Report of Foreign Issuer (6-k)

June 12 2017 - 9:29AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2017

Commission File Number:

001-37669

Nomad Foods Limited

(Translation of registrant’s name in English)

No. 5

New Square

Bedfont Lakes Business Park

Feltham, Middlesex TW14 8HA

+ (44) 208 918 3200

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1): ☐

Note

: Regulation

S-T

Rule

101(b)(1) only permits the submission in paper of a Form

6-K

if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

Note

: Regulation

S-T

Rule

101(b)(7) only permits the submission in paper of a Form

6-K

if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the

jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as

the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form

6-K

submission or other Commission filing on EDGAR.

Repurchase of Ordinary Shares Held in Escrow

On June 12, 2017, Nomad Foods Limited (the “

Company

”) issued a press release announcing that it has entered into an agreement to

repurchase 9,779,729 of its ordinary shares (the “

Shares

”) beneficially owned by funds advised by Permira Advisers LLP (“

Permira

”) at a purchase price of $10.75 per share, which represents a 25% discount to the

closing price of the Company’s ordinary shares on the New York Stock Exchange on June 9, 2017. The transaction relates to a final settlement of indemnity claims against an affiliate of Permira of legacy tax matters that predate its

acquisition of Iglo Group in 2015 (the “

Acquisition

”). The aggregate purchase price of approximately $105.1 million will be funded from the Company’s cash on hand and the Shares will be retired. The Shares were previously

held in escrow since the closing of the Acquisition pending resolution of such claims.

The press release is furnished as Exhibit 99.1 to this Report. The

information contained in this Report on Form

6-K

is incorporated by reference into the registration statements on (i) Form

S-8

filed with the Securities and

Exchange Commission (the “

Commission

”) on May 3, 2016 (File

No. 333-211095)

and (ii) Form

F-3,

initially filed with the Commission on

March 30, 2017 and declared effective on May 2, 2017 (File

No. 333-217044).

Forward-Looking

Statements

Certain statements in this report are forward-looking statements which are based on the Company’s expectations, intentions and

projections regarding its future performance, anticipated events and other matters that are not historical facts, including expectations regarding the repurchase of ordinary shares. Given these risks and uncertainties, prospective investors are

cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of such statements and, except as required by applicable law, the Company does not undertake any obligation to update or revise

publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

NOMAD FOODS LIMITED

|

|

|

|

|

By:

|

|

/s/ Paul Kenyon

|

|

Name:

|

|

Paul Kenyon

|

|

Title:

|

|

Group Chief Financial Officer

|

Dated: June 12, 2017

Exhibit Index

|

|

|

|

|

Exhibit

Number

|

|

Exhibit Title

|

|

|

|

|

99.1

|

|

Press Release issued by Nomad Foods Limited on June 12, 2017.

|

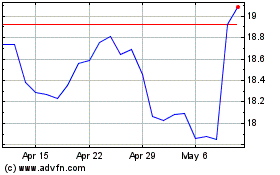

Nomad Foods (NYSE:NOMD)

Historical Stock Chart

From Aug 2024 to Sep 2024

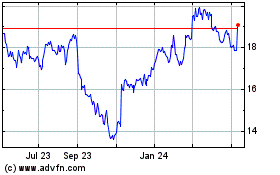

Nomad Foods (NYSE:NOMD)

Historical Stock Chart

From Sep 2023 to Sep 2024