are made, and are not guarantees of future

performance. We do not undertake any obligation to publicly update

or revise these forward-looking statements.

The following factors, in addition to those

discussed in our other filings with the SEC, including our Form

10-K for the year ended December 31, 2016 and subsequent reports on

Form 10-Q, could cause actual results to differ materially from our

current expectations expressed in forward-looking statements:

| •

exposure to damages, fines, criminal and civil penalties, and

reputational harm arising from a negative outcome in litigation,

including claims arising from an accident involving our railcars •

inability to maintain our assets on lease at satisfactory rates due

to oversupply of railcars in the market or other changes in supply

and demand • weak economic conditions and other factors that may

decrease demand for our assets and services • decreased demand for

portions of our railcar fleet due to adverse changes in the price

of, or demand for, commodities that are shipped in our railcars •

higher costs associated with increased railcar assignments

following non-renewal of leases, customer defaults, and compliance

maintenance programs or other maintenance initiatives • events

having an adverse impact on assets, customers, or regions where we

have a concentrated investment exposure • financial and operational

risks associated with long-term railcar purchase commitments •

reduced opportunities to generate asset remarketing income •

operational and financial risks related to our affiliate

investments, including the Rolls-Royce & Partners Finance joint

ventures (collectively the “RRPF affiliates”) • fluctuations

in foreign exchange rates |

|

•

failure to successfully negotiate collective bargaining

agreements with the unions representing a substantial portion of

our employees • changes in railroad operations that could decrease

demand for railcars, either due to increased railroad efficiency or

decreased attractiveness of rail service relative to other modes •

the impact of regulatory requirements applicable to tank cars

carrying crude, ethanol, and other flammable liquids • asset

impairment charges we may be required to recognize • deterioration

of conditions in the capital markets, reductions in our credit

ratings, or increases in our financing costs • competitive factors

in our primary markets, including competitors with a significantly

lower cost of capital than GATX • risks related to international

operations and expansion into new geographic markets •

changes in, or failure to comply with, laws, rules, and

regulations • inability to obtain cost-effective insurance •

environmental remediation costs • inadequate allowances

to cover credit losses in our portfolio • inability to maintain and

secure our information technology infrastructure from cybersecurity

threats and related disruption of our business |

Investor, corporate, financial, historical financial, and news

release information may be found at www.gatx.com.

--Tabular Follows--

| GATX CORPORATION AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)(In millions, except per share

data) |

| |

| |

Three Months Ended June

30 |

|

Six Months Ended June

30 |

| |

|

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

Revenues |

|

|

|

|

|

|

|

| Lease revenue |

$ |

274.1 |

|

|

$ |

281.2 |

|

|

$ |

546.8 |

|

|

$ |

565.7 |

|

| Marine operating

revenue |

55.1 |

|

|

57.3 |

|

|

72.1 |

|

|

77.6 |

|

| Other revenue |

19.2 |

|

|

20.4 |

|

|

45.6 |

|

|

50.0 |

|

| Total

Revenues |

348.4 |

|

|

358.9 |

|

|

664.5 |

|

|

693.3 |

|

|

Expenses |

|

|

|

|

|

|

|

| Maintenance

expense |

84.9 |

|

|

86.5 |

|

|

162.8 |

|

|

165.0 |

|

| Marine operating

expense |

38.0 |

|

|

37.4 |

|

|

50.9 |

|

|

49.7 |

|

| Depreciation

expense |

77.3 |

|

|

75.8 |

|

|

149.3 |

|

|

145.1 |

|

| Operating lease

expense |

15.2 |

|

|

18.5 |

|

|

31.0 |

|

|

35.3 |

|

| Other operating

expense |

7.8 |

|

|

14.8 |

|

|

17.4 |

|

|

23.6 |

|

| Selling, general and

administrative expense |

43.1 |

|

|

40.9 |

|

|

86.0 |

|

|

79.7 |

|

| Total

Expenses |

266.3 |

|

|

273.9 |

|

|

497.4 |

|

|

498.4 |

|

| Other Income

(Expense) |

|

|

|

|

|

|

|

| Net gain on asset

dispositions |

22.0 |

|

|

36.9 |

|

|

46.9 |

|

|

60.1 |

|

| Interest expense,

net |

(40.0 |

) |

|

(36.5 |

) |

|

(79.2 |

) |

|

(73.7 |

) |

| Other expense |

(1.1 |

) |

|

(3.9 |

) |

|

(2.4 |

) |

|

(7.2 |

) |

| Income before

Income Taxes and Share of Affiliates’ Earnings |

63.0 |

|

|

81.5 |

|

|

132.4 |

|

|

174.1 |

|

| Income

Taxes |

(19.3 |

) |

|

(26.7 |

) |

|

(39.9 |

) |

|

(57.5 |

) |

| Share of

Affiliates’ Earnings (net of tax) |

9.7 |

|

|

6.4 |

|

|

18.4 |

|

|

13.9 |

|

| Net

Income |

$ |

53.4 |

|

|

$ |

61.2 |

|

|

$ |

110.9 |

|

|

$ |

130.5 |

|

| |

|

|

|

|

|

|

|

| Share

Data |

|

|

|

|

|

|

|

| Basic earnings per

share |

$ |

1.37 |

|

|

$ |

1.51 |

|

|

$ |

2.83 |

|

|

$ |

3.18 |

|

| Average number of

common shares |

39.0 |

|

|

40.6 |

|

|

39.2 |

|

|

41.1 |

|

| Diluted earnings per

share |

$ |

1.35 |

|

|

$ |

1.49 |

|

|

$ |

2.79 |

|

|

$ |

3.15 |

|

| Average number of

common shares and common share equivalents |

39.5 |

|

|

41.1 |

|

|

39.7 |

|

|

41.5 |

|

| Dividends declared per

common share |

$ |

0.42 |

|

|

$ |

0.40 |

|

|

$ |

0.84 |

|

|

$ |

0.80 |

|

| GATX CORPORATION AND

SUBSIDIARIESCONSOLIDATED BALANCE SHEETS

(UNAUDITED)(In millions) |

| |

| |

|

June 30 |

|

December 31 |

| |

|

2017 |

|

2016 |

|

Assets |

|

|

|

|

| Cash and Cash

Equivalents |

|

$ |

284.3 |

|

|

$ |

307.5 |

|

| Restricted

Cash |

|

3.7 |

|

|

3.6 |

|

|

Receivables |

|

|

|

|

| Rent and other

receivables |

|

76.4 |

|

|

85.9 |

|

| Finance leases |

|

141.6 |

|

|

147.7 |

|

| Less: allowance for

losses |

|

(5.7 |

) |

|

(6.1 |

) |

| |

|

212.3 |

|

|

227.5 |

|

| |

|

|

|

|

| Operating

Assets and Facilities |

|

8,801.4 |

|

|

8,446.4 |

|

| Less: allowance for

depreciation |

|

(2,743.3 |

) |

|

(2,641.7 |

) |

| |

|

6,058.1 |

|

|

5,804.7 |

|

| |

|

|

|

|

| Investments in

Affiliated Companies |

|

407.8 |

|

|

387.0 |

|

|

Goodwill |

|

82.6 |

|

|

78.0 |

|

| Other

Assets |

|

223.3 |

|

|

297.1 |

|

| Total

Assets |

|

$ |

7,272.1 |

|

|

$ |

7,105.4 |

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

| Accounts

Payable and Accrued Expenses |

|

$ |

196.5 |

|

|

$ |

174.8 |

|

|

Debt |

|

|

|

|

| Commercial paper and

borrowings under bank credit facilities |

|

15.7 |

|

|

3.8 |

|

| Recourse |

|

4,261.2 |

|

|

4,253.2 |

|

| Capital lease

obligations |

|

13.1 |

|

|

14.9 |

|

| |

|

4,290.0 |

|

|

4,271.9 |

|

| |

|

|

|

|

| Deferred Income

Taxes |

|

1,134.1 |

|

|

1,089.4 |

|

| Other

Liabilities |

|

208.5 |

|

|

222.1 |

|

| Total

Liabilities |

|

5,829.1 |

|

|

5,758.2 |

|

| Total

Shareholders’ Equity |

|

1,443.0 |

|

|

1,347.2 |

|

| Total

Liabilities and Shareholders’ Equity |

|

$ |

7,272.1 |

|

|

$ |

7,105.4 |

|

| GATX CORPORATION AND

SUBSIDIARIESSEGMENT DATA (UNAUDITED)Three Months

Ended June 30, 2017(In millions) |

| |

| |

Rail N.A. |

|

Rail Int’l |

|

ASC |

|

PortfolioManagement |

|

Other |

|

GATXConsolidated |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

| Lease revenue |

$ |

225.7 |

|

|

$ |

46.2 |

|

|

$ |

1.0 |

|

|

$ |

1.2 |

|

|

$ |

— |

|

|

$ |

274.1 |

|

| Marine operating

revenue |

— |

|

|

— |

|

|

47.7 |

|

|

7.4 |

|

|

— |

|

|

55.1 |

|

| Other revenue |

17.3 |

|

|

1.6 |

|

|

— |

|

|

0.3 |

|

|

— |

|

|

19.2 |

|

| Total

Revenues |

243.0 |

|

|

47.8 |

|

|

48.7 |

|

|

8.9 |

|

|

— |

|

|

348.4 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

| Maintenance

expense |

68.5 |

|

|

9.7 |

|

|

6.7 |

|

|

— |

|

|

— |

|

|

84.9 |

|

| Marine operating

expense |

— |

|

|

— |

|

|

30.6 |

|

|

7.4 |

|

|

— |

|

|

38.0 |

|

| Depreciation

expense |

59.7 |

|

|

11.8 |

|

|

4.0 |

|

|

1.8 |

|

|

— |

|

|

77.3 |

|

| Operating lease

expense |

14.8 |

|

|

— |

|

|

0.4 |

|

|

— |

|

|

— |

|

|

15.2 |

|

| Other operating

expense |

6.3 |

|

|

1.2 |

|

|

— |

|

|

0.3 |

|

|

— |

|

|

7.8 |

|

| Total

Expenses |

149.3 |

|

|

22.7 |

|

|

41.7 |

|

|

9.5 |

|

|

— |

|

|

223.2 |

|

| Other Income

(Expense) |

|

|

|

|

|

|

|

|

|

|

|

| Net gain on asset

dispositions |

10.7 |

|

|

0.8 |

|

|

— |

|

|

10.5 |

|

|

— |

|

|

22.0 |

|

| Interest (expense)

income, net |

(28.5 |

) |

|

(8.1 |

) |

|

(1.3 |

) |

|

(2.4 |

) |

|

0.3 |

|

|

(40.0 |

) |

| Other (expense)

income |

(1.2 |

) |

|

(1.1 |

) |

|

0.8 |

|

|

— |

|

|

0.4 |

|

|

(1.1 |

) |

| Share of affiliates’

pretax income (loss) |

0.2 |

|

|

(0.1 |

) |

|

— |

|

|

12.3 |

|

|

— |

|

|

12.4 |

|

| Segment

Profit |

$ |

74.9 |

|

|

$ |

16.6 |

|

|

$ |

6.5 |

|

|

$ |

19.8 |

|

|

$ |

0.7 |

|

|

$ |

118.5 |

|

| Selling,

general and administrative expense |

43.1 |

|

| Income

taxes (includes $2.7 related to affiliates’ earnings) |

22.0 |

|

|

Net Income |

$ |

53.4 |

|

| Selected

Data: |

|

|

|

|

|

|

|

|

|

|

|

| Investment

Volume |

$ |

127.6 |

|

|

$ |

33.1 |

|

|

$ |

5.5 |

|

|

$ |

— |

|

|

$ |

0.1 |

|

|

$ |

166.3 |

|

| Net Gain on

Asset Dispositions |

|

|

|

|

|

|

|

|

|

|

|

| Asset

Remarketing Income: |

|

|

|

|

|

|

|

|

|

|

|

|

Disposition gains on owned assets |

$ |

10.9 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1.8 |

|

|

$ |

— |

|

|

$ |

12.7 |

|

| Residual

sharing income |

0.2 |

|

|

— |

|

|

— |

|

|

8.7 |

|

|

— |

|

|

8.9 |

|

| Non-remarketing

disposition gains (1) |

1.5 |

|

|

0.8 |

|

|

— |

|

|

— |

|

|

— |

|

|

2.3 |

|

| Asset impairments |

(1.9 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1.9 |

) |

| Total Net Gain

on Asset Dispositions |

$ |

10.7 |

|

|

$ |

0.8 |

|

|

$ |

— |

|

|

$ |

10.5 |

|

|

$ |

— |

|

|

$ |

22.0 |

|

(1) Includes scrapping gains.

| GATX CORPORATION AND

SUBSIDIARIESSEGMENT DATA (UNAUDITED)Three Months

Ended June 30, 2016(In millions) |

| |

|

|

|

Rail N.A. |

|

Rail Int’l |

|

ASC |

|

PortfolioManagement |

|

Other |

|

GATXConsolidated |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| Lease revenue |

|

$ |

233.4 |

|

|

$ |

45.3 |

|

|

$ |

1.1 |

|

|

$ |

1.4 |

|

|

$ |

— |

|

|

$ |

281.2 |

|

| Marine operating

revenue |

|

— |

|

|

— |

|

|

46.4 |

|

|

10.9 |

|

|

— |

|

|

57.3 |

|

| Other revenue |

|

18.4 |

|

|

1.6 |

|

|

— |

|

|

0.4 |

|

|

— |

|

|

20.4 |

|

| Total

Revenues |

|

251.8 |

|

|

46.9 |

|

|

47.5 |

|

|

12.7 |

|

|

— |

|

|

358.9 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Maintenance

expense |

|

67.6 |

|

|

12.9 |

|

|

6.0 |

|

|

— |

|

|

— |

|

|

86.5 |

|

| Marine operating

expense |

|

— |

|

|

— |

|

|

29.6 |

|

|

7.8 |

|

|

— |

|

|

37.4 |

|

| Depreciation

expense |

|

58.1 |

|

|

11.5 |

|

|

4.4 |

|

|

1.8 |

|

|

— |

|

|

75.8 |

|

| Operating lease

expense |

|

16.6 |

|

|

— |

|

|

2.0 |

|

|

— |

|

|

(0.1 |

) |

|

18.5 |

|

| Other operating

expense |

|

9.5 |

|

|

1.2 |

|

|

— |

|

|

4.1 |

|

|

— |

|

|

14.8 |

|

| Total

Expenses |

|

151.8 |

|

|

25.6 |

|

|

42.0 |

|

|

13.7 |

|

|

(0.1 |

) |

|

233.0 |

|

| Other Income

(Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net gain on asset

dispositions |

|

4.7 |

|

|

0.3 |

|

|

— |

|

|

31.9 |

|

|

— |

|

|

36.9 |

|

| Interest (expense)

income, net |

|

(26.9 |

) |

|

(7.3 |

) |

|

(1.1 |

) |

|

(2.1 |

) |

|

0.9 |

|

|

(36.5 |

) |

| Other expense |

|

(1.1 |

) |

|

(1.3 |

) |

|

(0.2 |

) |

|

— |

|

|

(1.3 |

) |

|

(3.9 |

) |

| Share of affiliates’

pretax income |

|

0.1 |

|

|

— |

|

|

— |

|

|

7.7 |

|

|

— |

|

|

7.8 |

|

| Segment Profit

(Loss) |

|

$ |

76.8 |

|

|

$ |

13.0 |

|

|

$ |

4.2 |

|

|

$ |

36.5 |

|

|

$ |

(0.3 |

) |

|

$ |

130.2 |

|

| Selling,

general and administrative expense |

40.9 |

|

| Income

taxes (includes $1.4 related to affiliates’ earnings) |

28.1 |

|

|

Net Income |

$ |

61.2 |

|

| Selected

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Investment

Volume |

|

$ |

145.4 |

|

|

$ |

30.4 |

|

|

$ |

4.4 |

|

|

$ |

— |

|

|

$ |

1.8 |

|

|

$ |

182.0 |

|

| Net

Gain on Asset Dispositions |

|

|

|

|

|

|

|

|

| Asset

Remarketing Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Disposition gains on owned assets |

|

$ |

3.0 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

2.1 |

|

|

$ |

— |

|

|

$ |

5.1 |

|

| Residual

sharing income |

|

0.1 |

|

|

— |

|

|

— |

|

|

31.6 |

|

|

— |

|

|

31.7 |

|

| Non-remarketing

disposition gains (1) |

|

1.6 |

|

|

0.3 |

|

|

— |

|

|

— |

|

|

— |

|

|

1.9 |

|

| Asset impairments |

|

— |

|

|

— |

|

|

— |

|

|

(1.8 |

) |

|

— |

|

|

(1.8 |

) |

| Total Net Gain

on Asset Dispositions |

|

$ |

4.7 |

|

|

$ |

0.3 |

|

|

$ |

— |

|

|

$ |

31.9 |

|

|

$ |

— |

|

|

$ |

36.9 |

|

(1) Includes scrapping gains.

| GATX CORPORATION AND

SUBSIDIARIESSEGMENT DATA (UNAUDITED)Six Months

Ended June 30, 2017(In millions) |

| |

|

|

|

Rail N.A. |

|

Rail Int’l |

|

ASC |

|

PortfolioManagement |

|

Other |

|

GATXConsolidated |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| Lease revenue |

|

$ |

452.9 |

|

|

$ |

89.5 |

|

|

$ |

2.0 |

|

|

$ |

2.4 |

|

|

$ |

— |

|

|

$ |

546.8 |

|

| Marine operating

revenue |

|

— |

|

|

— |

|

|

54.1 |

|

|

18.0 |

|

|

— |

|

|

72.1 |

|

| Other revenue |

|

42.1 |

|

|

2.7 |

|

|

— |

|

|

0.8 |

|

|

— |

|

|

45.6 |

|

| Total

Revenues |

|

495.0 |

|

|

92.2 |

|

|

56.1 |

|

|

21.2 |

|

|

— |

|

|

664.5 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Maintenance

expense |

|

136.2 |

|

|

19.7 |

|

|

6.9 |

|

|

— |

|

|

— |

|

|

162.8 |

|

| Marine operating

expense |

|

— |

|

|

— |

|

|

35.9 |

|

|

15.0 |

|

|

— |

|

|

50.9 |

|

| Depreciation

expense |

|

118.7 |

|

|

23.0 |

|

|

4.1 |

|

|

3.5 |

|

|

— |

|

|

149.3 |

|

| Operating lease

expense |

|

29.8 |

|

|

— |

|

|

1.2 |

|

|

— |

|

|

— |

|

|

31.0 |

|

| Other operating

expense |

|

14.4 |

|

|

2.4 |

|

|

— |

|

|

0.6 |

|

|

— |

|

|

17.4 |

|

| Total

Expenses |

|

299.1 |

|

|

45.1 |

|

|

48.1 |

|

|

19.1 |

|

|

— |

|

|

411.4 |

|

| Other Income

(Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net gain on asset

dispositions |

|

34.5 |

|

|

1.6 |

|

|

— |

|

|

10.8 |

|

|

— |

|

|

46.9 |

|

| Interest (expense)

income, net |

|

(59.6 |

) |

|

(16.0 |

) |

|

(2.5 |

) |

|

(4.6 |

) |

|

3.5 |

|

|

(79.2 |

) |

| Other expense

(income) |

|

(3.2 |

) |

|

(2.6 |

) |

|

0.8 |

|

|

2.3 |

|

|

0.3 |

|

|

(2.4 |

) |

| Share of affiliates’

pretax income (loss) |

|

0.3 |

|

|

(0.1 |

) |

|

— |

|

|

23.9 |

|

|

— |

|

|

24.1 |

|

| Segment

Profit |

|

$ |

167.9 |

|

|

$ |

30.0 |

|

|

$ |

6.3 |

|

|

$ |

34.5 |

|

|

$ |

3.8 |

|

|

$ |

242.5 |

|

| Selling,

general and administrative expense |

86.0 |

|

| Income

taxes (includes $5.7 related to affiliates’ earnings) |

45.6 |

|

|

Net Income |

$ |

110.9 |

|

| Selected

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Investment

Volume |

|

$ |

230.4 |

|

|

$ |

51.8 |

|

|

$ |

12.8 |

|

|

$ |

— |

|

|

$ |

0.3 |

|

|

$ |

295.3 |

|

| Net

Gain on Asset Dispositions |

|

|

|

|

|

|

|

|

| Asset

Remarketing Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Disposition gains on owned assets |

|

$ |

32.0 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1.8 |

|

|

$ |

— |

|

|

$ |

33.8 |

|

| Residual

sharing income |

|

0.3 |

|

|

— |

|

|

— |

|

|

9.0 |

|

|

— |

|

|

9.3 |

|

| Non-remarketing

disposition gains (1) |

|

4.1 |

|

|

1.6 |

|

|

— |

|

|

— |

|

|

— |

|

|

5.7 |

|

| Asset impairments |

|

(1.9 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1.9 |

) |

| Total Net Gain

on Asset Dispositions |

|

$ |

34.5 |

|

|

$ |

1.6 |

|

|

$ |

— |

|

|

$ |

10.8 |

|

|

$ |

— |

|

|

$ |

46.9 |

|

(1) Includes scrapping gains.

| GATX CORPORATION AND

SUBSIDIARIESSEGMENT DATA (UNAUDITED)Six Months

Ended June 30, 2016(In millions) |

| |

|

|

|

Rail N.A. |

|

Rail Int’l |

|

ASC |

|

PortfolioManagement |

|

Other |

|

GATXConsolidated |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| Lease revenue |

|

$ |

470.0 |

|

|

$ |

90.2 |

|

|

$ |

2.1 |

|

|

$ |

3.4 |

|

|

$ |

— |

|

|

$ |

565.7 |

|

| Marine operating

revenue |

|

— |

|

|

— |

|

|

50.5 |

|

|

27.1 |

|

|

— |

|

|

77.6 |

|

| Other revenue |

|

46.2 |

|

|

3.2 |

|

|

— |

|

|

0.6 |

|

|

— |

|

|

50.0 |

|

| Total

Revenues |

|

516.2 |

|

|

93.4 |

|

|

52.6 |

|

|

31.1 |

|

|

— |

|

|

693.3 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Maintenance

expense |

|

133.4 |

|

|

25.4 |

|

|

6.2 |

|

|

— |

|

|

— |

|

|

165.0 |

|

| Marine operating

expense |

|

— |

|

|

— |

|

|

32.5 |

|

|

17.2 |

|

|

— |

|

|

49.7 |

|

| Depreciation

expense |

|

114.6 |

|

|

22.6 |

|

|

4.4 |

|

|

3.5 |

|

|

— |

|

|

145.1 |

|

| Operating lease

expense |

|

33.4 |

|

|

— |

|

|

2.0 |

|

|

— |

|

|

(0.1 |

) |

|

35.3 |

|

| Other operating

expense |

|

16.4 |

|

|

2.6 |

|

|

— |

|

|

4.6 |

|

|

— |

|

|

23.6 |

|

| Total

Expenses |

|

297.8 |

|

|

50.6 |

|

|

45.1 |

|

|

25.3 |

|

|

(0.1 |

) |

|

418.7 |

|

| Other Income

(Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net gain on asset

dispositions |

|

23.3 |

|

|

1.0 |

|

|

— |

|

|

35.8 |

|

|

— |

|

|

60.1 |

|

| Interest (expense)

income, net |

|

(54.1 |

) |

|

(14.6 |

) |

|

(2.2 |

) |

|

(4.3 |

) |

|

1.5 |

|

|

(73.7 |

) |

| Other expense |

|

(2.4 |

) |

|

(3.5 |

) |

|

(0.2 |

) |

|

— |

|

|

(1.1 |

) |

|

(7.2 |

) |

| Share of affiliates’

pretax income (loss) |

|

0.3 |

|

|

(0.1 |

) |

|

— |

|

|

17.8 |

|

|

— |

|

|

18.0 |

|

| Segment

Profit |

|

$ |

185.5 |

|

|

$ |

25.6 |

|

|

$ |

5.1 |

|

|

$ |

55.1 |

|

|

$ |

0.5 |

|

|

$ |

271.8 |

|

| Selling,

general and administrative expense |

79.7 |

|

| Income

taxes (includes $4.1 related to affiliates’ earnings) |

61.6 |

|

|

Net Income |

$ |

130.5 |

|

| Selected

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Investment

Volume |

|

$ |

258.3 |

|

|

$ |

52.4 |

|

|

$ |

9.1 |

|

|

$ |

— |

|

|

$ |

2.4 |

|

|

$ |

322.2 |

|

| Net

Gain on Asset Dispositions |

|

|

|

|

|

|

|

|

| Asset

Remarketing Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Disposition gains on owned assets |

|

$ |

20.6 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

4.5 |

|

|

$ |

— |

|

|

$ |

25.1 |

|

| Residual

sharing income |

|

0.4 |

|

|

— |

|

|

— |

|

|

33.1 |

|

|

— |

|

|

33.5 |

|

| Non-remarketing

disposition gains (1) |

|

2.3 |

|

|

1.0 |

|

|

— |

|

|

— |

|

|

— |

|

|

3.3 |

|

| Asset impairments |

|

— |

|

|

— |

|

|

— |

|

|

(1.8 |

) |

|

— |

|

|

(1.8 |

) |

| Total Net Gain

on Asset Dispositions |

|

$ |

23.3 |

|

|

$ |

1.0 |

|

|

$ |

— |

|

|

$ |

35.8 |

|

|

$ |

— |

|

|

$ |

60.1 |

|

(1) Includes scrapping gains.

| GATX CORPORATION AND

SUBSIDIARIESSUPPLEMENTAL INFORMATION

(UNAUDITED)(In millions, except per share

data) |

| |

| Impact of Tax

Adjustments and Other Items on Net Income* |

|

|

|

| |

Three Months Ended June 30 |

|

Six Months Ended June 30 |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Net income (GAAP) |

$ |

53.4 |

|

|

$ |

61.2 |

|

|

$ |

110.9 |

|

|

$ |

130.5 |

|

| |

|

|

|

|

|

|

|

| Adjustments

attributable to consolidated income, pretax: |

|

|

|

|

|

|

|

| Net gain

on wholly owned Portfolio Management marine investments |

(1.8 |

) |

|

(0.3 |

) |

|

(1.8 |

) |

|

(2.7 |

) |

| Total adjustments

attributable to consolidated income, pretax |

$ |

(1.8 |

) |

|

$ |

(0.3 |

) |

|

$ |

(1.8 |

) |

|

$ |

(2.7 |

) |

| Income taxes thereon,

based on applicable effective tax rate |

$ |

0.7 |

|

|

$ |

0.1 |

|

|

$ |

0.7 |

|

|

$ |

1.0 |

|

| |

|

|

|

|

|

|

|

| Net income, excluding

tax adjustments and other items (non-GAAP) |

$ |

52.3 |

|

|

$ |

61.0 |

|

|

$ |

109.8 |

|

|

$ |

128.8 |

|

| Impact of Tax

Adjustments and Other Items on Diluted Earnings per

Share* |

|

|

|

| |

Three Months Ended June 30 |

|

Six Months Ended June 30 |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Diluted earnings per

share (GAAP) |

$ |

1.35 |

|

|

$ |

1.49 |

|

|

$ |

2.79 |

|

|

$ |

3.15 |

|

| Diluted earnings per

share, excluding tax adjustments and other items (non-GAAP) |

$ |

1.32 |

|

|

$ |

1.49 |

|

|

$ |

2.76 |

|

|

$ |

3.11 |

|

(*) In addition to financial results reported in

accordance with GAAP, we provide certain non-GAAP financial

information. Specifically, we exclude the effects of certain tax

adjustments and other items for purposes of presenting net income

and diluted earnings per share because we believe these items are

not attributable to our business operations. Management utilizes

this information when analyzing financial performance because such

amounts reflect the underlying operating results that are within

management’s ability to influence. Accordingly, we believe

presenting this information provides investors and other users of

our financial statements with meaningful supplemental information

for purposes of analyzing year-to-year financial performance on a

comparable basis and assessing trends.

| GATX CORPORATION AND

SUBSIDIARIESSUPPLEMENTAL INFORMATION

(UNAUDITED)(In millions, except

leverage)(Continued) |

| |

| |

|

6/30/2016 |

|

9/30/2016 |

|

12/31/2016 |

|

3/31/2017 |

|

6/30/2017 |

|

Assets by Segment, as adjusted (non-GAAP)* |

|

|

|

|

|

|

|

|

| Rail North America |

|

$ |

5,235.7 |

|

|

$ |

5,243.0 |

|

|

$ |

5,216.5 |

|

|

$ |

5,269.4 |

|

|

$ |

5,304.3 |

|

| Rail International |

|

1,127.2 |

|

|

1,153.0 |

|

|

1,084.8 |

|

|

1,116.0 |

|

|

1,209.3 |

|

| ASC |

|

301.9 |

|

|

289.6 |

|

|

281.3 |

|

|

307.5 |

|

|

322.0 |

|

| Portfolio

Management |

|

608.3 |

|

|

595.0 |

|

|

589.9 |

|

|

597.4 |

|

|

573.2 |

|

| Other |

|

77.0 |

|

|

75.9 |

|

|

80.9 |

|

|

72.2 |

|

|

63.9 |

|

| Total Assets, excluding

cash, as adjusted (non-GAAP) |

|

$ |

7,350.1 |

|

|

$ |

7,356.5 |

|

|

$ |

7,253.4 |

|

|

$ |

7,362.5 |

|

|

$ |

7,472.7 |

|

| Debt, Net of

Unrestricted Cash* |

|

|

|

|

|

|

|

|

|

|

| Unrestricted cash |

|

$ |

(177.6 |

) |

|

$ |

(211.5 |

) |

|

$ |

(307.5 |

) |

|

$ |

(155.2 |

) |

|

$ |

(284.3 |

) |

| Commercial paper and

bank credit facilities |

|

28.5 |

|

|

5.1 |

|

|

3.8 |

|

|

3.0 |

|

|

15.7 |

|

| Recourse debt |

|

4,298.8 |

|

|

4,204.4 |

|

|

4,253.2 |

|

|

4,250.9 |

|

|

4,261.2 |

|

| Non-recourse debt |

|

2.3 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Capital lease

obligations |

|

16.6 |

|

|

15.1 |

|

|

14.9 |

|

|

13.5 |

|

|

13.1 |

|

| Total debt, net of

unrestricted cash (GAAP) |

|

4,168.6 |

|

|

4,013.1 |

|

|

3,964.4 |

|

|

4,112.2 |

|

|

4,005.7 |

|

| Off-balance sheet

recourse debt |

|

449.0 |

|

|

483.1 |

|

|

459.1 |

|

|

424.6 |

|

|

488.6 |

|

| Total debt, net of

unrestricted cash, as adjusted (non-GAAP) |

|

$ |

4,617.6 |

|

|

$ |

4,496.2 |

|

|

$ |

4,423.5 |

|

|

$ |

4,536.8 |

|

|

$ |

4,494.3 |

|

| Total Recourse Debt

(1) |

|

$ |

4,615.3 |

|

|

$ |

4,496.2 |

|

|

$ |

4,423.5 |

|

|

$ |

4,536.8 |

|

|

$ |

4,494.3 |

|

| Shareholders’

Equity |

|

$ |

1,308.5 |

|

|

$ |

1,371.5 |

|

|

$ |

1,347.2 |

|

|

$ |

1,385.2 |

|

|

$ |

1,443.0 |

|

| Recourse Leverage

(2) |

|

3.5 |

|

|

3.3 |

|

|

3.3 |

|

|

3.3 |

|

|

3.1 |

|

_________

(1) Includes on- and off-balance sheet recourse

debt; capital lease obligations; commercial paper and bank credit

facilities, net of unrestricted cash.(2) Calculated as total

recourse debt / shareholder’s equity.

|

Reconciliation of Total Assets, excluding cash (GAAP) to

Total Assets, excluding cash, as adjusted (non-GAAP) |

| Total Assets |

|

$ |

7,090.6 |

|

|

$ |

7,089.3 |

|

|

$ |

7,105.4 |

|

|

$ |

7,096.9 |

|

|

$ |

7,272.1 |

|

| Less:

cash |

|

(189.5 |

) |

|

(215.9 |

) |

|

(311.1 |

) |

|

(159.0 |

) |

|

(288.0 |

) |

| Total Assets, excluding

cash (GAAP) |

|

6,901.1 |

|

|

6,873.4 |

|

|

6,794.3 |

|

|

6,937.9 |

|

|

6,984.1 |

|

| Add off-balance sheet

assets: |

|

|

|

|

|

|

|

|

|

|

| Rail

North America |

|

443.3 |

|

|

478.9 |

|

|

456.5 |

|

|

423.9 |

|

|

488.1 |

|

| ASC |

|

5.7 |

|

|

4.2 |

|

|

2.6 |

|

|

0.7 |

|

|

0.5 |

|

| Total off-balance sheet

assets |

|

449.0 |

|

|

483.1 |

|

|

459.1 |

|

|

424.6 |

|

|

488.6 |

|

| Total Assets, excluding

cash, as adjusted (non-GAAP) |

|

$ |

7,350.1 |

|

|

$ |

7,356.5 |

|

|

$ |

7,253.4 |

|

|

$ |

7,362.5 |

|

|

$ |

7,472.7 |

|

(*) We disclose total on- and off-balance sheet

assets because certain operating assets are accounted for as

operating leases and are not recorded on the balance sheet. We

include these leased-in assets in our calculation of total assets

(as adjusted) because we believe it gives investors a more

comprehensive representation of the magnitude of the assets we

operate and that drive our financial performance. In addition, this

calculation of total assets (as adjusted) provides consistency with

other non-financial information we disclose. We also provide

information regarding our leverage ratios, which are expressed as a

ratio of debt (including off-balance sheet debt) to equity. The

off-balance sheet debt amount in this calculation is the equivalent

of the off-balance sheet asset amount. We believe reporting

this corresponding off-balance sheet debt amount provides investors

and other users of our financial statements with a more

comprehensive representation of our debt obligations, leverage, and

capital structure.

| GATX CORPORATION AND

SUBSIDIARIESSUPPLEMENTAL INFORMATION

(UNAUDITED)(Continued) |

| |

| |

6/30/2016 |

|

9/30/2016 |

|

12/31/2016 |

|

3/31/2017 |

|

6/30/2017 |

| Rail North

America Statistics |

|

|

|

|

|

|

|

|

|

| Lease Price

Index (LPI) (1) |

|

|

|

|

|

|

|

|

|

| Average renewal lease

rate change |

(25.4 |

)% |

|

(21.4 |

)% |

|

(36.2 |

)% |

|

(32.6 |

)% |

|

(21.4 |

)% |

| Average renewal term

(months) |

34 |

|

|

29 |

|

|

29 |

|

|

29 |

|

|

32 |

|

| Fleet

Rollforward (2) |

|

|

|

|

|

|

|

|

|

|

Beginning balance |

105,422 |

|

|

105,368 |

|

|

104,874 |

|

|

104,522 |

|

|

103,672 |

|

| Cars

added |

857 |

|

|

764 |

|

|

1,087 |

|

|

795 |

|

|

1,224 |

|

| Cars

scrapped |

(567 |

) |

|

(590 |

) |

|

(579 |

) |

|

(806 |

) |

|

(640 |

) |

| Cars

sold |

(344 |

) |

|

(668 |

) |

|

(860 |

) |

|

(839 |

) |

|

(249 |

) |

|

Ending balance |

105,368 |

|

|

104,874 |

|

|

104,522 |

|

|

103,672 |

|

|

104,007 |

|

| Utilization |

98.1 |

% |

|

99.0 |

% |

|

98.9 |

% |

|

99.1 |

% |

|

98.8 |

% |

| Average active

railcars |

103,824 |

|

|

103,479 |

|

|

103,702 |

|

|

102,976 |

|

|

102,760 |

|

| Boxcar

Fleet |

|

|

|

|

|

|

|

|

|

| Ending balance |

18,209 |

|

|

18,089 |

|

|

17,706 |

|

|

17,415 |

|

|

17,138 |

|

| Utilization |

97.1 |

% |

|

94.7 |

% |

|

93.8 |

% |

|

92.9 |

% |

|

90.2 |

% |

| Rail Europe

Statistics |

|

|

|

|

|

|

|

|

|

| Fleet

Rollforward |

|

|

|

|

|

|

|

|

|

|

Beginning balance |

22,859 |

|

|

23,088 |

|

|

22,966 |

|

|

23,122 |

|

|

23,131 |

|

| Cars

added |

323 |

|

|

78 |

|

|

287 |

|

|

207 |

|

|

288 |

|

| Cars

scrapped/sold |

(94 |

) |

|

(200 |

) |

|

(131 |

) |

|

(198 |

) |

|

(239 |

) |

|

Ending balance |

23,088 |

|

|

22,966 |

|

|

23,122 |

|

|

23,131 |

|

|

23,180 |

|

| Utilization |

94.8 |

% |

|

95.0 |

% |

|

95.6 |

% |

|

95.0 |

% |

|

95.7 |

% |

| Average active

railcars |

21,747 |

|

|

21,830 |

|

|

22,002 |

|

|

22,012 |

|

|

22,024 |

|

| Rail North

America Industry Statistics |

|

|

|

|

|

|

|

|

|

| Manufacturing Capacity

Utilization Index (3) |

75.4 |

% |

|

75.3 |

% |

|

76.0 |

% |

|

75.8 |

% |

|

76.6 |

% |

| Year-over-year Change

in U.S. Carloadings (excl. intermodal) (4) |

(12.3 |

)% |

|

(10.5 |

)% |

|

(8.2 |

)% |

|

5.7 |

% |

|

6.4 |

% |

| Year-over-year Change

in U.S. Carloadings (chemical) (4) |

2.4 |

% |

|

1.7 |

% |

|

1.5 |

% |

|

(1.2 |

)% |

|

0.1 |

% |

| Year-over-year Change

in U.S. Carloadings (petroleum) (4) |

(21.7 |

)% |

|

(22.2 |

)% |

|

(21.4 |

)% |

|

(13.2 |

)% |

|

(14.1 |

)% |

| Production Backlog at

Railcar Manufacturers (5) |

89,155 |

|

|

77,640 |

|

|

66,681 |

|

|

60,471 |

|

|

n/a (6) |

| American

Steamship Company Statistics |

|

|

|

|

|

|

|

|

|

| Total Net Tons Carried

(millions) |

8.9 |

|

|

8.7 |

|

|

7.2 |

|

|

1.0 |

|

|

8.5 |

|

_________

(1) GATX’s Lease Price Index (LPI) is an

internally-generated business indicator that measures lease rate

pricing on renewals for our North American railcar fleet, excluding

boxcars. The index is calculated using the weighted average lease

rate for a group of railcar types that GATX believes best

represents its overall North American fleet, excluding boxcars. The

average renewal lease rate change is reported as the percentage

change between the average renewal lease rate and the average

expiring lease rate, weighted by fleet composition. The average

renewal lease term is reported in months and reflects the average

renewal lease term of railcar types in the LPI, weighted by fleet

composition.(2) Excludes boxcar fleet.(3) As reported and revised

by the Federal Reserve.(4) As reported by the Association of

American Railroads (AAR).(5) As reported by the Railway Supply

Institute (RSI).(6) Not available, not published as of the date of

this release.

FOR FURTHER INFORMATION CONTACT:

GATX Corporation

Jennifer McManus

Director, Investor Relations

GATX Corporation

312-621-6409

jennifer.mcmanus@gatx.com

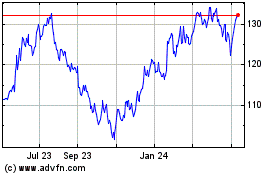

GATX (NYSE:GATX)

Historical Stock Chart

From Mar 2024 to Apr 2024

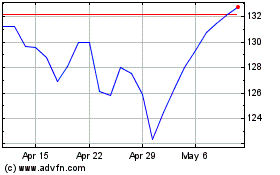

GATX (NYSE:GATX)

Historical Stock Chart

From Apr 2023 to Apr 2024