Current Report Filing (8-k)

July 10 2017 - 5:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 10, 2017

pSivida Corp.

(Exact

Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

000-51122

|

|

26-2774444

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

480 Pleasant Street, Watertown, MA 02472

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code:

(617) 926-5000

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 1.01.

|

Entry into a Definitive Material Agreement.

|

On July 10, 2017, pSivida US, Inc.

(the “Company”), a wholly owned subsidiary of pSivida Corp., entered into a Second Amended and Restated Collaboration Agreement (the “New Collaboration Agreement”) with Alimera Sciences, Inc., (“Alimera”), which amended

and restated the Amended and Restated Collaboration Agreement entered into between the parties on March 14, 2008 (as amended to date, the “Prior Collaboration Agreement”).

Under the Prior Collaboration Agreement, the Company granted Alimera an exclusive worldwide license to manufacture, develop, market and sell

ILUVIEN

®

for the treatment and prevention of human eye diseases other than uveitis. ILUVIEN is marketed in the United States and in certain countries in Europe for the treatment of diabetic

macular edema (“DME”). Under the New Collaboration Agreement, in addition to the rights to ILUVIEN for the treatment of DME, we also granted Alimera rights to the Company’s Durasert™ three-year treatment for posterior segment

uveitis in Europe, the Middle East and Africa (the “EMEA”). The New Collaboration Agreement allows Alimera to pursue an indication for posterior segment uveitis for ILUVIEN

®

in the EMEA. The Company retained commercialization rights for posterior segment uveitis in all other countries, including the United States. The New Collaboration Agreement also modified the

parties’ global licensing arrangement with respect to sales of ILUVIEN for the treatment of DME.

The New Collaboration Agreement

converted the Prior Collaboration Agreement’s profit sharing arrangement based on net profits from sales of ILUVIEN for the treatment of DME on a

country-by-country

basis to a tiered sales-based royalty arrangement based on global net revenues, effective July 1, 2017. Sales-based royalty payments to the Company start at 2% and increase to 6% upon the earliest of (i) January 1, 2019; (ii)

Alimera’s receipt of the first European Union country marketing approval for ILUVIEN for the treatment of posterior segment uveitis; and (iii) one year from Alimera’s filing of a marketing authorization application in the European

Union for posterior segment uveitis. The sales-based royalty payments will rise to 8% based on total ILUVIEN revenues in excess of $75 million in any calendar year.

In connection with the New Collaboration Agreement, Alimera forgave $10 million of the Company’s share of previous losses associated

with the commercialization of ILUVIEN (capped at $25 million under the New Collaboration Agreement), which were to be utilized to partially offset future profit sharing payments under the Prior Collaboration Agreement, and has the right to

recover $15 million of such previous losses as a partial offset to future royalty payments. Alimera will forgive an additional $5 million of the remaining $15 million of the previous losses upon approval of ILUVIEN for posterior

uveitis in any European Union country or January 1, 2020, whichever occurs first, unless certain conditions under the New Collaboration Agreement are not met. If the amounts recoverable by Alimera are less than $5 million at that time,

Alimera will pay the Company the difference in cash.

In connection with entering into the New Collaboration Agreement, the Company will

withdraw its marketing approval application and orphan drug designation for posterior segment uveitis in the European Union. Going forward, Alimera will be responsible for a number of due diligence and development obligations, including filing a

Type II variation for ILUVIEN for the treatment of posterior segment uveitis in the 17 countries in the European Union where ILUVIEN is currently approved for the treatment of DME.

A copy of the New Collaboration Agreement will be filed as an exhibit to the Company’s Annual Report on Form

10-K

for the fiscal year ended June 30, 2017. The foregoing description of the terms of the New Collaboration Agreement is qualified in its entirety by reference to the full text of such exhibit.

The press release announcing the entry into the New Collaboration Agreement is attached hereto as Exhibit 99.1, and is incorporated herein by

reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release dated July 10, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

PSIVIDA CORP.

|

|

|

|

|

By:

|

|

/s/ Nancy Lurker

|

|

|

|

Nancy Lurker

|

|

|

|

President and Chief Executive Officer

|

Date: July 10, 2017

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release dated July 10, 2017.

|

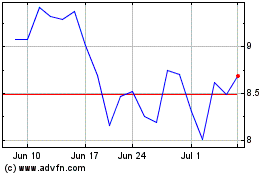

EyePoint Pharmaceuticals (NASDAQ:EYPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

EyePoint Pharmaceuticals (NASDAQ:EYPT)

Historical Stock Chart

From Apr 2023 to Apr 2024