Current Report Filing (8-k)

May 24 2017 - 4:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 24, 2017

WEIGHT WATCHERS INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Virginia

|

|

001-16769

|

|

11-6040273

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

675 Avenue of the Americas, 6

th

Floor, New York, New York

|

|

10010

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(212) 589-2700

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of

this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On May 18, 2017, Weight Watchers International, Inc. (the

“Company”) commenced an offer to prepay at a discount to par up to $75 million of Initial Tranche

B-2

Term Loans outstanding under, and as defined in, and pursuant to the terms of, the Credit

Agreement among the Company, the lenders party thereto, JPMorgan Chase Bank, N.A., as administrative agent and an issuing bank, The Bank of Nova Scotia, as revolving agent, swingline lender and an issuing bank, and the other parties thereto. On

May 24, 2017, the Company accepted offers with a discount equal to or greater than 3.28% in respect of the Initial Tranche

B-2

Term Loans. To complete the prepayment of the accepted offers, on

May 25, 2017, the Company will expend an aggregate amount of cash proceeds totaling approximately $73.03 million plus an amount sufficient to pay accrued and unpaid interest on the amount to be prepaid to prepay approximately

$75.51 million of the Initial Tranche

B-2

Term Loans, resulting in approximately $2.48 million in savings on the payment. A copy of the Company’s press release regarding the matter described

above is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

Item

9.01.

|

Financial Statements and Exhibits

.

|

(d) Exhibits.

|

|

99.1

|

Press Release dated May 24, 2017.

|

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHT WATCHERS INTERNATIONAL, INC.

|

|

|

|

|

|

|

DATED: May 24, 2017

|

|

|

|

By:

|

|

/s/ Nicholas P. Hotchkin

|

|

|

|

|

|

Name:

|

|

Nicholas P. Hotchkin

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer & Member, Interim Office of the Chief Executive Officer

|

3

Exhibit Index

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release dated May 24, 2017.

|

4

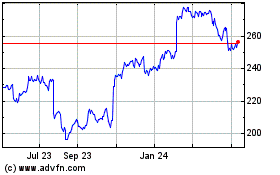

Willis Towers Watson Pub... (NASDAQ:WTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

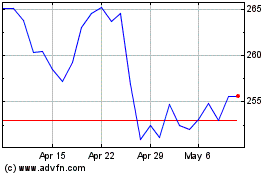

Willis Towers Watson Pub... (NASDAQ:WTW)

Historical Stock Chart

From Apr 2023 to Apr 2024