American Eagle Outfitters, Inc. (NYSE:AEO) today reported EPS of

$0.14 for the first quarter ended April 29, 2017. Excluding

restructuring and related charges of $0.02 per diluted share, the

company’s adjusted EPS was $0.16 for the first quarter.

Jay Schottenstein, Chief Executive Officer commented, "The first

quarter results reflected mall traffic headwinds, especially early

in the quarter, with improved trends over Easter and a strong

digital business throughout. As we look ahead, we are taking the

right steps to improve our results and adjust our business for

today’s rapidly evolving retail environment. We are creating

efficiencies across our organization, as we aim to continue

capitalizing on the strength of our brands, product leadership and

other competitive advantages. The six million shares repurchased

this quarter reflects the company’s strong cash flow, healthy

balance sheet and confidence in our brands and long-term strategic

initiatives."

First Quarter 2017 Results

- Total net revenue increased 2% to $762

million from $749 million last year.

- Consolidated comparable sales were up

2%, following a 6% increase last year.

- Gross profit decreased to $278 million

from $293 million last year with a gross margin rate of 36.5% to

revenue compared to 39.2% last year, a 270 basis point decline. The

margin declined primarily due to increased promotional activity and

higher shipping costs related to a strong digital business.

- Selling, general and administrative

expense declined 1% to $195 million compared to $196 million last

year, and leveraged 60 basis points to a rate of 25.6% to revenue.

Higher advertising expense was offset by lower compensation expense

and favorability across a number of other expense categories.

- Operating income of $37 million, which

includes $5 million of restructuring charges, compared to $59

million last year. Adjusted operating income* of $42 million

compared to $59 million last year with a rate of 5.6% to revenue

compared to 7.8% last year.

- The effective tax rate decreased to

32.4% compared to 36.4% last year, reflecting the impact of

discrete items this quarter.

- EPS of $0.14 compared to EPS of $0.22

last year. Adjusted EPS* of $0.16 compared to EPS of $0.22 last

year.

* The preceding adjusted amounts are based on Non-GAAP results,

as presented in the accompanying GAAP to Non-GAAP

reconciliation.

Restructuring and Related Charges

In the first quarter, the company had charges totaling $5.4

million, approximately $0.02 per share, consisting primarily of

severance and related charges corresponding to home office

restructuring and the previously announced initiative to explore

the closure or conversion of company owned and operated stores in

Hong Kong, China, and the United Kingdom to licensed

partnerships.

Shareholder Returns, Cash

During the first quarter, the company returned $110 million to

shareholders through cash dividends and share repurchases. We paid

dividends of $22 million and repurchased six million shares for $88

million. The remaining authorization under the current repurchase

program is 19 million shares. We ended the quarter with total cash

of $225 million compared to $239 million last year.

Inventory

Total ending inventories at cost increased 9% to $364 million.

Ending units were flat compared to last year, while the average

unit cost was up 9% to last year. The increase in average unit cost

reflects a higher mix of AE bottoms and Aerie apparel, consistent

with our merchandise strategy.

Capital Expenditures

In the first quarter, capital expenditures totaled $40 million.

We continue to expect fiscal year 2017 capital expenditures in the

range of $160 million to $170 million, with roughly half of the

spend related to store remodeling projects and new openings, and

the balance to support the e-commerce business, omni-channel tools

and general corporate maintenance.

Store Information

In fiscal 2017, the company plans to open a total of 35 American

Eagle Outfitters and Aerie stores throughout the U.S., Canada and

Mexico. Management plans to close between 25 and 40 store locations

in 2017. Internationally, the company plans to open 45 licensed

stores and close 2 licensed locations. For additional store

information, see the accompanying table.

Second Quarter Outlook

Based on anticipated comparable store sales in the range of flat

to a low single digit decline, management expects second quarter

2017 EPS to be approximately $0.15 to $0.17. This guidance excludes

potential asset impairment and restructuring charges, and compares

to EPS of $0.23 last year.

Conference Call and Supplemental Financial

Information

Today, management will host a conference call and real time

webcast at 9:00 a.m. Eastern Time. To listen to the call, dial

1-877-407-0789 or internationally dial 1-201-689-8562 or go to

http://investors.ae.com to access the webcast and audio replay.

Also, a financial results presentation is posted on the company’s

website.

Non-GAAP Measures

This press release includes information on non-GAAP financial

measures (“non-GAAP” or “adjusted”), including earnings per share

information and the consolidated results of operations excluding

non-GAAP items. These financial measures are not based on any

standardized methodology prescribed by U.S. generally accepted

accounting principles (“GAAP”) and are not necessarily comparable

to similar measures presented by other companies. The company

believes that this non-GAAP information is useful as an additional

means for investors to evaluate the company’s operating

performance, when reviewed in conjunction with the company’s GAAP

financial statements. These amounts are not determined in

accordance with GAAP and therefore, should not be used exclusively

in evaluating the company’s business and operations.

About American Eagle Outfitters, Inc.

American Eagle Outfitters, Inc. (NYSE: AEO) is a leading global

specialty retailer offering high-quality, on-trend clothing,

accessories and personal care products at affordable prices under

its American Eagle Outfitters® and Aerie® brands. The company

operates more than 1,000 stores in the United States, Canada,

Mexico, China, Hong Kong and the United Kingdom, and ships to 81

countries worldwide through its websites. American Eagle Outfitters

and Aerie merchandise also is available at more than 170

international locations operated by licensees. For more

information, please visit www.ae.com.

"Safe Harbor" Statement under the Private Securities Litigation

Reform Act of 1995: This release contains forward-looking

statements, which represent our expectations or beliefs concerning

future events, including second quarter 2017 results. All

forward-looking statements made by the company involve material

risks and uncertainties and are subject to change based on factors

beyond the company's control. Such factors include, but are not

limited to the risk that the company’s operating, financial and

capital plans may not be achieved and the risks described in the

Risk Factor Section of the company's Form 10-K and Form 10-Q filed

with the Securities and Exchange Commission. Accordingly, the

company's future performance and financial results may differ

materially from those expressed or implied in any such

forward-looking statements. The company does not undertake to

publicly update or revise its forward-looking statements even if

future changes make it clear that projected results expressed or

implied will not be realized.

AMERICAN EAGLE OUTFITTERS, INC.

CONSOLIDATED BALANCE SHEETS (Dollars in thousands)

April 29, January 28, April 30,

2017 2017 2016 (unaudited)

(unaudited) ASSETS Cash and cash equivalents $

225,197 $ 378,613 $ 238,976 Merchandise inventory 364,274 358,446

334,301 Accounts receivable 79,432 86,634 73,283 Prepaid expenses

and other 94,769 77,536 82,767 Total current

assets 763,672 901,229 729,327 Property and

equipment, net 710,500 707,797 706,221 Intangible assets, net

48,462 49,373 51,432 Goodwill 14,772 14,887 17,520 Non-current

deferred income taxes 33,408 49,250 38,903 Other assets 62,379

60,124 52,893 Total Assets $

1,633,193

$

1,782,660 $

1,596,296

LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable $

208,857 $ 246,204 $ 202,692 Accrued compensation and payroll taxes

31,106 54,184 34,838 Accrued rent 78,018 78,619 77,477 Accrued

income and other taxes 12,446 12,220 6,915 Unredeemed gift cards

and gift certificates 39,744 52,966 38,508 Current portion of

deferred lease credits 12,743 12,780 12,850 Other current

liabilities and accrued expenses 37,677 36,810 45,206

Total current liabilities 420,591 493,783

418,486 Deferred lease credits 56,551 45,114 54,738

Non-current accrued income taxes 4,655 4,537 4,675 Other

non-current liabilities 33,523 34,657 41,089

Total non-current liabilities 94,729 84,308 100,502

Commitments and contingencies - - - Preferred stock - - -

Common stock 2,496 2,496 2,496 Contributed capital 582,512 603,890

583,689 Accumulated other comprehensive income (32,671 ) (36,462 )

(24,484 ) Retained earnings 1,774,315 1,775,775 1,675,031 Treasury

stock (1,208,779 ) (1,141,130 ) (1,159,424 ) Total stockholders'

equity 1,117,873 1,204,569 1,077,308 Total

Liabilities and Stockholders' Equity $

1,633,193 $

1,782,660 $

1,596,296 Current

Ratio 1.82 1.83 1.74

AMERICAN

EAGLE OUTFITTERS, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (Dollars and shares in thousands, except per share

amounts) (unaudited)

GAAP Basis 13 Weeks

Ended April 29, % of April 30, % of

2017 Revenue 2016

Revenue Total net revenue $ 761,836 100.0 % $ 749,416

100.0 %

Cost of sales, including certain buying,

occupancy and warehousing expenses

484,014 63.5 % 455,964 60.8 % Gross profit 277,822

36.5 % 293,452 39.2 % Selling, general and administrative expenses

194,979 25.6 % 195,993 26.2 % Restructuring charges 5,448 0.7 % -

0.0 % Depreciation and amortization 40,446 5.3 % 38,783

5.1 % Operating income 36,949 4.9 % 58,676 7.8 % Other

income (expense), net 403 0.0 % 4,935 0.7 % Income

before income taxes 37,352 4.9 % 63,611 8.5 % Provision for income

taxes 12,116 1.6 % 23,135 3.1 % Net income $ 25,236

3.3 % $ 40,476 5.4 % Net income per diluted

share $ 0.14 $ 0.22

Weighted average common shares outstanding

- basic

179,312 180,697

Weighted average common shares outstanding

- diluted

181,678 182,927

AMERICAN EAGLE

OUTFITTERS, INC. GAAP TO NON-GAAP RECONCILIATION

(Dollars in thousands, except per share amounts) (unaudited)

13 Weeks Ended April 29, 2017 Operating income

Diluted income (loss) Net income per common

share GAAP Basis $ 36,949 $ 25,236 $ 0.14 % of Revenue 4.9 %

3.3 %

Add:Restructuring Charges (1):

5,448 3,439 0.02 Non-GAAP Basis $ 42,397 $ 28,675 $ 0.16 %

of Revenue 5.6 % 3.7 %

(1) $5.4 million pre-tax restructuring charges for severance and

related charges, which includes corporate overhead reductions and

charges for the United Kingdom, Hong Kong, and China.

AMERICAN EAGLE OUTFITTERS, INC. COMPARABLE

SALES RESULTS BY BRAND (unaudited)

First Quarter

Comparable Sales 2017 2016 American Eagle

Outfitters, Inc. (1) 2 % 6 % AE Total Brand (1) -1 % 4 %

aerie Total Brand (1) 25 % 32 %

(1) AEO Direct is included in consolidated

and total brand comparable sales.

AMERICAN EAGLE OUTFITTERS, INC. STORE

INFORMATION (unaudited)

First Quarter Fiscal

2017 2017 Guidance Consolidated stores at

beginning of period 1,050 1,050 Consolidated stores opened during

the period AE Brand 3 15-20 aerie 2 15 Tailgate Clothing Co. 0 1

Todd Snyder 1 1 Consolidated stores closed during the period AE

Brand (2) (20) - (30) aerie (1) (5) - (10)

Total consolidated

stores at end of period 1,053 1,042 - 1,062

Stores remodeled and refurbished during the period 14 50

Total gross square footage at end of period 6,637,435 Not Provided

International license locations at end of period (1) 189 221

(1) International license locations are

not included in the consolidated store data or the total gross

square footage calculation.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170517005600/en/

American Eagle Outfitters, Inc.Kristen McGraw, 412-432-3300

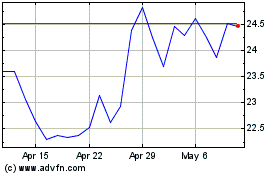

American Eagle Outfitters (NYSE:AEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

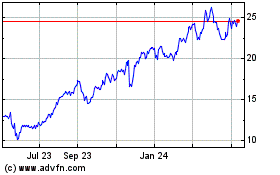

American Eagle Outfitters (NYSE:AEO)

Historical Stock Chart

From Apr 2023 to Apr 2024