UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☒

Definitive Additional Materials

☐

Soliciting Material Pursuant to Rule 14a-11(c) or rule 14a-12

Triumph Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒

No fee required.

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

|

|

(1)

|

Amount previously paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement no.:

|

June 22, 2017

Ms. Kathy Cohen

Attention: ISS US Research

Institutional Shareholder Services

702 King Farm Boulevard Suite 400

Rockville, Maryland 20850

Dear Ms. Cohen:

We are writing in preparation for your upcoming review of our annual proxy statement and your attendant vote recommendations - specifically, your recommendations for our Say on Pay proposal and our Triumph Group, Inc. 2016 Directors’ Equity Compensation Plan. This letter provides additional information and thinking as they relate to your upcoming vote recommendations.

Our Performance in Fiscal Year 2017

Our performance in fiscal year 2017 was challenged in terms of revenue and total shareholder return, but we saw improvements in our net income and free cash flow. We also made significant progress in our transformation plan and successfully negotiated contract improvements and settlements with key customers, which allow us to be better positioned going into fiscal year 2018. Looking forward, we will continue to focus on repositioning the Company for profitability and long-term success. Since the close of our fiscal year on March 31, 2017, our stock price has increased nearly 30%, reflecting a positive market response to our fiscal year earnings announcement and press releases about our settlements with Boeing and Bombardier.

Our Approach to CEO Compensation in Fiscal Year 2017

A key element of our turnaround efforts is the Company’s ability to attract and retain necessary talent. During fiscal year 2017, we made strong progress in building our talent base in key executive positions. Most notably, we hired Mr. Daniel Crowley to serve as our President and Chief Executive Officer. Mr. Crowley brings to the Company 33 years of industry experience during which he has held key leadership roles in the development, production, and deployment of some of the largest and most complex aerospace and defense products. His previous leadership experience positions him well to lead our Company through this turnaround period.

In order to induce Mr. Crowley to join our Company and serve as our new CEO, we structured a competitive compensation package, which included an employment agreement, two sign-on awards and annual short-term and long-term incentive awards primarily focused on providing performance-based compensation. As an example, one of the sign-on awards was an inducement grant intended to provide Mr. Crowley with an immediate stake in the Company and focus him on restoring stockholder value creation. Please see the discussion of our CEO’s compensation package on pages 34-35 of our proxy statement.

Our Approach to Executive Compensation for Fiscal Year 2017

We made several changes to our executive compensation programs in fiscal year 2017 to align them more closely with the Company’s transformation priorities and stockholder value creation. The key changes are outlined on page 36 of our annual proxy statement.

Pay for performance remains a cornerstone of our compensation philosophy. One example includes the higher weighting of 70% placed on performance-based restricted stock units (“PSUs”) in our long-term incentive plan, which exceeds all of the Company’s peers except for one. The newly designed PSUs are based equally on three-year cumulative EPS performance and three-year cumulative adjusted return on net assets (“RONA”) performance. We moved from a one year to three year performance period to align with market practice. We also changed from paying our long-term incentives 30% in cash and 70% in stock awards to 100% in stock awards to enable employees to achieve meaningful equity positions in the Company.

In addition to the changes to our long-term incentive plan, we modified our annual incentive plan’s metrics and weightings. In fiscal year 2017, we transitioned from an annual incentive based 70% on earnings per share (“EPS”) and 30% on free cash flow to 60% on operating income, 30% on free cash flow, and 10% on strategic objectives. The decision to incorporate a strategic component in the annual incentive plan was to achieve greater consistency in implementing strategic measures throughout the Company, while the decision to move away from EPS in the annual incentive plan was to avoid mirroring the annual and long-term incentive measures.

Another demonstration of our pay for performance philosophy is the Compensation Committee’s application of negative discretion in determining our final fiscal year 2017 annual incentive payout. At the corporate level, we achieved 81% of our operating income goal, 168% of our free cash flow goal, and 100% of our strategic goals, resulting in a corporate payout potential of 109% of target. This payout potential represented only one input in the Committee’s determination of the final payout. Other considerations included:

|

|

|

|

–

|

The full year performance results including the declining stock price over the fiscal year

|

|

|

|

|

–

|

The need to do additional work to restore the confidence of both stockholders and customers

|

|

|

|

|

–

|

The Committee’s recognition that the challenges presented to the new management team during the fiscal year were greater than anticipated at the time the annual incentive operating income and free cash flow goals were put in place

|

|

|

|

|

–

|

The need to recognize the progress that was made throughout the fiscal year

|

In light of these considerations, the Committee used negative discretion and determined that the fiscal year 2017 annual incentive plan corporate goals had been achieved at 75% of target, a 34 percentage point decrease from the payout potential.

Amendment to Our 2013 Incentive Plan to Provide for Double-Trigger Acceleration in a Change in Control

As described on pages 54-55 of our proxy statement, the Compensation Committee has amended the change in control provisions of our 2013 Incentive Plan, the only active incentive compensation plan under which awards are made to employees, including executive officers, to remove the potential for single trigger acceleration of equity awards for our executive officers. We believe these changes provide certainty to our executive officers with respect to any termination of employment associated with a change in control, while removing the potential for single-trigger acceleration, a problematic pay practice.

Our Approach to Non-Employee Director Compensation for Fiscal Year 2017

The new 2016 Directors’ Equity Compensation Plan is critical to our philosophy of encouraging meaningful ownership of our common stock by non-employee directors. We do not want to use cash compensation in place of equity for several reasons. First, we need to preserve cash within the business to directly support our turnaround strategy. Second, equity compensation more naturally reinforces the alignment of non-employee director and shareholder interests. Related to this, equity brings a longer lens to Company performance and non-employee director service than cash compensation.

To further align with our philosophy of meaningful stock ownership, we have increased the stock ownership guidelines for non-employee directors from three times to five times the annual cash retainer fees, and added a requirement for each non-employee director to retain at least 50% of the after-tax value of vested equity awards until retirement or departure from the Board. In addition, we have provided a mechanism though the deferred compensation plan to non-employee directors to defer payment of the restricted stock units and all or a portion of annual cash compensation into deferred stock accounts to provide for payment at or after departure from the Board. The deferred compensation plan provides non-employee directors with more flexibility with respect to the timing and distribution method of their cash and equity compensation.

We are committed to managing our director equity program responsibly. We have established maximum limits on the fair market value of non-employee director equity grants - $600,000 for annual equity grants and an additional $250,000 for discretionary, one-time grants. We have also eliminated the equity sign-on awards and added an explicit repricing prohibition without stockholder approval, which aligns with our employee equity plan.

Another change we want to address is the reduction of the vesting period for equity compensation from three years to one year. The one year vesting period is intended to align with the one year Board term and promote Board refreshment. Further, the one year vesting period aligns with peer and general industry practice.

Finally, we want to acknowledge that we are requesting 500,000 shares for our 2016 Directors’ Equity Plan, which is greater than the 230,000 shares we requested in our previous directors’ equity plan which expired in 2016. The reason for this increase in shares is five-fold: (i) doubling of annual equity retainers from $70,000 to $140,000 to align with market and to provide a competitive pay program for recruiting new director talent, (ii) the introduction of cash deferrals, (iii) a decline in the share price from historical

levels, (iv) an increase in the number of non-employee directors since the last directors’ equity plan was put in place from 6 to 8, and (v) our announced plans to continue to refresh our Board over time as part of our overall transformation plan. Of note, two of our long-term directors are not standing for re-election at the 2017 Annual Meeting.

* * * * *

We thank you for your time and consideration, and we very much appreciate your perspectives on our programs. We welcome any opportunity to discuss this information with you further. Please contact me, wherever helpful.

Sincerely,

/s/Richard R. Lovely

Mr. Richard Lovely

Senior Vice President, Human Resources

Triumph Group

899 Cassatt Road

Suite 210

Berwyn, Pennsylvania 19312

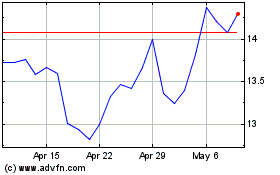

Triumph (NYSE:TGI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Triumph (NYSE:TGI)

Historical Stock Chart

From Sep 2023 to Sep 2024