Registration Statement for Securities to Be Issued in Business Combination Transactions (s-4/a)

June 21 2017 - 6:03AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on June 20, 2017

Registration

No. 333-217479

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

No. 1

to

FORM

S-4

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Diamondback Energy, Inc.*

(Exact Name of Registrant As Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

1311

|

|

45-4502447

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

500 West Texas

Suite 1200

Midland,

Texas 79701

(432)

221-7400

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Teresa L. Dick

Chief

Financial Officer

9400 N. Broadway, Suite 700

Oklahoma City, Oklahoma 73114

(405)

463-6900

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

Seth

R. Molay, P.C.

Akin Gump Strauss Hauer & Feld LLP

1700 Pacific Avenue, Suite 4100

Dallas, TX 75201

(214)

969-4780

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If the

securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a

post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and

“emerging growth company” in Rule

12b-2

of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large Accelerated Filer

|

|

☒

|

|

Accelerated Filer

|

|

☐

|

|

|

|

|

|

|

Non-Accelerated Filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller Reporting Company

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

Emerging Growth Company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule

13e-4(i)

(Cross-Border Issue Tender Offer) ☐

Exchange Act Rule

14d-1(d)

(Cross-Border Third-Party Tender

Offer) ☐

*

Co-Registrants

|

|

|

|

|

|

|

Exact Name of

Co-Registrant

as Specified in its

Charter (1)

|

|

State or Other Jurisdiction of Incorporation

or

Organization

|

|

I.R.S. Employer Identification Number

|

|

Diamondback O&G LLC

|

|

Delaware

|

|

26-1409444

|

|

Diamondback E&P LLC

|

|

Delaware

|

|

36-4728559

|

|

(1)

|

The address of each

Co-Registrant

is c/o Diamondback Energy, Inc., 500 West Texas, Suite 1200, Midland, Texas 79701 and the telephone number for each

Co-Registrant

is (432)

221-7400.

|

The Registrants hereby amend

this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may

determine.

EXPLANATORY NOTE

We are filing this Amendment No. 1 to our Registration Statement on Form

S-4

(File

No. 333-217479)

for the sole purpose of filing an updated consent of Grant Thornton LLP, dated as of the current date, attached to this Amendment No. 1 as Exhibit 23.2.

PART II

INFORMATION NOT

REQUIRED IN PROSPECTUS

|

Item 20.

|

Indemnification of Directors and Officers.

|

Limitation of Liability

Section 102(b)(7) of the Delaware General Corporation Law, or the DGCL, permits a corporation, in its certificate of incorporation, to

limit or eliminate, subject to certain statutory limitations, the liability of directors to the corporation or its stockholders for monetary damages for breaches of fiduciary duty, except for liability:

|

|

•

|

|

for any breach of the director’s duty of loyalty to the company or its stockholders;

|

|

|

•

|

|

for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

|

|

|

•

|

|

in respect of certain unlawful dividend payments or stock redemptions or repurchases; and

|

|

|

•

|

|

for any transaction from which the director derives an improper personal benefit.

|

In

accordance with Section 102(b)(7) of the DGCL, Section 9.1 of our certificate of incorporation provides that that no director shall be personally liable to us or any of our stockholders for monetary damages resulting from breaches of their

fiduciary duty as directors, except to the extent such limitation on or exemption from liability is not permitted under the DGCL. The effect of this provision of our certificate of incorporation is to eliminate our rights and those of our

stockholders (through stockholders’ derivative suits on our behalf) to recover monetary damages against a director for breach of the fiduciary duty of care as a director, including breaches resulting from negligent or grossly negligent

behavior, except, as restricted by Section 102(b)(7) of the DGCL. However, this provision does not limit or eliminate our rights or the rights of any stockholder to seek

non-monetary

relief, such as an

injunction or rescission, in the event of a breach of a director’s duty of care.

If the DGCL is amended to authorize corporate

action further eliminating or limiting the liability of directors, then, in accordance with our certificate of incorporation, the liability of our directors to us or our stockholders will be eliminated or limited to the fullest extent authorized by

the DGCL, as so amended. Any repeal or amendment of provisions of our certificate of incorporation limiting or eliminating the liability of directors, whether by our stockholders or by changes in law, or the adoption of any other provisions

inconsistent therewith, will (unless otherwise required by law) be prospective only, except to the extent such amendment or change in law permits us to further limit or eliminate the liability of directors on a retroactive basis.

Indemnification

Section 145

of the DGCL permits a corporation, under specified circumstances, to indemnify its directors, officers, employees or agents against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlements actually and reasonably

incurred by them in connection with any action, suit or proceeding brought by third parties by reason of the fact that they were or are directors, officers, employees or agents of the corporation, if such directors, officers, employees or agents

acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe their conduct was unlawful. In a

derivative action, i.e., one by or in the right of the corporation, indemnification may be made only for expenses actually and reasonably incurred by directors, officers, employees or agents in connection with the defense or settlement of an action

or suit, and only with respect to a matter as to which they shall have acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification shall be made if

such person shall have been adjudged liable to the corporation, unless and only to the extent that the court in which the action or suit was brought shall determine upon application that the defendant directors, officers, employees or agents are

fairly and reasonably entitled to indemnity for such expenses despite such adjudication of liability

Our certificate of incorporation provides that we will, to the fullest extent authorized or

permitted by applicable law, indemnify our current and former directors and officers, as well as those persons who, while directors or officers of our corporation, are or were serving as directors, officers, employees or agents of another entity,

trust or other enterprise, including service with respect to an employee benefit plan, in connection with any threatened, pending or completed proceeding, whether civil, criminal, administrative or investigative, against all expense, liability and

loss (including, without limitation, attorney’s fees, judgments, fines, ERISA excise taxes and penalties and amounts paid in settlement) reasonably incurred or suffered by any such person in connection with any such proceeding. Notwithstanding

the foregoing, a person eligible for indemnification pursuant to our certificate of incorporation will be indemnified by us in connection with a proceeding initiated by such person only if such proceeding was authorized by our board of directors,

except for proceedings to enforce rights to indemnification and advancement of expenses.

The right to indemnification conferred by our

certificate of incorporation is a contract right that includes the right to be paid by us the expenses incurred in defending or otherwise participating in any proceeding referenced above in advance of its final disposition, provided, however, that

if the DGCL requires, an advancement of expenses incurred by our officer or director will be made only upon delivery to us of an undertaking, by or on behalf of such officer or director, to repay all amounts so advanced if it is ultimately

determined by final judicial decision that such person is not entitled to be indemnified for such expenses under our certificate of incorporation or otherwise.

The rights to indemnification and advancement of expenses will not be deemed exclusive of any other rights which any person covered by our

certificate of incorporation may have or hereafter acquire under law, our certificate of incorporation, our bylaws, an agreement, vote of stockholders or disinterested directors, or otherwise.

Any repeal or amendment of provisions of our certificate of incorporation affecting indemnification rights, whether by our stockholders or by

changes in law, or the adoption of any other provisions inconsistent therewith, will (unless otherwise required by law) be prospective only, except to the extent such amendment or change in law permits us to provide broader indemnification rights on

a retroactive basis, and will not in any way diminish or adversely affect any right or protection existing at the time of such repeal or amendment or adoption of such inconsistent provision with respect to any act or omission occurring prior to such

repeal or amendment or adoption of such inconsistent provision. Our certificate of incorporation also permits us, to the extent and in the manner authorized or permitted by law, to indemnify and to advance expenses to persons other that those

specifically covered by our certificate of incorporation.

Our bylaws include the provisions relating to advancement of expenses and

indemnification rights consistent with those set forth in our certificate of incorporation. In addition, our bylaws provide for a right of indemnitee to bring a suit in the event a claim for indemnification or advancement of expenses is not paid in

full by us within a specified period of time. Our bylaws also permit us to purchase and maintain insurance, at our expense, to protect us and/or any director, officer, employee or agent of our corporation or another entity, trust or other enterprise

against any expense, liability or loss, whether or not we would have the power to indemnify such person against such expense, liability or loss under the DGCL.

Any repeal or amendment of provisions of our bylaws affecting indemnification rights, whether by our board of directors, stockholders or by

changes in applicable law, or the adoption of any other provisions inconsistent therewith, will (unless otherwise required by law) be prospective only, except to the extent such amendment or change in law permits us to provide broader

indemnification rights on a retroactive basis, and will not in any way diminish or adversely affect any right or protection existing thereunder with respect to any act or omission occurring prior to such repeal or amendment or adoption of such

inconsistent provision.

We have entered into indemnification agreements with each of our current directors and executive officers. These

agreements require us to indemnify these individuals to the fullest extent permitted under Delaware law against liabilities that may arise by reason of their service to us, and to advance expenses incurred as a result of any proceeding against them

as to which they could be indemnified. We also intend to enter into indemnification agreements with future directors and executive officers.

We may enter into an Underwriting Agreement in connection with a specific offering under which the underwriters will be obligated, under

certain circumstances, to indemnify our directors and officers against certain liabilities, including liabilities under the Securities Act. Reference is made to the form of Underwriting Agreement to be filed as an Exhibit 1.1 or 1.2 to our Current

Report on Form

8-K

in connection with a specific offering.

The following is a list of exhibits filed as a part of this registration

statement.

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation of the Company (incorporated by reference to Exhibit 3.1 to the Form

10-Q,

File

No. 001-35700,

filed by the Company with the SEC on November 16, 2012).

|

|

|

|

|

3.2

|

|

Certificate of Amendment No. 1 of the Amended and Restated Certificate of Incorporation of the Company (incorporated by reference to Exhibit 3.1 to the Form

8-K,

File

No. 001-35700,

filed by the Company with the SEC on December 12, 2016).

|

|

|

|

|

3.3

|

|

Amended and Restated Bylaws of the Company (incorporated by reference to Exhibit 3.2 to the Form

10-Q,

File

No. 001-35700,

filed by the Company

with the SEC on November 16, 2012).

|

|

|

|

|

4.1

|

|

Specimen certificate for shares of common stock, par value $0.01 per share, of the Company (incorporated by reference to Exhibit 4.1 to Amendment No. 4 to the Registration Statement on Form

S-1,

File

No. 333-179502,

filed by the Company with the SEC on August 20, 2012).

|

|

|

|

|

4.2

|

|

Registration Rights Agreement, dated as of October 11, 2012, by and between the Company and DB Energy Holdings LLC (incorporated by reference to Exhibit 4.2 to the Form

10-Q,

File

No. 001-35700,

filed by the Company with the SEC on November 16, 2012).

|

|

|

|

|

4.3

|

|

Registration Rights Agreement, dated as of October 11, 2012, by and between the Company and DB Energy Holdings LLC (incorporated by reference to Exhibit 4.2 to the Form

10-Q,

File

No. 001-35700,

filed by the Company with the SEC on November 16, 2012).

|

|

|

|

|

4.4

|

|

Indenture, dated as of October 28, 2016, among Diamondback Energy, Inc., the guarantors party thereto and Wells Fargo Bank, National Association, as trustee (including the form of Diamondback Energy, Inc.’s 4.750 %

Senior Notes due 2024) (incorporated by reference to Exhibit 4.1 to the Form

8-K,

File

No. 001-35700,

filed by the Company with the SEC on November 2,

2016).

|

|

|

|

|

4.5

|

|

Registration Rights Agreement, dated as of October 28, 2016, among Diamondback Energy, Inc., the guarantors party thereto and J.P. Morgan Securities LLC (incorporated by reference to Exhibit 4.2 to the Form

8-K,

File

No. 001-35700,

filed by the Company with the SEC on November 2, 2016).

|

|

|

|

|

4.6

|

|

Indenture, dated as of December 20, 2016, among Diamondback Energy, Inc., the guarantors party thereto and Wells Fargo Bank, National Association, as trustee (including the form of Diamondback Energy, Inc.’s 5.375% Senior

Notes due 2025) (incorporated by reference to Exhibit 4.1 to the Form

8-K,

File

No. 001-35700,

filed by the Company with the SEC on December 21,

2016).

|

|

|

|

|

4.7

|

|

Registration Rights Agreement, dated as of December 20, 2016, among Diamondback Energy, Inc., the guarantors party thereto and Credit Suisse Securities (USA) LLC (incorporated by reference to Exhibit 4.2 to the Form

8-K,

File

No. 001-35700,

filed by the Company with the SEC on December 21, 2016).

|

|

|

|

|

4.8

|

|

Registration Rights Agreement, dated as of February 28, 2017, by and between Diamondback Energy, Inc., Brigham Resources, LLC, Brigham Resources Operating, LLC and Brigham Resources Upstream Holdings, LP (incorporated by

reference to Exhibit 4.1 to the Form 8-K, File No. 001-35700, filed by the Company with the SEC on March 6, 2017).

|

|

|

|

|

5.1**

|

|

Opinion of Akin Gump Strauss Hauer & Feld LLP as to the legality of the 4.750% Senior Notes due 2024 being registered.

|

|

|

|

|

5.2**

|

|

Opinion of Akin Gump Strauss Hauer & Feld LLP as to the legality of the 5.375% Senior Notes due 2025 being registered.

|

|

|

|

|

21

|

|

Subsidiaries of the Registrant (incorporated by reference to Exhibit 21.1 to the Form

10-K

(File

No. 001-35700,

filed by the Company with the SEC

on February 15, 2017).

|

|

|

|

|

12.1**

|

|

Statement Regarding the Computation of Ratio of Earnings (Deficit) to Fixed Charges.

|

|

|

|

|

23.1**

|

|

Consent of Akin Gump Strauss Hauer & Feld LLP (included on Exhibits 5.1 and 5.2).

|

|

|

|

|

23.2*

|

|

Consent of Grant Thornton LLP.

|

|

|

|

|

23.3**

|

|

Consent of Ryder Scott Company, L.P. with respect to the Diamondback Energy, Inc. reserve report.

|

|

|

|

|

23.4**

|

|

Consent of Ryder Scott Company, L.P. with respect to the Viper Energy Partners LP reserve report.

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

24**

|

|

Power of Attorney (included on the signature pages of this Registration Statement).

|

|

|

|

|

25.1**

|

|

Statement of Eligibility on Form

T-1

for the Indenture governing 4.750% Senior Notes due 2024 under the Trust Indenture Act of 1939, as amended, of Trustee.

|

|

|

|

|

25.2**

|

|

Statement of Eligibility on Form

T-1

for the Indenture governing 5.375% Senior Notes due 2025 under the Trust Indenture Act of 1939, as amended, of Trustee.

|

|

|

|

|

99.1**

|

|

Form of Letter of Transmittal for 4.750% Senior Notes due 2024.

|

|

|

|

|

99.2**

|

|

Form of Letter of Transmittal for 5.375% Senior Notes due 2025.

|

Insofar as indemnification for liabilities arising under the Securities

Act of 1933, as amended, or the Securities Act of 1933, may be permitted to directors, officers and controlling persons of the registrants, we have been advised that in the opinion of the Securities and Exchange Commission, or the SEC, such

indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by a registrant of expenses incurred

or paid by a director, officer or controlling person of such registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, such

registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the

Securities Act of 1933 and will be governed by the final adjudication of such issue.

Each registrant hereby undertakes:

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(a) to include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(b) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC

pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration

statement; and

(c) to include any material information with respect to the plan of distribution not previously disclosed in the

registration statement or any material change to such information in the registration statement.

That, for the purpose of determining any

liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof.

To remove from registration by means of a post-effective amendment any of the securities being

registered which remain unsold at the termination of the offering.

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser,

if such registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in

reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of

the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior

to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

That, for the purpose of determining liability of such registrant under the Securities Act of 1933 to any purchaser in the initial

distribution of the securities, in a primary offering of securities of such registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold

to such purchaser by means of any of the following communications, such undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(a) any preliminary prospectus or prospectus of the undersigned registrants relating to the offering required to be filed pursuant to Rule

424;

(b) any free writing prospectus relating to the offering prepared by or on behalf of such registrant or used or referred to by the

undersigned registrants;

(c) the portion of any other free writing prospectus relating to the offering containing material information

about the undersigned registrants or their securities provided by or on behalf of such registrant; and

(d) any other communication that

is an offer in the offering made by such registrant to the purchaser.

That, for purposes of determining any liability under the

Securities Act of 1933, each filing of a registrant annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to

section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

To respond to requests for information that is incorporated by

reference into the prospectus pursuant to Items 4, 10(b), 11, or 13 of this Form, within one business day of receipt of such request, and to send the incorporated documents by first class mail or other equally prompt means. This includes information

contained in documents filed subsequent to the effective date of the registration statement through the date of responding to the request.

To supply by means of a post-effective amendment all information concerning a transaction, and the company being acquired involved therein,

that was not the subject of and included in the registration statement when it became effective.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form

S-4

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Midland, Texas on the

20th day of June, 2017.

|

|

|

|

|

DIAMONDBACK ENERGY, INC.

|

|

|

|

|

By:

|

|

/s/ Teresa L. Dick

|

|

|

|

Teresa L. Dick

|

|

|

|

Chief Financial Officer, Executive Vice

President and Assistant Secretary

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration

statement has been signed by the following persons in the capacities indicated on June 20, 2017.

|

|

|

|

|

NAME

|

|

TITLE

|

|

|

|

|

*

|

|

Chief Executive Officer (principal executive officer), Director

|

|

Travis D. Stice

|

|

|

|

|

|

|

/s/ Teresa L. Dick

|

|

Chief Financial Officer, Executive Vice President and Assistant

|

|

Teresa L. Dick

|

|

Secretary (principal financial and accounting officer)

|

|

|

|

|

*

|

|

Chairman of the Board and Director

|

|

Steven E. West

|

|

|

|

|

|

|

*

|

|

Director

|

|

Michael P. Cross

|

|

|

|

|

|

|

*

|

|

Director

|

|

David L. Houston

|

|

|

|

|

|

|

*

|

|

Director

|

|

Mark L. Plaumann

|

|

|

|

|

|

|

|

*By:

|

|

/s/ Teresa L. Dick

|

|

|

|

Teresa L. Dick

|

|

|

|

Attorney-in-Fact

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form

S-4

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Midland, Texas on the

20th day of June, 2017.

|

|

|

|

|

DIAMONDBACK O&G LLC

|

|

|

|

|

By:

|

|

/s/ Teresa L. Dick

|

|

|

|

Teresa L. Dick

|

|

|

|

Chief Financial Officer

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration

statement has been signed by the following persons in the capacities indicated on June 20, 2017.

|

|

|

|

|

NAME

|

|

TITLE

|

|

|

|

|

*

|

|

President and Chief Executive Officer (principal executive

|

|

Travis D. Stice

|

|

officer)

|

|

|

|

|

/s/ Teresa L. Dick

|

|

Chief Financial Officer (principal financial and accounting

|

|

Teresa L. Dick

|

|

officer)

|

|

|

|

|

DIAMONDBACK ENERGY, INC.

|

|

Sole Member

|

|

|

|

|

|

By:

|

|

/s/ Teresa L. Dick

|

|

|

|

Teresa L. Dick

|

|

|

|

Chief Financial Officer, Executive Vice President and Assistant Secretary

|

|

|

|

|

*By:

|

|

/s/ Teresa L.Dick

|

|

|

|

Teresa L. Dick

|

|

|

|

Attorney-in-Fact

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form

S-4

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Midland, Texas on the

20th day of June, 2017.

|

|

|

|

|

DIAMONDBACK E&P LLC

|

|

|

|

|

By:

|

|

/s/ Teresa L. Dick

|

|

|

|

Teresa L. Dick

|

|

|

|

Chief Financial Officer

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration

statement has been signed by the following persons in the capacities indicated on June 20, 2017.

|

|

|

|

|

NAME

|

|

TITLE

|

|

|

|

|

*

|

|

Chief Executive Officer (principal executive

|

|

Travis D. Stice

|

|

officer)

|

|

|

|

|

/s/ Teresa L. Dick

|

|

Chief Financial Officer (principal financial and accounting

|

|

Teresa L. Dick

|

|

officer)

|

|

|

|

|

DIAMONDBACK ENERGY, INC.

|

|

Sole Member

|

|

|

|

|

By:

/s/ Teresa L. Dick

|

|

|

|

Teresa L. Dick

|

|

|

|

Chief Financial Officer, Executive Vice President and Assistant Secretary

|

|

|

|

|

|

|

|

|

|

*By:

|

|

/s/ Teresa L. Dick

|

|

|

|

|

|

Teresa L. Dick

|

|

|

|

|

|

Attorney-in-Fact

|

|

|

Diamondback Energy, Inc.

Exhibit Index

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation of the Company (incorporated by reference to Exhibit 3.1 to the Form

10-Q,

File

No. 001-35700,

filed by the Company with the SEC on November 16, 2012).

|

|

|

|

|

3.2

|

|

Certificate of Amendment No. 1 of the Amended and Restated Certificate of Incorporation of the Company (incorporated by reference to Exhibit 3.1 to the Form

8-K,

File

No. 001-35700,

filed by the Company with the SEC on December 12, 2016).

|

|

|

|

|

3.3

|

|

Amended and Restated Bylaws of the Company (incorporated by reference to Exhibit 3.2 to the Form

10-Q,

File

No. 001-35700,

filed by the Company

with the SEC on November 16, 2012).

|

|

|

|

|

4.1

|

|

Specimen certificate for shares of common stock, par value $0.01 per share, of the Company (incorporated by reference to Exhibit 4.1 to Amendment No. 4 to the Registration Statement on Form

S-1,

File

No. 333-179502,

filed by the Company with the SEC on August 20, 2012).

|

|

|

|

|

4.2

|

|

Registration Rights Agreement, dated as of October 11, 2012, by and between the Company and DB Energy Holdings LLC (incorporated by reference to Exhibit 4.2 to the Form

10-Q,

File

No. 001-35700,

filed by the Company with the SEC on November 16, 2012).

|

|

|

|

|

4.3

|

|

Registration Rights Agreement, dated as of October 11, 2012, by and between the Company and DB Energy Holdings LLC (incorporated by reference to Exhibit 4.2 to the Form

10-Q,

File

No. 001-35700,

filed by the Company with the SEC on November 16, 2012).

|

|

|

|

|

4.4

|

|

Indenture, dated as of October 28, 2016, among Diamondback Energy, Inc., the guarantors party thereto and Wells Fargo Bank, National Association, as trustee (including the form of Diamondback Energy, Inc.’s 4.750 %

Senior Notes due 2024) (incorporated by reference to Exhibit 4.1 to the Form

8-K,

File

No. 001-35700,

filed by the Company with the SEC on November 2,

2016).

|

|

|

|

|

4.5

|

|

Registration Rights Agreement, dated as of October 28, 2016, among Diamondback Energy, Inc., the guarantors party thereto and J.P. Morgan Securities LLC (incorporated by reference to Exhibit 4.2 to the Form

8-K,

File

No. 001-35700,

filed by the Company with the SEC on November 2, 2016).

|

|

|

|

|

4.6

|

|

Indenture, dated as of December 20, 2016, among Diamondback Energy, Inc., the guarantors party thereto and Wells Fargo Bank, National Association, as trustee (including the form of Diamondback Energy, Inc.’s 5.375% Senior

Notes due 2025) (incorporated by reference to Exhibit 4.1 to the Form

8-K,

File

No. 001-35700,

filed by the Company with the SEC on December 21,

2016).

|

|

|

|

|

4.7

|

|

Registration Rights Agreement, dated as of December 20, 2016, among Diamondback Energy, Inc., the guarantors party thereto and Credit Suisse Securities (USA) LLC (incorporated by reference to Exhibit 4.2 to the Form

8-K,

File

No. 001-35700,

filed by the Company with the SEC on December 21, 2016).

|

|

|

|

|

4.8

|

|

Registration Rights Agreement, dated as of February 28, 2017, by and between Diamondback Energy, Inc., Brigham Resources, LLC, Brigham Resources Operating, LLC and Brigham Resources Upstream Holdings, LP (incorporated by

reference to Exhibit 4.1 to the Form 8-K, File No. 001-35700, filed by the Company with the SEC on March 6, 2017).

|

|

|

|

|

5.1**

|

|

Opinion of Akin Gump Strauss Hauer & Feld LLP as to the legality of the 4.750% Senior Notes due 2024 being registered.

|

|

|

|

|

5.2**

|

|

Opinion of Akin Gump Strauss Hauer & Feld LLP as to the legality of the 5.375% Senior Notes due 2025 being registered.

|

|

|

|

|

21

|

|

Subsidiaries of the Registrant (incorporated by reference to Exhibit 21.1 to the Form

10-K

(File

No. 001-35700,

filed by the Company with the SEC

on February 15, 2017).

|

|

|

|

|

12.1**

|

|

Statement Regarding the Computation of Ratio of Earnings (Deficit) to Fixed Charges.

|

|

|

|

|

23.1**

|

|

Consent of Akin Gump Strauss Hauer & Feld LLP (included on Exhibits 5.1 and 5.2).

|

|

|

|

|

23.2*

|

|

Consent of Grant Thornton LLP.

|

|

|

|

|

23.3**

|

|

Consent of Ryder Scott Company, L.P. with respect to the Diamondback Energy, Inc. reserve report.

|

|

|

|

|

23.4**

|

|

Consent of Ryder Scott Company, L.P. with respect to the Viper Energy Partners LP reserve report.

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

24**

|

|

Power of Attorney (included on the signature pages of this Registration Statement).

|

|

|

|

|

25.1**

|

|

Statement of Eligibility on Form

T-1

for the Indenture governing 4.750% Senior Notes due 2024 under the Trust Indenture Act of 1939, as amended, of Trustee.

|

|

|

|

|

25.2**

|

|

Statement of Eligibility on Form

T-1

for the Indenture governing 5.375% Senior Notes due 2025 under the Trust Indenture Act of 1939, as amended, of Trustee.

|

|

|

|

|

99.1**

|

|

Form of Letter of Transmittal for 4.750% Senior Notes due 2024.

|

|

|

|

|

99.2**

|

|

Form of Letter of Transmittal for 5.375% Senior Notes due 2025.

|

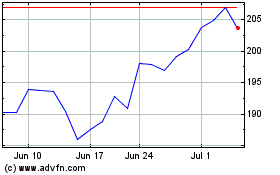

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Mar 2024 to Apr 2024

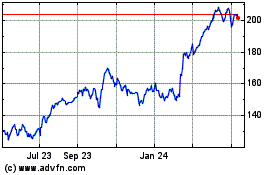

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Apr 2023 to Apr 2024