|

|

Filed by Huntsman Corporation

|

|

|

pursuant to Rule 425 under the Securities Act of 1933

|

|

|

and deemed filed pursuant to Rule 14a-12 under

|

|

|

the Securities Exchange Act of 1934

|

|

|

Subject Company: Huntsman Corporation

|

|

|

Commission File No. 1-32427

|

22-May-2017

Huntsman Corp. (HUN)

Clariant AG and Huntsman Corporation Investor Call Transcript

CORPORATE PARTICIPANTS

|

Anja Pomrehn

Head-Investor Relations, Clariant AG

|

|

J. Kimo Esplin

Executive Vice President-Strategy & Investment, Huntsman Corp.

|

|

|

|

|

|

Hariolf Kottmann

Chief Executive Officer & Executive Director, Clariant AG

|

|

Patrick Jany

Chief Financial Officer, Clariant AG

|

|

|

|

|

|

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

|

|

|

OTHER PARTICIPANTS

|

Stephanie Bothwell

Analyst, Merrill Lynch International

|

|

Laurence Alexander

Analyst, Jefferies LLC

|

|

|

|

|

|

Robert Andrew Koort

Analyst, Goldman Sachs & Co.

|

|

Paul R. Walsh

Analyst, Morgan Stanley & Co. International Plc

|

|

|

|

|

|

Andrew Stott

Analyst, UBS Ltd.

|

|

Kevin McCarthy

Partner, Vertical Research Partners

|

|

|

|

|

|

P.J. Juvekar

Analyst, Citigroup Global Markets, Inc.

|

|

Peter Mackey

Analyst, Exane Ltd.

|

|

|

|

|

|

Martin Rödiger

Analyst, Kepler Cheuvreux SA (Germany)

|

|

Markus Mayer

Analyst, Baader Bank AG

|

MANAGEMENT DISCUSSION SECTION

Operator:

Ladies and gentlemen, good morning or good afternoon. Welcome to the Clariant Investor and Analyst Call. I’m Sarah, the Chorus Call operator. I would like to remind you that all participants will be in listen-only mode, and the conference is being recorded. After the presentation, there will be a Q&A session. [Operator Instructions] The conference must not be recorded for publication or broadcast.

At this time, it’s my pleasure to hand over to Ms. Anja Pomrehn, Head of Corporate Investor Relations. Please go ahead, madam.

Anja Pomrehn

Head-Investor Relations, Clariant AG

Good morning and welcome to our call to discuss the merger of Clariant Ltd and Huntsman Corporation. My name is Anja Pomrehn, Head of Investor Relations of Clariant. I am joined on the call today by Hariolf Kottmann, President and CEO of Clariant; by Peter Huntsman, President and CEO of Huntsman; Patrick Jany, CFO of Clariant; Kimo Esplin, Executive Vice President of Huntsman; and Ivan Marcuse, Vice President Investor Relations of Huntsman. A copy of the press release announcing the transaction and a related investor presentation are available in the Investor Relations section of our respective websites, clariant.com and huntsman.com, and has been filed with the SEC.

Before starting, I’d like to remind you that today’s discussion will include forward-looking statements, and actual results could differ material from projections in those statements. You should review the press release and related investor presentation, [Clariant’s] SIX Swiss filings and SEC filings that Huntsman and Clariant will make in connection with the transaction, including a Form [F-4] registration statement that will include a proxy statement of Huntsman and prospectus of Clariant for more information regarding the factors that could cause actual results to differ material from projections and expectations. Neither Clariant nor Huntsman undertake any obligation to update publicly any forward-looking statements.

In addition, Huntsman and its directors and executive officers may be deemed to be participants in the solicitation of proxies in favor of the proposed merger. You can find information about Huntsman’s directors and executive officers in Huntsman’s Proxy Statement and Annual Report filed with the SEC.

And with that, I will now turn the call over to Hariolf to discuss the transaction. Hariolf?

Hariolf Kottmann

Chief Executive Officer & Executive Director, Clariant AG

Thank you, Anja. Ladies and gentlemen, good afternoon. It’s my pleasure to have you join our conference call. For us, today is an exciting day. Two great companies, Clariant and Huntsman, are joining forces to become a single entity with more sustained innovation power, a much broader global reach and, hence, further new growth opportunities. Peter Huntsman and I share the same strategic vision and I very much look forward to working with him.

2

Let us start with the highlights of the transaction on slide number one. The merger of equals, and we think it’s a true merger of equals that we are describing today, accelerates our joint path towards creating a leading global specialty chemical company committed to profitable growth. The combined group will have a significant enterprise value of approximately $20 billion. Together, the incremental accelerated value accretion is expected to exceed $3.5 billion based on an annual run rate synergies of approximately $400 million within two years of closing.

In addition to the synergies expected to be realized, this step will also provide HuntsmanClariant with access to new growth opportunities. HuntsmanClariant will maximize its operational efficiency in its market-leading positions across attractive end markets in key geographies like China and the U.S.

We also anticipate improved returns via the joint innovation platform. We have accumulated extensive combined knowledge with regards to sustainability which we will continue to successfully transfer into our competitive portfolio in the marketplace. Our product leadership and focus on sustainability will allow us to effectively differentiate our extensive product offering. Our new company will have a robust balance sheet and will be a highly cash-generative business, which will provide us with the financial power to implement additional operational options.

I will now turn the call over to Peter Huntsman to provide an overview of the transaction.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Hariolf, thank you very much and it’s a pleasure to be with you here today. Let’s turn to slide number two to discuss the specifics of this transaction. Based on the agreement of this all-stock merger of equals, Huntsman shareholders will receive 1.2196 shares for every one share of Clariant. This translates in the Clariant shareholders owning 52% and Huntsman shareholders owning 48% of the combined company, which will be named HuntsmanClariant. The Board of Directors will be equally represented from each company, with Hariolf Kottman serving as the Chairman of the Board, and I am looking forward to lead the combined company as the Chief Executive Officer. Jon Huntsman, Huntsman’s Founder and Chairman, will be a Board Member of HuntsmanClariant and serve as Chairman Emeritus.

We anticipate that Clariant’s attractive dividend will be maintained which will offer Huntsman shareholders about a 12% increase in the dividend based on last year’s payout. The combined company will have a strong balance sheet with a pro forma net debt to EBITDA ratio of 2.4 times. As previously announced, we still plan an IPO of our Pigments and Additives business this summer, with proceeds being used to pay down debt. Upon completion of our sale of shares of Venator, our Pigments and Additives business, we expect these proceeds alone to improve our combined debt to EBITDA ratio to better than 1.5 times. In addition, our combined cash flow will be strong and further enhance HuntsmanClariant’s financial profile.

The global headquarters will be located in Pratteln, Switzerland and the operating headquarters will be in The Woodlands, Texas. Shares of the new company will be directly listed on the New York Stock Exchange and also on the Swiss Exchange. The combined company’s financials will

3

be reported in U.S. dollars and we will file 10-Qs and 10-Ks compliant with the SEC’s requirements using IFRS. We’re targeting a year end closing but this is subject to regulatory and shareholder approval in addition to customary closing conditions. Hariolf?

Hariolf Kottmann

Chief Executive Officer & Executive Director, Clariant AG

On slide number three, we see that as per closing on Friday, 19 May 2017, HuntsmanClariant will have an enterprise value of approximately $20 billion and a market capitalization greater than $13 billion. Pro forma 2016 sales from continuing operations, excluding Venator, were $13.3 billion. The EBITDA, including run rate synergies of $400 million, was $2.3 billion. And the operating cash flow comprise more than $1.9 billion. These strong results reflect that HuntsmanClariant is a high cash-generative company. The impressive $361 million R&D spend, more than 200 production sites, and an excess of 28,000 employees display the enhanced scale which can be mobilized to realize value creation opportunities for all stakeholders.

Slide four provides an overview of HuntsmanClariant’s wide-reaching scope and critical size within the specialty chemical company arena. This merger of equals will result in one of the largest global specialty chemical company in the market based on pro forma 2016 sales. This size will better position us to realize our shared vision.

Slide number five shows the composition of HuntsmanClariant sales and EBITDA, reflects its specialty chemicals profile, and the group’s profitability breakdown. This larger sales base will serve to reduce the group’s cyclicality and will allow us to provide our customers with a sizeable, increased product portfolio while simultaneously providing a platform optimized for cross-sell opportunities. In terms of profitability improvement potential, we are convinced that in addition to generating run rate synergies of approximately $400 million within two years of closing, the merger of our two companies will also enable us to realize additional margin enhancing measures.

Slide number six illustrates the balanced geographic footprint of HuntsmanClariant and how this combination will also result in enhanced growth opportunities by significantly increasing Clariant’s presence in North America by benefiting from Huntsman’s strength in the United States, profiting from low-cost economies through vertical integration, extending Huntsman’s formulation expertise and downstream applications, strengthening the geographic platform to amplify the current growth strategy with extended local market access, a stronger product and application offering, expanding into adjacent markets and combining end market exposure, becoming a market-leading international chemical company in China, capitalizing from ongoing growth investments and building on our manufacturing footprint with more than 20 locations as well as benefiting from strong local joint ventures.

The increased scale and strength of HuntsmanClariant, as set out on slide seven, reflects the strong specialty chemicals portfolio of the new company. The two high-margin businesses, Catalysis and Advanced Materials, both ranging well above the 20% EBITDA margin range, are in the top of the list. These businesses will make clear contributions to the profitable growth of the combined company. The complementary businesses, Care Chemicals and Performance Products, share similar margin potentials in the high teens closely followed by Polyurethanes and

4

Natural Resources which are also well above the 15% EBITDA margin. Textile Effects is at the low end of the product portfolio margin range while Plastics and Coatings will continue to be steered for absolute EBITDA following the successful profitable transformation, which is the result of the differentiated business steering since 2016. Peter?

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Thank you, Hariolf. Let’s move on to slide number eight. The combination of these two companies create an opportunity for operational and procurement synergies in excess of $400 million per annum or roughly 3% of total pro forma 2016 revenues. Merging our corporate and business services as well as sharing our infrastructure will enable roughly two-thirds of the cost reduction while the remainder comes from combined purchasing power, supply chain, logistics, and procurement. These synergies are expected to reach a 50% run rate by end of year one, with a full run rate by the end of the second year. We estimate that the one-time cost will be approximately 1.25 times, the savings spread over the next three years. Additionally, we expect cash tax savings of more than $25 million per year.

I feel that both companies have a great deal of experience accomplishing large-scale integration and synergies projects. I’ve been impressed with the early cooperation and focus of our respective managers. Given our strong start, I have a great deal of confidence that these objectives will not only be met but exceeded as we have more time and exchange between our two companies.

Let’s turn to slide number nine. While achieving our synergies is a clear means of increasing shareholder value, longer-term we need to accelerate the growth in margins both companies have achieved in past years. Over 80% of the EBITDA of HuntsmanClariant will come from businesses with margins in excess of 15%. This will more rapidly expand as we combine our commitment to innovation, customer satisfaction, research, and sustainability.

Let’s move to slide number 10. In addition to synergies and margin growth, a key driver to accomplishing further value will not only be our molecular overlap but our combined end market opportunities. Huntsman and Clariant are already actively supplying large global end markets such as consumer, transportation, construction, industrial, and energy. Our combined geographic and technological platforms will only enhance our ability to better serve end markets.

Let’s turn to slide number 11. The automotive end market is a prime example where we have multiple touch points. In many cases, our companies are selling to the same customer. Combined, our product offering will now be greater and we’ll be a more important partner in this constantly changing and innovative field. This is vital to both companies as we don’t want to be just a supplier of raw materials but partners in developing new specifications and applications.

Turning to slide number 12. The key to future growth and margin expansion is a commitment to R&D. Separately, our companies have made significant investments into innovation, technology development, and sustainable business improvement. Together, we’re spending more than $350 million annually on research and development. Combined, we will have more than 70 R&D centers across six continents. The combination of R&D platforms will enable us to improve our

5

efforts in multiple areas as we focus on commercializing new products and further developing existing products in order to grow our customer.

On slide number 13, we highlight what the pro forma financials would look like based on 2016 results and including our expected synergies. Our combined financial strength will give us a level of financial flexibility that neither company would be able to experience separately. Furthermore, this transaction will not impact our expected IPO of our Pigments and Additives business this summer. The proceeds expected to be well in excess of $2 billion after tax will still be used to reduce debt and will further strengthen our combined balance sheet.

Let’s turn to slide number 14. For the past eight years, we have been discussing opportunities between our companies. As Hariolf said earlier, this is the right time for us to combine two great companies and create a new, larger, more profitable, and financially stronger company than either of us could’ve built on our own. This is an exciting and unique opportunity to further create shareholder value.

I’ll hand us back now to Hariolf to summarize his presentation.

Hariolf Kottmann

Chief Executive Officer & Executive Director, Clariant AG

Thanks. Slide 14 also reflects that this transaction results in a compelling strategic fit underpinned by a strong industrial rationale. HunstmanClariant is implementing a clearly defined integration roadmap to capitalize on both companies’ strengths, realized combined synergies, and maximize the growth potential of a diverse range of markets. HunstmanClariant is a more diversified global specialty chemical player with multiple avenues for above market growth. This combined with the realization of $400 million of synergies as well as a robust balance sheet and a strong cash flow generation will further open the value creation. Anja, please.

Anja Pomrehn

Head-Investor Relations, Clariant AG

Thank you, gentlemen, for taking us through the details of this exciting transaction. And with that, we will open the line for questions. Operator?

QUESTION AND ANSWER SECTION

Operator:

We will now begin the question-and-answer session. [Operator Instructions] The first question is from Stephanie Bothwell from Bank of America (sic) [Merrill Lynch] (20:31). Please go ahead.

Stephanie Bothwell

Analyst, Merrill Lynch International

Yes. Good morning and thank you very much for the presentation. Perhaps just firstly, if you can share with us where you see the largest areas of overlap between the two businesses. It would be useful to have something by product line perhaps as a percentage of sales if possible. My second

6

questions are predominantly on the cash flow side. Couple of points of clarification. So firstly, could you share with us what leverage you’re targeting for the combined company? And the second point on the cash flow side is what CapEx requirements you will need as a joint company? And I have one final clarification question which I’ll come to afterwards. Thanks.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Yeah. I think that when we talk about product overlap, this is a difficult question to answer just because I think that we probably have about 10% of our overall production of both companies would be going into end use markets where I would say that we would have similar products going to similar customers. And that’s one of the unique aspects of this deal, it’s that you have so many complementary products, not overlapping products. And so this isn’t an exercise as to how we combine a lot of the same manufacturing formulas and so forth but rather how we bring together two diverse product platforms that are largely going into some of the same industries, many of the same industries globally, but through different routes to market, through different technological platforms, and different applications. So I think that there’s going to be a natural overlap but I think it’s challenging to go through and say that 12% of our products is going to be going into exactly the same customer and the same products.

With leverage, I think that the leverage that we talked about earlier is around better than 1.5 times EBITDA. I think that that would be something that we ought to be looking at as a minimal threshold when we look at the proceeds of the Venator IPO once this is complete. And, again, I would just remind you that that objective does not include the free cash flow that’s going to be generated from the operations anyway, so I would think that within very short order that we ought to have a better debt to equity ratio than either of the companies enjoy today.

Hariolf Kottmann

Chief Executive Officer & Executive Director, Clariant AG

Maybe to complement on Peter’s answer on your second part of the question, Stephanie. Indeed, that the leverage will then be in the 1.5 range, really in line with BBB rating. That’s really the positioning of the company we’ll see post-closing and post-IPO of the Venator business. And what refers to the combined CapEx, we currently see the CapEx needs of the combined entities around $600 million to $650 million a year, out of which the maintenance CapEx is around $220 million, $250 million.

Stephanie Bothwell

Analyst, Merrill Lynch International

Okay. Thanks. One final point of clarification. On slide 13 where you disclosed the $953 million of operating cash flow for Huntsman, can you just confirm the basis for that? Is it ex-Venator excluding interest costs as well or are interest costs already included within that $953 million?

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

7

Can you repeat that question? I’m sorry.

Stephanie Bothwell

Analyst, Merrill Lynch International

Yeah, sure. So I’m just trying to understand the basis for the $953 million of operating cash flow that you disclosed on slide 13 of the presentation. Is the only thing that’s stripped out of that is the Venator interest costs or interest costs already taken out of that number? So if I look at the $654 million for Clariant, I think it excludes interest costs. I just want to understand the basis for the $953 million.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Yes, that is just simply cash generated from operating activities in our cash flow statement, and we’ve excluded the cash generation from the Pigments and Additives Venator business. Likewise, it’s the same with Clariant.

Stephanie Bothwell

Analyst, Merrill Lynch International

Okay, so it’s just the Venator portion that’s stripped out of your group number. Okay. Thank you very much.

Operator

: The next question is from Robert Koort from Goldman Sachs. Please go ahead.

Robert Andrew Koort

Analyst, Goldman Sachs & Co.

Thank you very much. Peter, I wanted to ask about the pivot in strategy. I know you had planned the Venator IPO and had hoped that would lead to some value lift for the remaining businesses. So did you think that it wasn’t going to happen or from your shareholders’ standpoint why dilute that opportunity by sharing that potential value improvement with Clariant shareholders?

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

I think that when we look at the overall picture as to the timing of this acquisition and the certainty of getting it done at this time and so forth, the combined benefits that Huntsman shareholders will receive by being part of a combination with Clariant, I think, far exceeds the 50% of the proceeds coming in from Venator. I think if we look at this thing from a longer-term basis, opportunities like these are tough to come by to say the least. Hariolf and I have been talking around this sort of an opportunity for nearly eight years now, and either we’re going through a restructuring or they are or simulating an acquisition or they are. And we have a time right now where the time is right, the equity values are right, the marketplace is perfect for this, and I think that we need to strike at these sort of things. And so there’ll be things that our shareholders perhaps may be looking on a short-term basis and Clariant shareholders may well

8

be looking on a short-term basis. But longer-term, I think that I would much prefer to have a combined balance sheet with the debt levels and so forth post-Venator combined than separately.

Bob, if I could add, I think, sure, post-separation of Venator we have expected a rerating of the Huntsman Corporation multiple, and we do share that with Clariant shareholders now. However, we also reaffirm what multiple we think we should be trading at with this transaction, that Clariant has a multiple that’s one turn better than us and we think that’s really what we should be. And, in fact, it reinforces what this new multiple should be, and this transaction helps us in that regard.

Robert Andrew Koort

Analyst, Goldman Sachs & Co.

Got it. Thank you.

Operator:

The next question is from Andrew Stott from UBS. Please go ahead.

Andrew Stott

Analyst, UBS Ltd.

Yeah. Good afternoon. Thanks for the presentation also. A couple of questions. I wonder if you could share the wider balance of the Board? Maybe this is just too preliminary and you can’t answer that question, but beyond the three appointments you’ve mentioned, just wondering how many seats are Huntsman, how many seats are Clariant? Question number two, are there going to be any accounting inconsistencies between the two groups? So as you go to IFRS in U.S. dollars, is there anything that we should be particularly aware of?

And actually, sorry, I did have a third question, a smaller one. You talked about cash tax synergies at $25 million a year. One of Huntsman’s latest presentation that was from May 16 from the website, it guides for cash taxes of zero for this financial year. So I’m wondering quite how you managed to get further cash tax benefits at least in the short-term? Thank you.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Well I’ll take the latter because it’s specifically Huntsman. Yes, we have a year this year where we’re not paying any taxes because we pre-funded our taxes from a year ago or two years ago. That is just a one-year anomaly. Certainly, our long-term effective tax rate from a cash standpoint will be around 25%, and we think that by combining certain subsidiaries we’ll efficiently use certain NOLs. That tax benefit doesn’t come from the merger itself into a Swiss company, these are non-Swiss tax opportunities that we’re pointing to.

Hariolf Kottmann

Chief Executive Officer & Executive Director, Clariant AG

The both of Huntsman and Clariant will consist of, in total, 12 members. Each company will contribute six members. We haven’t talked within Clariant about names and people.

9

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Then likewise on the Huntsman side, certainly before this transaction is closed we will be announcing the six Board Members. But until then, both of us have active stand-alone boards that will have to do shared responsibilities to fulfill between now and the time of closing.

Hariolf Kottmann

Chief Executive Officer & Executive Director, Clariant AG

Yeah. Going back to your second question, Andrew. Indeed, there will be actually two differences. We’ll have the Huntsman accounts moving into IFRS, which will be one change. And the second change is that we will move the Clariant accounts into U.S. dollar. Both will imply recalculations, more adjustments particularly when you move into IFRS, pensions, interest, and so on do get classified a bit differently but we will just start the process. We don’t expect a major deviation that would distort relevant figures, but certainly in terms of accounting there’s a change in adoptation to come.

Andrew Stott

Analyst, UBS Ltd.

Got it. Thank you very much for taking the questions.

Operator:

Our next question is from P.J. Juvekar from Citi. Please go ahead.

P.J. Juvekar

Analyst, Citigroup Global Markets, Inc.

Yes. Hi. Good morning. Question for Peter. Peter, can you talk about this merger of equals? Was this selling the company outright? Did you look at the latter option and did you have any discussions related to a possible sale?

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Well we as a company obviously have a fiduciary responsibility to explore all options. But I think that as we look at this option, our board and our major shareholders, and those shareholders that we’ve discussed this transaction with are in unanimous support. I think anybody that knows our history knows that we certainly wouldn’t shy away from either acquisitions or a purchase. As we look at this and we look at the ability to maintain value and to create further value, the certainty behind this we feel that this certainly is the best path forward.

P.J. Juvekar

Analyst, Citigroup Global Markets, Inc.

10

Thank you. And when companies combine, there are cost synergies and, in many cases, there are revenue synergies. I didn’t see any revenue synergies here. Wondering if you’re targeting any revenue synergies, and if yes what they might be?

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

I think that as we look at synergies, at this point we’ve been focused on the cost synergies. The revenue synergies, I would assume and, again, this is more of a gut than any sort of a scientific feel, I wouldn’t be surprised if we’re able to see 1% to 2% growth on a net per annum basis that we otherwise wouldn’t say that we ought to be growing better than GDP in most of our businesses. And I think that as you look at the amount of R&D that is being spent with this group, we ought to have better than GDP sort of growth with this business portfolio. So I’m not sure that we’d be specific on that, but we would certainly have high expectations.

J. Kimo Esplin

Executive Vice President-Strategy & Investment, Huntsman Corp.

P.J., one great example would be the Care Chemicals business of Clariant and Huntsman’s Performance Products business. The Care Chemicals business is further downstream than we are, and they tend to formulate products that we have been selling to formulators. And so I can see how we could provide raw materials and also take some of our means further downstream into formulation than we currently are, adding value to those molecules.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

I would just add, if you go to slide number seven I think that if you look at the various businesses, I think that we’re seeing global growth realistically somewhere around 3%, 3.5% today. And if you look on slide seven, you look at the growth rates that we’re seeing in virtually all of our businesses, you’re seeing certainly at the high end of that GDP range of global growth and probably 50%, again higher than that. And I think with that sort of investment, again, that we’re making in the R&D area, that somehow would be sustainable.

P.J. Juvekar

Analyst, Citigroup Global Markets, Inc.

And one quick question for Kimo. I know you talked about NOLs being used more effectively to lower the tax rates. Can you just tell us where those NOLs are? Thank you.

J. Kimo Esplin

Executive Vice President-Strategy & Investment, Huntsman Corp.

Yeah. Most of our NOLs are in Western Europe and some of them have been created over years and that we just haven’t been able to utilize them efficiently and that Clariant has profitable businesses in some of those regions certainly.

11

P.J. Juvekar

Analyst, Citigroup Global Markets, Inc.

Thank you.

Operator:

The next question is from Martin Rödiger from Kepler Cheuvreux. Please go ahead.

Martin Rödiger

Analyst, Kepler Cheuvreux SA (Germany)

Thank you very much for taking three questions, [ph] basically all are clarification (35:11). You say that the global headquarters will be in Pratteln in Switzerland and also CEO and CFO also based in Pratteln but the operational headquarter will be in The Woodlands, Texas. Does that mean that all other Board Members and the heads of the business units will be also located in Texas or how should that work?

Secondly, it’s a question on Huntsman. On page 13, you say that $2 billion of net financial debt will be transferred from Huntsman to Venator. Can you also mention how much of your pension provisions will be shifted or is that part of your $2 billion figure? And finally, maybe you can confirm what is the breakup fee from both sides. Thanks.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Well if I can just take a stab at the headquarters. We will be a Swiss company. We’ll be headquartered in Switzerland. I think that when you talk about operational headquarters in The Woodlands, perhaps that’s something of a balancing act. I wouldn’t get too caught up on the word headquarters. I think from a legal and from a financial and from where the executives are going to be, certainly Switzerland is that headquarters. But if to our customers and to our associates, I think that the excellent work that is being done today in developing products in Munich and developing products and servicing customers out of Frankfurt and out of The Woodlands; out of Everberg; out of Basel, Switzerland; out of Shanghai; these are all headquarters to our customers, these are all centers of excellence and operations.

Like Hariolf, I spend probably three weeks of every month on a plane flying around, and my office is probably as much Lufthansa as it is my office in The Woodlands. So I would just say that we’re going to make great utilization of the talent and the people wherever they’re located, and I don’t see people really changing around because of headquarter locations.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

From our point of view, let me add. We don’t really understand why we focus on locations. Everything, which is on a legal basis, very clear. We have a clear understanding in times of digitalization, of globalization. As Peter said, you can manage the company out of a plane in a regular month without these kinds of transactions. I’ve spent maybe seven, eight days in my

12

office in Pratteln and the rest I’m internationally on the road. Therefore, I think we have more important things to discuss than where is the headquarters A and where is the headquarters B.

J. Kimo Esplin

Executive Vice President-Strategy & Investment, Huntsman Corp.

Maybe I can shed light on slide 13. Four quadrants, three of them for Huntsman are ex-Venator or without the Pigments and Additives business, assuming it had been separated. You’re right. The bottom right-hand corner, Huntsman Corporation debt and leverage does not assume that but we provide a pro forma for the combined businesses assuming Venator has been taken public and has been completely sold down. That includes debt and equity proceeds and is net of taxes. It does not include an additional roughly $250 million of pension liabilities that will go with the business.

Patrick Jany

Chief Financial Officer, Clariant AG

And going back to your question on the breakup fee, it is determined slightly north of $200 million in case one party should terminate the transaction.

Martin Rödiger

Analyst, Kepler Cheuvreux SA (Germany)

Thanks.

Patrick Jany

Chief Financial Officer, Clariant AG

All right.

Operator:

The next question is from Alexander Lauren (sic) [Laurence Alexander] (39:09) from Jefferies. Please go ahead.

Laurence Alexander

Analyst, Jefferies LLC

Good morning. Two quick ones. First, on further activity, is this bit for a while? Some of the end markets you’ve touched are also consolidating. Do you want to participate in that? Do you have the bandwidth? And secondly, can you speak a little bit about the operating cultures? What you can learn from each other and what you see as areas you need to focus on?

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

If I can take just a minute or so and Hariolf can probably give a much better follow-up. As we look at the cultures and so forth of the various businesses, look, I think there are a lot of things

13

that Huntsman does very well, and we’ve proven that in the marketplace and we’ve proven that in our ability to create shareholder value. However, as I look at Clariant, I look at a business that has done a fantastic job in really building out very aggressively their performance, their differentiation, their specialty chemicals, and those things that we have pulled the market for the past year, where we want to be going as a company. And I think that that discipline to research, that discipline to developing new products and so forth frankly for Huntsman will be something that we’ll really look at as a great opportunity to be able to expand our horizons and to become an even better company.

But I think what’s important here, this new company is not just Huntsman on steroids nor is it a larger Clariant; the new company is just that, a new company. This is beyond a merger of equals; it’s a merger of opportunities and both companies will bring unique cultures, unique disciplines, unique routes to market, balance sheet, and so forth to the overall combination that I think will really strengthen our position with investors, shareholders, and customers and our associates.

Hariolf Kottmann

Chief Executive Officer & Executive Director, Clariant AG

Talking about culture, I think everything has already been said by Peter but both companies do have a different culture, for sure. And as Peter rightly said, we do not want to enlarge Clariant and enlarge Huntsman. We do not want to have a HuntsmanClariant in three years with a Clariant culture or a Huntsman culture. I think our people are mature enough to take this opportunity of a new company and just draft their own storyline. And I think integrating businesses or integrating service units is one aspect of the entire process. I don’t know if you can integrate or change cultures. I think it is extremely important that in HuntsmanClariant, starting from the Chairman of the Board and the CEO and the executive committees and the global management team, everybody has to spend a lot of time being present in the company just to try to avoid frictions and tensions and create, what I said, a new company.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

I will just add, I think, one of the early examples of cooperation. While Hariolf and I had been working here for eight years on a mutually compatible relationship, friendship and all of that, we really put our teams together three weeks ago to put together a transaction that essentially creates a $20 billion total enterprise value company in three weeks. That was the first time any of our management teams had even met each other, and in that time they came up with $400 million of synergy. This is not a top-down number, this is not a number that Hariolf or I came up with and said, meet it; this is something that came up from the bottom up, people being challenged, but it goes to speak to the professionalism of two very diverse cultures being able to come together and become even better than some of the parts.

So I think that we’ve got a great opportunity before us to, really, on both sides, to learn, expand, to grow, and to take advantage.

Laurence Alexander

Analyst, Jefferies LLC

14

And appetite for consolidation or further M&A?

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Well I think that we certainly will have a balance sheet that will enable a size of a company and a balance sheet. Traditionally for Huntsman at least, bolt-on acquisitions have been in the low tens of millions of dollars. The size that we are today, the balance sheet and the abilities we have today, I imagine that our ability to have bolt-on acquisitions going forward will be significantly larger and will be a much wider envelope as we look at the chemistry, applications, geographies, downstream growth opportunities, and so forth.

Laurence Alexander

Analyst, Jefferies LLC

All right. Thank you.

Operator:

The next question is from Paul Walsh from Morgan Stanley. Please go ahead.

Paul R. Walsh

Analyst, Morgan Stanley & Co. International Plc

Thanks very much. Afternoon, guys. I’ve got three questions, please. First on the synergies. Given the lack of product overlap and I think you’ve said no real revenue synergies, can you give some practical examples of the types of procurement synergies that you want to deliver? And on the operational side as well, you’ve talked there about some bottom-up analysis delivering the $400 million. Maybe a bit more flesh around exactly what kind of projects we’re talking about.

My second question was just to come back to some of the expected growth and margin targets across the different business units. Polyurethane is obviously a hot topic of debate at the moment, and you guys are one of the industry leaders in MDI. It seems at least on the face of it there’s some rather aggressive margin assumptions for that business. I wonder if you can help me understand how you see the cyclicality of that industry against those margins. And also on textiles, it’s a business Clariant got out of some years ago. Just wondering if the pro forma portfolio could also be subject to further changes as we go forward. Thank you.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Well perhaps I can answer the last one first just as we talk about textiles here. Look, our objective is to create as much shareholder value as possible. I’ll say unequivocally right out of the chute, we’re not going to come out on day one and look at spinning businesses. However, as we continuously look at our portfolio, if we have businesses and divisions that don’t carry their fair share, that are not generating the sort of shareholder growth and creation, then we’ll take a very thorough analysis of that business. For those of you that have followed Huntsman, remember that in the past we said the same thing about Textile Effects, and if we didn’t see

15

double-digit sort of percentage of EBITDA margins and return on net assets we would get rid of it, and we see that today; it’s an improving business.

Now, if we think that that division or any division is going to be a drag on the overall business, I think that the management of this company will act decisively and will be committed to do whatever we have to do to maintain and to grow shareholder value.

Patrick Jany

Chief Financial Officer, Clariant AG

All right. Coming back to the first question, Paul, on the synergies. Indeed, the first work resulted in a $400 million synergy estimate. It is really the result of a deep work of a combined group, and we found many areas where you can actually find an optimization within both groups. For instance, if you take procurement we looked at direct spend and indirect spend. Just to give you an idea, we have a direct spend now as a combined company of more than $6 billion. We have indirect spend of more than $3.5 billion. And that’s where we need to work, in those categories, in the detail, and we’re fairly sure we can extract here quite a lot, and $150 million is our first guess at this number.

Then if you obviously look and combine two groups, you’ll have overlap. You’ll have overlap in the back office, you’ll have overlap in accounting structures, you’ll have overlap in processes. And we looked at all of that in terms of transactional processes on IT for instance, on finance, on HR. And that’s why you find, really, that it makes sense to combine both companies and that really is the underlying base for finding $250 million operational synergies.

J. Kimo Esplin

Executive Vice President-Strategy & Investment, Huntsman Corp.

I think you mentioned polyurethanes.

Paul R. Walsh

Analyst, Morgan Stanley & Co. International Plc

Yes, please.

J. Kimo Esplin

Executive Vice President-Strategy & Investment, Huntsman Corp.

And you referenced to slide seven, I believe.

Paul R. Walsh

Analyst, Morgan Stanley & Co. International Plc

That’s right.

J. Kimo Esplin

Executive Vice President-Strategy & Investment, Huntsman Corp.

16

And so we have targeted 16% to 18% margins. As you know, currently the business in the last few quarters has been on the low end of that, roughly 15%, 16% EBITDA margins. But remember that reflects an MTBE business which is a by-product of propylene oxide at 0. And so we would expect on a normalized basis, just that business alone would put you right in the middle of that range and we believe that there will be continued margin expansion in polyurethanes in the next three, four years as that smaller piece of utilization rate-sensitive polymeric MDI continues to be tighter globally as we move into the low 90% utilization range. So we really feel like that EBITDA margin target is appropriate and feel like we will be towards the top end of that in not too long. In terms of growth, that business has grown at 7% volumetric growth for the last 15 years, and we think that growth rate is also still intact driven by insulation requirements globally.

Paul R. Walsh

Analyst, Morgan Stanley & Co. International Plc

That’s great and just maybe one follow-on question, if I can, on Venator. You talked about $2 billion of after-tax proceeds, and that including the debt and equity. What assumptions are you making there on multiples for that business, please?

J. Kimo Esplin

Executive Vice President-Strategy & Investment, Huntsman Corp.

We believe that second half of 2017, the business will have roughly a $400 million EBITDA run rate. We’ll hit that run rate somewhere in that second half of the year. We’re targeting the summer of 2017 for the offering and think that is a good run rate metric, and you can run multiples off of that. There will be minimal tax leakage as we sell shares. Now, there are comparable companies that you can look to, three specifically. They are more pure-play TiO2 players. All of them trade in the 8 to 9 times range currently. We would expect at the initial public offering we will receive debt proceeds, and you should think about that as roughly 3 times EBITDA on an LTM basis at the time of the offering. That may be, for those of you who are not familiar with that business, roughly $700 million of debt proceeds and the offering probably will target around 20%, 25% of the shares.

Paul R. Walsh

Analyst, Morgan Stanley & Co. International Plc

That’s really helpful. Thank you very much.

Operator:

The next question is from Kevin McCarthy from Vertical Research Partners. Please go ahead.

Kevin McCarthy

Partner, Vertical Research Partners

Yes. Good morning. On slide eight, you break down the $400 million of synergies into procurement and operational. I was wondering if you might be willing to provide a bit more

17

granularity on the operational side? For example, how much you would target to extract from R&D, SG&A, and other sources of overhead?

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

The numbers that are here do not anticipate any operational closures, any plant closures, and does not include any cuts taking place from a personnel basis in R&D. That’s not to say that there aren’t any, but it is to say that right now in our preliminary view this is an area of the company that we want to keep intact and we want to keep those projects going. So we will be looking at the physical facilities, but the individuals themselves and the equipment and the resources and everything going to R&D. Much beyond that, I think Patrick spoke earlier about some of the back office and so forth. And until we come up with an internal communication plan and so forth, I would be hesitant to get into too much more detail on what the operational side of that is.

Suffice it to say that this number came from management teams within the organization working together, coming, looking, reviewing their own costs, their own areas of opportunity whether they’d be in finance, whether they’d be in IT, whether they’d be in purchasing, procurement and so forth, comparing raw material costs, shipping costs and so forth, and this was the number they arrived at.

Kevin McCarthy

Partner, Vertical Research Partners

And as a follow-on if I may. In the press release this morning, you characterized the value creation opportunity associated with the $400 million in synergies at $3.5 billion. How is that number derived?

Patrick Jany

Chief Financial Officer, Clariant AG

Yeah. We took there the average multiple of both companies just as a reference, and that’s how we derived the $3.5 billion from the $400 million.

Kevin McCarthy

Partner, Vertical Research Partners

So just to clarify, does it reflect the $500 million in costs that are attached to the achievement of the synergies?

Patrick Jany

Chief Financial Officer, Clariant AG

No, it’s a pure multiple-based evaluation now. But if you do a DCF of the same savings and you deduct the costs, you’ll come up actually with quite a similar number.

18

Kevin McCarthy

Partner, Vertical Research Partners

Okay. Thank you very much.

Patrick Jany

Chief Financial Officer, Clariant AG

You’re welcome.

Operator:

The next question is from Peter Mackey from Exane BNP Paribas. Please go ahead.

Peter Mackey

Analyst, Exane Ltd.

Thanks very much and good afternoon and good morning, everybody. Two questions please. One is just on the — going back to the procurement savings. The way, Patrick, you’ve presented it, it sounds very much as if it’s a sort of scale issue as a purchaser. Are there any other significant overlaps in particular products that you’re buying or, indeed, are there areas where you can source for instance from Huntsman internally? So I’m thinking ethylene oxide or something similar.

Secondly, and apologies that I don’t know enough about the Venator details but just to be 100% clear. When you presented the pro forma balance sheet, is that assuming that Venator is entirely separated and you released all of the equity value in that business? Because I think the implication was you’re going to place a stake in Venator. So I just wanted to clarify that.

And actually apologies, one very last question. I believe, Peter, I don’t know if you were misquoted on this but there was a headline this morning post the press conference saying something on the lines that the break fee won’t deter approaches from others. I wonder if you could just give us the context in which you made that statement and what the message you’re trying to give there, please.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Well I’ll start with the break fee. Look, this is a $20 billion enterprise value entity and you’re looking at a break fee of, as far as that value is concerned, of around 1.5% to 2%. I’m not sure that break fees would, I think, deter people. That certainly makes something of an obstacle, but I don’t think break fees are supposed to completely eliminate the idea that somebody can come in with a competitive bid, and that was the point that I was trying to make this morning. I think that the economics and the rationale of this transaction has to stand on something beyond a break fee, and I think that that’s apparent in the way that early shareholder reaction is taking to our announcement and the feedback that we’re getting from markets and so forth. I think that this is a deal that creates huge amounts of value and it will stand on its own there, it’s not because of a break fee.

19

J. Kimo Esplin

Executive Vice President-Strategy & Investment, Huntsman Corp.

I could speak to the capitalization of Venator. I mentioned $700 million roughly of possible debt at the time of the IPO, which would be proceeds back to Huntsman Corporation. That business will be initially consolidated. And so, you’re right. I think your comment is that while we will have debt on Venator, stand-alone debt, it will be consolidated for a period of time certainly until there is a follow-on offering and the ownership that Huntsman Corporation will have will drop below 50%.

Patrick Jany

Chief Financial Officer, Clariant AG

And then going back to your first question, Peter. Indeed, the procurement savings we specified here with $150 million come from the biggest scale really, both on indirect spend and direct spend. We do have some overlap in raw materials but we didn’t go into the specific of the detailed contract comparison. We’ll do that in the next few months. And we would expect indeed as you rightly mentioned that, for instance, in ethylene or ethylene oxide we do change our cost position particularly if you try to picture on the slide on the North American business. We now have a backward integration as a combined entity where we actually produce ethylene oxide and transform it into specialty chemicals to the end market, a position — looking from the client point of view — our ICS business, Care Chemicals business has in Europe which has been always a tremendous advantage over in this backward integration we will now have in the U.S.

So really combining the fundamental strength and ethylene production or ethylene oxide production of the Huntsman side with the end market’s approach from clients. So from that point of view, we’ll gain a tremendous position here which we have not quantified yet.

Peter Mackey

Analyst, Exane Ltd.

Okay. Thanks very much. Just a quick follow-up back on the Venator situation. Have you indicated the timescale over which you intend to get down to below 50% there, please?

J. Kimo Esplin

Executive Vice President-Strategy & Investment, Huntsman Corp.

We would hope to be below 50% within a year of the offering. Of course, at the IPO there will be a period of time where the company is locked up and is not allowed to sell. But within a year or so I think that would get us to that 50%.

Peter Mackey

Analyst, Exane Ltd.

Wonderful. Thank you very much.

Operator:

The next question is from [indiscernible] (59:06) from JPMorgan. Please go ahead.

20

Yeah. Hi. I have three questions. Firstly, I’m not sure I still understand the strategic rationale of the merger clearly because with all the activities that Huntsman is getting out like the Pigments and Additives business or the European Surfactants business would have been more relevant for Clariant with the merger. So is this just a merger to increase the scale of both the companies? That is number one question.

Number two question I had was on the comment around $2 billion of proceeds from Venator IPO. You said $400 million run rate EBITDA from second half of next year. So within that $2 billion, are you just assuming that you get 25% of the overall IPO value of the business or is this including the 100% of the IPO value because otherwise the multiple sort of would seem high?

And the last question I had was just a clarification on the Venator EBITDA that you’ve stripped out for 2016 which says $1.2 million in the presentation you filed today. But if I just look at Venator’s filing from earlier this year, it suggests that they have EBITDA last year of $93 million. So why is that [indiscernible] (1:00:32) of $30 million also? Thank you.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Well let me just comment and invite Hariolf to do the same on the rationale. If this were simply an exercise to become bigger, I think we’d probably could’ve or would’ve done this much sooner than now and we probably could’ve done it with any number of people. I look at the impact that this is going to have on our balance sheet which I think is very meaningful. I will get the impact that this is going to have through synergies in the overall businesses, being able to be a more competitive business going forward. I look at the globalization and the size of this business. We’re certainly if not the than a market leader in specialty chemicals. I look at the formulations. I look at the technology, sustainability, the research platform and so forth, the ability to expand our downstream businesses to be more competitive in these areas and expand further margins on a per pound basis, and I see tremendous opportunity there. I see short-term gains in synergies, I see longer-term gains in growth, I see balance sheet improvements, I see size. I think that this is far more than just being a merger of convenience merely to get larger, so I think that the rationale behind this is a very compelling one.

And I would invite Hariolf to make any comments down that line as well.

Hariolf Kottmann

Chief Executive Officer & Executive Director, Clariant AG

No. Again, just fully agree on everything what Peter said. And I think you should be aware that both company were not under pressure to do something or we must do something and we were desperately looking for somebody to merge with. We have our own objectives where Clariant should be positioned in four or five years from now like Huntsman does, and you can do this on your own way with your own strategy and then you need several years to get there and you have a risk of implementation, or you combine forces with somebody who shares your vision and have the same objectives and a similar strategy. And by combination, you reach a new level of financial strengths, of global position, and as a fundament for further international acquisitions for example.

21

We’re convinced that the next 5 to 10 years in the specialty chemicals industry will be dominated by six, seven, eight companies in the range of $14 million, $15 million in sales, $16 million, $17 million — at that size. And they will set the trend, they will set the milestones, and that is very important I think to be, now in 2017, 2018, part of this group of four, five, six companies. And these are all reasons which are very logic and very sensible in the interest of our shareholders or in the interest of our employees to combine forces.

J. Kimo Esplin

Executive Vice President-Strategy & Investment, Huntsman Corp.

Maybe I could briefly address two of your comments. Huntsman’s strategic activities have included the sale of our European surfactants and now our pigments business. Please don’t confuse those with, for example, the pigments business that Clariant has. Our pigments business is a commodity TiO2 business. Clariant’s business is an organics pigments business, very different even though they have the same name. Likewise, in European surfactants the business that we sold was a household detergent business and, in fact, Clariant sold a business similar to that a few years ago, and so it’s consistent with both of our desire to get out of those more commoditized markets.

As it relates to Venator, the $2 billion are net after-tax proceeds selling down 100% of the business. The difference in EBITDA that you may see in the S1 is one is corporate stand-alone costs that have been added to the Venator EBITDA relative to Huntsman’s divisional EBITDA for that business.

Operator:

The next question is from Markus Mayer, Baader-Helvea. Please go ahead.

Markus Mayer

Analyst, Baader Bank AG

Yeah. Good morning and good afternoon, gentlemen. I have two questions still outstanding. One is antitrust. Of course, is not an issue but nevertheless do you expect antitrust divestitures to come? And secondly, could you also shed more light on this process, how long have you been in talks in advance of the closing, have been in talks with other potential partners, and just how many of each of you have spoken?

And then also, why have you pushed the merger now? And I understand this point you made on the size and the [indiscernible] (1:05:56) you can have on R&D in the special chemical area. But is this size then really the only kind of logic behind it because you explained the portfolio as such was not the most obvious portfolio to combine all of this? Thanks.

Peter R. Huntsman

President, Chief Executive Officer & Director, Huntsman Corp.

Well from an antitrust basis I don’t foresee any problems there. We obviously are subject to regulatory approval and so I don’t wish to speak as to exactly what they might do. But we do believe from the outside counsel that we’ve been given that we should be closing by the fourth quarter of this year. As we look at why now, again, I hope not to repeat myself too much here but

22

mergers of equals are difficult in the best of conditions to being able to put together and define two companies that have a same focus and same strategy going forward, same market values and so forth, and to have two leadership teams that are willing to give and take and compromise, I think, is very rare and very unique.

And I think that people make a mistake that the only successful mergers are companies that have the exact same product lines, it has got to be two companies that basically do the same thing over and over again. And the objective of Huntsman, similar to Clariant, is not just to get larger in any one product but rather if we look about the world, as you look at the growing end markets, the growing technological opportunities and so forth, the diversification will in and of itself be an opportunity to create value, and that is something that is certainly very important to Huntsman and to our shareholders and our longer-term strategy, and we see that now is the right time for this.

As far as the amount of time that it took to put this together, as I said earlier, our teams really engaged each other for the first time about three weeks ago and that’s all that has been done during that time period. Hariolf and I had an opportunity as we have over the last couple of years to conceptualize, to think about where we may be able to go, and putting things off until various projects and so forth were done. And I think that the two of us, it’s fair to say that in fairly short order just a few weeks ago kind of cleared some of the brush as far as some of the basic issues around headquarters, names, positions of senior people, board, governance, and some of these things that I think are usually very sensitive issues for companies to talk about.

I believe that the idea that both of us are in a position where, going into this deal, our equity values of our respective companies are strong, our reputation in the markets are strong. This is not a deal that’s done out of desperation or because we have to do it; it’s a deal that’s done out of opportunism because we want to do it. And that, I think, is a groundwork for why this will be successful going forward.

Hariolf Kottmann

Chief Executive Officer & Executive Director, Clariant AG

Markus, Hello. This is Hariolf. Please let me add one thing. I think your colleagues know the chemical industry very well, and you know that one of the most important responsibilities of a CEO is to define where the company want to be in four, five years from now, what kind of strengths should be developed, and then analyze and think your strategic options and your current position. And one part of this analysis is, for sure, to talk to colleagues in the industry. That’s a very open, trustful relationship with many, many colleagues, and only a few of them like to go hostile. We don’t like hostile approaches because we respect the position of our colleagues if they are not interested in further sharing the ideas. Therefore, I’m pretty much sure in the same way as I met Peter many, many times in the last years, he talks to other colleagues and I talk to other colleagues as well. But as I’ve said, we respect the opinion and the position of another company and try to find another solution in such a case.

Markus Mayer

Analyst, Baader Bank AG

23

Understood. But maybe can I ask you then another question in this respect? So on the value chains, where is basically the [indiscernible] (1:10:51) of the value chain of Huntsman which then you can enrich or the areas of Huntsman that’s enriched in Clariant’s portfolio and the other way around? So does the [ph] white batch (1:11:01) technology of Clariant [indiscernible] (1:11:03)? Does the technology of Catalyst enrich the Huntsman portfolio and other way around? Just the kind of thinking we should have in mind?

Hariolf Kottmann

Chief Executive Officer & Executive Director, Clariant AG

That’s one way of finding a logic in that approach. Another way could well be that we have a portfolio currently which is highly specialized, combined with a few commoditized product. We see similar, I would say, products and portfolio in Huntsman’s area. And as you know, in both companies in the last seven, eight years, portfolio management was a key tool in order to increase profitability and reposition the company. And I would say looking now at the combined portfolio, there’s a lot of opportunity in more strengthened businesses and on the other side in also possible divestments.

Markus Mayer

Analyst, Baader Bank AG

Okay. Understood. Thank you.

Operator:

Ladies and gentlemen, that was the last question. I would now like to turn the conference back over to Ms. Anja Pomrehn. Please go ahead.

Anja Pomrehn

Head-Investor Relations, Clariant AG

Ladies and gentlemen, this concludes today’s conference call. There were still many of you who wanted to ask a question. I’m sorry that we cannot take them now but we trust we will see many of you within the next days when we go on road show. If you have any further questions in the meantime, please contact the respective Investor Relation teams. We are happy to answer any questions. So once again, thank you very much for joining the call today. Have a good day and bye-bye.

Operator:

Ladies and gentlemen, the conference is now over. Thank you for choosing Chorus Call and thank you for participating in the conference. You may now disconnect your lines. Good-bye.

24

Cautionary Statement Regarding Forward-Looking Statements

This communication contains certain statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “

Securities Act

”), and Section 21E of the Securities Exchange Act of 1934, as amended. Clariant Ltd (“

Clariant

”) and Huntsman Corporation (“

Huntsman

”) have identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “possible,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook” or “continue,” the negative of these words, other terms of similar meaning or the use of future dates. Forward-looking statements in this communication include, without limitation, statements about the anticipated benefits of the contemplated transaction, including future financial and operating results and expected synergies and cost savings related to the contemplated transaction, the plans, objectives, expectations and intentions of Clariant, Huntsman or the combined company, the expected timing of the completion of the contemplated transaction and information relating to the proposed initial public offering of ordinary shares of Venator Materials PLC. Such statements are based on the current expectations of the management of Clariant or Huntsman, as applicable, are qualified by the inherent risks and uncertainties surrounding future expectations generally, and actual results could differ materially from those currently anticipated due to a number of risks and uncertainties. Neither Clariant nor Huntsman, nor any of their respective directors, executive officers or advisors, provide any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur. Risks and uncertainties that could cause results to differ from expectations include: uncertainties as to the timing of the contemplated transaction; uncertainties as to the approval of Huntsman’s stockholders and Clariant’s shareholders required in connection with the contemplated transaction; the possibility that a competing proposal will be made; the possibility that the closing conditions to the contemplated transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a necessary regulatory approval; the effects of disruption caused by the announcement of the contemplated transaction making it more difficult to maintain relationships with employees, customers, vendors and other business partners; the risk that stockholder litigation in connection with the contemplated transaction may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability; ability to refinance existing indebtedness of Clariant or Huntsman in connection with the contemplated transaction; other business effects, including the effects of industry, economic or political conditions outside of the control of the parties to the contemplated transaction; transaction costs; actual or contingent liabilities; disruptions to the financial or capital markets, including with respect to the initial public offering of ordinary shares by Venator Materials PLC or financing activities related to the contemplated transaction; and other risks and uncertainties discussed in Huntsman’s filings with the U.S. Securities and Exchange Commission (the “

SEC

”), including the “Risk Factors” section of Huntsman’s annual report on Form 10-K for the fiscal year ended December 31, 2016. You can obtain copies of Huntsman’s filings with the SEC for free at the SEC’s website (www.sec.gov). Forward-looking statements included herein are made only as of the date hereof and neither Clariant nor Huntsman undertakes any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as expressly required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

25

Important Additional Information and Where to Find It

NO OFFER OR SOLICITATION

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC

In connection with the contemplated transaction, Clariant intends to file a registration statement on Form F-4 with the SEC that will include the Proxy Statement/Prospectus of Huntsman.

The Proxy Statement/Prospectus will also be sent or given to Huntsman stockholders and will contain important information about the contemplated transaction. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CLARIANT, HUNTSMAN, THE CONTEMPLATED TRANSACTION AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Clariant and Huntsman through the website maintained by the SEC at www.sec.gov.

PARTICIPANTS IN THE SOLICITATION

Huntsman and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Huntsman investors and shareholders in connection with the contemplated transaction. Information about Huntsman’s directors and executive officers is set forth in its proxy statement for its 2017 Annual Meeting of Stockholders and its annual report on Form 10-K for the fiscal year ended December 31, 2016. These documents may be obtained for free at the SEC’s website at www.sec.gov. Additional information regarding the interests of participants in the solicitation of proxies in connection with the contemplated transactions will be included in the Proxy Statement/ Prospectus that Huntsman intends to file with the SEC.

26

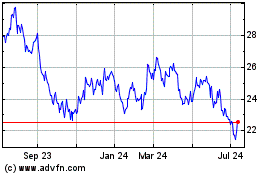

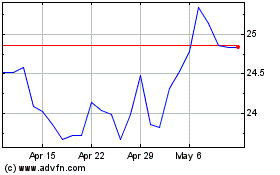

Huntsman (NYSE:HUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Huntsman (NYSE:HUN)

Historical Stock Chart

From Apr 2023 to Apr 2024