Additional Proxy Soliciting Materials (definitive) (defa14a)

June 22 2017 - 3:45PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☒

Definitive Additional Materials

☐

Soliciting Material Pursuant to Rule 14a-11(c) or rule 14a-12

Triumph Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒

No fee required.

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

|

|

(1)

|

Amount previously paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement no.:

|

Dear Shareholders:

Triumph’s proxy statement is now available for our July 20, 2017 Annual Meeting. I’m reaching out to highlight a few key features and offer a call or in-person meeting with me and two of our directors, Jack Drosdick and Dawne Hickton.

|

|

|

|

•

|

Triumph has been undergoing a large-scale transformation.

Since appointing Dan Crowley as CEO in January 2016, we have been simplifying the organization, placing more emphasis on key markets and customers, strengthening our senior leadership team, and providing aligned segment financial reporting.

|

|

|

|

|

•

|

Triumph came out of fiscal year 2017 better positioned for fiscal year 2018. Highlights include:

|

|

|

|

|

◦

|

Exceeded our fiscal year 2017 cost-cutting goal of $44 million by $25 million

|

|

|

|

|

◦

|

Reduced our long-term debt by over $339 million

|

|

|

|

|

◦

|

Delivered three consecutive quarters of improved cash flow

|

|

|

|

|

◦

|

Successfully negotiated contract improvements and settlements with key customers

|

|

|

|

|

•

|

Our non-employee director compensation program has been updated.

Compensation for non-employee directors was below the median. We therefore increased our independent directors’ annual cash and equity compensation, and at the same time, eliminated the equity sign-on awards. We also increased our stock ownership guidelines to encourage meaningful ownership. The increase to director compensation and the increase in shares requested from the prior directors’ equity plan align with our announced plans to continue to refresh our Board over time as part of our overall transformation plan. Of note, two of our long-term directors are not standing for re-election at the 2017 Annual Meeting.

|

|

|

|

|

•

|

Our executive compensation program has been enhanced to focus on key outcomes critical to driving the transformation.

We have incorporated a strategic component in the annual cash bonus plan to align compensation more closely with our transformation priorities.

We have also emphasized EPS in the long‑term incentive program. Our fiscal 2017 compensation program structure includes:

|

|

|

|

|

◦

|

Annual cash bonus based 60% on operating income, 30% on free cash flow, and 10% on strategic measures focused on customer priorities and transformation objectives

|

|

|

|

|

◦

|

One LTI program with two vehicles (70% performance-based restricted stock units and 30% time-based restricted stock units)

|

|

|

|

|

◦

|

Performance-based restricted stock units based equally on three-year cumulative EPS performance and three-year cumulative adjusted return on net assets ("RONA") performance

|

|

|

|

|

•

|

We continue to refresh our Board of Directors

.

The founder and two other legacy directors have moved on, or will be stepping down at the 2017 Annual Meeting. We have subsequently reduced the size of the Board from 10 to eight directors, with six of our eight directors having joined the Board in the past seven years. We expect to add individuals to our Board with strong expertise in our business.

|

Our Board of Directors takes representing you seriously. Thank you for your interest, and please let me know if I can set up a meeting with Jack, the Chair of our Compensation Committee and Dawne, the Chair of our Governance Committee (as of the 2017 Annual Meeting).

Warm Regards,

Sheila Spagnolo

Triumph Group

Vice President, Tax & Investor Relations

Triumph (NYSE:TGI)

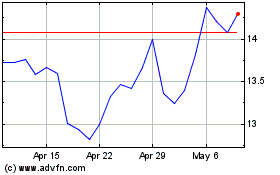

Historical Stock Chart

From Aug 2024 to Sep 2024

Triumph (NYSE:TGI)

Historical Stock Chart

From Sep 2023 to Sep 2024