Explains the Harm of JCP’s 11th Hour

Cookie-Cutter ‘Plan’

Refutes Baseless Allegations Regarding its

Engaged and Highly Qualified Board

Highlights Patterns of Shareholder Value

Destruction by James Pappas and John Morlock

Reaffirms that Fiesta Board Took Careful and

Deliberate Action to Effectuate Change Before the Pappas Group

Surfaced

Recommends Shareholders Vote FOR the Company’s

Highly Qualified Director Nominees on the WHITE Proxy Card

Fiesta Restaurant Group, Inc. (“Fiesta” or the “Company”)

(NASDAQ:FRGI), parent company of the Pollo Tropical® and Taco

Cabana® fast casual restaurant brands, today announced its Board of

Directors (the “Board”) clarified misrepresentations and falsehoods

in an investor presentation and a press release filed by a

dissident group of several activist hedge funds led by JCP

Investment Management, LLC (collectively, the “Pappas Group” or

“JCP”) regarding the Company. The Pappas Group has filed a

presentation and a press release with regards to Fiesta that are

rife with mistakes, misleading comparisons, distorted analyses,

material omissions and alternative facts. The Fiesta Board believes

that these communications destroy James Pappas’ and John Morlock’s

credibility as agents for change and casts doubt on their level of

insight into the restaurant industry. We believe their presentation

and press release are designed to divert attention away from the

damaging facts about their troublesome backgrounds and track

records. While the Board looks forward to continuing to directly

engage with shareholders, it believes it is necessary to highlight

at least some of the major distortions embedded in JCP’s

presentation and press release:

1. After Not Proposing Any Plan For

9 Months, JCP Unveils a Cookie-Cutter “Plan” in the 11th

Hour that Would Cause Serious Harm to Fiesta if Adopted

The Pappas Group did not present a plan to Fiesta in the over

nine months since they first surfaced. Neither their proxy

statement nor any of their previous press releases or letters

included a real plan. Now, 14 days prior to the annual meeting, the

Pappas Group presents for the first time a purported “plan.” JCP’s

last minute “plan” is what you would expect from a novice

investment banker: a handful of amateurish and shallow back-of-the

envelope calculations on an Excel spread sheet. This “plan” is

completely detached from the important nuances and realities of the

Company’s operations and the inner-workings of a real public

company, and lacks analytical rigor. It is a Hail Mary thrown in

the context of a failing campaign.

The contrast to the detailed and sophisticated Renewal Plan

introduced by Fiesta’s new CEO, Rich Stockinger, could not be

starker. Rich, an accomplished and respected restaurant operator,

has spearheaded our strategic Renewal Plan, which is already

underway and delivering tangible results. Our strategic Renewal

Plan was developed following an extensive analysis of both public

and non-public data. Rich recently implemented a very similar plan

at Benihana that revitalized Benihana and maximized value to its

shareholders by increasing the company’s stock price by ~600%.

The Pappas “plan” is conspicuously light on details or

assumptions. Many of its components are vague recommendations and

contain arbitrary financial metric benchmarks that have been thrown

at the wall in an attempt to see what sticks. The specifics that

are included, however, appear eerily reminiscent of failed

initiatives that Mr. Pappas previously introduced at other

companies like Jamba Juice. At the very least, introducing JCP’s

competing, unproven “plan” in the 11th hour would be a significant

disruption that would take valuable resources away from the

continued execution of the ongoing Renewal Plan. Your Board is

concerned that this alternative “plan” carries significant and

unnecessary risks.

If you are asking yourself, “what’s the harm?” of putting JCP’s

nominees on the board, you have to look no further than to Mr.

Pappas’s performance at Jamba Juice for your answer. After forcing

himself onto the company’s board and audit committee in 2015

through an activist campaign, Mr. Pappas implemented a plan with

similar features to the “plan” proposed for Fiesta at Jamba Juice.

Since then, Jamba Juice has lost more than half of its market value

and missed earnings for eleven consecutive quarters. To add insult

to shareholder injury, according to its SEC filings, Jamba Juice

will now likely disclose a material weakness in internal controls,

which has resulted in significantly delayed financial reporting and

a possible delisting from NASDAQ. Just as with Jamba Juice, JCP

proposes a change in Fiesta’s headquarters during a critical

turnaround period, without acknowledging that this very same

approach has generated an accounting crisis and shareholder value

destruction at Jamba Juice.

2. Pappas Exaggerates His Own

Record and Downplays His Most Relevant Directorship

In setting forth his track record, Mr. Pappas makes no

distinction between the mostly microcap companies where he has

served as a director versus the larger companies where he was a

cheerleader from the sidelines, in some cases taking credit for

actions the companies were already in the process of executing.

Perhaps Mr. Pappas’ list suggests he’s a decent day-trader (or had

good timing) given the short-term nature of many of his purported

successes. But he ignores what’s actually relevant to his candidacy

at Fiesta.

He downplays Jamba Juice, which we discuss above and is the

situation that is most clearly and directly relevant to his

potential election at Fiesta. He also neglects to mention his board

service on Samex Mining Corp., where the company filed for

bankruptcy less than one year after Mr. Pappas joined its board

pursuant to a settlement agreement.

Ironically, Mr. Pappas also claims Casella as a success that

justifies his election to the Board of Fiesta. Certainly the

Casella stock price increased, for which he misleadingly claims

credit. But Mr. Pappas’ own ideas were soundly rejected by Casella

shareholders. In fact, by the time Casella’s annual meeting

occurred, shareholders so strongly rejected Mr. Pappas’ plan that

Mr. Pappas withdrew his nominees and didn’t even bother turning in

the few voting proxies he did receive, disenfranchising these

shareholders. Here is what proxy advisory firm Proxy Mosaic said

when it joined ISS and Glass Lewis in rejecting his plan and

nominees:

“Perhaps the most remarkable aspect of JCP’s plan for Casella is

precisely how unremarkable it is…. [The plan] reads like a laundry

list of steps that the Company has taken… We believe that [Pappas’]

election to the Board could potentially disrupt the execution of

Management’s strategic plan…The choice, in our view, is a fairly

clear one: the election of the Dissident simply presents an

unacceptable risk.”

We believe it would be completely accurate to replace “Casella”

with “Fiesta” in the quote above.

3. JCP’s Cherry-Picked Peer Group

is Clearly Designed to Arrive at a Predetermined Conclusion

In an apparent attempt to mislead shareholders about Fiesta’s

strong historic performance through 2015, JCP artificially

manufactured a peer group of only four “Most Similar Competitors,”

arbitrarily disregarding nine peer companies of Fiesta.

These four cherry-picked restaurants have only one thing in

common: strong performance. But one of these companies, Popeyes,

has a completely different business model than Fiesta. And while

Fiesta utilized the other three of these so-called “Most Similar

Competitors” for its own TSR analysis, these restaurants are

inappropriate for realistic operating performance benchmarking when

used as a standalone group.

We assume JCP ignored Fiesta’s other nine peer companies for one

reason only: Fiesta outperformed this group.

4. The Pappas Group’s Attempts to

Malign Fiesta’s Directors with Jefferies’ Associations Are a

Desperate Smokescreen to Distract From Relevant Director

Qualifications

JCP attempts to label three of Fiesta’s Directors as “not

independent” because of their affiliation with Jefferies. Nothing

could be further from the truth.

Brian Friedman is President and Nicholas Daraviras is a managing

director of Leucadia, the parent company of Jefferies, a leading

investment bank in the restaurant industry. Barry Alperin sits on

the board of Jefferies, not Leucadia and is an employee of neither.

JCP fails to mention that Barry was nominated to the Fiesta Board

by a Carrols Restaurant Group director, not Mr. Friedman or Mr.

Daraviras, and was invited to join the Jefferies board well

after he was elected to the Fiesta

Board. Mr. Friedman and Mr. Daraviras joined the Fiesta Board in

2011 as a result of an investment in our Company by a private

equity fund they managed. Upon request of management and the other

Directors, Mr. Friedman and Mr. Daraviras agreed to remain on the

Fiesta Board even after their fund had distributed its remaining

stake in Fiesta to their investors in late 2013. The Board asked

them to stay because of their invaluable expertise in the

restaurant industry, and Mr. Friedman and Mr. Daraviras agreed

because they believe in Fiesta’s story and business and are

committed to creating long-term value for all of the Company’s shareholders.

JCP’s accusations are belied by the facts: rather than profiting

from their Board memberships, Jefferies has, in fact, foregone

millions of dollars of potential investment banking fees as a

result of having affiliates on the Fiesta board. For example,

Jefferies was unable to represent Fiesta in its review of strategic

alternatives for Taco Cabana in 2015 or in the sale evaluation

process for Fiesta in 2016; J.P. Morgan represented Fiesta instead

in both reviews. JCP has also tried to manufacture a history of

Jefferies selling Fiesta stock and leaving shareholders to hold the

bag. When JCP points out that Jefferies sold its last Fiesta shares

in September 2013 at a price of $35.50, it neglected to provide the

necessary context that the stock price of Fiesta thereafter

continued to rise to a high of $65.01. Moreover, JCP does not

mention who never sold any of their Fiesta shares: Brian Friedman

and Barry Alperin.

Most importantly, JCP fails to mention the significant

advantages of having Mr. Friedman and Mr. Alperin on the Board:

Their decades of experience, tremendous expertise and deep

relationships in the restaurant and consumer industry, not to

mention their objectivity and integrity, are difficult to match and

have afforded Fiesta a critical competitive advantage over many

similar restaurant companies.

Contrast this with the Pappas Group’s view of director

qualifications. The Pappas Group appears to be so desperate to

convince the shareholders that their candidates measure up to

Fiesta’s highly qualified Directors that they actually argue that

having “personally built restaurants or liv[ing] in

Texas” somehow makes them more qualified than our two

Directors with decades of corporate leadership and board experience

in the restaurant and consumer space.

Moreover, JCP demonstrates further deception and hypocrisy when

it claims in its presentation that only Mr. Pappas and Mr. Morlock

qualify as “direct shareholder representative” on the Board – but

not Mr. Friedman or Mr. Alperin. Leucadia, of which Mr. Friedman is

President, owns more than 4% of the shares of Fiesta, and Mr.

Friedman and Mr. Alperin personally own more than 70,000 additional

shares. Apparently, in Mr. Pappas’ world view, an “ownership

perspective” counts only when it is provided by James Pappas – but

not from seasoned directors with decades of experience of investing

in the restaurant and consumer space. In addition, Pappas’ cited

list of investments illustrates his short-term investment

horizon.

We should also highlight how many shares JCP’s other purported

“direct shareholder representative” Mr. Morlock owns by quoting

directly from JCP’s proxy statement:

“Mr. Morlock does not beneficially own any shares of Common

Stock, constituting 0% of the outstanding shares.”

5. The Pappas Group’s

Characterization of an “Unengaged Board” and Claim that Fiesta’s

Actions in Response to Them is Contradicted by the Facts

In July 2015, Fiesta’s stock price was $58.01, near its all-time

high. After the business declined in late 2015 and early 2016, the

Board swiftly took bold and decisive action, including engineering

a CEO leadership transition announced in August 2016 – only 13

months after the stock price was near its all-time high and a month

before the Pappas Group filed its initial Schedule 13D. The public

announcements we made in the Fall of 2016 and the Spring of 2017

for which JCP takes credit were the direct result of actions that

were taken and committees that were formed in the Spring and Summer

of 2016. In short, the Board’s response to Fiesta’s deteriorating

business performance was proactive, rapid and decisive and in no

way connected to the Pappas Group. The full timeline is below:

- In November 2015, the Board formed a

special committee and engaged financial and legal advisors to

evaluate strategic alternatives for Taco Cabana

- In May 2016, the Board commenced

discussions with former CEO Tim Taft about this retirement

- In August 2016, the Board announced

Taft’s retirement and formed a special committee to search for a

new CEO and additional Board members with significant restaurant

operating experience, with the assistance of Heidrick &

Struggles

- In September 2016, the Board halted the

spin-off of Taco Cabana and suspended the expansion of Pollo

Tropical into Texas

- In October 2016, the Board decided to

close 10 Pollo Tropical restaurants

- Later in October, the Board formed a

special committee to conduct a review of strategic alternatives,

including the possible sale of the Company, with the assistance of

legal and financial advisors

- In February 2017, the Board chose

industry veteran Richard Stockinger as new CEO, appointed

restaurant expert Paul Twohig (former President, Dunkin Donuts) to

the Board and appointed retired McKinsey & Company senior

partner, Stacey Rauch, to become the Chair of the Board

- In April 2017, our new CEO announced

the Renewal Plan and the closure of an additional 30 Pollo Tropical

restaurants (which contributed to an operating loss of $14.7

million), and later announced ~$7.5 million of annualized G&A

savings

- In May 2017, the Board appointed two

new directors to the Board: Rich Stockinger (our new CEO) and Nick

Shepherd (former CEO and President, TGI Friday’s)

Lastly, we would like to highlight that each director on

Fiesta’s purportedly “unengaged Board” attended 100% of all Board

meetings. In fact, it is questionable whether Mr. Pappas could keep

up with the Fiesta Board’s level of engagement in light of the fact

that he already sits on the boards of Jamba Juice, Tandy Leather

and US Geothermal, in addition to his involvement with the Pappas

family business and running a hedge fund with new activist

campaigns against other companies like Kona Grill.

DO NOT LET THESE MISLEADING CLAIMS,

DISRUPTIVE PROPOSALS AND CHARACTER ATTACKS SWAY YOUR VOTE - PROTECT

THE VALUE OF YOUR INVESTMENT IN FIESTA: VOTE THE

WHITE PROXY CARD TODAY

Your Board’s commitment to acting in the best interests of all

Fiesta shareholders remains unwavering. We have acted thoughtfully

and decisively to review strategic options, enhance the composition

of our Board, execute a CEO transition and implement a

comprehensive Renewal Plan to improve financial results.

At this point in the Company’s evolution – with a new CEO,

revitalized strategy, and an experienced, refreshed and expanded

Board – your Board is excited about the visible path to shareholder

value creation. We strongly believe that it would be detrimental to

shareholders to replace two of Fiesta’s highly-qualified directors

with JCP’s candidates and risk experiencing the shareholder value

destruction that Mr. Pappas is currently generating at Jamba Juice

and that Mr. Morlock oversaw during his tenures at Potbelly

(negative 55% TSR from IPO until his resignation), SpinCycle

(distressed sale), Clubhouse International (bankruptcy) and Boston

Chicken (bankruptcy).

We believe Fiesta shareholders should protect the value of their

investment by voting “FOR” ALL of our experienced and highly

qualified director nominees on the WHITE proxy card: Barry J. Alperin,

Stephen P. Elker and Brian P. Friedman.

Shareholders can vote by completing, dating and signing the

Company-provided WHITE proxy

card, or by telephone or the internet by following the instructions

on the WHITE proxy card.

If you have questions or need assistance voting

your shares please contact:

MacKenzie Partners, Inc.105 Madison

AvenueNew York, New York 10016proxy@mackenziepartners.comCall

Collect: (212) 929-5500orToll-Free (800) 322-2885

About Fiesta Restaurant Group, Inc.

Fiesta Restaurant Group, Inc. is the parent company of the Pollo

Tropical and Taco Cabana restaurant brands. The brands specialize

in the operation of fast-casual restaurants that offer distinct and

unique tropical and Mexican inspired flavors with broad appeal at a

compelling value. For more information about Fiesta Restaurant

Group, Inc., visit the corporate website at www.frgi.com.

Important Additional Information

The Company, its directors and certain of its executive officers

are participants in the solicitation of proxies from the Company’s

stockholders in connection with the Company’s 2017 Annual Meeting

of Stockholders. The Company has filed a proxy statement and white

proxy card with the U.S. Securities and Exchange Commission (the

“SEC”) in connection with such solicitation. STOCKHOLDERS OF THE

COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT,

ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH

THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

AS THEY WILL CONTAIN IMPORTANT INFORMATION. Information regarding

the identity of potential participants, and their direct or

indirect interests, by security holdings or otherwise, are set

forth in the definitive proxy statement and other materials filed

with the SEC in connection with the 2017 Annual Meeting of

Stockholders. Stockholders can obtain the proxy statement, any

amendments or supplements to the proxy statement, and any other

documents filed by the Company with the SEC at no charge at the

SEC’s website at www.sec.gov. These

documents are also available at no charge at the Company’s website

at www.frgi.com in the section

“Investor Relations.”

Forward-Looking Statements

Except for the historical information contained in this news

release, the matters addressed are forward-looking statements.

Forward-looking statements, written, oral or otherwise made,

represent Fiesta’s expectation or belief concerning future events.

Without limiting the foregoing, these statements are often

identified by the words “may,” “might,” “believes,” “thinks,”

“anticipates,” “plans,” “expects,” “intends” or similar

expressions. In addition, expressions of Fiesta’s strategies,

intentions or plans are also forward-looking statements. Such

statements reflect management’s current views with respect to

future events and are subject to risks and uncertainties, both

known and unknown. You are cautioned not to place undue reliance on

these forward-looking statements as there are important factors

that could cause actual results to differ materially from those in

forward-looking statements, many of which are beyond Fiesta’s

control. Investors are referred to the full discussion of risks and

uncertainties as included in Fiesta’s filings with the Securities

and Exchange Commission.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170525006088/en/

Investor Relations:Raphael Gross,

203-682-8253investors@frgi.comorMedia Relations:Phil Denning,

646-277-1258Phil.Denning@icrinc.com

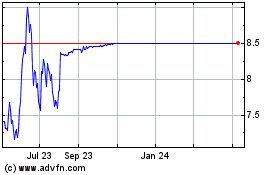

Fiesta Restaurant (NASDAQ:FRGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

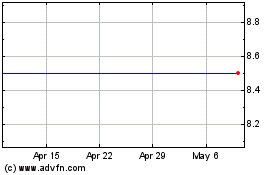

Fiesta Restaurant (NASDAQ:FRGI)

Historical Stock Chart

From Apr 2023 to Apr 2024