FBR Capital Markets & Co. Acts as Sell-Side Advisor to RockPile Energy Services, LLC in its Acquisition by Keane Group, Inc.

July 13 2017 - 4:30PM

FBR Capital Markets & Co. (“FBR”), a leading investment bank

and wholly owned subsidiary of B. Riley Financial, Inc.

(NASDAQ:RILY), served as a sell-side advisor to RockPile Energy

Services, LLC (the “Company”), an oil services company, in its

acquisition by Keane Group, Inc., a provider of integrated well

completion services, for $276 million.

The Company, along with its financial sponsor White Deer Energy,

engaged FBR to pursue a 144A equity offering in the first quarter

of 2017. The Company, FBR and White Deer established a dual track

for the potential offering with a targeted sale process and

executed a closed sale within four months of the signed engagement.

The acquisition closed on July 3, 2017.

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About RockPile Energy Services, LLC RockPile

Energy Services, LLC is a growth oriented oil services company

providing engineered completions solutions to oil and gas

exploration and production companies primarily in the Williston and

Permian Basins. RockPile's unique suite of capabilities and

technologies deliver improved well economics to clients operating

in the most challenging basins in North America. The

Company's service offerings include hydraulic fracturing, cased

hoble wireline, ancillary pump services, advanced completions

logistics solutions, and workover rig services.

About Keane Group, Inc. Headquartered

in Houston, Texas, Keane is one of the largest pure-play

providers of integrated well completion services in the U.S.,

with a focus on complex, technically demanding completion

solutions. Keane's primary service offerings include horizontal and

vertical fracturing, wireline perforation and logging, engineered

solutions, and cementing, as well as other value-added service

offerings. Keane owns approximately 1.2 million hydraulic

fracturing horsepower and 31 wireline trucks and provides

engineered solutions. Keane’s broad geographic footprint spans the

most prolific U.S. shale basins including the Permian,

Bakken, Marcellus/Utica, and SCOOP/STACK. Keane prides itself on

its outstanding employee culture, its efficiency and its ability to

meet and exceed the expectations of its customers and communities

in which it operates. About FBR Capital Markets &

Co. FBR provides investment banking, M&A advisory,

institutional brokerage, and research services with focused capital

and financial expertise in consumer; energy & natural

resources; financial institutions; healthcare; insurance;

industrials; real estate; and technology, media & telecom

industries.

B. Riley Financial, Inc. is a publicly traded, diversified

financial services company which takes a collaborative approach to

the capital raising and financial advisory needs of public and

private companies and high net worth individuals. The Company

operates through several wholly-owned subsidiaries,

including B. Riley & Co.,

LLC (www.brileyco.com), FBR Capital Markets & Co.

(www.fbr.com), Wunderlich Securities

(www.wunderlichonline.com), Great American Group,

LLC (www.greatamerican.com), and B. Riley Capital

Management, LLC (which includes B. Riley Asset Management

(www.brileyam.com), B. Riley Wealth Management

(www.brileywealth.com), and Great American Capital Partners, LLC

(www.gacapitalpartners.com). The Company also makes

proprietary investments in other businesses, such as the

acquisition of United Online, Inc. (www.untd.com)

in July 2016, where B. Riley Financial, Inc. is

uniquely positioned to leverage its expertise and assets in order

to maximize value.

Media Contact:

mediacontact@brileyco.com

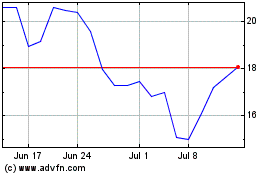

B Riley Financial (NASDAQ:RILY)

Historical Stock Chart

From Mar 2024 to Apr 2024

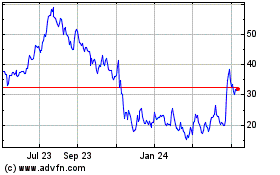

B Riley Financial (NASDAQ:RILY)

Historical Stock Chart

From Apr 2023 to Apr 2024