UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2016

OR

|

|

|

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from

to

Commission file number 001-32327

|

|

|

|

|

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

MOSAIC UNION SAVINGS PLAN

|

|

|

|

|

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

The Mosaic Company

Atria Corporate Center - Suite E490

3033 Campus Drive

Plymouth, MN 55441

763-577-2700

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Financial Statements and Supplemental Schedule

December 31, 2016 and 2015

(With Report of Independent Registered Public Accounting Firm Thereon)

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Table of Contents

|

|

|

|

|

|

|

|

|

|

Page

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

Financial Statements:

|

|

|

|

|

|

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

Notes to Financial Statements

|

|

|

|

|

|

Supplemental Schedule

|

|

|

|

|

|

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

|

|

Report of Independent Registered Public Accounting Firm

The Plan Administrator

Mosaic Union Savings Plan:

We have audited the accompanying statements of net assets available for benefits of the Mosaic Union Savings Plan (the Plan) as of December 31, 2016 and 2015, and the related statement of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

-

An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2016 and 2015, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the accompanying Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2016

,

has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but include supplemental information required by the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedules, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2016 is fairly stated in all material respects in relation to the financial statements as a whole.

KPMG LLP

Minneapolis, Minnesota

June 27, 2017

MOSAIC UNION SAVINGS PLAN

Statements of Net Assets Available for Benefits

December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Assets:

|

|

|

|

|

|

|

|

Investments, at fair value

|

$

|

173,723,543

|

|

$

|

161,032,748

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

Employer contributions

|

|

4,855,442

|

|

|

4,693,984

|

|

|

|

|

Notes receivable from participants

|

|

8,744,757

|

|

|

9,138,744

|

|

|

|

|

|

|

|

Total receivables

|

|

13,600,199

|

|

|

13,832,728

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$

|

187,323,742

|

|

$

|

174,865,476

|

|

See accompanying notes to financial statements.

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Statements of Changes in Net Assets Available for Benefits

Years ended December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Additions to net assets attributed to:

|

|

|

|

|

|

|

Investment income (loss):

|

|

|

|

|

|

|

|

Interest and dividends

|

$

|

1,970,587

|

|

$

|

2,572,481

|

|

|

|

|

Net realized and unrealized appreciation (depreciation) in

|

|

|

|

|

|

|

|

|

fair value of investments:

|

|

8,919,403

|

|

|

(4,765,876

|

)

|

|

|

|

|

|

|

Net investment income (loss)

|

|

10,889,990

|

|

|

(2,193,395

|

)

|

|

Contributions:

|

|

|

|

|

|

|

Participants

|

|

12,959,208

|

|

|

12,106,996

|

|

|

|

Employer

|

|

8,987,232

|

|

|

8,683,303

|

|

|

|

|

|

|

|

Total contributions

|

|

21,946,440

|

|

|

20,790,299

|

|

|

Other

|

|

|

|

2,697

|

|

|

10,685

|

|

|

|

|

|

|

|

Total additions

|

|

32,839,127

|

|

|

18,607,589

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

|

|

Benefits paid

|

|

19,613,848

|

|

|

22,348,155

|

|

|

|

Asset transfers to qualified plans

|

|

413,782

|

|

|

580,664

|

|

|

|

Administrative fees

|

|

353,231

|

|

|

324,937

|

|

|

|

|

|

|

|

Total deductions

|

|

20,380,861

|

|

|

23,253,756

|

|

|

|

|

|

|

|

Net increase (decrease)

|

|

12,458,266

|

|

|

(4,646,167

|

)

|

|

Net assets available for benefits:

|

|

|

|

|

|

|

Beginning of year

|

|

174,865,476

|

|

|

179,511,643

|

|

|

|

End of year

|

$

|

187,323,742

|

|

$

|

174,865,476

|

|

See accompanying notes to financial statements.

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Notes to Financial Statements

December 31, 2016 and 2015

|

|

|

|

(1)

|

Description of the Plan

|

The following description of the Mosaic Union Savings Plan (the Plan) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

The Plan was established pursuant to collective bargaining agreements with the unions.

The following union hourly employees of The Mosaic Company (the Company) are eligible to participate upon their hire date:

Employees represented by Local #188‑A of the United Steelworkers of America at the Carlsbad, New Mexico operations;

Employees represented by Local #1625 International Chemical Workers Union Council of the United Food and Commercial Workers International Union at the New Wales, Florida operations;

Employees represented by Local #35C International Chemical Workers Union Council of the United Food and Commercial Workers International Union at the Four Corners, Florida operations;

Employees represented by Local #1625 International Chemical Workers Union Council of the United Food and Commercial Workers International Union at the Port Sutton, Florida facility (through December 23, 2003);

Employees represented by Local #12458‑02 of the United Steelworkers of America at the Hutchinson, Kansas operations (through October 31, 2005);

Employees represented by Local #22 Bakery, Confectionary, Tobacco Workers and Grain Millers at the Savage, Minnesota operations;

Employees represented by Locals #39C, 439C, and 814C International Chemical Workers Union Council of the United Food and Commercial Workers International Union at the Bartow, Riverview and Hookers Prairie, Florida operations;

Employees represented by Allied‑Industrial Union and its Local #4‑227, AFL‑CIO, CLC at the Houston, Texas operations (through December 11, 2008); and

Employees represented by Local #7‑662 of the United Steelworkers of America at the Pekin, Illinois operations.

Pursuant to certain collective bargaining agreements, newly hired represented employees are automatically enrolled in the Plan upon meeting the eligibility requirements. A participant is assumed to have authorized the Company to withhold from each paycheck a union-negotiated percentage of pay on a before‑tax basis. Automatic payroll withholding can begin no sooner than 60 days from date of hire. A participant has the right to decline automatic enrollment within 60 days from date of hire. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA), as amended.

The Plan is funded by contributions from participants in the form of payroll deductions/salary reductions from 1% to 75% of participants’ eligible pay (subject to Internal Revenue Service (IRS) annual statutory limits of $18,000 for 2016 and 2015, respectively) in before‑tax dollars. Additional before‑tax “catch‑up” contributions are allowed above the IRS annual dollar limit for employees at least age 50 or who will reach age 50 during a given calendar year. Participants direct the investment of their contributions into various investment options offered by the Plan. The Plan is also funded by Company matching contributions, which are subject to certain limitations imposed by Section 415 of the Internal Revenue Code (IRC). Participants should refer to their collective bargaining agreement or contact local Human Resources to determine the specific matching contributions.

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Notes to Financial Statements

December 31, 2016 and 2015

Pursuant to certain collective bargaining agreements, the Company added a Defined Contribution Retirement Plan (DCRP) feature to the Plan. Pursuant to certain collective bargaining agreements, the Plan was amended to allow certain participants to freeze their defined benefit accruals and begin participating in the DCRP feature of the Plan. The Company contribution to the DCRP feature is based on a percentage of an employee’s eligible pay. The Plan has become the primary retirement vehicle for employees covered by certain collective bargaining agreements. Generally, a participant must be employed on the last day of the Plan year to be eligible for the DCRP contribution.

Participants may roll over their vested benefits from other qualified retirement plans to the Plan.

Each participant’s account is credited with the participant’s contributions and allocations of (a) the Company contributions, (b) Plan earnings (losses), and (c) notes receivable from participant administrative expenses. Each participant’s account is charged with an allocation of certain administrative expenses. Allocations are based on earnings or account balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

|

|

|

|

(d)

|

Administrative Expenses

|

Administrative expenses are to be paid by the Plan but may be paid by the Company.

The Plan’s investments are administered by Vanguard Fiduciary Trust Company. Participants can choose from among twenty‑four investment funds.

Participants may elect to change the investment direction of their existing account balances and their future contributions daily.

Participants are immediately vested in the portion of their account related to participant contributions, Company matching contributions, and earnings thereon. Certain participants eligible for DCRP contributions are vested in their DCRP account after either three years of service, attaining age 65, or death while an employee. Forfeited, nonvested accounts will be used to reduce future employer contributions. In 2016 and 2015, Company contributions were reduced by $24,963 and $120,840, respectively, from forfeited nonvested accounts.

Participants may withdraw their vested account balance upon termination of employment. Under certain conditions of financial hardship, participants working for the Company may withdraw certain funds, but their participation in the Plan will be suspended for six months. Certain withdrawals are available after age 59½ or in the event of disability. Additionally, while still employed, in‑service withdrawals are available subject to certain requirements and limitations.

Subject to potential IRS penalties, participants whose employment is terminated and have a vested account balance in excess of $5,000 may receive their distribution in a lump sum or installments that commence immediately after termination or a later date, but no later than age 70½. Participants may be entitled to additional forms of payment or may need to obtain spousal consent to a distribution or withdrawal if the participant had an account balance from another qualified plan, that plan was maintained by a company that was acquired by the Company, and the participant’s account balance was transferred to this Plan.

|

|

|

|

(h)

|

Notes Receivable from Participants

|

Participants in the Plan may be granted loans subject to certain terms and maximum dollar or plan account balance limits, as defined by the Plan. Principal repayments, whose terms range from six months to five years, and related interest income are credited to the borrowing participant’s account. Generally, loan payments are made by payroll deductions. The loan interest rate that will be charged for both general purpose and residential loans is calculated on

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Notes to Financial Statements

December 31, 2016 and 2015

a monthly basis using the prime rate, as quoted in

The Wall Street Journal

, plus 1%. Interest rates on outstanding loans ranged from 4.25% to 9.0% in 2016 and from 4.25% to 9.0% in 2015. Principal and interest are paid through payroll deductions.

Although it has not expressed any interest to do so, the Company reserves the right under the Plan (subject to the collective bargaining agreements) to make changes at any time or even suspend or terminate the Plan subject to the provisions of ERISA.

|

|

|

|

(2)

|

Summary of Significant Accounting Policies

|

The financial statements of the Plan are prepared under the accrual basis of accounting.

The preparation of financial statements in conformity with U.S. Generally Accepted Accounting Principles (GAAP) requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

|

|

|

|

(c)

|

Investment Valuation and Income Recognition

|

Investments are stated at fair value. The investments in common/collective trust funds hold indirect investments in fully responsive investment contracts and as a result they are recognized at fair value and not contract value which is required for direct investments. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Fair value for shares of mutual and common/collective trust funds is the net asset value of those shares or units, as determined by the respective funds.

In May 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2015-07,

Fair Value Measurement (Topic 820) - Disclosures for Investments in Certain Entities That Calculate Net Asset Value Per Share or Its Equivalent

. This guidance removes the requirement to include within the fair value hierarchy leveling table those investments for which fair value is measured using the net asset value per share practical expedient. The guidance also removes the requirement to make certain disclosures for all investments that are eligible to be measured at fair value using the net asset value per share practical expedient. Rather, those disclosures are limited to investments for which the entity has elected to measure the fair value using that practical expedient. The guidance is effective for fiscal years beginning after December 15, 2015, with early adoption permitted. A reporting entity should apply the amendments retrospectively to all periods presented. Plan management adopted this guidance effective January 1, 2016 on a retrospective basis, which did not have an impact on the financial statements or notes to the financial statements.

Net appreciation (depreciation) in the fair value of investments includes realized gains and losses on investments bought and sold and the change in appreciation (depreciation) from one period to the next. Purchases and sales of securities are accounted for on a trade‑date basis. Dividend income is recorded on the ex‑dividend date. Interest from investments is recorded on the accrual basis.

|

|

|

|

(d)

|

Notes Receivable from Participants

|

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2016 or 2015. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded.

Benefit payments are recorded when paid.

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Notes to Financial Statements

December 31, 2016 and 2015

|

|

|

|

(f)

|

Administrative Expenses

|

Certain expenses of maintaining the Plan are paid directly by the Company and are excluded from these financial statements. Fees related to the administration of notes receivable from participants are charged directly to the participant's account and are included in administrative expenses. Investment related expenses are included in net realized and unrealized appreciation in fair value of investments.

|

|

|

|

(3)

|

Fair Value Measurements

|

Accounting Standards Codification (ASC) 820,

Fair Value Measurements

, defines fair value as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required to be recorded at fair value, the Plan considers the principal or most advantageous market in which it would transact and considers assumptions that market participants would use when pricing the asset or liability, such as inherent risk, transfer restrictions, and risk of nonperformance.

ASC 820 also establishes a fair value hierarchy that requires the Plan to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 established three levels of inputs that may be used to measure fair value:

|

|

|

|

•

|

Level 1: quoted prices in active markets for identical assets or liabilities;

|

|

|

|

|

•

|

Level 2: inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices in active markets for similar assets or liabilities, quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities; or

|

|

|

|

|

•

|

Level 3: unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

|

Instruments Measured at Fair Value on a Recurring Basis

Investments measured at fair value on a recurring basis consisted of the following types of instruments as of December 31, 2016 and 2015 (Level 1, 2, and 3 inputs are defined above):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at fair value as of December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Common stock

|

$

|

4,143,716

|

|

$

|

—

|

|

$

|

—

|

|

$

|

4,143,716

|

|

|

Mutual funds

|

|

37,151,373

|

|

|

—

|

|

|

—

|

|

|

37,151,373

|

|

|

Common/collective trust funds

|

|

—

|

|

|

132,428,454

|

|

|

—

|

|

|

132,428,454

|

|

|

|

|

Total investments at

|

|

|

|

|

|

|

|

|

|

|

|

|

fair value

|

$

|

41,295,089

|

|

$

|

132,428,454

|

|

$

|

—

|

|

$

|

173,723,543

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at fair value as of December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Common stock

|

$

|

3,231,400

|

|

$

|

—

|

|

$

|

—

|

|

$

|

3,231,400

|

|

|

Mutual funds

|

|

36,307,386

|

|

|

—

|

|

|

—

|

|

|

36,307,386

|

|

|

Common/collective trust funds

|

|

—

|

|

|

121,493,962

|

|

|

—

|

|

|

121,493,962

|

|

|

|

|

Total investments at

|

|

|

|

|

|

|

|

|

|

|

|

|

fair value

|

$

|

39,538,786

|

|

$

|

121,493,962

|

|

$

|

—

|

|

$

|

161,032,748

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Notes to Financial Statements

December 31, 2016 and 2015

Common stocks traded on national exchanges are valued at their closing market prices.

The fair values of the mutual funds are based on observable unadjusted market quotations for identical assets and are priced on a daily basis at the close of the NYSE.

The common/collective trusts (CCTs) are valued utilizing the respective net asset values as reported by such trusts, which represents readily determinable fair value, and are reported at fair value. The fair value has been determined by the trustee sponsoring the CCT by dividing the trust’s net assets at fair value by its units outstanding at the valuation dates. There are no restrictions as to the redemption of these investments and the Plan has no contractual obligations to further invest in any of these CCTs.

For each of the Plan funds (other than money market funds and short-term bond funds), a participant is prohibited from exchanging into a fund account for 60 calendar days after the participant has exchanged out of that fund account.

For the years ended December 31, 2016 and 2015, the Plan held no assets in which significant unobservable inputs (Level 3) were used in determining fair value and there were no transfers between levels.

|

|

|

|

(4)

|

Federal Income Tax Status

|

The Plan has received a determination letter from the IRS dated August 17, 2015 stating that the Plan is qualified under Section 401(a) of the IRC and, therefore, is exempt from taxation. Subsequent to this determination by the IRS, the Plan was amended. Once qualified, the Plan is required to operate in conformity with the IRC to maintain its qualification. The Plan Administrator believes the Plan is being operated in compliance with the applicable requirements of the IRC, and therefore, the Plan, as amended, is qualified and is tax‑exempt.

U.S. GAAP requires plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2016, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to 2011.

|

|

|

|

(5)

|

Risks and Uncertainties

|

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

A portion of the Plan’s net assets is invested in the common stock of the Company. At December 31, 2016 and 2015, approximately 2.2% and 1.8%, respectively, of the Plan’s total assets were invested in the Company’s common stock. The underlying value of the Company common stock is entirely dependent upon the performance of the Company and the market’s evaluation of such performance.

|

|

|

|

(6)

|

Party-in-Interest Transactions

|

Transactions resulting in Plan assets being transferred to or used by a related party are prohibited under ERISA unless a specific exemption applied. Vanguard Fiduciary Trust Company is a party in interest as defined by ERISA as a result of being trustee of the Plan. The Plan invests in funds managed by Vanguard Fiduciary Trust Company. The Plan also engages in transactions involving the acquisition or disposition of common stock of the Company, a party in interest with respect to the Plan. The Plan also engages in loans to participants. These transactions are covered by an exemption from the “prohibited transactions” provisions of ERISA and the IRC.

|

|

|

|

(7)

|

Reconciliation of Financial Statements to Form 5500

|

The following is a reconciliation of net assets available for benefits, and investment income per the financial statements to Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Net assets available for benefits per the financial statements

|

$

|

187,323,742

|

|

$

|

174,865,476

|

|

|

Adjustment to investment valuation

|

|

236,101

|

|

|

452,051

|

|

|

Net assets available for benefits per Form 5500

|

$

|

187,559,843

|

|

$

|

175,317,527

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,016

|

|

2,015

|

|

Benefits paid to participants per the financial statements

|

$

|

19,613,848

|

|

$

|

22,348,155

|

|

|

Less corrective distributions

|

|

—

|

|

|

(625

|

)

|

|

Benefits paid to participants per the Form 5500

|

$

|

19,613,848

|

|

$

|

22,347,530

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,016

|

|

2,015

|

|

Total additions per the financial statements

|

$

|

32,839,127

|

|

$

|

18,607,589

|

|

|

Add adjustment to investment valuation – current year

|

|

236,101

|

|

|

452,051

|

|

|

Less adjustment to investment valuation – prior year

|

|

(452,051

|

)

|

|

(760,534

|

)

|

|

Total income per Form 5500

|

$

|

32,623,177

|

|

$

|

18,299,106

|

|

The Plan has evaluated subsequent events from the statement of net assets available for benefits date through June 27, 2017, the date at which financial statements were available to be issued, and determined there were no other items to disclose.

SUPPLEMENTAL SCHEDULE

Schedule

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of

|

|

Current

|

|

Identity of issuer

|

|

Description

|

|

shares

|

|

value **

|

|

PIMCO

|

|

PIMCO Total Return Fund

|

|

441,174

|

|

|

4,424,977

|

|

|

Oakmark Funds

|

|

Oakmark Fund

|

|

35,187

|

|

|

2,550,354

|

|

|

MFS Investment Management

|

|

MFS Institutional International Equity Fund

|

|

10,009

|

|

|

202,784

|

|

|

T. Rowe Price Trust Co.

|

|

T. Row Price Small Cap Stock

|

|

135,298

|

|

|

2,961,674

|

|

|

Delaware Investments

|

|

Delaware U.S. Growth Fund

|

|

336,065

|

|

|

7,595,071

|

|

|

Northern Trust Global Investments

|

|

Northern Trust S&P 500 Index Fund

|

|

66,812

|

|

|

16,113,625

|

|

|

|

|

Northern Trust Russell 2000 Index Fund

|

|

13,272

|

|

|

3,290,110

|

|

|

GMO Funds

|

|

GMO Benchmark-Free Allocation Series Fund

|

|

12,542

|

|

|

120,400

|

|

|

Vanguard Fiduciary Trust Company*

|

|

Vanguard Total Bond Market Index Fund

|

|

828,789

|

|

|

8,826,599

|

|

|

|

|

|

|

|

|

|

|

Vanguard Prime Money Market Fund

|

|

68,613

|

|

|

68,613

|

|

|

|

|

|

|

|

|

|

|

Vanguard Retirement Savings Master Trust

|

|

28,109,221

|

|

|

28,109,221

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement Income Fund

|

|

16,161

|

|

|

505,514

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement 2010 Trust Fund

|

|

64,447

|

|

|

1,862,528

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement 2015 Trust Fund

|

|

208,469

|

|

|

6,062,283

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement 2020 Trust Fund

|

|

625,798

|

|

|

18,041,769

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement 2025 Trust Fund

|

|

585,090

|

|

|

16,593,166

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement 2030 Trust Fund

|

|

408,264

|

|

|

11,341,570

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement 2035 Trust Fund

|

|

320,612

|

|

|

8,925,848

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement 2040 Trust Fund

|

|

240,173

|

|

|

6,808,902

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement 2045 Trust Fund

|

|

232,925

|

|

|

6,605,758

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement 2050 Trust Fund

|

|

201,427

|

|

|

5,738,645

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement 2055 Trust Fund

|

|

54,729

|

|

|

2,088,443

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement 2060 Trust Fund

|

|

11,339

|

|

|

341,072

|

|

|

|

|

|

|

|

|

|

|

Vanguard Total International Stock Index Fund

|

|

105,593

|

|

|

10,400,901

|

|

|

The Mosaic Company*

|

|

Mosaic Stock Fund

|

|

141,279

|

|

|

4,143,716

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

173,723,543

|

|

|

N/A

|

|

|

|

|

|

Notes receivable from participants due through December 2020

|

|

|

$

|

8,744,757

|

|

|

|

|

|

|

|

*

|

Indicates party-in-interest to the Plan

|

|

|

|

|

|

|

**

|

Historical cost is not required for participant directed accounts

|

See accompanying report of independent registered public accounting firm.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the trustee (or other person who administers the employee benefit plan) has duly caused this annual report to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Plymouth, State of Minnesota, on the 27th day of June, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MOSAIC UNION SAVINGS PLAN

|

|

|

|

|

|

|

By:

|

|

Global Benefits Committee,

as Plan Administrator

|

|

|

|

|

|

|

By:

|

|

/s/ Corrine D. Ricard

|

|

|

|

|

Corrine D. Ricard, Chair

|

Exhibit Index

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

Incorporated Herein

by Reference to

|

|

Filed with

Electronic

Submission

|

|

23

|

|

Consent of KPMG LLP, independent registered public accounting firm

|

|

|

|

X

|

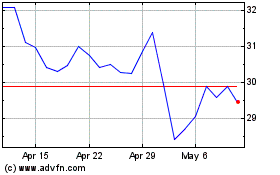

Mosaic (NYSE:MOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

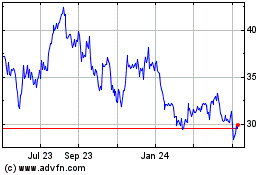

Mosaic (NYSE:MOS)

Historical Stock Chart

From Apr 2023 to Apr 2024