Report of Foreign Issuer (6-k)

May 12 2017 - 5:23PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN ISSUER

PURSUANT

TO RULE 13a-16 OR 15b-16 OF

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of May, 2017

IRSA

Inversiones y Representaciones Sociedad

Anónima

(Exact name of Registrant as specified in its charter)

IRSA

Investments and Representations Inc.

(Translation of registrant´s name into English)

Republic

of Argentina

(Jurisdiction of incorporation or organization)

Bolívar

108

(C1066AAB)

Buenos

Aires, Argentina

(

Address of principal

executive offices)

Form 20-F ⌧

Form

40-F ☐

Indicate by

check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ☐

No

x

IRSA

INVERSIONES Y REPRESENTACIONES SOCIEDAD

ANÓNIMA

(THE

“COMPANY”)

REPORT

ON FORM 6-K

By letter

dated May 12, 2017, the Company reported that in compliance

with Section 63 of the Regulations issued by the Buenos Aires Stock

Exchange, this is to report the following information:

|

1. Profit / (loss) for the period

|

In ARS million

|

|

|

03/31/2017

|

03/31/2016

|

|

Profit / (loss) for the period (nine-month period)

|

3,799

|

(1,039)

|

|

Attributable to:

|

|

|

|

Equity holders of the parent

|

2,138

|

(676)

|

|

Non-controlling interest

|

1,661

|

(363)

|

|

|

|

|

|

2. Other comprehensive income for the period

|

In ARS million

|

|

|

03/31/2017

|

03/31/2016

|

|

Other comprehensive income for the period (nine-month

period)

|

1,923

|

1,815

|

|

Attributable to:

|

|

|

|

Equity holders of the parent

|

516

|

204

|

|

Non-controlling interest

|

1,407

|

1,611

|

|

|

|

|

|

3. Total comprehensive income for the period

|

In ARS million

|

|

|

03/31/2017

|

03/31/2016

|

|

Total comprehensive income for the period (nine-month

period)

|

5,722

|

776

|

|

Attributable to:

|

|

|

|

Equity holders of the parent

|

2,654

|

(472)

|

|

Non-controlling interest

|

3,068

|

1,248

|

|

|

|

|

|

4. Shareholders’ Equity

|

In ARS million

|

|

|

03/31/2017

|

03/31/2016

|

|

Stock capital

|

575

|

575

|

|

Treasury stock

|

4

|

4

|

|

Comprehensive adjustment of stock capital and treasury

stock

|

123

|

123

|

|

Additional paid-in capital

|

793

|

793

|

|

Premium for trading of treasury shares

|

16

|

16

|

|

Statutory reserve

|

143

|

117

|

|

Special reserve

|

-

|

4

|

|

Cost of treasury stock

|

(29)

|

(29)

|

|

Changes in non-controlling interest

|

(59)

|

(641)

|

|

Reserve for equity-based payments

|

76

|

63

|

|

Reserve for future dividends

|

494

|

520

|

|

Reserve for conversion

|

551

|

358

|

|

Reserve for hedge instruments

|

40

|

-

|

|

Reserve for defined benefit plans

|

(38)

|

(4)

|

|

Other reserves of subsidiaries

|

35

|

53

|

|

Retained earnings

|

899

|

(675)

|

|

Total attributable to equity holders of the parent

|

3,623

|

1,277

|

|

Non-controlling interest

|

15,229

|

6,284

|

|

Total shareholders’ equity

|

18,852

|

7,561

|

In compliance with

Section o) of the referred Regulations, we report that as of the

closing date of the financial statements, the Company’s

capital stock was ARS 578,676,460 (including treasury shares)

divided into 578,676,460 common, registered, non-endorsable shares

of ARS 1 par value each and entitled to one vote per

share.

The Company’s

principal shareholder is Cresud S.A.C.I.F. y A. (Cresud) with

366,788,243 shares, accounting for 63.4% of the issued capital

stock.

In addition, we

report that as of March 31, 2017, after deducting Cresud’s

interest and the treasury shares, the remaining shareholders held

208,377,030 common, registered, non-endorsable shares of ARS 1 par

value each and entitled to one vote per share, accounting for 36.0%

of the issued capital stock.

As of March 31,

2017, no warrants or convertible notes for the purchase of the

Company’s stock were outstanding.

Below are the

highlights for the period ended March 31, 2017:

●

EBITDA for the

nine-month period of FY 2017 reached ARS 7,504 million (ARS 1,827

million from Argentina and ARS 5,677 million from

Israel)

●

Net result for 9M17

registered a gain of ARS 3,799 million compared to a loss of ARS

1,039 million in the same period of 2016 mainly explained by the

results from Israel Business Center coming from Adama sale and the

increase in Clal share price, valued at market value.

●

Tenant Sales in our

malls grew by 19.9% in 9M17 while the average rent per sqm of the

office portfolio reached USD/sqm 26.3. EBITDA of the rental segment

increased by 31.8% in the compared period.

●

We reached 98.0%

occupancy in our shopping malls and 100% occupancy in our portfolio

of premium offices.

●

During February

2017, IDBD has issued notes in the Israeli market for NIS 1,060

million at a fixed rate of 5.40% due 2019 to cancel existing

debt.

●

We decided to

change the valuation method for the investment properties from

historical cost to reasonable value, which was already reflected in

our subsidiary IRSA Commercial Properties S.A. this quarter and

will be reflected in the company’s financial statements by

the end of our fiscal year as of June 30, 2017.

SIGNATURES

Pursuant to the

requirements of the Securities and Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized, in the city of

Buenos Aires, Argentina.

|

|

IRSA

Inversiones y Representaciones Sociedad

Anónima

|

|

|

|

|

|

By:

|

/S/ Saúl

Zang

|

|

|

|

|

Name:

Saúl Zang

|

|

|

|

|

Title:

Responsible for the Relationship with the Markets

|

|

Dated: May 12,

2017

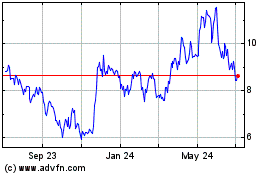

IRSA Inversiones and Rep... (NYSE:IRS)

Historical Stock Chart

From Aug 2024 to Sep 2024

IRSA Inversiones and Rep... (NYSE:IRS)

Historical Stock Chart

From Sep 2023 to Sep 2024